"The company manufactures South African favourites that are found in most middle income households across the depth and breadth of the country, All Gold, Albany, Tastic, Fatti's and Moni's (did those brothers really exist, like Charles Glass?), Koo, Oros, Black Cat and of course the old favourite, Jungle Oats."

To market to market to buy a fat pig There was a whole ton of stuff going on yesterday. Results from Tiger Brands, which we will deal with in a moment, in the below segment and another slew of company news from the likes of Impala Platinum offering convertible bonds through 2022, to replace an existing program. The Foschni Group (TFG) were out with year end numbers, the stock sold off heavily through the day. The Massmart CEO was putting on a brave face against the backdrop of a tricky environment, the stock sold off really heavily. All retailers were "re-rated" alongside the rather glum sounding outlook.

The Massmart CEO spoke of green shoots being extinguished, in fact as follows: "The nascent signs that some or all of these positive influences were coming to bear were unfortunately washed away by the negative economic impact of political events in late March and April that culminated in two credit-rating downgrades." Green shoots washed away? I have seen pictures of old vines emerging from the dusty bowls of dams dried up in the Cape (Theewaterskloof dam in Villiersdorp), the language being used is almost the same as the pictures. See one below ->

Obliterated, parched, extinguished, the green shoots have disappeared, this is what Massmart CEO said. TFG looked a little better than that Massmart release. The Massmart folks writing that piece may well be up for a Pulitzer, or was it Guy Hayward himself? Check it out - CEO's AGM Statement.

The Easter sales period is always a moving target for businesses reporting quarterly or half year numbers to March, sometimes it is in, sometimes it is out. Sales are flat to lower. Jeepers, it is increasingly difficult out there, a crisis of confidence. So much so that the company has the following to say about the outlook for the balance of the year: "The current levels of political, business and consumer uncertainty make it difficult to provide any useful trading expectations for the remainder of the 2017 financial year, but we do not expect the SA consumer economy to show any noticeable improvement during this time." If you needed reminding ...... The next sales update from the company is expected at the end of June, in around 4 weeks time. Understandably the stock was sold off heavily, down six and nearly three-quarters of a percent by the close of business. Eish.

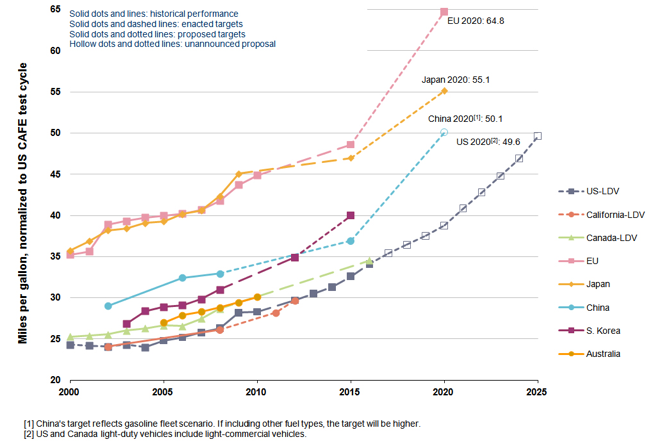

Another "event" happening was the OPEC meeting during the day. Byron was outraged that such a cartel still exists. I said that it would encourage humans to innovate and find better ways to remove their shackles and reliance on sellers that are intent on keeping a price at a certain level to balance their budgets. It just seems strange that you would "control" the supply to the users. Eventually humans will decide what is cheapest for them. Business responds in this manner, the higher the price, the greater the efficiencies (i.e. your vehicle will use less fuel). This graph below is the projected miles per gallon usage in a motor vehicle.

Whatever OPEC tried to achieve by sticking to quotas, does not seem to be working. At least in my mind. Oil prices tanked over five to six percent. If oil prices go up too much, users will adopt more and more on the EV (electric vehicle) front. As the battery technology improves markedly and that component becomes cheaper and cheaper, consumers will adopt cheaper EVs. As oil prices increased, engines will improve their usage. As fracking technology improves markedly, and the cost per barrel of extraction plunges (as it has), the supply meets the local US demand. Opec loses. Again. Fossil fuels ....... I am not too sure that it is a multi decade investment theme with any certainty.

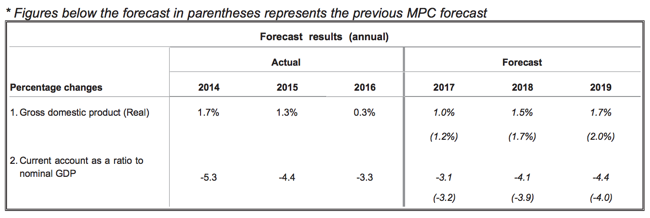

If that was not enough for you, there was a Reserve Bank Monetary Policy committee (MPC) meeting yesterday - Statement of the Monetary Policy Committee - 25 May 2017. Inflation expectations in the forecasts look like they are "in the range", between 3-6 percent. In fact, the MPC suggest 5.5 percent inflation through 2019, in that sort of range. Growth prospects unfortunately (according to the MPC forecast) looks anaemic at best:

The MPC outlook, the last paragraph is a little like the Massmart assessment:

"The MPC remains of the view that the current level of the repo rate is appropriate for now and that we are likely at the end of the tightening cycle. A reduction in rates would be possible should inflation continue to surprise on the downside and the forecast over the policy horizon be sustainably within the target range. However, in the current environment of high levels of uncertainty, the risks to the outlook could easily deteriorate, and derail the current favourable assessment."

Too much uncertainty that could derail the current favourable environment.

Company corner

Tiger Brands reported their half year numbers to March yesterday. I saw the CEO, who is now a year in the job on the box with the CFO, who has done some hard yards at that business. They were talking about how tough it has been to operate, suggesting that much unrest in South Africa has been logistically challenging at times. i.e., if a bakery needs to send their trucks out to deliver and roads are blocked, that means that there is an extra insuring cost to the company and by extension to you the shareholder. And ironically, in trying to recuperate the costs, staples prices would have to go up a little.

The company manufactures South African favourites that are found in most middle income households across the depth and breadth of the country, All Gold, Albany, Tastic, Fatti's and Moni's (did those brothers really exist, like Charles Glass?), Koo, Oros, Black Cat and of course the old favourite, Jungle Oats. The other major and well known household brands are Energade, Maynards and Beacon, Doom, Ingram's, Purity and Enterprise. Whilst these brands may not be in the larder of the serious banter, or in the fridge of said hipster eaters, for most middle class citizens, these represent the staples alongside protein sources and vegetables.

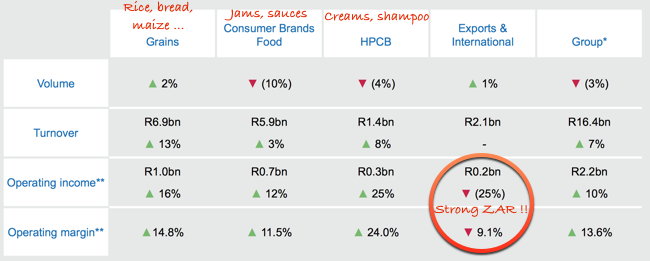

Group turnover for the period for continuing operations (they are in the process of selling various East African assets, one sold, one pending) increased 7 percent to 16.4 billion Rand. Operating income grew 10 percent to 2.2 billion Rand. The dividend was hiked 4 percent, bearing in mind that the new dividend tax is at the higher rate (20 percent as opposed to the older rate 15 percent). The company, through the watchful eye of CFO Noel Doyle, have managed to contain costs to below inflation (at least at a sales/distribution and marketing level). The main reasons that profits were flat for the period was as a result of a higher tax expense and a marginal loss (from a profit situation) from discontinued operations.

Here is a nice slide from the results that shows all the different divisions, I have tried my best to stick in the various divisions. See the impact of the much stronger Rand on the international business, which is the smallest revenue contributor.

How do we see the medium to long term prospects for this business? I quite enjoyed the part of one-year-in CEO Lawrence MacDougall who said:

"Tiger Brands has defined its core as the manufacturing, marketing and distribution of everyday branded food to middle-income consumers. This already accounts for 70% of Tiger Brands' current sales. These consumers are a growing proportion of the South African market, are more brand loyal, have similar shopping destinations and utilise the media in a similar manner. Food is a large, attractive core that offers strong growth potential, allowing us to build on our resilient positions and good adjacencies."

We continue to hold and accumulate on weakness a quality business. One thing that I can always be sure of is that people will eat food. And keep themselves clean. And drink fluids. I am sure that Tiger will always have a business. Their brands are supreme quality, management is classy and is controlling costs in a tough environment. Buy and hold. There is a new strategy at Tiger, that they will focus on, it seems that they want to boost margins and be less a volumes business. I like that strategy, it will take many years to execute though.

Linkfest, lap it up

Is this a case of the "sins of the fathers" affecting the next generation? - If You Speak German, You're More Likely to Be a Penny Pincher. If you grow up in a household that has a strong savings culture, there is a good chance that you learn that same habit from your parents and then pass it on to your children.

If this comes to fruition it would be welcomed as an Alphabet shareholder. It is about time that the "other bets" division comes to the party given the huge amount of cash that the division chews through each quarter - Morgan Stanley: Alphabet could be sitting on a new $70 billion business

Home again, home again, jiggety-jog. Stocks locally are heading higher, having started lower! Mixed out there. Brazil, how crazy is that? Troops deployed .... phew. Venezuela, almost totally finished. As PM thatcher once said, the problem with socialism is that eventually you run out of other people's money (to spend).

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment