"Unfortunately, blaming a lack of global growth for our woes is not factually accurate (alternative facts is what Kellyanne Conway calls them, I call them inaccuracies, others may call them lies). There are few countries currently in recession, it is definitely not global. What it may be is a combination of lower commodity prices and a distinct lack of investment confidence, a strike by capital by both business and ordinary citizens."

To market to market to buy a fat pig We were watching a little of the Q&A session in parliament yesterday, politics is an art that has been crafted over the centuries and indeed millennia. The first democracy is said to have been established by the Athenians in around 507 BC, by a fellow of the name Cleisthenes. He threw out a tyrant and imposed the rule of equals on the nobles (and future tyrants).

In fact, according to the stuff that I have read, Cleisthenes introduced the term Ostracism. It was when the citizens could vote for the expulsion from the city of Athens. How it would work is that citizens would put forward a person whom was considered "tyrant" material and then vote later in the year. 6000 votes meant you were expelled for a period of ten years. Wow, no wonder we associate the word (ostracised) with such power. Nowadays it is still used less subtly by teenagers across the globe. No, no, that isn't it, it is used in the workplace. Nope .....

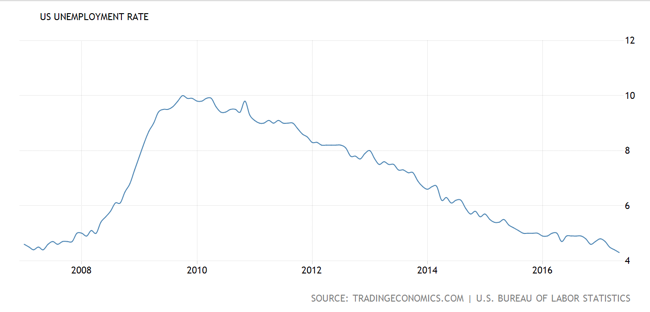

All we must know is that democracy is better than the alternative. The leader of the opposition is able to appear in parliament and question the president. The president unfortunately for him had some facts (who needs those nowadays) brought up on the economy. He suggested that South African economic woes and unemployment were global matters that we couldn't escape. According to Tradingeconomics, this is the unemployment rate over the last ten years, their data comes from the US Bureau of Labor Statistics:

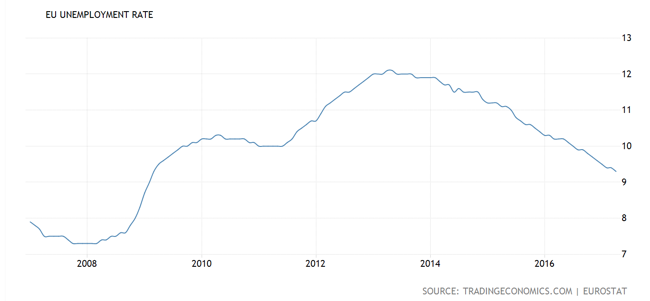

A closer look at Europe showed that the unemployment rate had been on a steady decline since it peaked in the middle of 2012, Tradingeconomics data again:

China perhaps? Nope, not them either, again data aggregated by Tradingeconomics:

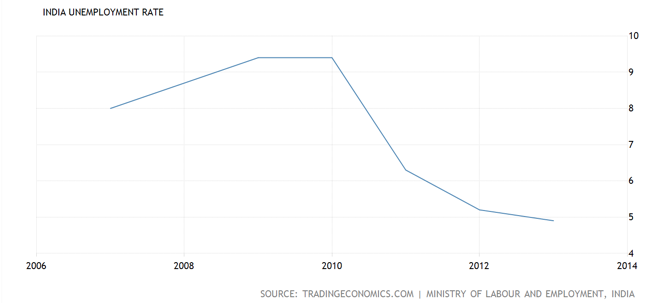

One last one, being India, that would give us around half the world there with Europe, the US, India and China. Or nearly half. It turns out that finding the Indian data is a little harder, Tradingeconomics has a graph, it looks less recent data, the picture is there to see, however.

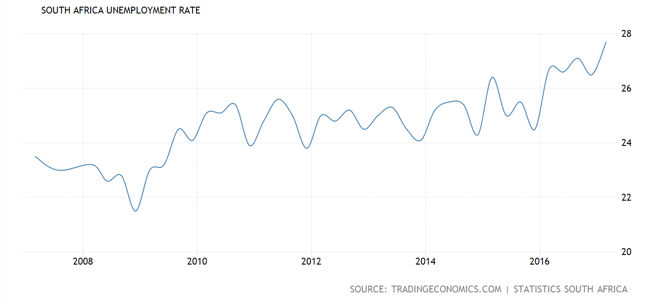

And how does that compare to ourselves, the mighty South Africa? Well, luckily for us, Tradingeconomics has that too:

Unfortunately, blaming a lack of global growth for our woes is not factually accurate (alternative facts is what Kellyanne Conway calls them, I call them inaccuracies, others may call them lies). There are few countries currently in recession, it is definitely not global. What it may be is a combination of lower commodity prices and a distinct lack of investment confidence, a strike by capital by both business and ordinary citizens. Uncertainty does that, people tend to sit on their hands when it comes to investing. And unfortunately that leads to lower growth rates, when the Uber driver tells me that this recession is bad for his business (and people need to get around), perhaps he has a point. Nigeria. That is another country that is currently in recession. Russia has been fluctuating between oil prices up and down and economic growth (and trying to stave off sanctions).

Session end the Jozi all share index had shed two-thirds of a percent, the Rand strengthened through the day, which is excellent for keeping a lid on inflation. The tumbling oil price should definitely help us too. The sell off locally was pretty broad based, down across the board with no clear sector faring much worse than their peers. The precious metal majors recovered off their worst levels for a while, both AngloGold Ashanti and Amplats were at the top of the leaderboard (a very short list yesterday), with Richemont holding them up too. In the losers column, which was unfortunately much longer, Mondi, Nedbank and Discovery were the ones dragging us lower. There was not a single new 12 month high and a whole host of recurring new 12 month lows, including Brait, Pick n Pay and Sun International as well as Tsogo Sun. And Lonmin. Sadly this is beginning to sound like the daily naughty list.

Stocks across the oceans and vast seas closed the session mixed at best. The Dow Jones lost a few points, as did the broader market S&P 500, the nerds of NASDAQ added a few. We are talking about moves both up and down of 0.05 percent, somewhere in that region. As good old Eddy pointed out in his Friday weekly message, volatility is chillingly low whilst the news flow is rough, earnings season is now a few weeks away and we are in this lull. The period in-between earnings season in my experience is when people tend to focus on the Fed and economic news, latching onto this or that. I guess that is their job and that they do very well. Without information, we are pretty much all useless, in terms of making informed decisions and progress. The vacuum and void of news is the watchword here.

Linkfest! Lap it up

As we spoke about last week, having more knowledge doesn't always lead better results - Discipline vs Knowledge. When it comes to investing we are normally our own worst enemies. Investing in ETF's and getting the market average return over the long run sounds easy but most people can't handle the market's volatility and all the emotion that comes with it. As research shows, the average holding period for a US ETF is around 3 months, defeating the whole point of owning index trackers.

Based on this, Johannesburg property is rather cheap, a combination of having large amounts of land available and low economic growth - The Best (And Worst) Cities for Renters.

You will find more statistics at Statista

You will find more statistics at Statista

Given how important the internet is in our modern world, I was very surprised to see how many people living in urban areas in developed countries don't have access to the internet - Nearly A Quarter Of Urban Americans Are Unconnected. What about the free internet in places like McDonald's and Starbucks?

You will find more statistics at Statista

You will find more statistics at Statista

Home again, home again, jiggety-jog. Stocks are mixed across to the East. If I had a buck every time that I have said that, I may have around 200 and I wouldn't be that rich. Please note that we are again working on our server and that there may be moments when the site will be unavailable. Wishing us a safe and complete cutover!

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment