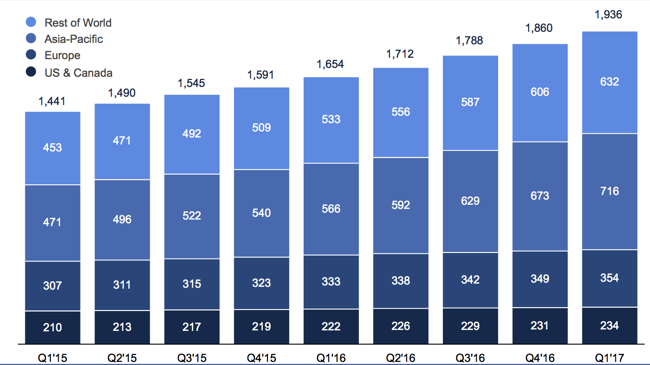

"OK, Facebook numbers quickly. The Facebook platform is nearing two billion monthly users, currently 1.94 billions, which represents a little over one-quarter of all the folks on the planet. I guess at some level there will have to be a subscriber ceiling."

To market to market to buy a fat pig May the Fourth be with you, it is Star Wars Day, Michael told me this morning. Man, I wasn't into Star Wars or Star Trek, and marginally into Indiana Jones. It is possibly as a result of living in less desirable places and the movie and TV scene being nonexistent when I was growing up. As such, Readers Digest became my Star Wars and Star Trek. The A-Team, MacGyver and all that, sorry about that, I had books to pass my time. I suppose it was probably better for me in the end. Star Wars, Indiana Jones and all their friends had to wait until the digital era. Oh, talking of that, retraction from yesterday, we thought (the internet said) that May Day was not celebrated in Germany. A client is in Germany and said WRONG, they did have a holiday. Our humblest apologies. Darn internet.

Markets locally, in the city founded on a whole pile of gold, finished the day much lower from where we started off. Down six-tenths by the close. Industrials sank around one-fifth, financials around four-fifths. The resource stocks, which sank nearly a percent and one-third were all to blame for the lower markets on the day, and in particular the resource stocks. Expect more of the same today, copper prices dropped some three and a half percent last evening. Platinum prices are off around three percent on the session.

Unsurprisingly, Amplats was down five and three-quarters of a percent yesterday, leading the losers. Glencore fell nearly three and three-quarters of a percent, Anglo was down two and three-quarters. Anglo now trades at the same price from around six months ago. At the other end of the spectrum there was gains for some Rand hedges, AngloGold Ashanti and Richemont (which is now trading at the best level since November 2015) were at the top of the leaderboards. New 12 month lows for Clover and Distell, amongst a few others.

There was so much going on, in the midst of earnings season in the US, we had an ADP read and a Federal Reserve meeting announcement. And we had political machinations around budget approvals and of course loads of talk about trade deals and the like. There was lots to get distracted about, we remain focused on the business of companies, their quarterly numbers are often reflection time, if not a reason to react one way or another. Normally, earnings on a quarterly basis are time to breath, to do deep research and time to make sure that you stay on top of the news flows.

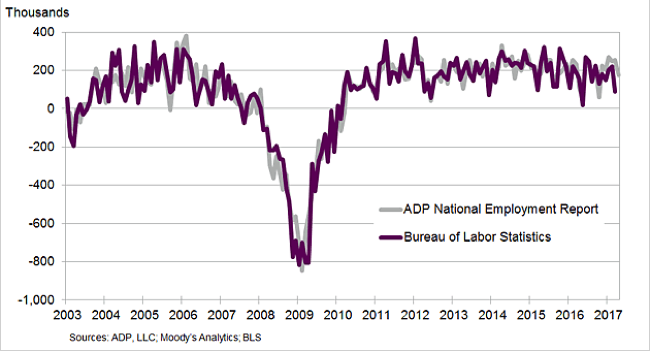

Before that, let us touch briefly on the ADP numbers, which was down from March and a slight beat in terms of what the consensus was - April 2017: ADP Employment Reports. As you can see, pretty much a broad based hiring from all types of businesses, only construction the noticeable loser. We have seen quite a lot of consistency on the jobs front since the horror of 2008/2009:

See that? Seems pretty much a V shape to me. So much for the Nouriel Roubini double dip recession, or the new normal from Pimco (El Erian and Gross). When forced to stick your neck out, or make longer dated predictions, you are probably going to get lots wrong, as well as right. We were looking in the office at the museum of failed products in Sweden and believe it or not, there was an Apple competitor to the Palm Pilot (remember that awesome gadget) called the Apple Newton that "failed". Whilst the Apple Newton product failed, it laid the foundations for the iPod and ultimately the best selling consumer device of all time, the iPhone. When 50 odd million devices a quarter is a miss, you know that you have high standards.

And then there was the conclusion of the Fed meeting, and the statement after the two day deliberation - Federal Reserve issues FOMC statement.

"The Committee views the slowing in growth during the first quarter as likely to be transitory and continues to expect that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace, labor market conditions will strengthen somewhat further, and inflation will stabilize around 2 percent over the medium term."

Rates on hold and expectations are that perhaps a rate hike at the next meeting is in order. All members voted. As did Kashkari of course, the brilliant fellow who weirdly looks like Sylar from the series Heroes. Those eyes, perhaps Kashkari wants to eat our economic brains for himself. Enough of that. The markets in New York closed the session mixed, better than the earlier part of the day. The Dow managed to squeak into the green by the close, up 8 points by the close, the broader market S&P 500 gave up 0.13 percent, whilst the nerds of NASDAQ lost nearly four-tenths of a percent by the end of the day. Results from Apple overnight, the stock reacted by giving up three-tenths of a percent, hardly one way or another. With that, straight into the results from last evening.

Company corner

Facebook has changed the ways that we communicate with one another. Perhaps the improvements in hardware, handheld mostly, has given platforms like Facebook/Messenger, Instagram and WhatsApp the ability to grow sharply. If the front and very important back cameras and delivery mechanism to the internet (Wifi and LTE - 5G nearing) did not exist, we wouldn't be able to share our thoughts, pictures and experiences immediately. It must be far harder to make important decisions as a teen and in the early stages of adulthood when there are all these platforms around. At the same time, it has never been easier to stay in touch with one another than at any other stage in humanity.

The ancient Persians are attributed with having the first reliable postal system, the Indians and Chinese too. The Romans, like many things of that era, perfected the system to a degree not seen, around 2000 years ago. Modern mail, like our grandparents became used to, was as a result of modern transportation strides by humanity. Remember the very lightweight "airmail" letters when sending overseas? One page that you could seal to have one and a half pages of writing ..... Ha ha, those were the days my friends of lightweight blue paper. Mail volumes have steadily declined over the last decade, email and social media platforms make it far easier to communicate. Thanks to Facebook, and the wonders of handheld devices, network infrastructure and the like, you can call (via WhatsApp and not "wifi" calling) anyone, anywhere in the world at almost any moment. So there.

OK, Facebook numbers quickly. The Facebook platform is nearing two billion monthly users, currently 1.94 billions, which represents a little over one-quarter of all the folks on the planet. I guess at some level there will have to be a subscriber ceiling. Owing to the age thing (one has to be a certain age to get an account) and the fact that internet penetration around the world isn't 100 percent (and is unlikely to be any time soon), I suspect we may see a levelling soon.

The other platforms are big, in fact huge. Messenger has 1.2 billion monthly users. Equally, Facebook businesses is used by 70 million living and breathing companies across the globe. That is a LOT. Instagram crossed 700 million users in the last few months. Instagram revenues are included within Facebook revenues, they don't break those out. How did those ads impact your user experience? Not at all ...... WhatsApp is 8 years old in February, they have 1.2 billion users. These are all big numbers, obviously many of them are overlaps, I use all four.

Revenues for the first quarter of their 2017 financial year topped 8 billion Dollars, that represents nearly 50 percent growth from this time last year. 85 percent of revenues were derived from mobile. Remember the anxiety when they (Facebook) were going to struggle to monetise mobile? WRONG! Cash on hand is 32.3 billion Dollars, which represents around 7.3 percent of the market cap. Markedly lower than their "peers" (of which there are none, really). Diluted earnings per share clocked 1.04 cents (a 73 percent growth on the corresponding quarter), meaning that the rolling 12 month multiple is 43 times earnings. And the PEG ratio, the price to earnings ratio relative to the growth rates forward is around 1. Which actually means that the stock is cheap by that metric.

The trick will be to keep all the irons in the fire at top heat, bashing out the multiple platforms present and future (VR is still going to be big, the hardware needs to catch up). Capex is likely to be around 7.5 billion Dollars at the top end of the range, a 50 percent increase over last year. The headcount is 38 percent higher than this time last year, Facebook now employs 18,800 people. From a dorm room in 2004 to a big employer, that is something astonishing.

A few things are starting to happen here, one, the share price is growing into the company delivering astonishing earnings. Costs are likely to pick up as the user base and product widens. The key will be cost control, that will undoubtably come in the next half a decade or so. Revenues are likely to expand off a higher and higher base, I suspect people will hardly notice the changes in their streams (WhatsApp and Messenger) which will see adverts and relevant content displayed. We continue to recommend what is an entertainment business with many different avenues. A little steam has gone out of the stock, post these results, use it as an opportunity to buy on weakness.

Linkfest, lap it up

What! The average holding period for an ETF is only 150 days. People can't help themselves, being patient and sitting on your hands probably seems lazy? Given the diversification in most ETFs there should be almost no reason to be jumping in and out of them - Are You An ETF 'Trader' Or An ETF 'Investor'?.

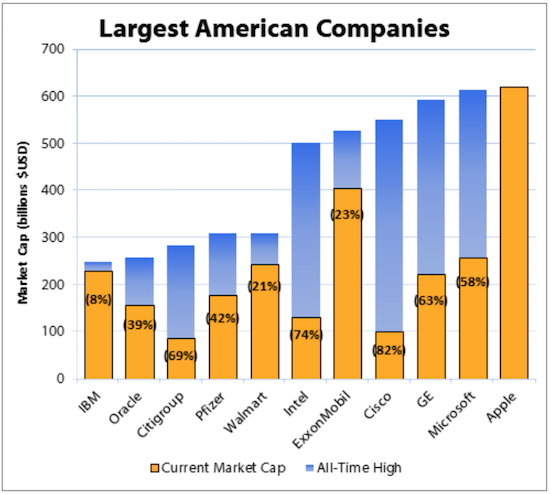

We touched on Apple's cash pile yesterday, here is are some companies you could buy with it today - What Apple's Cash Pile Could Buy. The pile is just short of the entire GDP of South Africa, at that size it makes you think Tim Cook and his management team should be paid more?

You will find more statistics at Statista

You will find more statistics at Statista

Sticking with Apple, here is how it's current market value stacks up against other companies - A History of Ridiculously Big Companies. Apple still looks small when compared to the large shipping companies from centuries gone by!

Home again, home again, jiggety-jog. Stocks across Asia are mixed, Hong Kong down, Japan up. Futures in the US are up marginally. Jobs data tomorrow! Woo hoo!

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment