"Mediclinic released their full year numbers during the course of yesterday. We all had a very solid look at these, this is the first year that the integration is all comparable. Remember that the company reversed into the Al Noor listing and then converted your shares of Mediclinic to Mediclinic international."

To market to market to buy a fat pig A mixed old day for the market here, financials enjoying a great day as the Rand continued to strengthen through the session, currently as we look this morning at 12.89 to the US Dollar. Resources stocks were sucking wind, down nearly a percent, as a result of the weakening Rand. Amplats, AngloGold Ashanti and South32 were the losers on the day, along with Mediclinic (see below) being the biggest loser on the day. In the winners column were the likes of Standard Bank, Barclays Africa, Nedbank and FirstRand, in that order. Inflation my comrades is abating somewhat.

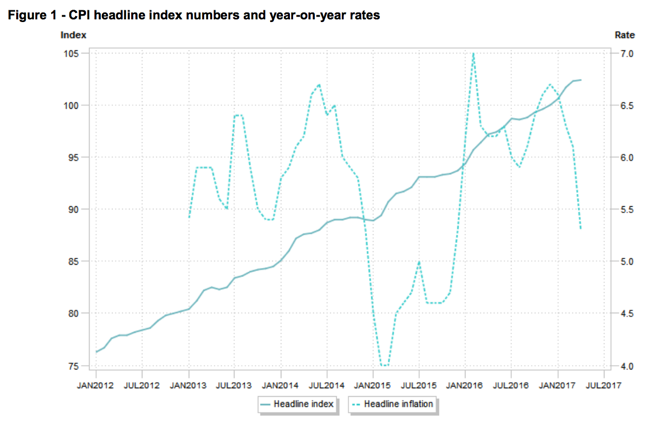

Slowing CPI (5.3 percent), inflation data, led Mr. Market to believe that the consumer may look in better shape towards the end of the year, perhaps the Reserve Bank, who deliver their monetary policy announcement later today, will indicate there is a chance of a rate cut later this year. Check it out, via the Stats SA website - . There may well be a chance of a rate cut if the trajectory continues (So you're telling me there's a chance), a better chance of Lloyd ever marrying Mary - Dumb and Dumber 'There's a Chance'. Last Harry and Lloyd reference, I cannot help it, that movie had such a big impact on me, it appeals to my quirkiness.

Here below from the release is the falling inflation graphic, a marked downturn perhaps as a result of a lower demand environment and improving conditions from the drought. Food prices, fruit and veg and cereals all down, transport inline with the lower headline print, fish and meat up. All as expected!

Back to Mr. Market before we close out this piece. Sibanye lost just over one-third of their value, the stock started to trade "ex" the rights, those became tradable yesterday. Remember that the rights issue is 9 new shares for every 7 you have existing, at 11.28 Rand, there is a big dilutionary impact if you decide to not follow. Sibanye are going for a big deal in which they will acquire one of the biggest PGM assets in North America. Good for them, I wish them the best.

Pioneer foods and Rhodes Food Group touched 12 month lows, the stocks coming under pressure since their recent results. DRDGold too touching a 12 month low, the oldest listed ZA inc. stock has a market cap of 1.8 billion Rand after 122 years of being listed. You would hope for a bit better than that, right? It matters what company you buy relative to their prospects, you may well argue that people are always going to wear gold jewellery, perhaps the extraction method will be more difficult in time. As it has gotten. There goes.

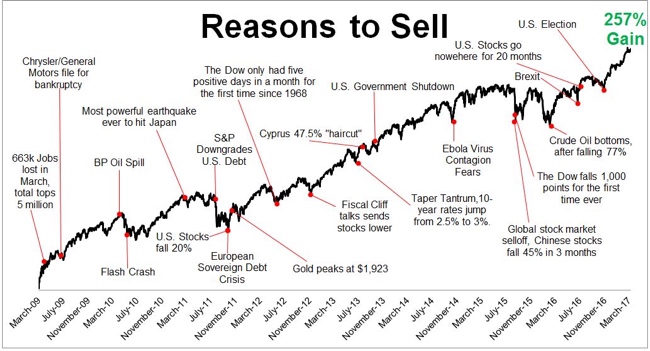

Over the seas (from here of course), stocks in New York, New York rallied again, even if it was just modest. The Dow Jones Industrial average once again popped over the 21 thousand mark, up just over one-third of a percent by the end of the session. The broader market S&P 500 added one-quarter of a percent to close above 2400 points, whilst the nerds of NASDAQ added four-tenths of a percent to flirt with all time highs. All indices were that close to all time highs. Trump is out meeting the G7, the Pope, NATO and the like, a week ago the searches for Trump and impeachment were crushing the market.

There was the small matter of the Minutes of the Federal Open Market Committee from the May 2-3 meeting. Apparently "investors" are always looking for clues as to what the Fed are going to do next with interest rates. They watch the incoming data the same as all of us, they have to stick out their necks and make economic predictions, often when wrong or right, they are lost in the mists of time. And in three years time, does it really matter as an equity investor whether they were right or wrong? Does it? Not for me anyhow, some people live and die by the Fed and their announcements.

They (the Fed) are going to raise rates and reduce their balance sheet as economic conditions improve. In twenty/fifty years time when people study this period, they are unlikely to disagree with what the Fed did. All the evidence points to them having "done the right thing", notwithstanding all of the chattering classes and naysayers. If I had a buck for every time I heard the Fed was wrong, I would have been made "very right". So there. Watch and listen, please do not act on your long term retirement investments as to how the Fed sees the future. We may have shared this Michael Batnick graph (the irrelevant investor) before, it is worth the share again. Look at it, and then remind yourself that you own companies, not all these "events" that may or may not scuttle economic growth. Short response to this should be to not make investment decisions based on anything other than the company you are buying.

Company corner

Mediclinic released their full year numbers during the course of yesterday. We all had a very solid look at these, this is the first year that the integration is all comparable. Remember that the company reversed into the Al Noor listing and then converted your shares of Mediclinic to Mediclinic international. You will recall that as a shareholder from before, you were bought out at a ratio of around 0.625 new Mediclinic for the older ones that you had, at a conversation Rand price of above 200 Rand a share, regardless of what level you had owned them before.

In other words, if you bought, let us say 100 shares, you got 62 and a half (rounded up or down) and a price of 204 Rand for the new ones. Since that moment, 13 February, the price has on balance trended lower. In part, some of that is currency related, the Rand is 37 percent stronger to the Pound since the day Mediclinic "listed" (in the version as we know it) in London. It really is. Some of that is Brexit related and the subsequent recovery of the Rand. The timing has not been that good.

Equally, the results themselves have been tepid. Part UAE stresses on their business as a result of government finances and by extension healthcare benefits under pressure. Taking a bit more time than anticipated. As you can tell, the company has a growth multiple valuation, and if earnings cannot deliver that immediately, the stock will get a re-rating. That of course is very separate to a good business, which we definitely think that this is. Healthcare is a great medium for long term investors, hospitals even more so.

The amount of costs and mistakes that are likely to be reduced in hospitals as a result of improved and improving technology makes me feel that they are going to become more profitable and not less. Added to that will be that an ageing population will be able to have more procedures, and not fewer, as less invasive surgery continues to evolve. My dad (and I hope he doesn't trash me for this) had a small procedure on Friday that required local anaesthetic, yesterday he walked around 15km on a hike in the Cape Mountains. No probs.

The consolidated group reported revenue growth of 30 percent to 2.759 billion Pound Sterling, underlying EBITDA grew 17 percent to 501 million Pounds. Earnings per share were down 19 percent to 29.8 pence. The dividend declared for this period is 4.7 pence (7.9 pence for the whole year), not the biggest payer. In fact, for the full year it is below one percent. So you do not own this business because it pays you a wonderful dividend. You would own this business for their growth prospects. Underlying earnings per share clocked 29.8 pence, which is 19 percent lower than the prior period, which was 36.7 pence. Why? We shall deal with that in a second. Net Debt, as a result of all the recent deals, ramped up 9 percent to 1.669 billion Pounds.

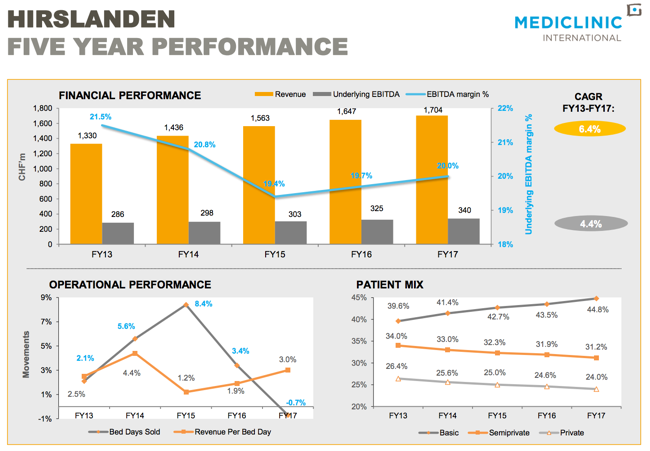

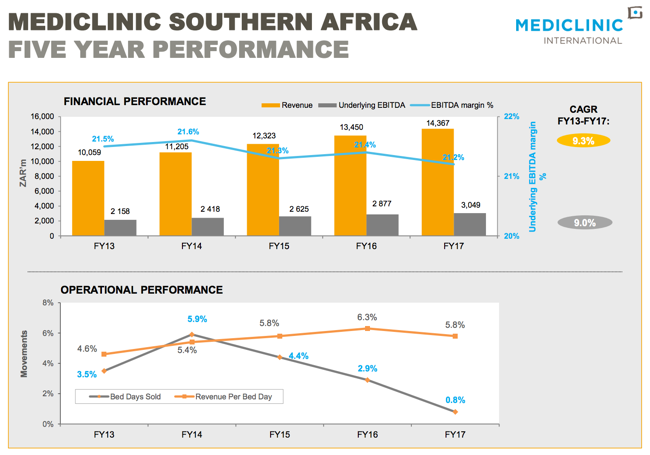

Here are some interesting slides from the presentation that shows the separate business, which are as follows, in revenues: 48 percent Switzerland, 28 percent Southern Africa and 24 percent Middle East (UAE). From an underlying Ebitda perspective, the geographical breakdown is as follows: 53 percent Switzerland, 33 percent Southern Africa and 15 percent Middle East. Firstly, a five year performance of the Swiss business, Hirslanden:

This is a great business that definitely caters for the richest patients, possibly on earth. They (Hirslanden) have a one-third share of the private healthcare market in Switzerland. And then below, the South African business, in the same format from the results presentation.

The CEO says in the commentary: "We expect a gradual improvement in the Middle East platform as we progress through the 2018 financial year and beyond." That is part of the reason why we expect the outlook to brighten. To lend credence to our thesis above, we are in total agreement with CEO Danie Meintjes: "We continue to see growing demand for quality healthcare services which is underpinned by an ageing population, growing disease burden and technological innovation. This is why we place such an emphasis on our Patients First strategy and continue to invest in our facilities and people. With this focus and our leading positions in core markets, Mediclinic is well-positioned to deliver sustainable long-term growth."

When a share price does badly, ordinary investors think that there must be something wrong with the business. In this case, the share price was probably overvalued. I suspect that integration and regulatory issues (healthcare is made an emotive issue for politicians and ordinary citizens) have impacted their performance. I suspect that they will continue to do deals as they see fit. We continue to be patient, and will encourage investors to accumulate on weakness. This time next year the comparable numbers are likely to look more favourable.

Linkfest, lap it up

Flipkart is the Indian e-retailer that Naspers has a stake in and whose value has slipped from around $15 billion to around $11 billion - Flipkart and Rivigo are India's top "breakthrough" brands. Given the level of informal housing and high level of regulations, the Indian market is very difficult to operate in. If Flipkart can gain scale, having a potential 1 billion clients will mean a valuation much higher than the current $11 billion.

Sticking with Naspers investments, their latest one is set to list in the next 2 months - Delivery Hero set to list before summer break: sources. The company reported a 68% increase in revenue compared to last year, the type of growth we have come to expect from internet companies.

When we look back we can't imagine people not wanting new technologies like cars or computers, but with change comes fear of the unknown and pushback from some areas of society - Pessimism in Historical Perspective.

Home again, home again, jiggety-jog. Stocks down here to begin with, the Rand is stronger and that is having something of an impact. If not much, then a little. OPEC has a meeting today, right now. I couldn't care a less about that, even as a fuel user. Cartels and products that are likely to be used less in the future.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment