"What is Amazon likely to look like in 20 years from now? The irony in the fact that 20 years and three days ago (just before Amazon listed), Barnes and Noble sued the company for claiming they were the biggest book store in the world, claiming they were just a book broker."

To market to market to buy a fat pig Friday was a mixed bag for the JSE all share index, financials added around one-quarter of a percent on the day (over the last three years financials are up around 14 percent as a collective), resources slipped around one-fifth of a percent, whilst industrials were a bit of a drag, down one-quarter of a percent by the time the closing bell rang. Richemont, with a very poor bunch of numbers was the main drag on stocks as a collective (the all share ended the session down around one-tenth), that stock was down over five percent on the day. We will cover those results in due course and report back. Other "losers" included the likes of Amplats, Glencore and Woolies. In the winners column it was the likes of Capitec, Naspers (with another all time high) and Aspen pulling us ahead.

There is a ton of news this morning, including Astral foods, Barloworld, Vodacom and Netcare (and Lonmin). Yowsers, this is very busy. Vodacom at the same time have acquired a stake in Safaricom, this may be part of a grand plan for Vodafone to sink their sub-saharan African investments in Vodacom here locally. Through one tradable and liquid instrument with a strong pension fund in a country that is ready to be more active in this regard. i.e. the PIC or the IDC, or any such other investment arm. Vodacom would fit right in. Having said that, government sold their stake to the PIC for 25 odd billion Rand, around two years ago (July 2015). Just saying that I think that this is sensible from the perspective of Vodafone, keeping their asset base in one place where capital markets are at their deepest.

Stocks across the oceans and seas were a mixed bag, the nerds of NASDAQ closed marginally higher after another all time high from Apple inc., it is now bigger than ever before. Apple now trades at over 156 Dollars a share, a market capitalisation of 825 billion Dollars. Edging closer, with huge anticipation of the new form iPhone in the coming six months. It is going to be the biggest and most anticipated launch from the company in their history. By the end of the session, the nerds of NASDAQ had tacked on nearly one-tenth of a percent. The Dow Jones Industrial Average lost just over one tenth of a percent, the broader market S&P 500 lost 0.15 percent as the industrials weighed heavily, GE down over two percent on the session, Wells Fargo down nearly one and one-third of a percent by the session end. Healthcare added just over one-third of a percent. Political machinations aside.

Company Corner

It has been 20 years to the day since Amazon listed. You can even read the prospectus in text form - FORM S-1. Bezos will not be at the NASDAQ to ring the bell, he doesn't mix with the investment community well, despite being from that sort of background. He was, in another life, an investment banker. Heck, he does not even "attend" earnings calls.

I had a lengthy chat to older clients (older than me) about their experiences of "things" from technology, to consumption to healthcare improvements and travel. It is always worth the exercise writing down the important technology you had then, versus now. Do the exercise, write down all the mobile phones you ever had, all the personal computers and their relative computing power to today. And then try and draw a historical context, i.e. the time between 1950 and 1960 seems like a short period in history, 10 years has seen a massive change in mobile handset technology.

I had a Nokia 3310, predictive text was something huge. That was the year 2000. I had a Nokia before that, and through to the Nokia N95, heck, that was 2007. It was only in 2008, less than ten years ago that the Apple iPhone 3G started to attract multiple users. And the rest is history. Amazon has a similar trajectory, with their fearless leader Jeff Bezos always looking to try new things and avenues of business. Failure is just a seven letter word for him.

If you do not try, you will never know what could or might transpire. There are many success stories, the Kindle, we just take that for granted nowadays. The seamless delivery of books. If I want it, I can have it in minutes, or less, depending on my skills. Hotel booking, high end fashion, a Shopify competitor, payment services, Q&A website called askville, all of these services have been pulled by Amazon. If they try something and it seems that there is little or no traction, the company normally pulls the plug. Heck, even the Fire phone has not been a success, Amazon are "working on that" still.

What is Amazon likely to look like in 20 years from now? The irony in the fact that 20 years and three days ago (just before Amazon listed), Barnes and Noble sued the company for claiming they were the biggest book store in the world, claiming they were just a book broker. The rest as they say is history. It is easy to say that it was obvious to have seen the trajectory of Amazon and their dominance. Same day delivery, automation and technology

along with their drive to be more and more efficient. The consumer has reacted with an overwhelming yes. And now there are cloud services.

That still leaves us wondering about the investment case for Amazon at their all time closing high of 961.35 Dollars a share. The business increasingly invests in existing lines of business, as well as new lines of business. It is not very profitable. And yet ..... it is the fourth largest company in the US by market cap. Here is what the company says in the prospectus: "Amazon.com was founded to capitalize on the opportunity for online book retailing. The Company believes that the retail book industry is particularly suited to online retailing for many compelling reasons."

Ironically, they contradicted themselves: "Furthermore, unlike with clothing or other personal products, consumers can make educated book purchase decisions using online information." And then immediately make good: "Amazon.com intends to use technology to deliver an outstanding service offering and to achieve the significant economies inherent in the online store model. The Company's strategy is to build strong brand recognition, customer loyalty and supplier relationships, while creating an economic model that is superior to that of the capital and real estate intensive traditional book retailing business."

Amazon will be what they will be. Bigger and better than their peers. You must, as a shareholder, be prepared to experience bouts of extreme volatility as the investment community struggles to come to terms with the valuation and enterprise value - the sum of the parts. We remain long this wonderfully innovative business, here is to the next 20 years of investing. What hasn't changed (some of it), in the prospectus: "LIMITED OPERATING HISTORY; ACCUMULATED DEFICIT; ANTICIPATED LOSSES." Longer History, the last two .... the same.

Richemont results on Friday. These were worse than most people anticipated, in recent quarters there had been signs of better luxury goods markets globally, in bits and pieces. The likes of LVMH and Tiffany's have seen better sales recently. Watches taking a hit, jewellery rebounded (sales up 7 percent), leather goods sales doing really well (up 11 percent) and clothing bumbling through. Ironically, sales of writing instruments (in the internet era), increased by five percent. Margins in jewellery declined, in watches margins halved. Ugly. We will do a full review today coupled with a longer update of the expectations.

Linkfest, lap it up

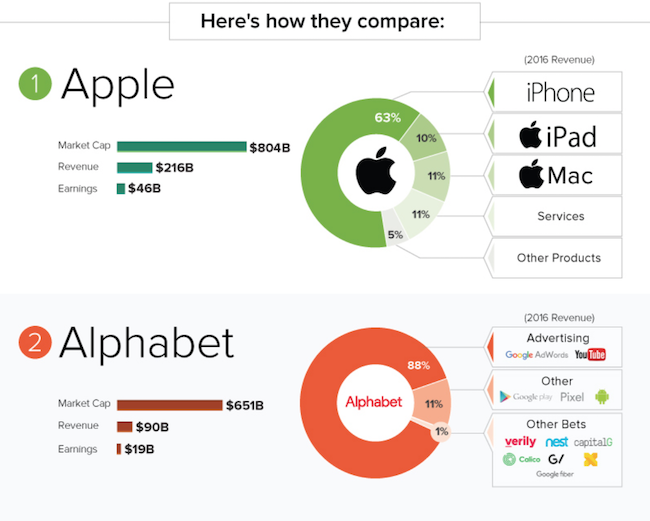

Here is a nice graphic showing the breakdown of revenues for the largest tech companies. Notice that with age the more diversified they become, which is what you want to see as an investor - Chart: Here's How 5 Tech Giants Make Their Billions

Wow, the wonders of AI. This way your alarm is always on but doesn't get triggered by family and pets - This Home Camera Can Tell Who's There. What happens when you have guests come over?

When people look to the past many people think that investing was easy, it is human nature to look to the past and think that the course of history was the most obvious course - Everything, in retrospect, is obvious. Good read with a nice one liner from Tom Cruise:

"Everything ends badly, otherwise it wouldn't end."

Home again, home again, jiggety-jog. Stocks are mixed to start with. Naspers is at another all time high, courtesy of the positive Tencent momentum. A stronger Rand in these parts, thanks to positive momentum for emerging markets. Woo hoo.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment