"Andy Compion, the chap in charge of the Nike brand (the president) had this to say: 'I was just in China three weeks ago, and I can sum up my visit in one word, amazing. Our brand and business in China have never been stronger. And we continue to build momentum. That's not by accident.'"

To market to market to buy a fat pig Oh no. I guess we are living in a world one quarter of a century after the cold war has ended with a new conflict, one that holds no borders and targets citizens. The rise of fundamentalists is a worldwide phenomenon, I often think that the internet does more to demystify ourselves from one another, it seems technology has trodden on old ways and old norms, that is my opinion. Hence the pushback from militant groups, who have their own agendas.

It is real, it claims real lives on both sides, most of the time those who are not involved in active conflict. They just happen to be born at the wrong place at the wrong time. Imagine being born in present day Syria, you lost the ovarian lottery right there, to put a spin on the Buffett phrase. It can't be said that life won't improve, I am pretty sure that at the depths of the atrocities of the Second World War there is no way you would imagine Europe as it is today, one passport, one trading block, more people trying to get in, not out. There are tons of countries that provide direct military assistance and military aid, as well as intelligence in multiple hot spot countries. The optimist in me suggests that evil shall be overcome, there is too much good in the world. For the time being, these acts are a reminder that the world has changed, not necessarily for the good.

See the coverage from the New York Times -> Strikes Claimed by ISIS Shut Brussels and Shake European Security. And then the FT -> Brussels attacks: Police launch manhunt for suspected bomber. As well as the WSJ -> ISIS Claims Responsibility for Brussels Attacks; More Than 30 Dead. I am afraid that some of those are behind a paywall, they are some of the stuff that I read each and every day. I certainly believe that quality is always worth paying for.

The reaction from equity markets was not as severe as one would expect, unfortunately we have all been a little desensitised to acts of this nature. By the end of the UK session, that market was in the green. As hard as I try to always see the other side of the story, the methodology and modus operandi of the Daesh is not one I remotely subscribe to. I think that it is important to remember that this is a small minority of people globally, a tiny portion of the overall population. Education and conversation changes us all for the better, encourage learning and teach where you can. Education is the true leveller. Many times there is "stuff" that you can't wrap your head around, the senseless deaths of ordinary people globally at the hands of other peoples agenda is one of those things. Be it in North Korea, or be it at the hands of fundamentalists.

Back home, where local is lekker, it wasn't the case for the scoreboard over at Jozi All Share central, the index was down 0.8 percent on the day. i.e. Not lekker. We were however comfortably off the worst levels of the day, it was a mixed bag. Amplats and Nedbank were at the top of the winners board, Richemont and BHP Billiton at the bottom of the leaderboard, perhaps missing the cut! There were some majors making new 12 month highs, that included Vodacom. The stock is up nearly 20 percent over the last year, and has crushed their peer in the listed space, MTN. We haven't covered ourselves in glory in that one, we continue to hold the stock however, the shift to data is still afoot, and MTN customers continue to work off a lower base.

Over the seas and far away in New York, New York, stocks were mixed by the close. They were comfortably off the worst levels, the S&P 500 closed down less than one-tenth of a percent, the Dow Jones Industrial Average was down just shy of one-quarter of a percent, whilst the nerds of NASDAQ were buoyed by continued buying of Apple stock (up 0.76 percent), that tech heavy index closing out up 0.27 percent. Reminder, the NASDAQ is still down 3.7 percent for the year. Noticeable losers were amongst the travel and travel services companies, TripAdvisor, Expedia and Priceline fell, over in Europe the airline stocks took some heat. Lufthansa, Air France-KLM, as well as EasyJet sold off heavily. Ryanair and Air Berlin also took some pain. As expected I guess, if people are spooked to travel (which is ultimately what the perpetrators want), the impact is noticeable. Of those, the only one that we own at the fringes is Priceline.

Company corner

Nike did it last night. Nike have been doing it since January 1964. That is over 50 years of doing it. The name change from Blue Ribbon Sports to the name we know today took place in 1971. Bill Bowerman (co-founder) was Phil Knight's coach. Phil Knight had a personal best of 4 minutes and ten seconds for a mile, that is no mean feat! Bowerman was a spectacular coach, and according to Wikipedia, trained 31 Olympic athletes. As well as 16 folks that managed to go under 4 minutes for the mile, the holy grail of middle distance. As Wiki points out, if you do the math, under 4 minutes for a mile means that you are moving at 24.14 km per hour, or 14.91 seconds per 100 metres. The current record for that distance, the mile, belongs to legendary athlete Hicham El Guerrouj of Morocco, who ran 3.43.13 for that distance in 1999.

We digress, it was supposed to be third quarter numbers for the 2016 financial year -> Q3 2016. Revenues were light, up 8 percent to 8 billion Dollars (expectations were 8.2 billion), excluding the stronger greenback, revenues were 14 percent higher. Diluted EPS clocked 55 cents, up 22 percent and a comfortable beat relative to expectations. 2 percent fewer shares in issue to report on, thanks to some strong buybacks recently. Future orders, i.e. those placed already, grew 17 percent globally, excluding the currency. Including the currency, which you have to, future orders grew 12 percent. Gross margins were flat at 45.9 percent, their tax rate fell, as a result of increased sales outside of the US.

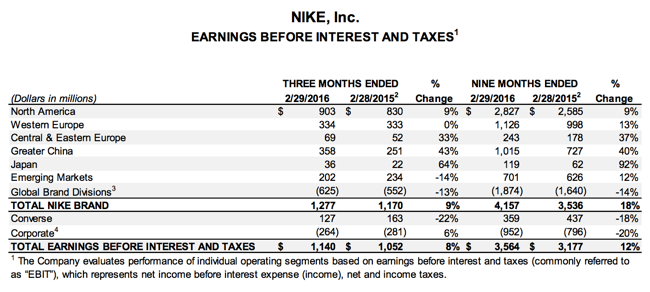

Herewith their EBIT breakdown in the table below, as you can clearly see the massive growth in China, it is now their second biggest territory after North America. With future orders from greater China up 28 percent in Dollar terms, this is fast becoming a bigger and bigger part of the Nike stable.

There I thought China was finished. Perhaps all the people are buying shoes in order to run away from there? For interests sake, revenues in Europe are 50 percent higher than the Greater China region, Chinese profits are better, just a touch. Cheaper rent, cheaper staff, proximity to manufacturing, perhaps even higher selling prices as a result of higher demand, it really is pretty astonishing.

On the conference call (Courtesy of SeekingAlpha -> CEO Mark Parker on Q3 2016 Results), Andy Compion, the chap in charge of the Nike brand (the president) had this to say: "I was just in China three weeks ago, and I can sum up my visit in one word, amazing. Our brand and business in China have never been stronger. And we continue to build momentum. That's not by accident."

The company is still pretty much a footwear company. Sales of footwear represents 61.28 percent of total sales, apparel is 28.29 percent of the total sales. Equipment, over 1.1 billion Rand represents the balance, 4.5 percent. Are those like running arm bands and the like? Further investigation reveals that it is actually hats, sun glasses, soccer and basket balls, back packs, golf bags, beanies, towels, golf clubs, baseball mitts, even lacrosse gloves. Everything that isn't clothing or shoes basically. The company supplies equipment, apparel and shoes for 13 different categories.

The headlines will read that they didn't do it. As Paul points out, this is another quarter of strong earnings in excess of twenty percent growth off a big base for a mega cap. What is actually not to like? We should be so very happy then that whilst we are in accumulation mode that the stock traded lower by 6 percent in the after market. The company continues to be at the cutting edge of innovation, they recently had a two day event showcasing the best of the new, including the USA Olympic uniforms. The company is pretty ruthless, when their athletes get into trouble, they drop them like hot a potato. Which is right, I want to associate the quality with a brand that prides themselves on excellence, not bad behaviour. People like Roger Federer and Serena Williams.

The stock is down, it trades on a lofty multiple of just over 30 times. I think for a growth company that has massive potential in mainland China, to turn that into their biggest destination, this continues to represent a massive opportunity. It is a serious growth business, and whilst the recent quarter looks mixed, the long term story of growth and quality remains intact, we continue to buy.

Late on Friday afternoon Steinhoff International Holdings announced that it would be going forward with one deal and dropping another. The deal being dropped is the one for Argos from HRG where Steinhoff were looking to spend around 1.4 billion Pounds. Remember that Sainsbury had already made an offer to HRG, the market was pricing in a pricing war, so Steinhoff probably would have had to spend more to complete the deal. This deal with HRG would have been around 10% of the company's market cap and the Darty deal around another 5%, it looks like Steinhoff decided to pick one deal and go for the company where they have better synergies.

The cheque book is being taken out for Darty at a cost of 673 million pounds - Steinhoff International holdings offer for Darty PLC. Darty is another company that was on the verge of being bought by someone else, with French retail group Fnac offering 558 million pounds last year and getting the boards backing. The Steinhoff offer is 19% higher and is an all cash offer, where the Fnac offer only has a cash component of 66 million pounds, it is unlikely that Fnac will be able to come with a counter offer that beats the Steinhoff one, even though they have told shareholders to expect one. Schroder who own 14.14% of Darty have put their weight behind Steinhoff making the deal look set to go through.

The idea is to combined the furniture offering of Conforama and the "white goods" offering of Darty to have a more complete product offering for the consumer, bringing more foot traffic to stores. The hope is to create further synergies through Steinhoff's existing distribution lines and get better prices from manufacturers as the combined group now has a stronger negotiating position. Great to see, Steinhoff using their new listing to expand in Europe.

Linkfest, lap it up

It is no secret that coal is on the way out, on the local front Eskom is still building coal powered power stations, so there local miners will still have a customer for years to come. Looking forward we will probably see less investments in coal mining and see coal mines run off as the power stations that they supply run off - Is It Game Over for Coal?

After the horrific bomb blasts yesterday, I am sure that some backlash will be directed at immigrants and those seeking asylum. There is an overwhelming amount of research that points to the positive impacts of foreigners moving to ones country - Immigrants and billion dollar startups. Research in the US has found that over half of the current unicorn companies have been founded by immigrants, with the result being that "immigrant founders have created an average of approximately 760 jobs per company in the United States"

Have a look at the new iPhone SE, the pictures show that ii looks almost exactly the same as the iPhone5s - Here's what it's like using the new iPhone SE

Home again, home again, jiggety-jog. Stocks are lower across the board, not everything though. Mostly across the globe, we are seeing a pause at this juncture, after the Fed inspired and confidence returning rally from about the middle of February. Around 40 odd days of stocks doing better after an equal number of days of stocks doing worse, swings and roundabouts. For now, in a shortened week, I guess caution is the watchword.

Sent to you by Sasha and Michael on behalf of team Vestact.

No comments:

Post a Comment