"As we spoke about in the Under Armour results, Columbia Sportswear also suffered due to the pressure that wholesalers are under, more so in Columbia's case given that their primary distribution channel to the consumer is via wholesalers"

To market to market to buy a fat pig Markets in Jozi ended the session up over one-third of a percent. For all the volatility seen in New York, it has been pretty quiet as far as overall moves have been concerned. The Rand weakened pretty dramatically through the day, perhaps the "risk off" trade, some suggesting that ratings agencies speaking to labour union movements had something to do with it. I even heard on the wireless that GM "quitting" South Africa (and some other countries) had something to do with it. If you are a GM vehicle owner, I suspect that you may want to read this (and block out the hysteria) - What did GM announce?

Isuzu will be the beneficiary of the global GM drive to scale down across not only here, in other places such as India too. One of the "reasons" given is pretty interesting and perhaps Mr. Musk and Tesla, as well as Uber, should get a hat tip here - "The most significant industry change has been the emergence of mobility (autonomous/ride sharing/electrification/connectivity) as a service and as a long-term growth opportunity." See? Companies in far flung regions of the world may recognise that their cheaper offerings will ultimately be unprofitable. Cut and sell, focus on something else.

Stocks that dominated the top end of the leaderboard, buoyed by a weaker Rand, were the likes of Steinhoff (clearly a late stamp of approval on the pending deal), Mediclinic and Richemont. At the opposite end of the spectrum was the likes of Amplats, Bidcorp (giving back after an incredible rally), as well as AB InBev (see the part about Brazil lower down). There were well received results from Investec, the stock rallied over one and three-quarters of a percent here in Jozi, the best levels since June last year, and over twenty percent higher since November last year.

Sibanye announced their deep discounted rights issue at 60 percent lower than the prevailing price (the stock ended over four percent lower on the day), initially the market sold off aggressively and then stabilised again. That is pretty big, they are raising 1 billion Dollars, with a firm commitment from one shareholder that holds nearly one-fifth of the shares. For every 7 shares you hold now, they are issuing 9 new ones. If you do not follow your rights, you are going to be diluted out of sight. I guess if you continue to hold them on the assumption that they will succeed, then best you take advantage of the MUCH lower price.

Oceana had results, and although weak, they were marginally better than most had anticipated. Our biggest interest in this is via Tiger Brands, who own just over 42 percent of the company. With a market cap of 13 billion Rand (Oceana), that equates to nearly five and a half billion Rand. Tiger has a market cap of just over 74 and a half billion Rand, this represents 7.3 percent of their total value. So yes, this is a big deal in the life of Tiger Brands. There is plenty of plastic fish in the sea.

Stocks recovered a little in New York, New York. The heaviest sell off in the session prior (and the worst of its kind this year) was attributed to an investigation into Trump and his political machinations. Or was it? Eddy in his Friday morning letter reckons it may be the Fed hiking rates next month, something Eddy is against. Well, I suspect that the Fed could hike rates at any time to make sure that they cover their dual mandate, growth and keeping inflation in check. The second part is becoming more important than the first part nowadays. In Fact, the same said fellow, Eddy, tweeted that there had been 115 consecutive weeks of jobs claims below the 300 thousand mark. That is right, every Thursday the labour department in the US releases the Unemployment insurance weekly claims.

What is also telling about this claim is the following: "The 4-week moving average was 1,946,000, a decrease of 20,000 from the previous week's revised average. This is the lowest level for this average since January 19, 1974 when it was 1,920,750. The previous week's average was revised up by 500 from 1,965,500 to 1,966,000." That was before I was born! And Paul would have just turned 7, the December prior. Paul and Byron debunk that December/January thing you know, both born in December! And our Howie too, a large percentage of the office is born in the 12th month of the year.

The other "big thing" during the day was the collapse of Brazilian asset prices, their president is embroiled in a big scandal that may see him thrown under the bus, not too long after the previous president was impeached - Brazilian President Michel Temer, accused of bribery, says he will not resign. The Brazilian market fell limit down and triggered the circuit breakers (to begin with), by the time the closing bell rang, the BOVESPA had lost 8.8 percent of the starting value. That is real hair raising stuff!

Session end, a pretty tepid time on Wall Street, stocks were up, the Dow added a little over one-quarter of a percent, the broader market S&P 500 added nearly four-tenths of a percent on the day (that is two-fifths) and the nerds of NASDAQ was where the real action was, up nearly three quarters of a percent. Remembering that those stocks had sold off the heaviest in the session prior. Apple, Facebook, Alphabet (Google) and Amazon were all huge winners on the day, coupled with Walmart, which reported earnings above consensus. Volatility sold off after a nasty spike in the session prior to that!

Company corner

There were numbers out from one of the smaller companies that we follow, Columbia Sportswear Company. It "only" has a market cap of $3.6 billion, annual sales of $2.4 billion and just over 6 000 employees globally. The results were a beat on the low expectations from the market. Sales were up 4% and income was up a more respectable 13%.

As we spoke about in the Under Armour results, Columbia Sportswear also suffered due to the pressure that wholesalers are under, more so in Columbia's case given that their primary distribution channel to the consumer is via wholesalers. Management estimate that there were 800 less stores carrying their stock due to store closures! The result was a 1% drop in sales for the US market, which accounts for 61% of sales. Their global operations faired much better with the LAAP region (Latin America, Asia Pacific) increasing by 17% and the EMEA region increasing by 10%. The SOREL brand which mostly sells leather shoes, increased their sales by 50% but currently is only responsible for 5% of sales.

Going forward the company is focusing on going directly to the consumer by opening up their own retail outlets and improving their online offering. This may be a more capital intensive approach but it means that you control the customer experience and you have a greater control over your own fate. In the last financial year they opened 7 stores in the US and this year they will open another 13. Not massive numbers like Starbucks opening a new store in China every 15 hours but they are gaining momentum as the team gains retail store experience. I think the biggest opportunity is in their online offering, where they have just taken the European e-commerce business in house.

As they build size and scale they will be able to improve their online offering and move digitally into other countries. Having a look from South Africa I am able to buy a limited range off their site but the prices are in Rands which was not always the case. There is a huge amount of growth potential ahead for this company as they move into the rest of the world, at the moment 70% of their sales are between the US and Canada. I like this company's niche position in the adventure side of the market, with almost blue sky ahead for growth thanks to their relatively small size. Given managements cautious approach, don't expect fire works going forward though, think more of a snowball rolling down a hill gaining momentum and size. Slow to start but when you look again it is a force to be reckoned with.

Linkfest, lap it up

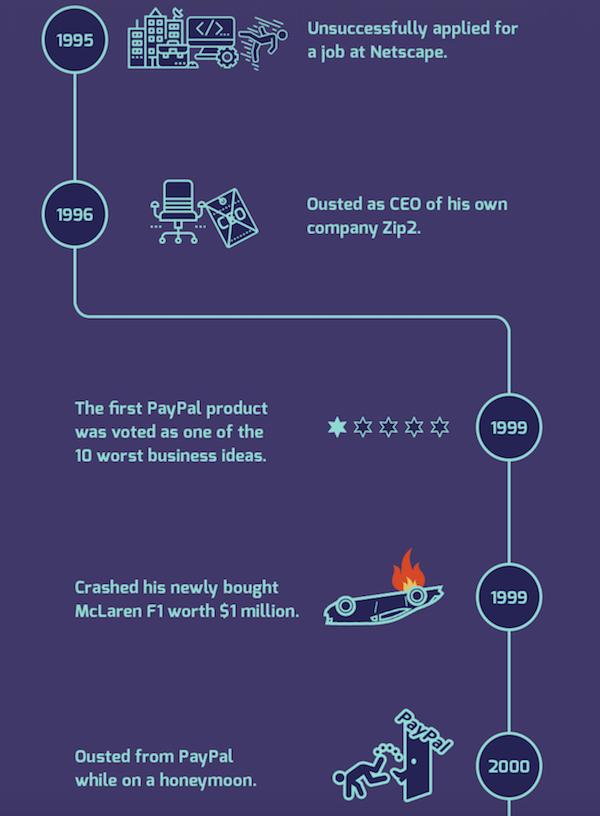

Elon Musk is CEO of two successful companies and has initiated other projects like the Hyperloop and SolarCity (which Tesla now owns). With all of those projects there were bound to be some failures along the way - A Timeline of Elon Musk's Long List of Failures. Having been ousted as CEO twice, I would say that he has very high expectations for himself and the people who work with him.

Another great piece from Ben Carlson. His advice is to start investing early and take the knocks when you have the time to bounce back - A Good Lesson For Millennial Investors.

"The worst thing that can happen for most inexperienced investors is to see success early on with their investments. Early success in this game can make it seem easy when investing is anything but."

Home again, home again, jiggety-jog. Stocks across Asia are mixed, Hong Kong up, mainland China down, Japan up. Our biggest interest is always Tencent, that stock is up two percent and trading at the all time highs from the session prior. Good results, continued growth trajectory. That should buoy at least one stock, right?

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment