"Shareholders are a different breed, they want action today, we have been conditioned to believe that swift action is the best way. The scoreboard says that since listing in July of 1999, the stock has returned (in Pound terms) 17.1 percent to their shareholders. Hardly a kings ransom you would say. Over the same time, and you are going to struggle to believe this, the FTSE 100 has returned minus 6.48 percent. Minus. Since July of 1999."

To market to market to buy a fat pig Friday was a good day for global equity markets, it seemed that the cheer was returning. In simple terminology, when nobody has any way of explaining who or what the natural buying is, the term "risk on" is used liberally. Risk on means that treasuries, in particular those of Japan and more so the US, as well as Germany, become less attractive and yield searching begins. It has been a long 7 years for those folks desperate for yield.

Not all stocks were enjoying the rally, mostly the commodity stocks, which have been on a ripper since the year started. Single commodity producers specifically have had a whale of a time, at least the share prices of these businesses. As a collective, year to date, the gold mining stocks are up 95 percent, whilst the platinum stocks are up 88 percent. Some of the single counters (and by extension the index) are still incredibly far away from the all time highs.

In the case of Impala Platinum for instance, which is at nearly 50 Rand a share, the stock crested 350 odd Rand in May of 2008. Remember when the lights went out and the platinum price went through the roof? Back then. Amplats was back then over 1400 Rand a share, now the stock is a little above 390 Rand. Harmony Gold was at 129 Rand a share in February of 2009, the stock may be up smartly this year, it is still at 51 Rand however. AngloGold Ashanti is at 210 Rand a share, in December of 2011, the stock traded over 385 Rand a share.

To a large extent the weakening Rand has masked poor performance of these companies in their Dollar listings. I saw two stories over the weekend, one about a UK budget that may tax diesel vehicles more (not good for PGM producers) and another suggesting that the Indian government have implemented a tax on gold in that country, that could see demand shrink. I guess the Indian government want people to progress to the 21st century and buy newer financial assets.

Bonds, equities, heck, even money instruments that will give you some sort of yield. You can't change hundreds of years of cultural buying and allure to the yellow metal overnight however, I suspect that will happen naturally. I for one and am pleased that the rising commodity prices will give our producers much needed respite, I fear with supply issues and demand being marginally lower than anticipated that this rally may be short lived. This could be a good moment to sell into strength. Equally over in the oil market the Iranians are not stocking to any supply freezes. The country suggested that 70 Dollar a barrel oil prices were ideal. I am not too sure what that means, isn't that akin to Apple saying that a 2000 Dollar price tag per iPhone was the optimum level for them. Supply/demand, isn't that economics 101?

After all was said and done here locally in Jozi, Jozi, stocks had added around 0.4 percent on the day. The big news however was Old Mutual, expectations were for a split in the group, I guess the reason why the stock fell was as a result of no natural buyers emerging immediately for any of their businesses.

They expect to distribute the Nedbank shares to their shareholders (of which there are tons of Old Mutual shareholders), the Old Mutual Asset Management US business is listed already, they could find a way to extract value for Old Mutual customers along the way, by selling from time to time. The UK investment assets are apparently being spoken about already, private equity types looking hard there. Or so we are told to believe. I suspect that by doing this in an orderly and slow fashion it will benefit shareholders rather than a fire sale.

They don't need to do that, i.e. Old Mutual have time on their side. Shareholders are a different breed, they want action today, we have been conditioned to believe that swift action is the best way. The scoreboard says that since listing in July of 1999, the stock has returned (in Pound terms) 17.1 percent to their shareholders. Hardly a kings ransom you would say. Over the same time, and you are going to struggle to believe this, the FTSE 100 has returned minus 6.48 percent. Minus. Since July of 1999.

If you miss the go-go days of the late 90's and the tech valuations that went nuts, then I guess a longer dated measure is in order. What I mean by that is that people refer to the last seven years since March 2009 as the most hated equity markets rally in history, where you can see that for investors in some markets the longer return has been really poor. Over that same time period the S&P 500 has returned 42.5 percent. So much for the most hated rally in history. To put it into perspective over a longer dated period, the broader market through the end of Clinton, the beginning of Bush number two and almost through Obama has hardly been earth shattering. Which is why I always think that you must be careful to cherry pick times and dates.

The other stock that attracted attention was MTN. There had been reports on Thursday, that spilled over into Friday that suggested that the company had reached some sort of settlement with the Nigerian authorities. Remember that the South African president was in Nigeria last week, speaking to the Nigerian parliament and the president. The company said that if anything arose, they would continue to brief their shareholders through the SENS channels. In other words, the negotiations are ongoing.

Uncertainty is going to continue to put a cap on the price, if the quantum of the fine is kept in the original format, I expect more weakness. If the fine is reduced and involves the company not only listing the entity in Nigeria (and giving ownership to some government entity), but also committing to an investment in the infrastructure of Nigerian telecommunications, this would be beneficial for the country and the company in the long run. If politicians are only interested in punishing foreign businesses (and MTN called their bluff, they were wrong too), expect no FDI. Really. That is the way that I perceive it, and we all know that sometimes perceptions are harder to break than reality.

Chinese investment in Africa plunged last year, by the half year stage (according to the FT in October last year - Chinese investment in Africa plunges 84%) investment by that country in Africa was 568 million Dollars. According to the same publication, in a story released last week, Chinese investment in Europe hits $23bn record in 2015, and 15 billion Dollars in the US last year. All companies and governments have choices, the bigger and more liquid your capital markets, the more sure it is, the better the chances you have of a solid and stable return over time. Nobody wants to invest in a place where the regulations change, rules become unclear and the outlook is fuzzy.

Over the seas and far away, in New York, New York, stocks rallied hard into the close of the business. The S&P 500 added around one and two thirds of a percent, the Dow Jones added one and one quarter of a percent, whilst the nerds of NASDAQ clocked 1.85 percent on the day. Energy stocks were on fire again, the oil price resurgence has caught everyone by surprise. Again. Surprised on the way up and surprised on the way down, that sounds about right to me!

Linkfest, lap it up

To kick off the week, here is Ben Carlson talking about how many ways you can be wrong as an investor - How To Be Wrong As An Investor. The point he makes is that you are guaranteed to make mistakes when investing. The longer your investment time frame the less of these mistakes are relevant and the less likely you are to make emotion linked mistakes. My favourite mistake listed is this one:

"You can bet against a terrible business that gets the seal of approval from Oprah."

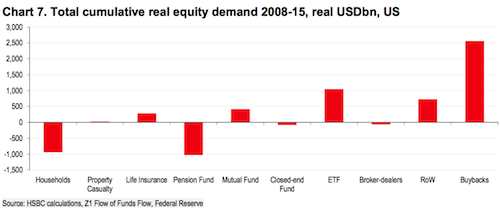

You will have read in last weeks newsletter that the bull market has been running for 7 years now, here is a look at who has been buying shares and who has been selling - One Astounding Chart Explains the Entire 7 Year Bull Market

There are a number of companies competing in this space, now we are starting to see dates for when the first people will be able to experience weightlessness - Bezos' space company aims for passenger flights in 2018.

Home again, home again, jiggety-jog. Stocks across Asia are comfortably ahead, Shanghai is up around one and two-thirds of a percent. The Japanese markets are pumping too, up over one and three-quarters of a percent. Hey, I saw the Natasha from Tasha's this weekend, inside the store in Sandton. Man, she was on the ball, paying very close attention to detail, making sure that everyone was on their toes. The Sandton Tasha's has opened a new fine dining segment, it seemed to be "doing well". Notwithstanding the constrained consumer, in fairness, this is Sandton, which is like Manhattan is to the USA, not the same.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment