To market, to market to buy a fat pig. Yesterday was rather quiet as the Americans were closed for a holiday, presidents day. It was a chance to reflect on the 43 presidents before the current sitting one. Currently there is George Bush senior and junior, Bill Clinton and Jimmy Carter, who is 88 years old. So, out of the 44 presidents that there have been in 74 different terms (I think I have that second part right), five are currently alive, including the sitting president. But presidents day is the celebration of the 1st American president's birthday, that of George Washington. And all the subsequent presidents get "celebrated" too. Although the NYSE was only founded in 1817, there was an earlier agreement, the Buttonwood agreement signed under a tree by the same name, in 1792. 3 years after independence from the British. And from there was born the best example, in scale, known to man for opportunities to be successful in the business place. Democracy coupled with capitalism made America what it is today. And don't you dare say nearly bankrupt.

Talking democracy, yesterday was perhaps the start of something fresh and new that I suspect the chattering classes were waiting for. The 65 year old, but still very health looking Dr. Mamphela Ramphele started a new movement which will lead to a new political party to contest the 2014 elections. She has launched Agang, which as per the Facebook page translates to "Build South Africa". Agang in the Nguni languages means Build. Is this something to get really excited about? Like I said above, democracy and capitalism combined together are truly a great mix for wealth creation. Dr. Ramphele covers all the necessary bases, the historical connection to Steve Biko is huge and shouldn't be completely discounted. That said, she is an academic, she has been involved on the world stage at the World Bank, she has been involved in business, she resigned as the chair of Gold Fields just last week. She seems like the human face that has been lacking. We will see how much momentum she gets initially and whether she, and whomever joins her, can maintain that momentum.

Over in Spain the folks at Iberia have had to take a long hard look at their business and unfortunately have plans to shed 3800 jobs. Of course this was met with violent protests from the unions, and "things" turned ugly. Out with unprofitable routes, and cost cutting at pace. According to the New York Times, Iberia loses 2 million Euros a day. That is unsustainable. No entity can suck that up. Byron and I had this discussion yesterday and he disagreed on my proposals for long haul flights that carried fewer staff and involved a greater deal of self service by passengers. The only reason I use (rarely at that) a long overnight flight is to get to my destination. Time for the work force to skill up, reliance on government or quasi government type jobs, that is gone. Big government is unsustainable. But hey, tell that to the people who wear black caps with little red stars. That did not work in Russia, that did not work in Eastern Europe, extreme socialism discounts the human element.

Jozi, Jozi 26o 12' 16" S, 28o 2' 44" E Platinum stocks got whacked, in particular Amplats as news came through that inter union violence had again risen at their Siphumelele mine, part of the Amplats Rustenburg mines. Siphumelele is next door to the Khomanani mine, where remember shafts one and two are targeted as potentially being shuttered in the operational review. So, as you can imagine tensions are already high. The official Amplats parent, Anglo American release is as follows: Incident at Siphumelele mine in Rustenburg. So it seems from that release that NUM shop stewards were told to vacate their offices by the workers committee at the mine. Now, what the release does not say is that rival union AMCU was involved here. That is what is being widely reported. So, once again it is about union rivalry.

And what is in it for championing the causes of the working class? Money. Unions make money off their members, by entering into the collective bargaining process on their behalf. How much money the unions "make" in South Africa is unclear to me, but what is clear is that being a shop steward for one of the unions comes with better working conditions than the miners themselves. And more money probably. In 2010, Cosatu's revenue was nearly 71 million Rands, that was from their affiliation fee collections, grants received and political levy. That information is available from the document: Cosatu Secretariat Report 2011. Now, I can't find the National Union of Mine Workers annual income. It turns out that a few unions are rather late with their financial statements, no wonder that my sneaking around could not find the relevant documentation. I managed to find however this story from the M&G titled: State nails errant unions. There is a key paragraph in there:

- "Unions receive membership fees from their workers, which Watkins estimated at an average of R30 to R35 per member per month. This means that Cosatu unions receive R60-million to R70-million a month in dues. But Watkins said that payments for pension and provident funds, funeral schemes and many other offerings far exceed membership fees and that unions were big business."

Yowsers. See what I mean. The business of being in unions is big business. A multi million Rand business. Now you can understand why there is violence at the mines and union turf wars, it ultimately boils down to money and a "what is in it for me" attitude. So much for the collective and taking the workers needs and putting them first. You have of course seen much written about this. David McKay as ever has a cracker of a story at MiningMx: Rival unions shatter fragile peace at Amplats. His conclusion is worth noting: "It will be interesting to see how the South African government responds to this latest setback for union peace after president Jacob Zuma declared in his State Of The Nation Address to parliament last week that public protests would no longer be tolerated." You heard anything yet?

So, what is the fallout expected to be? Well, as far as I can tell, don't expect that specific mine to be open today. More lost revenue for the company who is under pressure already. Very bad. Bloomberg and CNBC Asia ran the stories in their headlines. Err.... at the top of the hour. And I have already seen a research note that suggested that this event suggest further downside and heightened risks to mining equities in South Africa. As a journalist friend of mine said: "Money, money and more money, while people face losing their jobs. It’s quite sickening actually." As for Byron, I might actually have to tie him to his chair today, as he becomes more and more enraged with the unions in South Africa.

- Byron beats the streets. Yesterday Massmart released an informative trading update which told us what to expect in terms of earnings for the 26 week period ending 23 December 2012. Before we delve into the numbers they explain the once off effects. Last year's earnings included transaction costs, mostly integration costs following the Wal-Mart deal. That pushed the base down. This year the company is still facing integration costs as well as a R140m increase to the Supplier development fund. That total of that fund is R240m. That is a lot of money for a company who made R865 million in the comparable 6 month period last year.

When you consider these added costs, the R140 million charge probably having the biggest impact, headline earnings per share are expected to be down between 18% and 25%. That equates to between 312c and 341c a share. This is not good for a company that is priced for strong growth. Had it not been for these extra charges the company looks to make between 410c and 438c. That sees growth of between 2%-9%.

Again that is not good enough for this company. Annualise the top of the range 438c and we get 876c. Trading at R185 and 21 times forward earnings you can see why I say these results are not good enough. But as an investor we are not at all unhappy. I go back to something I have spoken about a lot of late. We are not worried about short term earnings. Of course it is important but it is only one element to consider when deciding on the long term bigger picture.

We have full faith in the Massmart management team who are investing heavily now, for the future. Africa is hungry not only for food but for appliances, sports equipment, entertainment devices and everything else that makes our lives as comfortable as they are. It is not going to be easy getting it there and this will be an expensive exercise. But once it is there they could experience growth that is unattainable anywhere else in the world. We will continue to add to this stock and will remain patient.

As for the share price, it was actually up 1.8% on the news yesterday. Obviously these numbers were slightly better than expected. However it lost that all today and more as Shoprite released disappointing numbers. Sasha has covered those in intricate detail, as always.

Shoprite has released results for the six months to end December 2012 this morning. Sales for the 6 months increased 13.2 percent to 46.723 billion Rands. That is a big number. Net profit for the period was 1.697 billion Rands, headline earnings clocked 1.690 billion, which was an increase of 18.9 percent. Growth in HEPS was more muted however, remembering that the company raised money through a share issuance last March. And extra 27 million shares were issued. Good for the company to raise money at what many would consider, a lofty share price. But we will get to that part later. Outside of South Africa (read as the rest of the continent) sales cracked on the pace, with turnover up 28.2 percent. Constant currency growth was very, very impressive managing to grow by 23,5 percent. See, stop worrying so much about the valuations.

Shoprite is still very much a South African business, with the fast growing non RSA business contributing 12.3 percent of group sales in this first half. For the full year to end June 2012 that number was 11.0 percent. Phew, that is growing at a serious click. At the full year stage the presentation documentation suggests that 100 million folks went through their Non RSA stores. Wow, now that is a big number. Angola strangely at that point (June 2012) was their biggest contributor to non RSA sales. You might have been forgiven for thinking that Nigeria would be the place where it was happening for them. At June 2012 Shoprite had also only just opened their first store in the DRC. The DRC, which as Shoprite points out (and this all happens in a territory where extreme violence is a way of life) has shown nearly a decade of 6 percent real GDP growth, astounding. Many believe that the DRC could be the real Africa unlock of extreme wealth. The country possesses extreme mineral wealth but yet struggles with conflict after conflict. A young and violent population. But with major risks come potential great rewards, bearing in mind that the country is able to have these growth rates against that sort of backdrop. Imagine the potential.

*Nice* little factoid, basically for every 1 ZAR in sales (imagine your Checkers basket) the company makes after all costs 3.6 cents. Retail is an incredibly tough old business folks, and these guys are amongst some of the best. Just bear that in mind next time you are standing in the queue, take a look around at the staff compliment and store infrastructure. And how well it runs, that does not just happen, that takes an enormous amount of skill.

Shoprite points out that 74 supermarkets were opened last year, 56 of those in South Africa, the rest across our continent. The company creates employment for 109 thousand people, those shops opening and also further beefing (and not horsing) up their infrastructural development saw another 6700 jobs being created. Retail jobs. If you do a quick analysis of the South African economy over the last decade plus, that is one of the strong growth points. At the expense of the old traditional part of the economy, mining and manufacturing. Shoprite reported that they had managed to continue to gain market share, South African sales increased 11.5 percent, which is comfortably ahead of the 8.2 percent growth rates in local food sales across the industry.

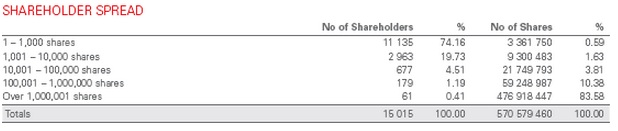

Valuations. I told you that I would get to this part. The company reported headline earnings per share of 315.9 cents per share, with an interim dividend of 123 cents. Last years HEPS was 590 cents. The stock trades at 170 odd Rands and is down over four percent this morning as these results clearly disappointed "investors". OK, but this perhaps explains more than anything else why the stock trades at a premium. Their shareholder analysis breakdown, first a list of who really owns the stock, Shareholder Analysis:

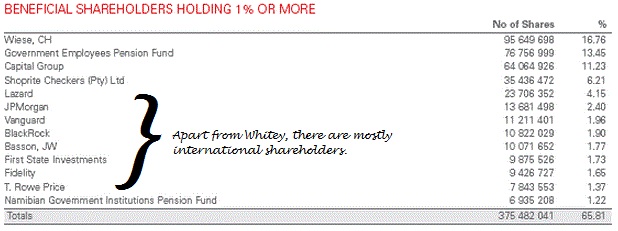

So, as you can see from that table, 61 shareholders own 83.58 percent of the company. And most of those as you can see from the second part that I hacked are "committed" long term holders.

These are the entities or shareholders that own more than one percent of the shares in issue. So, what you can see here is that Christo Weise, the GEPF, Shoprite Checkers and Whitey Basson are the South African shareholders. The international institutional shareholders are the other main shareholders. And in their world, paying between a 20 and 25 multiple for these growth rates is not out of line. Most especially when taking a much longer term view on the stock. So, I suspect without thinking too hard about the current valuations, these shareholders find Shoprite as a great investment for leveraging off the low base that is African retail sales.

Crow's nest. German ZEW numbers beat by a whopping margin, sentiment is obviously improving a lot in that part of the world. That is the very good news. The very bad news is that the noise around Amplats continues to get louder and louder. That is the awful truth, union turf wars. And I have not seen any government response as of yet.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment