To market, to market to buy a fat pig. Italian anxiety, something that is supposed to be associated with perfect homemade lasagne, or ravioli or even the perfect homemade tiramisu. All of which I have made before, true story. And deep dish pizza, been there done that. But this kind of Italian anxiety was directly related to their ability to service their great debts, the country has the third highest debt burden of all nations globally, after the Americans and Japanese. I will let you in on a not so big secret and a little old: Bank of Italy: Italian Household Wealth EUR8.62T at End 2011. That is five times GDP and four times the countries debt burden. And Paul asked in the office when I presented this figure yesterday that was the wealth that "they knew about" implying that loads of wealth is stashed away where the authorities do not know. In places like Switzerland. And, what makes this number even more intriguing is that this wealth to GDP multiplier in Italy is double that of what it is in Germany. The Italians, relative to their German counterparts are wealthier. Although in Germany it is probably more spread out, a quick look at the Wiki List of countries by income equality confirms that.

But that Italian debt, it is owned by someone right? And the government of Italy owns significant stakes in businesses like ENI and Enel (around 30 percent in each), which they could sell. They also own the railways. And the post office, people still use those, the railways more than the post office of course. But, I saw an article suggest that even if they sold off all of those assets, they would only rake in around 7 percent of all debts outstanding. That sounds like a good start to me, but the subject is as taboo in Italy as are the discussions in Washington DC of tackling the obesity problem. According to the Treasury Department in Italy's website, the sad truth is that the economy has been going sideways for five years, total debt outstanding is 120 percent of GDP. The average life of Government debt in Italy, as at the end of January was 6.52 years. Believe it or not, but this problem has been ongoing for a long time now. In the period 1994 to 1996 the debt to GDP ratios were as high as they are now. Italy actually needs more than a shake up, the country needs to live in the now, otherwise the European way will be having to get by with fewer resources. A labour shake up, a slimming down of government which will be most unpopular, but most of all, the economy needs to grow.

The other big event yesterday was Ben Bernanke who was being grilled by the Senate Banking committee on Capitol Hill. I always think that he must have better things to do, surely. But politicians being possibly the most self important types that they are think otherwise, and want to see Ben Bernanke twice a year. Perhaps they have never heard of Skype, I guess it will come in the future. If you want to read the whole speech, here it is: Semiannual Monetary Policy Report to the Congress. That one small line: "The challenge for the Congress and the Administration is to put the federal budget on a sustainable long-run path that promotes economic growth and stability without unnecessarily impeding the current recovery." probably means get your you know what together. C'mon people, the short term cuts are going to cause anxiety and the long term picture is rather one that must be addressed.

What I like least about these sessions is that the politicians forward their views and ramble on, before actually asking a question. What I like most is the answers that Ben Bernanke has, saying simple things like I am not an expert on Italian politics. One question was whether lurching from crisis to crisis wasn't shooting oneself in the foot, to which Bernanke answered "I think so senator". Gosh. And round two is on again today, we have to of course watch these, and there is no way of getting this to go away. Perhaps these same platforms should have the role reversed with Treasury officials able to grill politicians on their plans. Now that would make for some good squirming.

I read a few articles (see here -> Mail.ru Plans $899 Million Dividend on Facebook Disposal) that suggested that Mail.ru, the London listed Russian company is going to be paying a special dividend of 900 million Dollars. So what does that mean to us? Well, Naspers owns around 30 percent of Mail.ru, their stake is worth around 10.1 billion Rands, the current market cap of Mail.ru in London is 3.84 billion Dollars.

Not big, but certainly not small, Naspers did buy the stake initially for 165 million Dollars. Their portion of the dividend will be 270 million Dollars, which is around 2.38 billion Rands. Where did that amount of money come from? Well, a part sale of Facebook, as well as all of their Zynga and Groupon shares. How do they, Mail.ru get so involved in these companies, often taking stakes long before the internet businesses are listed? Well, there is a very interesting guy by the name of Yuri Milner, who is the founder of both Mail.ru and Digital Sky Technologies (DST), a serial entrepreneur that gets his hands real dirty in Silicon Valley.

Milner is also the guy that bought the most expensive single family home ever in the United States, the WSJ suggested 100 million Dollars was paid for a residence in Silicon Valley. Whoa. It must have good views! He has been called many things, Yuri Milner, mostly good things and is really smart and ambitious. As a share holder of Naspers you are able to be part of this guys ambitious plans and drive to invest on both himself and his mates (through DST) and Mail.ru in interesting technology start ups that morph into quality (perhaps overpriced) investments.

For Koos Becker and the fellows over at Naspers, this is a classic case of being alongside these types of people, ambitious and driven and able to create value for their shareholders. And themselves, remember that Koos Becker as per the Naspers annual report remuneration section owns indirectly and directly 12,480,563 shares. At the current share price of around 582 Rands that is equal to 7.263 billion Rands. Wow. That is around 3 percent of the company. His (Becker's) interests are very much aligned to yours as a shareholder. Remember though that some of these are options (3.895 million shares at 176.11 ZAR a share) that he will still have to pay for in time. But even then, he still has a bucketload of shares, the important part is that he is in, up the waist and beyond.

The other guy of course that you have to keep closer dibs on at Naspers is a fellow by the name of Ma Huateng, better known as Pony Ma. Now Pony Ma is the chairman and founder of TenCent. TenCent of course is far more valuable to you as a Naspers shareholder. Naspers owns 34.26 percent of TenCent. With a market cap of 488.14 billion Hong Kong Dollars, that translates to 170.36 billion Hong Kong Dollars for the Naspers holding. According to "the Google" one Hong Kong Dollar equals 1.14 Rands. So, that stake then translates to 194.2 billion Rands. As at the close last evening, Naspers market cap was 243.2 billion Rands. The market is telling you one of two things, either the local participants think that the Hong Kong market is overvalued (possibly) or that the rest of Naspers is really cheap essentially, which I think is wrong.

Unfortunately we will not see any more news from the company until late June, because the company has a March year end. Last year the trading statement came on the 18th of June and the results nine days later. They are always some of the most anticipated results, I guess the company will tell us what they are going to be doing with that cash, around 2.4 billion Rands, or roughly one percent of their market capitalisation from a special dividend from Mail.ru. I suspect that the cash will be deployed elsewhere as the company continues to look for opportunities.

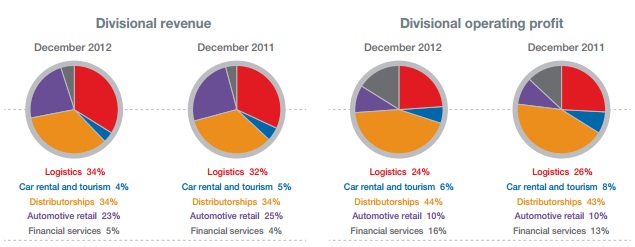

- Byron beats the streets. This morning we received 6 month results for the year ending 31 December from Imperial Holdings. Now there are lots of moving parts here so instead of explaining everything these pie graphs should do the trick.

For the whole group revenues were up 18%, operating profit was up 12% and headline earnings per share were up 14% to R8.29. This resulted in a nice dividend increase of 27% to 380c. Expectations for the full year are for around R17 a share. Trading at R201 the stock affords a forward valuation of 11.8 and assuming they pay out 50% of earnings, a dividend yield of 4%.

Per division the commentary is very interesting. The retail cluster which includes their distributorships (bringing in Kia and Hyundai vehicles from South Korea) and automotive retail which is their own dealerships has been the star of the show. Who would have thought that those two brands would have been so successful in South Africa. We do love our cars here and as those two brands have finally broken out of the low price, low quality mould their sales have flown. Profits from this division increased 19% and now contributes 54% to overall profits.

Logistics had a slow period, revenue increased by 27% but profits declined by 1%. The international business was hampered by a slowdown in the German economy and locally the strikes had a big impact. This is still a good business, as Paul mentioned to me earlier, these days everyone outsources their transport as bulk is by far cheapest. And people certainly are moving stuff around more and more. Long term we expect the German economy to start growing again as they increases exports to the developing world.

The financial division did well, buoyed by stronger equity markets and people buying second hand cars. As you can see by the pie graph the margins are great but as we all know, can be very volatile. The car rental and tourism division struggled. There were less trading weeks and the market is very competitive. This is a small part of their business however.

The future looks bright, they are 52% geared which is below their target of 60%-80%. This means there is room for another transaction. I am also positive on vehicle sales in South Africa. We love our cars here and because of the (generally) terrible public transport system, getting a car can liberalise your life in many ways. Logistics will grow with the economy and the international diversification is certainly a positive. The stock is not expensive at these levels. We are buyers of this stock.

Crow's nest. Markets are getting drilled today. We have given up all ours gains for the year. Resources are the main drag. Italy's "situation" is hardly improving, but the democrats (centre left) are open to talks, meaning that a coalition could be on the cards. Most important sort of market moving event here today, the budget speech.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment