"In my view, you needed Musk, whether Tesla is a huge success or not, to shake the industry up. And this he has done, setting consumers up for energy savings that are going to be epic. Whole industries from servicing the combustion engine to the oil industry are going to be under pressure."

To market to market to buy a fat pig We live in interesting times. It is better than the dark ages, where technological advancements were few (from what I can tell), other than formulating new ways to repel those trying to breach the castle walls. Whilst it does not feel like it for many (things were always better in the old days, they tell you), the statistics tell us it is so. We are better fed, we use less units of energy to achieve more, there is more information to be shared at any other point in humanity and on average we are getting less poor, again this is all relative.

It is tough out there though, there is not sunshine and lollipops rolling equally .... new 12 month lows for the likes of Tsogo, Sun International and Pick n Pay on Friday. That tells you something about the state of the consumer at both a discretionary and non-discretionary spend level. Although in the case of Pick n Pay, perhaps the market had got ahead of what the earnings expectations are likely to be. And when those fall flat, then the share price comes under pressure. The stock trades on a high teens multiple forward, and that I guess is a problem for Mr. Market.

At the opposite end of the spectrum though, and perhaps this is an indication of "through the worst" was a twelve month high for CMH (Combined Motor Holdings). If people are not going to casinos, then are they buying new cars? The stock traded at a 12 month high, and has recovered sharply since the monster sell off post the financial crisis of 2008. Perhaps the stock is just too cheap and has been like that for a while. On that subject, we were nattering in the office this morning about the future of transportation.

I made a throwaway comment that I thought that Elon Musk had "won", and by that, I mean the rest of the vehicle manufacturing businesses embracing electric vehicles as a result of consumer needs and wants. The thesis was given a stamp of approval when I read that Ford had just replaced their CEO. With a fellow by the name of Jim Hackett, who had been running Ford Smart Mobility. And what does that division do? As per Hackett's bio, does this sound familiar?: "The company is continuing to focus on and invest in its core business - designing, manufacturing, marketing, financing and servicing cars, SUVs, trucks and electrified vehicles. At the same time, Ford is aggressively pursuing emerging opportunities through Ford Smart Mobility, the company's plan to be a leader in connectivity, mobility, autonomous vehicles, the customer experience and data and analytics."

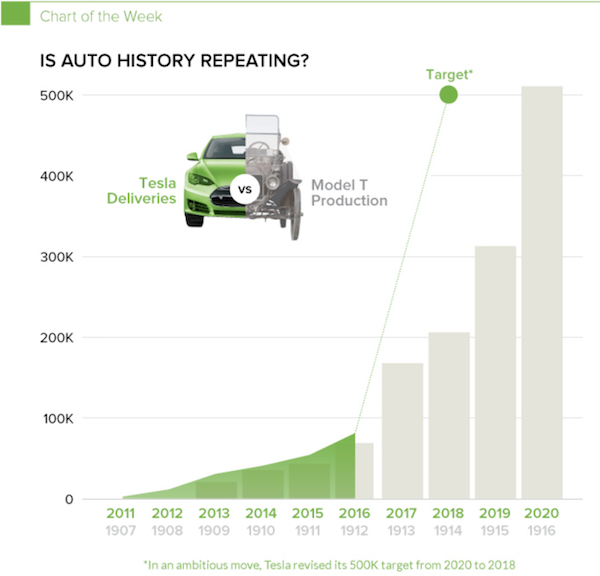

In my view, you needed Musk, whether Tesla is a huge success or not, to shake the industry up. And this he has done, setting consumers up for energy savings that are going to be epic. Whole industries from servicing the combustion engine to the oil industry are going to be under pressure. The oil majors cheering a crude price going up as a result of production cuts does not sound like a long term solution to me, now does it? I am sure that 125 years ago there were people who delivered hay and serviced stables that thought transportation would not change that much. I get the sense that we are at the same place, right now. It may take a couple of decades, we have definitely set ourselves northwards on that trajectory. See in the links below, the Model T Ford and the Tesla Model 3.

Let us finish off quickly here. Naspers also clocked another lifetime high, still smarting from the Tencent numbers that blew away expectations. Tencent is up at another all time high themselves this morning, up nearly three percent as I write this. I guess this bodes well for the open. Leading the charge Friday was another big day for Steinhoff, clearly both sets of shareholders happy with an announcement to split the business into two, the stock up over six percent on the day, up over ten percent in two sessions, since the announcement. It has still been a pretty dismal 1 year performance, the stock is down 17 percent over that time frame. At the other end of the spectrum was a bad day for Sappi, Remgro, Hammerson and Old Mutual, the Pound sterling certainly is a "moving target" and is impacting the Rand Hedges in that part of the world.

Session end the Jozi all share index closed up four-tenths of a percent, and is approaching a lifetime high. I think that we are about half a percent away from reaching an all time closing high! That point was reached 24 months ago though ...... it has been tough out there, with many stocks exhibiting stress if they are tied to the fortunes of ZA inc., others, like Naspers, have been non-stop gainers. That is why one should be using flat periods like this to continue to add all the time, when stocks are cheap relative to prior valuations. As ever, it all depends on the earnings. I am expecting that we may well breach the all time high today, perhaps closing there.

Stocks rallied again Friday in New York, New York. Session end, with energy, basic materials and industrials all charging ahead (all major sectors ended in the green), the Dow Jones added nearly seven-tenths of a percent. The broader market S&P 500 added about the same, whilst the nerds of NASDAQ trailed a little, up just under half a percent on the day. In a tricky week for stocks with the massive mid-week sell-off, stocks ended less than half a percent from where they started. Not so bad for "this time we are really going to sell off". Anyhows, if there is someone amongst us who is able to call the market consistently well on a very short term basis, please present yourself quickly. There are of course the titans of the industry who are able to turn in record gains and "make it big", we all know who those trading giants are. They do not compare to the corporate builders, Gates and the like, if you know what I mean.

The sneaker sales malaise continues to weigh, Foot Locker stock tanked nearly 17 percent .... there was of course external factors like a strong Dollar and delayed tax refunds. And besides, the miss at an earnings and revenue level was hardly "terrible". It was quite interesting what the CEO had to say, and I certainly agree with him: "our customers have not lost their tremendous appetite for athletic footwear and apparel." Whether or not he is right that their business is stronger than ever, time will tell whether the mainstream channels of yesterday start getting "chowed" by all the online platforms available to us. I mean .... you can order Columbia Sportswear online here in South Africa. The people who sell other peoples stuff, those places are called "the internet".

Linkfest, lap it up

Here is a comparative view of Tesla's targets compared to the Model T. I was amazed to see how quickly Ford managed to ramp up their production - Electric Vehicles are Poised for Their 'Model T' Moment

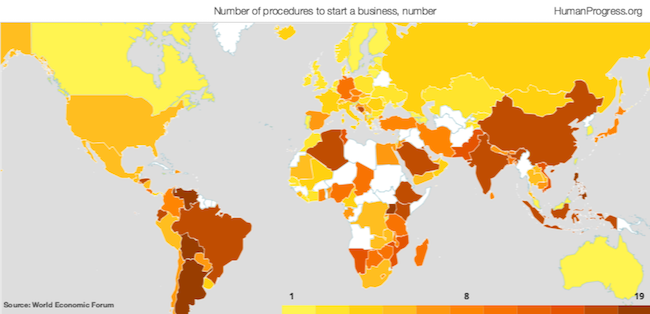

The easier it is to do something the more people will do it. In this case it is starting a business, something that South Africa desperately needs more of - Number of procedures to start a business. Less procedure means less regulation, which I think is a good thing. The counter argument is that less regulation means a bigger chance of fraud and tax evasion.

Take up might have been slow but momentum is building. The one key benefit of building a city from scratch is that you get greater control over the end result, avoiding issues that older cities have like roads being too narrow or a factory being too near residential housing - China's Copy of Manhattan Is No Longer a Ghost Town.

Home again, home again, jiggety-jog. Stocks across Asia are mostly higher. Mainland China stocks are lower, the rest are up my friends. We should have a better start here, watch out for that all time high.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment