"I am excited by the business of Stryker. They really are at the (excuse the pun) cutting edge of healthcare technological advances. Less invasive surgeries will lead to more procedures and more importantly for a company like Stryker, more quality equipment sold."

To market to market to buy a fat pig OK. I have seen a lot of people upset with the way that Trump just fired the FBI director. I hear their pain, it is part of the processes of the separation of power, who can and cannot make the decisions that have implications, not only for the short term, equally in the long run. According to the chattering classes, this was supposed to be very negative and as such, they were expecting a big sell off in the equities markets. So do not be surprised with reading headlines of shock/horror such as this one from Barron's: Shrug: Dow Drops 30 Points as Not Even Comey's Firing Can Move This Market.

This Market? It seems like the author, Ben Levisohn, is somehow bemused that a FBI agent firing doesn't see equities sell off. OK, what is the theory? Quite simply, this may be a roadblock in trying to get stuff done. If the president of the most powerful economy on the planet (no, not North Korea) is making executive decisions that peeve some folks, that may not lead to tax reform legislation getting passed. Look, there are tons of what ifs in there, and what could and might happen. From where we sit, you should never invest on the basis of what politics may, or may not pan out. Levels of markets are "targeted" by market strategists, based on momentum, or whatever.

Ben does not seem like the biggest optimist to me. I am naturally cautiously optimistic. As an investor, you have to always believe, after you have done your thorough research, that the thesis will hold true over time. Otherwise, you should go into the business of candles, paraffin, shotgun shells and baked beans. People spend way too much time on the Fed, or politics or forecasting, or targets or worrying about what can happen next. Investing is not like following your favourite sports teams. There are more ups and downs there. You have little control over team selection in sports team supporting, you can choose your entire portfolio without compromising the team inclusion or exclusion. You are Arsene Wenger. Goodness, I hope that Arsenal qualifies for Champions League, that would make some people sit down.

In closing this piece, know a few things about investing. You have absolutely no control over market levels and share price movements. Zero. You have complete control over what you own and what your holding period is likely to be. Peter Lynch once said in an interview: "I mean I deal in facts, not forecasting the future. That's crystal ball stuff. That doesn't work. Futile." He was a great investor on the back of human emotion and could recognise it better than most. In other words, he could see through the fear and greed. Nobody knows what is going to happen next and I think for many retail clients, that scares the proverbial investing pants right off them. No, it is too risky. In reality, that couldn't be further from the truth.

You have control over your investments. The calls I have fielded over the years about anxiety and wanting to sell to go to cash are forgotten in the mists of time as equity markets rise. Markets go up and down, the company that you own, lives, breathes, has real life customers and employees and managers, they make real life decisions on spending shareholder money to create new services and products. There are real life consumers of their products and services, looking for quality relative to the price they are willing to, or can, pay. So whilst Ben worries what may move This market (and that is his job), you must know you own a piece of a business, that happens to have a second by second quoted price with deep liquidity. And it is that simple. What you choose to do with it from there, well .... that is up to you.

I definitely subscribe to theory and practices of a simple line in the 1988 Warren Buffett annual Chairman's letter:

"In fact, when we own portions of outstanding businesses with outstanding managements, our favorite holding period is forever. We are just the opposite of those who hurry to sell and book profits when companies perform well but who tenaciously hang on to businesses that disappoint. Peter Lynch aptly likens such behavior to cutting the flowers and watering the weeds."

And there ends the investing lessons for the day. I am sure this is a drum we have beaten on five years/ten years ago and before, and over the next decade too. Keep on keeping on.

OK, a quick market look then. The Dow gave up 32 points (0.16 percent), as you saw above. The broader market S&P 500 added just over one-tenth of a percent, whilst the nerds of NASDAQ added 0.14 percent by the close. Disney was in the spotlight, many people still very anxious about the ESPN business. This business is intriguing for me, the longevity and the ability to span multiple generations across many different cultures. Heroes and villains for children of all ages. The stock sank over two percent. NVIDIA soared nearly 18 percent to an all time high, those results (we wrote about them yesterday) were very well received.

Locally, stocks added 0.15 percent as a collective. Industrials lost around that amount (0.15 percent), the Rand was stronger (on account of the Dollar being weaker). AngloGold, Amplats and Remgro were the big winners on the day, South32, Steinhoff and Shoprite were the big losers on the day. There was a complicated and multiple moving parts trading update from Netcare, the stock barely moved on the day. Over the last three years the stock is basically flat in Rand terms.

Company Corner

Homer Stryker was a pretty late starter, as far as business formation goes. Born in 1894, he only discovered a decade and a half into his medical career that he was most interested in orthopaedics. Fair enough, rather late than never! And sooner than Ray Croc (the McDonald's guy!). Little did Dr. Homer Stryker know that medical science would get to the point nowadays where the company he founded (and was named after him), Stryker, would be at the point where the company is responsible for Craniomaxillofacial and Spinal implats. We are talking about reconstruction of skeletal structures here, ones in which people can have multiple "parts". Knees, hips, your foot, your ankle, pins in bones, machines that help surgery (Mako), which include truly futuristic technology, after and pre care (ambulance stretchers to beds), and the original power tools business.

It was Homer after all that that patented the oscillating saw, to remove plaster casts. The website under history notes the following (from 1947): "As a result of a late-night brainstorm, Dr. Stryker hit on an idea for a powered cast cutter. The first prototype, created on the premise that an oscillating saw blade cuts hard material but not soft surfaces, incorporates a motor from a malted milk mixer. The once long and laborious process to remove a plaster cast now takes only minutes with the cast cutter. The saw cuts hard cast material, but not human tissue, and is the forerunner to a broad line of surgical instruments." Thanks to Homer not sleeping at night, we can all be grateful for the amazing ranges of tools at surgeons and health caregivers disposal. And technological advances in software and computer based technologies.

The company will leverage off the same healthcare growth that our other investments in the sector will benefit from. At the end of the day, modern technology will save money and boost the outcomes for the better for all parties. Better outcomes from the patient to the healthcare insurance businesses. And definitely allowing the professionals and hospitals to focus on what is important, the outcome. Watch this video (it is obviously from the company) to see what is available to patients, the technological innovations that Stryker supplies to surgeons, for less invasive surgery - Aim Platform, scroll to the bottom of the page.

The business is really well diversified, within their three core divisions, namely MedSurg, Orthopaedics and Neurotechnology and Spine, no one subsegment is more than 14 percent of total sales. In fact, here is the breakdown from the 2016 annual report: Instruments - 14%, Medical - 14%, Endoscopy - 13%, Knees - 13%, Trauma & Extremities - 12%, Hips - 11%, Spine 7%, Neurovascular - 5%, Neuro Powered Instruments - 4% and Craniomaxillofacial at 2%. Various "other" makes up the balance.

MedSurg was the standout, thanks to new products and acquisitions in that area. Growth outside of the US in revenue terms was around ten percent better than the corresponding quarter. The business is essentially still very much a US based one, roughly 30 percent of the business is outside of the US. This is good, it means that their ability to continue to attract big business from other territories. Europe, Canada and Australia, where there are loads of rich people.

I am excited by the business of Stryker. They really are at the (excuse the pun) cutting edge of healthcare technological advances. Less invasive surgeries will lead to more procedures and more importantly for a company like Stryker, more quality equipment sold. Stay long and accumulate on weakness, this is a fabulous business with a very fair share price at current levels. You must own this company in your long term portfolio. It is a must!

Linkfest, lap it up

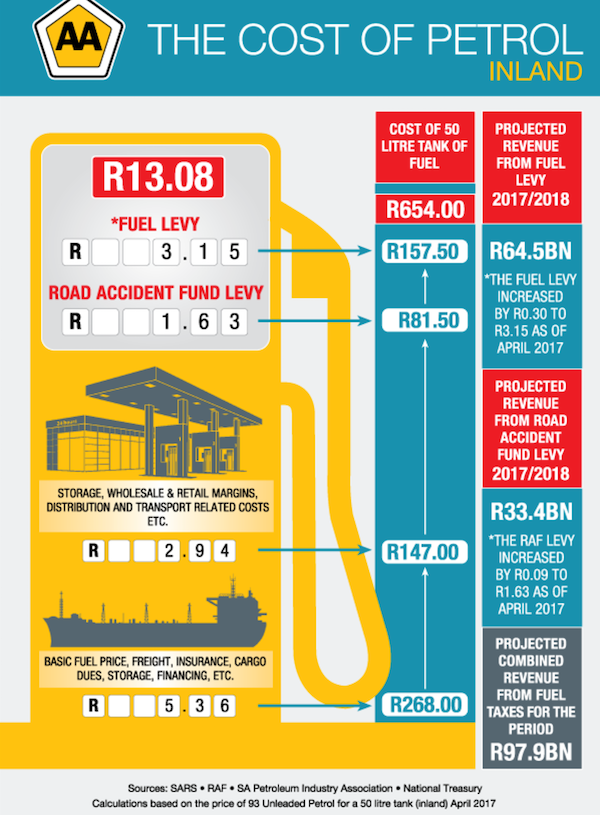

The AA regularly makes a nice breakdown of what we are paying for when we fill up our cars - The petrol price - all you need to know.

Here is a graphic showing that we drive on the wrong side of the road. A bit of Googling tells me that knights would keep left because their swords were in their right hands, people rebelling against the colonial system of doing things decided to then ride on the right hand side. Not sure how true it is but makes for a good story - Which Side Of The Road Do You Drive On?

You will find more statistics at Statista

You will find more statistics at Statista

Home again, home again, jiggety-jog. How was that moon this morning sportslovers? It was lovely. No ... it was spectacular. Stocks across Asia are all higher, on balance, if not by a huge amount. The Nikkei nearly broke the 20 thousand mark again! A long way to go to the 1989 level of the high 30 thousands though.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment