To market, to market to buy a fat pig. Everyone was getting excited about the Pope taking what I thought was a pretty bold decision, and perhaps the best decision for the Catholic Church. That announcement certainly dominated the news. Dominating this morning is the news that the nut jobs in North Korea conducted a nuclear test. I wonder if the North Koreans called the bomb "Fat Boy" after their esteemed leader and the "Fat man" bomb that was dropped on Nagasaki. Although there are around 4500 thousand bomb on the planet that could be deployed at any one given go. Nuclear ones that is. That is just nuts! Like the "leadership" in North Korea, they are just nuts.

Jozi, Jozi 26o 12' 16" S, 28o 2' 44" E Stocks ended the session slightly lower on the day, the trading statement that we chatted about yesterday weighed on Implats, but the stock certainly recovered off the lows of the day. There was some confusion around Cipla Medpro, and Indian company Cipla, an Indian newspaper reported that "talks were off", but the company down here in South Africa said talks were ongoing. Strange that. The Economic Times of India suggested that the deal had been put on ice as a result of valuations being too rich: Cipla puts Medpro buyout on hold over valuation issues. A very short story, with the conclusion that another Indian company, Sun pharma had "saved" money by not buying Israeli company Taro. Not sure, but the locals, Medpro (as the Indian journalist differentiates the two businesses) have suggested otherwise. Cipla Medpro is down another two and one quarter percent this morning, on top of five percent yesterday. Smoke and fire?

Kumba Iron Ore released results this morning, for the full year to end December. Normally Byron would have jumped all over this one, but I said that I wanted to cover them and work in resource nationalism, whatever that means. Because I had heard a radio interview with John Robbie and Prof. Ben Turok this morning, and in fact the first lines of the results nail what I am talking about. Record production of 43.1 million tons, that is excellent. Wait for it, export sales volumes increased to 39.7 million tons. The difference between the two is obviously what we use here, a total of 3.4 million tons. Wow. This is a 27 percent reduction in domestic sales, perhaps another sign that the local steel industry is in crisis mode. So, more than 90 percent of what is produced here is sold elsewhere. Why? Because someone else needs it more than we do.

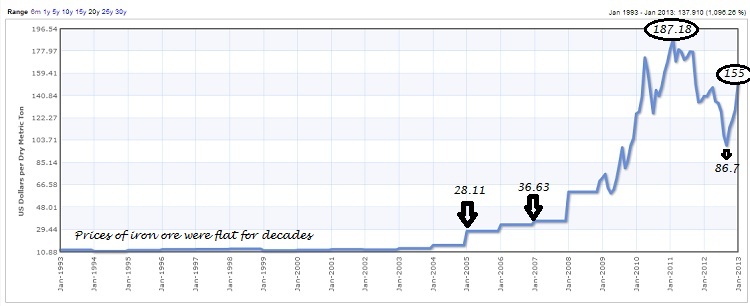

If our market was completely closed to the rest of the world and Kumba Iron Ore was selling iron ore at cost plus a small percentage amount to state owned steel mills. I am just guessing that they would employ a whole lot fewer folks and almost certainly wobble from one period to another. But, because of the great Chinese economic miracle of our time, South Africa has benefitted already from rising iron ore prices and greater tax collection. Kumba Iron Ore is a company that it could be argued is in the right place at the right time. Let me try and quantify that with a few graphs, first, the 20 year Iron Ore price from Index Mundi:

The whole idea I am trying to explain is that iron ore prices used to be negotiated once a year and then that changed to a spot market. It is amazing to think that 8 years ago the iron ore price was 28.11 Dollars a ton. Nowadays the price is around 155 Dollars per ton. The average price that Kumba Iron Ore received in a very volatile year last year was 122 Dollars per ton, a decrease of 23 percent from the year prior. If the iron ore maintains these current levels then expect the first six months of this year to be a record half. Production will be up, the rand will be weaker and the average price will be near records. However, as you can see, predicting the iron ore price is about as easy as predicting climate change and where the next natural disaster will happen. Or even harder, will Lindsay Lohan ever act in another movie?

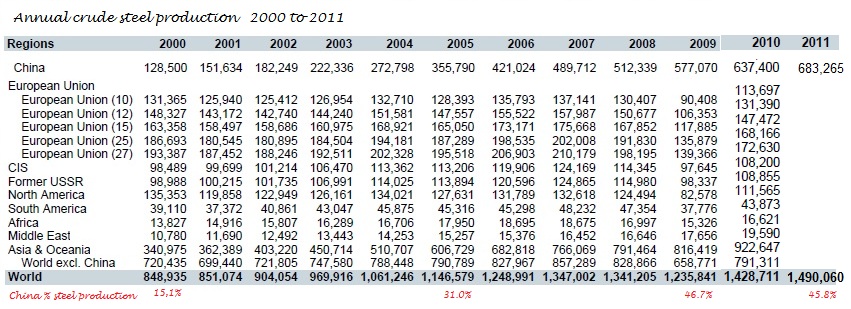

But, this is a more important table than any other here, and is taken from this document: Annual crude steel production, 2000-2009. I have then stuck on and hacked a column from this table, Annual crude steel production, 2010 mainly because 2010 saw a bounce back in demand for iron ore and metallurgical coal. So, I have tried to stick that onto the table, to give an extra year, and then I plugged in the 2011 results, that document you can find here: Crude steel production 2011.

OK, just to introduce the pieced together table, the total global steel production has risen 75 percent in the period from 2000 to 2011. Of that increase, China accounted for 86.5 percent. Strip Chinese steel production out of the equation and you see only 10 percent growth. Exclude the whole Asian continent and growth over that 12 year period would have been a mere 3 percent. Three whole percent. This is the whole point that I am trying to make. The new customer on the block and the other growing ones in Asia, South Korea and to a larger extent India have fuelled the increase in the underlying commodity prices. Iron ore and metallurgical coal prices have not increased because the Australian, Brazilian and South African governments suddenly "got so clever". No. It has nothing to do with you, the rising prices. The rising demand was fuelled and is fuelled by the Chinese decision to industrialize heavily. In fact, as far as I can tell from those longer dated tables, out steel production is lower. That now has something to do with us.

And you can see the amazing figure of how much China accounts of annual steel production. It is fair to say that the Chinese have changed the fundamentals for global iron ore and metallurgical coal trade. Nobody else has changed the industry as much as the Chinese have over the last decade plus. So, with the companies paying much higher taxes across the globe as a result of bigger investments (and risks) that private companies and their shareholders took on. And now the state wants to tax those companies higher, everywhere. Leeches. If we can go back to that quote from yesterday. Capitalism has lifted humanity out of the dirt and is greatest value creator in history of the world:

- "In statistics we discovered when we were researching the book, about 200 years ago when capitalism was created, 85% of the people alive lived on $1 a day. Today, that number is 16%. Still too high, but capitalism is wiping out poverty across the world. 200 years ago illiteracy rates were 90%. Today, they are down to about 14%. 200 years ago the average lifespan was 30. Today it is 68 across the world, 78 in the States, and almost 82 in Japan. This is due to business. This is due to capitalism. And it doesn't get credit for it."

That lays out all the reasons why I am opposed to higher taxes on specific industries that are perceived to have done well. The whole golden goose theory, lets milk it, because we can. And I am convinced that the intentions of the company Imperial Crown Trading 289 with regards to the prospecting rights (on a mine already in production, but that is a separate story) would not have existed in the first place if it were not for an iron ore price that had been catapulted higher due to increasing demand. It should be governments job to encourage the companies to mine as much as the commodities in the ground as they can, because the customer is not going to be there forever at this pace.

Back to the results now that we have explained the market and what has been going on over the last decade and a bit. Chinese customers account for 66.3 percent of all their sales last year, the geographical category "rest of Asia" account for 23.2 percent. Earnings decreased by 28 percent to 12.2 billion Rands from 17 billion Rands last year. Largely as a result of the average iron ore price being much lower than the prior year, but also as a result of costs increasing comfortably above inflation. Headline earnings per share clocked 37.97 ZAR for the full year, with a final dividend of 1250 cents being declared. That brings the full year dividend to 3170 cents. Lower than the 4420 cents per share last year, but of course that is understandable. Cash costs per unit cost is still mind blowing, 31.43 Dollars a ton at Sishen and 31.22 Dollars a ton at Kolomela.

One thing that I must say is that Anglo, the parent company who owns around two thirds of Kumba Iron Ore, has taken a lot of heat with regards to their Amplats holding, their Minas-Rio project in Brazil and their Copper operations on the West coast of South America, but sometimes they do not get the credit for Kumba Iron Ore. The work that has been done there was just somehow "expected" by shareholders. Kolomela was developed ahead of time and is rocking. Well done. But, it is clear to me that there are problems at Sishen, where production was lower by 5 million tons. That is more than 10 percent of production and at the average basket price of 130 Dollars a ton and the average exchange rate received (8.19 Rands to the US Dollar) that totals 5.323 billion Rand. Think of the lost revenue for government, let alone the company and the shareholders. More profits equals greater government revenue. Equals expansion. Equals more employment. What the strike did do however was wind down inventory, which was fairly important, sales exceeded production, so there were some benefits to the business, but as you can see, the costs were far greater to the broader economy.

Finally, the hot molten question is, does one continue to hold Kumba Iron Ore at these elevated levels. The stock no longer looks cheap, but that is because the expectations are perhaps for a big year this year. The anxiety around continued Chinese infrastructural plans fading have gone. The new Chinese leaders have committed to continued to development. Which will bode well for the underlying commodity prices. Being in a single commodity stock always has its problems. The dividend flow should continue to be good as Anglo, the parent company, continue to suck as much out as they can. I would expect the stock to continue to yield around 6 percent next year and the year thereafter. At current levels I have seen a few analyst reports suggest a sell on the stock. But if you bought them a long time ago, you can expect around another 75 odd Rands in the next two years, I suspect that you should continue to hold. And watch like a hawk in the coming years for signs that Chinese demand is slowing. Remember too that there are big plans globally to bring more iron ore into production as demand continues to grow. A hold for now.

- Byron beats the streets. It has been a tough start to the year for the retailers as the majority of their updates have not shown the growth that their share prices expect. That caused the index to drop nearly 16% as everyone started panicking about a credit bubble, strikes, inflation and a strong Rand. Yes these are factors one needs to consider but we have always been of the view that the selloff in the sector was an overreaction.

This has proven to be the case (so far) as the sector has improved 9%, now only down 5.6%. The market can definitely be volatile, especially when a sector hits the lime light. One of our preferred entrants into the sector came out with a good looking trading update yesterday, especially when you compare it to its direct competitors. I am talking about Holdsport here.

"Holdsport shareholders are advised that total sales for the five months ended 31 January 2013 ("the period") increased by 11.2% compared to the corresponding period last year. Retail sales increased by 11.5% with sales for comparable stores increasing by 8.6% over the period.

Total (and comparable) sales growths for each division for the five-month period, were as follows:

- Sportsmans Warehouse sales increased by 12.9% (10.4% comparable);

Retail trading space increased by 5.4% relative to the prior corresponding period and the retail divisions experienced price inflation of approximately 3.6% for the period."

- Outdoor Warehouse sales increased by 7.4% (3.6% comparable);

- Performance Brands recorded external sales growth of 1.5%.

Like I said above, these are good numbers and the market thought so too, pushing the stock up 3.5%. When you have a look at the trading statement the company released during the exact same period last year it looks very similar. Overall sales increased 11.5%, 12.3% from Sportsmans, 6.6% from Outdoor and 42.8% from the wholesale division. Evidently the sales from the Performance Brands division has slowed from a much higher base than last year.

On the back of this growth the company reported earnings of 387C in May last year. It's a difficult one to analyze though because in the first 6 months of this financial year they only reported 157c which was hampered by currency movements. Expectations are for about 400c but again the weakening Rand will certainly hamper margins as much of their products are imported.

However, and I have said this before, the share price, as you would expect has already factored in the movements of the rand. Trading at R44 or 11 times this year's earnings the stock sure does look cheap if it is poised to grow sales at this rate. And of course we believe they can. Sport is aspirational and a way of life in South Africa no matter what income bracket you fall in. A healthy lifestyle is becoming the norm. There is room for new stores and existing sales will continue to grow. We are happy to carry on adding to this stock.

Crow's nest. We are lower here. Retail taking some tap again, although there has been a heroic recovery from some lows ten days ago or so. Tomorrow is important, because US retail sales come. And that single figure will let us know how the US consumer is really doing in January, the first month with "issues" for Joe Public.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment