"I saw an earlier release also from this year in which Delivery Hero has partnered with two Skype co-founders, Starship Technologies. Starship has a small robot that goes at 6km per hour (pedestrian speed) along the sidewalk and holds goods to deliver in a short radius. Earlier this year, the US State of Virginia passed laws to allow such a robot to use the sidewalks. Starship has been funded by the likes of Daimler AG. Get your meal and never see a real person! Is that good or bad? "

To market to market to buy a fat pig Markets in Jozi benefitted from a weaker Rand, some of it due to a few clauses in the Public Protector's findings against Barclays Africa, that suggested that the mandate of the Central Bank ought to be changed. Of course in the US, the Fed has a dual mandate in which they are able to balance price controls (inflation) with growth (central bank intervention).

The purists of course would want the market to stand on their own two feet, all of the time, suggesting that the volatility of boom to bust is just a way of life that "teaches" the market participants to be cautious. Let the market decide is a good idea, for society the upheaval of a bust type scenario is not the best outcome. It may be raw capitalism and I know that I should trumpet that angle, sometimes people need to be kept from themselves. i.e. They may be their own worst enemies.

I have no idea what it means. Read this BL Premium article, that talks about the state bailout of Bankorp and more to the point, what the mandate of the Reserve Bank is - Protector pushes for change in Bank's role. All this "action" sent the currency lower, the Rand went through the 13 to the Dollar, this morning a little strength, 12.97 to the US Dollar. Brexit talks kicked off, the Rand ended the day to Sterling flat.

There were new 12 month lows for the likes of Woolies, Sun International and Spar, as well as Harmony (suffering from a lower Gold price). Amongst the majors it was the Rand hedge stocks that ruled the roost, the mining and banking shares (understandably) were in the bogger. Mondi up nearly 6 percent, Discovery up over four percent and Naspers up nearly 4. AngloGold Ashanti was down over five percent, South32 over two and Barclays Africa slipped nearly a percent. We live in tricky times, the longer term opportunities may have been built in here for the future, if we follow the high road scenario.

There is a Reuters story that quotes Reserve Bank Governor Lesetja Kganyago saying that by keeping inflation low, it is beneficial for the poor. Keep inflation lower, that means rates can go lower, the cost of goods can be cheaper than before on an inflation adjusted basis. And borrowing costs are lower and more manageable. I get him. He knows what he is talking about. He has seen rampant inflation across the globe. He does not want that here.

A couple of pithy inflation quotes, this one from Milton Friedman: "Inflation is the one form of taxation that can be imposed without legislation." Ronald Reagan was a little more to the point: "Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit man."

Stocks on Wall Street, at least the S&P 500 and the Dow Jones Industrial Average, closed at new record highs. The nerds of NASDAQ rallied sharply, up over a percent and four-tenths, the broader market S&P 500 added over four-fifths to 2453 points. The Dow, that ended above 21 500 points, a little better than two-thirds on the day. About that terrible tech sell off ..... the news of the Amazon takeout of Whole Foods seems to be feeding the juices of the chattering masses, somehow Amazon is going to change it all. The share price crested 1000 Dollars and rallied all the way to 1017 Dollars a share, failing to stay above that level. Apple rallied sharply, up nearly three percent on the day, still, the stock is nearly 10 Dollars a share lower than the all time high.

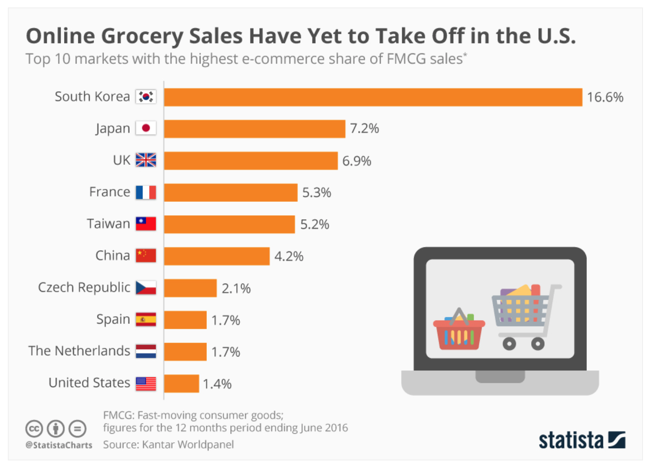

There were losers in all of this, big oil slipped as the oil prices fell, Exxon Mobil, Chevron and Royal Dutch Shell all were lower. Costco fell too, perhaps more on the idea that Amazon is going to push deep into grocers. Statista has a great graphic this morning about online sales of fast moving consumer goods per company, South Korea is top of the pops. Do you think that has something to do with population densities? i.e. the closer people live to urban areas, the easier it is to get the goods ..... which dovetails nicely to our next piece.

Company corner

Naspers recently (May 12 this year) took a 387 million Euro stake in a business called Delivery Hero, a German based European food delivery business (Naspers invests EUR 387 million into Delivery Hero). There may be UberEats and you may be used to that, Delivery Hero has many brands across the European continent and beyond, including foodora, hungryhouse, onlinepizza, yemeksepeti, as well as foodpanda. The business has over 150 thousand restaurants on their food network, with a day record of 602 thousand orders, providing dishes for over a million people (that was 22 May last year, as per their website). Food delivery is all about convenience. Being able to click and choose and 30 to 45 minutes later your chow is at your front door, no worries. You have paid, there are reviews, you get value for money.

I saw an earlier release also from this year in which Delivery Hero has partnered with two Skype co-founders, Starship Technologies. Starship has a small robot that goes at 6km per hour (pedestrian speed) along the sidewalk and holds goods to deliver in a short radius. Earlier this year, the US State of Virginia passed laws to allow such a robot to use the sidewalks. Starship has been funded by the likes of Daimler AG. Get your meal and never see a real person! Is that good or bad?

A very short document from Delivery Hero - Delivery Hero sets price range for planned IPO at EUR 22.00 to EUR 25.50. The new shares at the midpoint of the range (23.75 Euros) would raise 450 million Euros for the business, no doubt expanding their networks further. Existing shareholders will sell up to 20.092 million shares (15 million for sure). Again, at the midpoint, the offering would be in the region of 927 million Euros, close to a billion! We are expected to find out next Wednesday, the offer period begins today. It is another reminder that Naspers has many lines in the water, and judging by the initial statement from Captain (or is it builder?) Bob van Dijk, this is only the beginning:

"Naspers' deep expertise in building leading marketplace businesses in high-growth markets, which includes the leading food delivery business in Latin America, combined with the strength of Delivery Hero's platform, positions us well to build a leading, global food ordering and delivery platform."

Incredible technology that is both futuristic and here. Delivery of your favourite dishes delivered by a driving bot. Question is, how does the bot unlock the package, via some sort of GPS marker and the app on your phone? Possibly! Hopefully nobody else is noshing your paid for food. We continue to accumulate Naspers, which trades at a discount to their holding of Tencent, forget the rest of the businesses! Naspers of course has results pretty soon.

Linkfest! Lap it up

As the price of Bitcoin soars and drops again, the word blockchain has become more numerous. Byron found this great piece giving a simple explanation on how the technology works - A blockchain explanation your parents could understand

Ben Carlson talks about knowing what to do but human nature gets the better of us, in this context it is selling when the market is down even though you know it is probably a mistake - When Knowledge is Useless. Discipline and self control have been shown to come in limited qualities, the key is to put systems in place when you are "strong" and motivated. In the case of investing that takes the form of setting up a monthly/ quarterly transfer to your investments and letting this continue even when the market drops.

Home again, home again, jiggety-jog. Stocks across Asia are mixed, some lower and some higher, Japan up, Shanghai and Hong Kong lower. Mixed to start here again!

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment