"Whilst this is clearly more than a glancing blow to Google, the most dominant business inside of the Alphabet matrix, this share price still looks attractive at current levels (down two and a half percent by the close)."

To market to market to buy a fat pig You know the saying, shop 'til you drop? How about shopping 'til you drop .... say ..... 2.4 billion Euros? That is a lot of money, in any language. The European Union antitrust regulator has fined Google/Alphabet that amount, for abusing dominance as search engine by giving illegal advantage to own comparison shopping service. Read the release, the link before. How the number was arrived at (a specific 2 424 495 000 Euros) is as per guidelines. Google now have 90 days to "stop this practice".

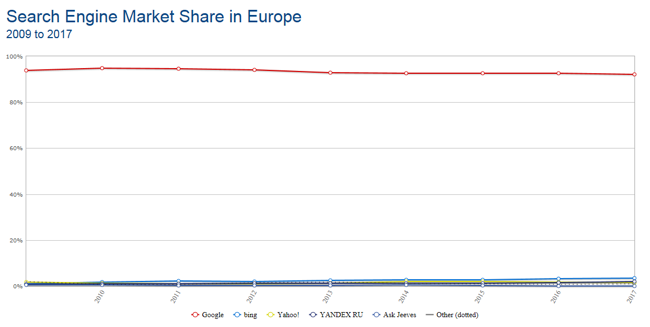

I find some of the findings weird, see - European Commission - Fact Sheet. First and foremost, if the word internet search is synonymous with "Google-it", is that the fault of anyone? It is consumer adoption. Microsoft with all their resources haven't had broader society talk about "Bing-it". We used to kid around in the office and shout: "why don't you Yahoo! it". Said nobody ever .... really. So the question then arrises, if you have such a dominant position in search (List of search engines), do you need to treat everyone fairly?

The release Fact Sheet deals with this issue of dominance and how you should behave:

"Market dominance is, as such, not illegal under EU antitrust rules. However, dominant companies have a special responsibility not to abuse their powerful market position by restricting competition, either in the market where they are dominant or in separate markets. Otherwise, there would be a risk that a company once dominant in one market (even if this resulted from competition on the merits) would be able to use this market power to cement/further expand its dominance, or leverage it into separate markets."

I am part European. Yes sir. I am also very much fully engaged in shareholder returns and the champion of capital. Yes sir, again. I sometimes feel that regulatory overreach stifles the rights of consumers. If consumers felt that they were "being ripped off", surely they would change their patterns? Yet, as per the release from the EU commission itself, here is the period in question:

It almost seems to me, again, I am talking with my capitalist hat here, it is when the dominance isn't government and is a private entity, then the competition people have a problem. Europe is about everyone getting a fair socialist shake. If you are a small family business, you enjoy protections. Get too dominant and that seems like it is "bad". There are some big state ownership of rail and energy companies across Europe, I suspect that in time, private enterprise at a micro level will usurp inefficient organisations, either of the private or public sector.

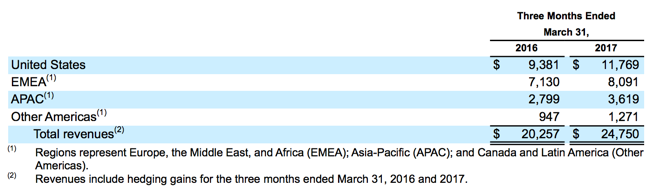

Whilst this is clearly more than a glancing blow to Google, the most dominant business inside of the Alphabet matrix, this share price still looks attractive at current levels (down two and a half percent by the close). We continue to accumulate, we know that the company will change their dominance behaviour (pfff), remembering that their business by geography (from the last results) is as follows currently:

The United Kingdom is roughly one-fifth to one-quarter of the EMEA revenues. And these are the billing addresses of their customers, that may be for tax purposes slightly skewed. It is also important to remember that the EU took around seven years to finally get here, this is a cumulative fine, not a yearly thing. They have threatened to fine Alphabet 5 percent of annual turnover, should this behaviour continue. In the end, all we can say is that Google has been fined bigly, this is a pro show, we do think that much has been made of it. As it is a big story.

Stocks across the oceans and seas, sank, mostly during the second half of the session. It turns out that the first of the delays of the shunting through of the Trump administration bills is weighing a little on Mr. Market. The US Senate plan to vote at a later date. Why? It seems that there are several Republican senators who oppose the what is termed the "Obamacare replacement bill". What this does is set the tone for further pushback internally in the GOP (the Republican party) for further tax reforms.

President Trump shrugged it off and suggested that they were working hard on this. What means is that any likely tax reform before the August recess is becoming less likely than before. And that may be bad for the perceptions of the market that there will be a more business friendly environment out there. Be that as it may ...... Rand Paul and Ted Cruz are amongst some of the senators blocking the bill in the current form.

In the end, stocks sold off, the Dow Jone ended the session down nearly half a percent, the broader market S&P 500 lost four-fifths of a percent whilst the nerds of NASDAQ, dragged lower by the poor show from Alphabet, lost 1.6 percent on the day. The European currency, the Euro, also got a boost from commentary from Mario Draghi that "deflationary forces had been replaced by reflationary ones", and perhaps this signals less intervention from the ECB. As a result, Euro up, Dollar down and oil prices recovering. Here it is, the Mario Draghi speech, from the beautiful little place called Sintra - Accompanying the economic recovery. What is quite interesting is that his opening lines fly in the face of what our president suggested to parliament:

"For many years after the financial crisis, economic performance was lacklustre across advanced economies. Now, the global recovery is firming and broadening."

It is a relatively short speech, the precursor to an ECB forum for the rest of today (and two days prior to this). Ben Bernanke is there, he is my hero, one of them. Point well made, "things" are starting to get better. There is a program of the "sessions", lunch looks about the most exciting for me.

Back home there was action from our Reserve Bank, see this piece - Errors in Public Protector's report - SARB affidavit. I will take Reserve Bank Governor Lesteja Kganyago on monetary policy every single day of the week over Public Protector Busisiwe Mkhwebane every single day of the ..... year/decade. The SARB needs to be independent, for the sake of the vast majority of the citizens of our land.

Resource stocks caught a serious bid, up 2.83 percent by the close of business. That boosted the all share index by just over one-quarter of a percent. Stocks at the top of the table included the likes of Anglo and BHP Billiton, Glencore and South32. In the losers list was the likes of Investec, Mediclinic (they just bought a Swiss hospital for 1 billion Rand, at least a 64 percent stake), and Discovery as well as Tiger and Remgro. Tough out there folks, tough out there.

Linkfest! Lap it up

When people think of the past we are wired to generally only think of the good times. The result is that we talk of 'the good old days' and think that the current and future will never match up - Even the ancient Greeks thought their best days were history.

When left to their own devices, Facebook's AI 'evolved'. This is the power of machine learning, that the machines will find better more efficient ways to do something, a path that the developer hadn't considered - Facebook's AI accidentally created its own language.

A new paper looking at minimum wage increases found that there was a drop in low paying jobs but more interesting is that low wage earners ended up taking less home each month due to working less hours each month - Minimum Wage Increases, wages, and low-wage employment: Evidence from Seattle. No two labour markets are the same due to the differences in business types, labour skills and labour regulation. The result is that minimum wage research in one part of the world may produce very different results to another part of the world.

Home again, home again, jiggety-jog. Facebook crossed through 2 billion users. Incredible. Barbie, the product took decades to sell one billion units of their product, the Apple iPhone took less than a decade to sell their units to the number 1 billion. Facebook has more than products sold, these are "users". Not all are great users, my friends will attest to the fact that I am a poor friend, I am a better Instagram friend and WhatsApp communicator.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment