"That certainly looks like a good company to own, one with rising revenues and earnings, right? Yet unfortunately we are hard wired to see that the price of a stock and link that to a company's "well-being". That is unfortunately the wrong way to go about investing. In large part we have resisted the selling of what is a good business. We will hold it through the (perhaps) Obamacare repeal, which now needs to go through the Senate - Senators Set to Write Their Own Version of the GOP Health Bill."

To market to market to buy a fat pig Markets locally were lower to mixed here in Jozi, Jozi, stocks at the end gave up around one-third of a percent by the close. Industrials were marginally higher, resource stocks were taking pain from commodity prices that have definitely been sold off. Part concerns over the supply side being still too strong and the demand side being average. In other words, for iron ore markets it may be as simple as strong Australian supply may be more than meeting tepid Chinese growth. I think in the end all of these factors will be fine and meet their balance, commodity price markets tend to be very volatile and as such it is a sector of the market that we do not view favourably for retail investors.

The stocks that took some pain were the likes of FirstRand, MTN, AngloGold Ashanti and Anglo American. AB InBev was on the top of the leaderboard with a quarterly update that was well received by the market. The brewer rose nearly 7 percent on the day, Richemont has continued to see follow through (like all the luxury stocks), up at 116 Rand a share and at the best levels in 18 months. And in fact near an all time high. As is Naspers. So what has transpired over the last few months is that the rally in the equities market (relative) has been led by industrials (the return of AB InBev has helped too). At the expense of the mining shares.

Stocks over the oceans and far away made a fist of things from the worst part of the session around midday, in the end stocks were flat to marginally higher. The Dow ended the session down a smidgen, both the S&P 500 and the nerds of NASDAQ were just a little higher. Eddy, in his newsletter this Friday pointed out that volatility was exceptionally low and that the range for the S&P over a few sessions was almost zip. Zero, nil. Niks. No range of any sort. Volatility story - The Mystery of the Stubbornly - Low Volatility Index Is Deepening.

Facebook closed the session down around two-thirds of a percent, there was a whole host of broker upgrades after these numbers. There really are endless opportunities for this business, they are going to make sure that they stay on top of their advertisers and more importantly their community. They are definitely going to continue to change the world. To think that the estimates are for 50 billion Dollars of revenues this year, they have around 32 billion Dollars worth of cash and that same business did not exist 15 years ago. A time when people were still licking their wounds from the dot-com crisis. Non-farm payrolls today. That will have an impact on markets.

Company corner

Cerner, the IT healthcare services business, reported numbers for the first quarter last week. Quarterly revenues rose 11 percent when compared to Q1 2016, it was at the top end of guidance given by the company. Earnings per share clocked 52 US cents, compared to 43 cents this time last year. Guidance for the coming quarter was at the top end of the range around 1.335 billion Dollars, with earnings per share likely to be in the region of 61 cents per share. For the full year, the company expects the mid point of the range to be 2.5 Dollars of earnings.

That means at the current share price of 64.28 Dollars a share, the stock trades forward at around 25 times earnings, relative to the growth prospects it looks a bit rich. The share price has been all over the show, at the depths of despair in December last year through to January this year. Since then however, the share price has been on an absolute tear, year to date the stock is up 35.7 percent. We like the space and the sector, the share price had reached an all time high of 75 Dollars a share back in April of 2015, around two years back.

Cerner has four decades worth of healthcare and information technology integration experience. They are one of the first to digitise medical healthcare records. The cofounders are very much still at the helm of the business, both Neal Patterson and Clifford Illig are in the Chair/CEO and Deputy-Chair roles respectively. Their solutions are smart, from devices connected, to feeding their cloud databases, to billing systems, to better help the business of hospitals, to focus on the important roles in providing quality healthcare.

Healthcare and hospitalisation is an emotive and complex affair, no two humans are the same, neither is their care. What the patients, the caregivers and the broader role players all want is continuity and world class care. Through advanced and specialised tools, time is saved and better care is given. Simply put, this business has loads of room to grow. They really do. The older and more technologically integrated the whole world gets, the more data there will be to put together for all our health records.

Revenues have seen astronomical growth, since the business went public in 1986 they have compounded by 21 percent per annum. And judging from their order books, there still is a lot of work to do. Retire paper and keep a data trail. This will help everyone. Not only will this business continue to steadily grow revenues and profits, it fulfils the role of being a humanity improving investment too.

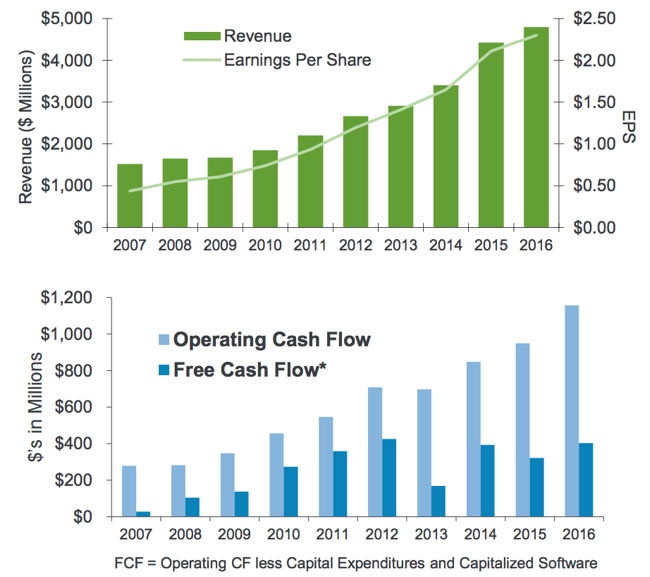

When a share price underperforms, people naturally question whether the business is still good and whether the business is still attractive for investors. To answer that question, I have attached below from the last Cerner investor community report the important financial metrics over the last decade.

That certainly looks like a good company to own, one with rising revenues and earnings, right? Yet unfortunately we are hard wired to see that the price of a stock and link that to a company's "well-being". That is unfortunately the wrong way to go about investing. In large part we have resisted the selling of what is a good business. We will hold it through the (perhaps) Obamacare repeal, which now needs to go through the Senate - Senators Set to Write Their Own Version of the GOP Health Bill. All things being equal, this would be a minor setback for Cerner, the road ahead is plenty. Whilst we were actively accumulating at lower levels, we are likely to just hold at current levels, if you have them. A great company, a wonderful future.

Linkfest, lap it up

If you are worried about Tencent's valuation and by extension Naspers valuation this graph should help calm things - China's Vast Digital Potential. Two things will happen in China, more and more people will become connected but more importantly the GDP per capita is continuing to grow. More people online, spending more! The potential is mindnumpingly huge.

You will find more statistics at Statista

You will find more statistics at Statista

I think in terms of quality internet/tech companies Naspers must be one of the top globally. It is great that we have such easy access to it and by extension one of the leading internet company's in China - China's Tencent is a sleeping giant in the global artificial intelligence race.

If a piece of art can sell for over $100 million, it makes perfect sense to me that a car (better in my opinion) can sell for the same price - Is This the Most Valuable Car in the World?. If I think that paying $100 million for anything is insane, that is another story.

Home again, home again, jiggety-jog. Whoa. Prices of metals are getting pasted, Iron Ore prices were heavily down, around 8 percent a few hours ago, I think 7 percent now. I suspect that there will be pretty big implications for the likes of BHP Billiton, Anglo and Kumba at the start. BHP was off around two and a half percent halfway through the Australian afternoon session. Wait! Tencent was off around one-third of a percent.

The Rand is a whole lot weaker. Perhaps few are convinced down there in Durban about the landscape for investment currently, or am I just being a "hater"? No, it is possibly the commodity price sell off that is impacting the Rand here this morning, Brent is also taking a paddy whack, that is good news for consumers!

French elections this weekend! We should know next week Monday/Tuesday what is going to happen with that! I suspect Le Pen will come a distant second. Hey, did you know (talking French and big things) that the Eiffel Tower was the tallest structure in the world for 41 years (1889 to 1930), and the Empire State was the tallest building in the world for 41 years too (1931 to 1972). Markets should be a little lower to start with, non-farm payrolls in the US a little later today.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment