"One such company that is at the cutting edge of the future is chip maker NVIDIA. Whilst the company has been entrenched in the gaming market for years, more recently their application for Data Centers and Artificial Intelligence have started to come to the fore. Coupled with growth businesses like their original and core gaming business, as well as the associated virtual reality market, the company is well placed. And then of course, driverless cars are going to benefit from the incredible chips that NVIDIA produce."

To market to market to buy a fat pig Stocks rallied in the city built on gold, the Jozi all share topped 54 thousand points with a nearly nine-tenths of a percent gain on the day. Industrials as a collective did a little better than that, financials were weaker than the rest of the market, still up on the day. Naspers followed through with another stunning gain, the stock was up over three percent on the day. JD.com produced equally stunning numbers, that propelled Tencent and by extension Naspers.

Naspers now trades at an all time high, closing in on 2700 Rand a share, a half ordinary day would propel the stock to that level. The all share index is now one very good day, like yesterday, away from the all time records which were set 24 months ago. It has been a slog and a hard road. If you think about it, and you are a long term investors that squirrels away every single month, you get few opportunities like the last 24 months. If you can buy the same stocks, at the same prices over 24 months, on an inflation adjusted basis you get the same stuff 2 years on for over 10 percent cheaper. i.e. for every ten units you buy now, you are getting a discount on the units you bought back then. The future is always uncertain, part of the share prices being lower have something to do with that.

Yet, the index may be the same, not all share prices are the same. For instance, Naspers is 51 percent higher than 24 months ago. Standard Bank is 15 percent lower over the same time. Anglo American is just over 9 percent lower over the last two years. MTN is 50 percent lower, for all reasons ranging from the Nigerian fine, to the lower oil price, to operating difficulties. Woolies is 20 percent lower over that time period. Richemont is 8 percent higher. Aspen is 22 percent lower. Discovery is about flat.

British American Tobacco is around 42 percent higher. Sasol is 15 percent lower. Famous Brands is 21 percent higher. Mediclinic and Bidcorp are of course harder to work out, those stocks have been listed for less time. And of course, these are all in Rand terms, the Rand itself is 13 percent weaker to the Dollar over that time. It is very fair to say that the last 24 months for local investors has been more than a little challenging. It has been downright awful.

The right thing to have done, in any market as an investor, if you are going to stay somewhere and live there forever, is to add every month. And then buy exactly the same businesses at varying prices in the cycle of markets. Your guess and my guess based on all the information that we have before us on what is likely to transpire with politics, and by extension economic policy, are equal. It is how the investable assets that are available to us (equities in our case) react.

History has shown us that the universe here in South Africa for companies is small, they need to spread their wings and find new opportunities. Equally, history tells us for the most part that these said companies end up "doing well" in their endeavours. Naspers, Aspen, Bidcorp, Steinhoff, Mediclinic and Woolworths have all built big business offshore over the last decade and a half (some less time than that).

Stocks across the oceans and seas had a mixed session. Whilst Apple clocked another intraday high and firmly entrenched their 800 billion Dollar market capitalisation mark, energy stocks took a hit as oil prices continued to give up ground. Rising US stockpiles, even as the Russians and Saudis suggest commitments to their "levels" and quotas agreed on. I am sorry, the way that I see it, the frackers will win every day of the week. The "cartel" may look to increase prices by suppressing volumes, every time the price goes up and technology improves, the costs of the frackers are reduced.

As such, the independent and profit driven model will beat state model each and every time. So good luck with your cartel and loose organisation (that doesn't seem to listen anyhow), I will take those chasing productivity and technological gains, thanks so much. Chase in the sense of suggesting who will win, rather than chase as an investment. Too volatile, no thanks. Session end the Dow closed 0.17 percent lower, the broader market S&P 500 gave up one-tenth of a percent, whilst the tech heavy NASDAQ added nearly three-tenths of a percent.

There was a JOLTS number (the number of job openings) that was near a record high (set mid last year), that is real and tangible, right? Meaning that there are more jobs being offered to Americans than usual. Of course there is the small matter of continuing earnings, so let us deal with the most exciting part of our job, looking at company releases.

Company corner

We had numbers from Tesla last week Wednesday, this was for their First Quarter 2017. Given that the Tesla share price is up 50% Year to Date, on an already lofty share price, the expectations on the company were huge. So how did they stack up?

On the revenue side of things, their automotive related revenue was $2.3 billion for the quarter, an increase of 123%, higher than the market was expecting. Even though the revenue growth was more than impressive they missed on the profit side of the equation or should I say the loss side, they made a loss of $1.33 a share when the 'market' was expecting a loss of only $0.77 a share.

Another key number for the company is deliveries which clocked in at 25 051 for the quarter, an increase of 69% from last year this time and 13% higher than the previous quarter. The company say they are on track to deliver 47 000 - 50 000 cars for the half year, which means they are on track to break the 100 000 mark for the year. The Model 3 will go into production in July of this year, where the goal is to produce 5 000 cars this year and increase the production so that in 2018 they can produce 10 000 cars a week. Given the demand for the Model 3, the speed that they can get it out of the factory will have a meaningful impact on their final delivery numbers.

A relatively small part of Tesla, is Tesla energy which had revenue of $214 million (out of $2.7 billion) for the quarter, an increase of 841% thanks to the purchase of Solar City. A further boost to this division will be the production of their solar roof tiles, production starts in 2Q2017. Given that they are not as reliant on the these revenues as the stand alone Solar City was, they have changed focus from quantity to quality. Meaning that they are focusing on higher margin business but lower volumes, sounds more sustainable to me.

There are many things that other car makers envy of Tesla, I think their gross margin number is the main one though. In the last quarter they had a gross margin of 27.4%, around double that of other mainstream cars. The margin is also growing as economies of scale take place, as opposed to decreasing because of increased competition in the space. Here is another reason other car brands want to be Tesla:

"Using remote diagnostics, our service technicians are increasingly able to identify repair needs in advance of meeting with customers and even before customers notice issues. This has helped reduce repair times by 35% this year. Our goal is to reduce repair times even further."

Okay, so we can see that they are growing like gangbusters and have amazing margins. The only reason that they may blow up from here is if they run out of cash. In the last quarter they made a loss of close to $400 million, $100 million of which was just interest payments. They plan to spend $2 billion in the first 6 months of this year on CAPEX, currently they have $4 billion in cash on the books. The company needs to become cashflow positive because debt is expensive and issuing equity is more expensive over the long run.

In 5 - 10 years time, when the dust settles on the growth rates and the margins, what value will their profit number be? Based on that profit number and a "normal" multiple, what will their market cap be? Remember that Tesla just passed Ford and GM in market cap. Ford sells 7 times more cars in one month, in the US alone than Tesla does all year round globally. Having said that Tesla is not a normal car company, they have the energy division (which I think will be bigger than the automotive division in time) and they are the leaders in self driving car technology. Do I think this company will be a success? Yes. Would this be an anchor position in my portfolio? I don't have the guts. Happy to be a shareholder with a small position, great to be 'part' of changing the world.

For a second, imagine a world in a decades time. For reference point, cast your mind back ten years in order to appreciate how quickly "things" can change. Whilst Amazon were working on their cloud business in 2007 and Apple was about to launch the first ever iPhone, internet speeds were slow and laptops needed only so much. The thought of electric driverless vehicles in 2007 and the thought of streaming music, content streaming, original content from anyone who wasn't an established participant was a little far fetched.

A trip to Mars? OK, perhaps that is still far away. It was all subprime mortgage talk this time ten years ago, a Blackberry was cooler than any Nokia you had, Samsung and Apple were a twinkle. Yes. Tesla had not even released the (ugly in my opinion) roadster. The Dow Jones was at 13250 odd points. BTW it is 58 percent higher now, than it was back then. Fast forward to today, and we are talking about artificial intelligence, the cloud, storage and streaming are all second nature to us, and the hardware we have is all pretty amazing if not incrementally obsolete on a daily basis (you know what I mean).

Try and now imagine a future in ten years where more electric autonomous vehicles operate in a fleet type mode (i.e. anyone can be a "taxi" owner), there is more cloud related activity (sorry Seagate and friends, they are going to provide to the huge cloud infrastructure) and more machines doing low grade work, from cleaning to heating/cooling. More machines doing high grade work too, from surgery to transportation and delivery of goods. There will always be winners and losers in this type of scenario, hardware providers are going to have to evolve. Some will be left behind for obvious reasons. There will always be the Blackberrys of the world.

One such company that is at the cutting edge of the future is chip maker NVIDIA. Whilst the company has been entrenched in the gaming market for years, more recently their application for Data Centers and Artificial Intelligence have started to come to the fore. Coupled with growth businesses like their original and core gaming business, as well as the associated virtual reality market, the company is well placed. And then of course, driverless cars are going to benefit from the incredible chips that NVIDIA produce.

The company reported numbers after-hours, revenues grew 48 percent when compared to the corresponding quarter. The biggest surprise was that Datacenter revenues grew 186 percent, and now represents one-fifth of the business. Gaming is still the "big daddy", accounting for 1.027 billion Dollars of the groups 1.937 billion in revenues. Automotive revenues grew by 24 percent (Tesla is of course a user of their technologies, see Partner Innovations > Tesla).

The company also provided guidance for a similar quarter to the last reported, in terms of revenues and all the other metrics, a slight softening of gross margins on the current quarter, above last year though. The market liked what they saw, in the aftermarket (post the close) the stock is trading 10 and a half percent higher. Expectations are for the company to make around 3.5 Dollars worth of earnings per share this year, which means at the opening price (suggested) the stock trades on 32 times earnings. That is expensive, the market have this right though, you may well at the likely trajectory of revenues (expected) be paying mid teen digits here, if you are going to hold for at least three to five years.

This is truly an exciting business. This is truly an exciting world changing industry, much of the AI, VR (that is artificial intelligence and Virtual Reality to you and I), driverless tech and gaming advances will come from this company (and of course their peers). They are in the sweet spot of growth globally in computing, and we continue to add the stock on weakness. Expect a bumpy ride, a stock that has done well, may suffer from bouts of weakness (as seen recently) as well as increased competition. This is one to watch closely.

Linkfest, lap it up

Imagine just taking a pill and it has the same impact as a workout. It seems like it is closer than you think, when you actually do exercise! Mice given 'exercise in a pill' show 'huge increase' in endurance, say Salk scientists

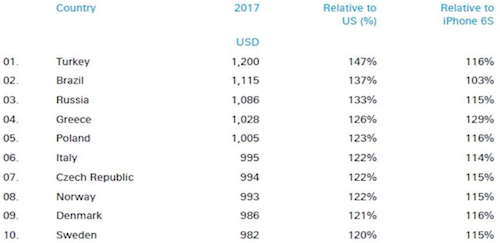

Here are the price differences between countries for the iPhone. I was surprised to see how big the price difference was for Euro based countries - Latest annual ranking shows the cheapest & most expensive countries to buy an iPhone.

This looks like the trend for cities going forward. Skyscraper forests and expect skyscraper farms - China is about to get its first vertical forest. Given that the two buildings will remove around 5 cars worth of C02 a year, it doesn't do much to clean the air but it will probably start a movement that becomes more efficient.

Home again, home again, jiggety-jog. I am starting to see some big European businesses report numbers well ahead of consensus. I cannot quite tell whether or not the expectations are low, or whether companies are genuinely after a long time, starting to look a whole lot better than before, time will tell. Stocks across Asia are mixed again, Tencent is up, you need to know that. Although, Naspers may have reacted already, if you know what I mean. The currency is marginally stronger, that may be a drag at some level as we start.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment