"Of all the recent fancy acronyms, FANG (Facebook, Amazon, Netflix and Google) and FAAMG (Facebook, Apple, Amazon, Microsoft and Google). Google is of course Alphabet, in theory that acronym should read FAAMA"

To market to market to buy a fat pig Oops it happened again. Thanks Britney Spears. Thanks for nothing. Of all the recent fancy acronyms, FANG (Facebook, Amazon, Netflix and Google) and FAAMG (Facebook, Apple, Amazon, Microsoft and Google). Google is of course Alphabet, in theory that acronym should read FAAMA, that may be too close to the Nobel economics laureate, Eugene Fama. Fama is also called the "Father of Finance". Sounds like a swell fellow. At twice the age of Spears, Fama is less well known to most people around the world. Possibly "has less" on paper too, relative to Spears. Facebook, Amazon, Netflix, Google/Alphabet are all younger than Spears (incorporation versus birthdate). Microsoft and Apple are older than her, recently in their fifth decade of existence.

The youngest company in those cutesy acronyms (the first of which is attributed to Jim Cramer, the second to a recent Goldman note) is Facebook. That company has gone in a decade from employing 150 people to 17 thousand plus (by the end of 2016) and possibly far exceeded the wildest dreams of all of the founders and original employees. Technology improves the lives of all those on planet earth, it increases productivity and definitely raises standards of living. Facebook, does that improve productivity? What are your internal work policies in that regard?

Anyhows, fancy acronyms aside, tech stocks opened the New York session with another fast and sharp sell off, down nearly one and a half percent to begin with. The buyers did emerge through the session though, coming back all the way through to the close. The nerds of NASDAQ still registered another half a percent lower on the session, it was a comeback from a far worse situation though. The losers still included Apple (down two and a half percent), Amazon (down one point four percent) and Alphabet and Microsoft, both giving up around three-quarters of a percent. There was news specific to General Electric, long time CEO (not the favourite of all and sundry) Jeff Immelt, is leaving the business at the end of the year. The full release is here - John Flannery named Chairman and CEO of GE.

For better or for worse, the stock was the main gainer on the day, up over three and a half percent. The company did also re-affirm guidance for the year, which may well have had something to do with the share price moving higher, it tells you that "the street" is in a way happy that the days of this CEO are numbered. Downtown Josh Brown tweeted that favourite graph of the era of Jack Welch and Jeff Immelt. Draw your own conclusions as they say!

What this tells you is that when earnings meet expectations, you may well have to scratch your head and think a little harder whether management were hell bent on pleasing the street, or whether earnings became more volatile in the era of Immelt. And by extension, harder to predict. It is also important to recall that Welch was outraged (tweeting something about Chicago gangsters) with a good "jobs number" just before Obama was re-elected. You be the judge of whether the street was incredible in their analysis or Welch smoothed earning. Either way, like him or not, another era ends at an iconic company.

We were not immune to the technology sell off here in Jozi, there may be FANG and FAAMG, here we basically only have N. N is for Naspers. Of which the whole value of Naspers is less than their holding in Tencent. Which at face value makes little to no sense, I hear that the market is discounting the sum of the parts, that happens. It is what it is, I guess. N for Naspers sank heavily, as global technology stocks sold off. The heavyweight sold off nearly 6 percent on the day, descending to 2525 Rand a share, which is a level seen in late April, just for perspective. Not benefitting from a weaker currency was the likes of AngloGold Ashanti and British American Tobacco, as well as Glencore and BHP. There were winners on the day, Amplats was top of the pile of the majors, followed by Nedbank and Barclays Africa.

After all was said and done, the move south by Naspers dragged the rest of the broader market down, the all share index closed the session off one and one-quarter of a percent. The Rand is now around three percent away from being at the strongest point to Pound Sterling since late 2013. That England cricket tour couldn't have been better timed for the visitors than last summer! At 16.15 to the Pound, the memories of 24 odd Rand to Sterling feel like a bad memory (it is a bad memory).

For the record, the Jozi all share index over the last three years is completely flat. Flat as a pancake. Which feels about right, bearing in mind that the local economy makes Chitty Chitty Bang Bang look like a Bugatti Veyron 16.4 Super Sport. Which just happens to be the fastest production car in the world.

Linkfest, lap it up

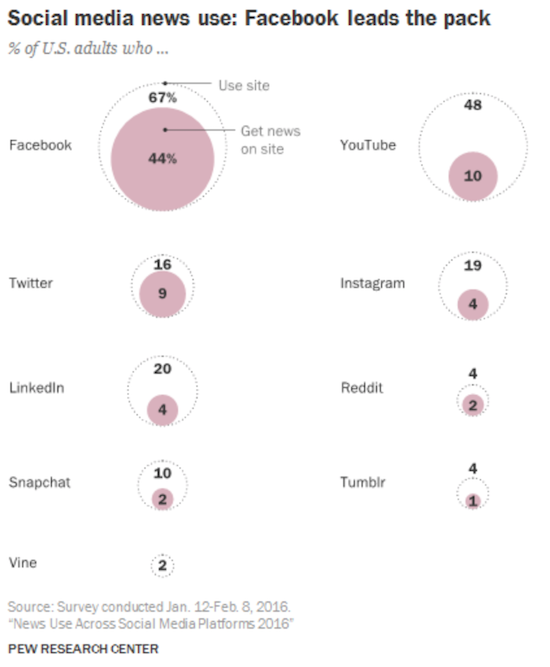

Social media is continually becoming a bigger and bigger part of our lives, getting our news from them is just another example of what we use them for - News Use Across Social Media Platforms 2016. Here is a look at what percentage of American's use each social media platform.

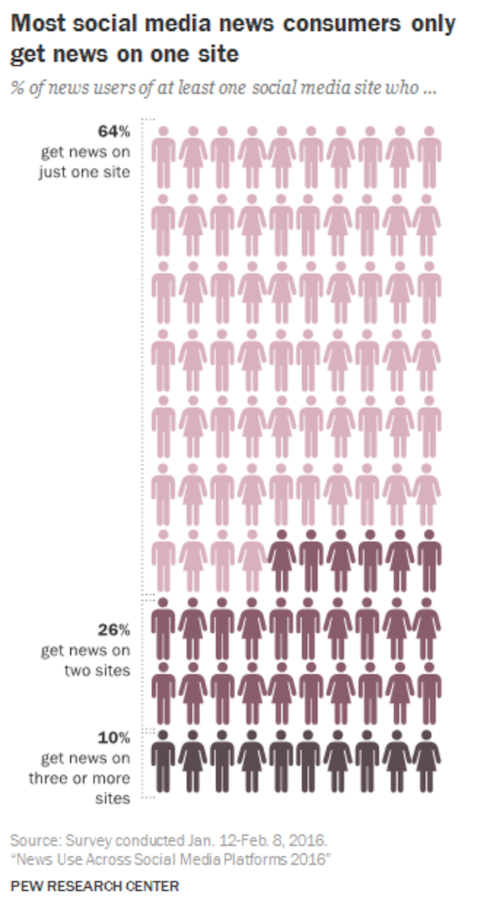

Given how many people only use one site to get news, it shows how easy it is for fake news to get a foothold and spread. It also shows how important it is for the likes of Facebook to stop the spread of fake news as soon as possible.

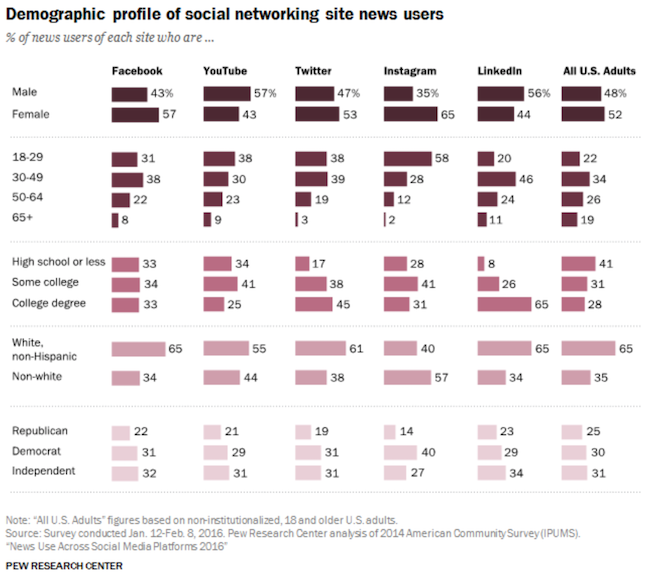

Lastly, here is the demographic breakdown of users. Interesting to see Republicans are the lowest users across the board, I would have expected in a developed country like the US that the a persons political views would be inconsequential in the use of the internet and social media.

Home again, home again, jiggety-jog. Stocks across in Asia are mixed to better. I saw a tweet that suggested that the equities market (the S&P 500) had gone 231 days without a 5 percent drawdown/sell off, the longest such period since 1996. That is 21 years! Whoa. I guess it always comes, the sell off, be it a technical bear market or whatever people like to call it, when it does it always feels very bad. That is however always the moment to remember why one does this! Gains are hard fought and enjoyed over the years, not won in days and weeks, or months.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment