"This period obviously includes the new home so to speak, with the listing in Frankfurt and the "home" in the Netherlands. As they point out in the presentation, the attraction for the local shareholder base is that 74 percent of profits are generated from the United Kingdom and Europe, on 59 percent of the revenue base. 34 percent of revenues are generated from Africa (25 percent of profits), balance of revenues (7 percent) and profits (1 percent) are from Australasia."

To market to market to buy a fat pig Stocks were having another ripper yesterday, we nearly reached 51 thousand points on the Jozi all share index, ending the day up 1.3 percent. We are now ever so positive for the year, into the third month. It has not been easy for holders of stocks, and in the middle of the last slump (where stocks were nearly 10 percent lower than now), it always feels hard. We are reminded by the folks who do this (save furiously) for a long time that these bumps in the market are a blessing. It is the hardest thing to try and explain to anyone, that when stock prices are lower, you should cheer. Most of the time, unlike Berkshire, we commit a lot of our funds to the market, and as such we don't have bottomless pits of money to deploy when stocks are cheaper. We reinvest dividends, we remain patient.

A great tweet via one of the craziest people on Twitter (he still remains anonymous), the Fly has another account called iBankCoin, which is a source of PG18 market information. The same old chap with the pony tail, Marc Faber rolls out the same BS over and over again. A contributor to the Fly's blog, Jeff Macke pointed out the last five big market calls from the Swiss nut job: Marc Faber: 3pct Higher, Then DOOOOM.

Why the channels still roll out this garbage and how the guy has any money left (of his own, or any new clients) is a mystery to me. Marc Faber has a Ph.D. in Economics from the University of Zurich. He must have been spanked as a child. File his ramblings into the category "ignore", he will be right once every generation and be the person that predicted it. The moral of the story is that nobody has the secret sauce, those who purport to have the answers do not. Buy quality, stay the course, ignore the noise. Wash, rinse, repeat.

Over the seas and far away, stocks closed the day on a positive note, the nerds of NASDAQ added over one-quarter of a percent, the broader market S&P 500 was driven higher (up 0.41 percent) by the energy and basic materials sector, you guessed it, better oil prices! The Dow Industrials added one-fifth of a percent. There was a pretty decent employment read, in the form of the ADP employment data, ahead of the non-farm payrolls number this Friday, the most important read since the last read. Private payrolls according to ADP (a payroll processor) increased by 214 thousand. Nice. And apparently in the Republican camp, America must be made great again. Great from what? Seems with unemployment at 4.9 percent, that is pretty great? Admittedly the wage bill is the biggest issue, as wages have stagnated for the middle class.

Across the seas towards where the sun rises, stocks in Hong Kong are lower by around two-thirds, stocks in Japan are up again, as are stocks in Shanghai, not so in Hong Kong. Expect markets to start a little better here this morning, the mood certainly seems to be changing a little bit, perhaps it really is the oil price that is going higher and higher. Oil closed at the highest level since January the 5th, strangely, stocks did too!

Company corner

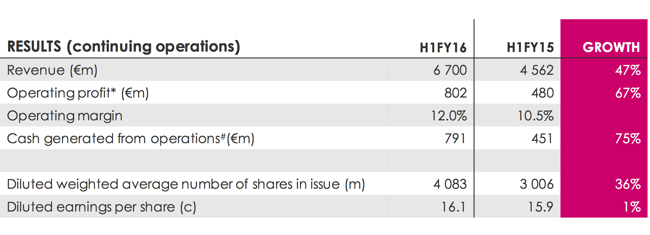

Steinhoff (International Holdings) have been in the news lately. For a lot of reasons. Yesterday the stock touched an all time high, in both the short listed history in Frankfurt, which has been since December last year, and here in Jozi. At one stage the stock was trading at 89 Rand a share, the stock was in the third week of January below 70 Rand a share. The company reported results on Monday for the first six months of their financial year.

This period obviously includes the new home so to speak, with the listing in Frankfurt and the "home" in the Netherlands. As they point out in the presentation, the attraction for the local shareholder base is that 74 percent of profits are generated from the United Kingdom and Europe, on 59 percent of the revenue base. 34 percent of revenues are generated from Africa (25 percent of profits), balance of revenues (7 percent) and profits (1 percent) are from Australasia.

EPS is flat as shares in issue increased sharply, as a result of the Pepkor transaction. Most pleasing, Conforama increased profits by 31 percent, margins widened by 130 basis points to 6.8 percent. The UK business was flat to middling, margins under pressure there. The group is now huge, 6900 plus outlets, 105 thousand employees, looking to generate sales in excess of 13 billion Euros, that is nearly 220 billion Rand in revenues. That is huge!

The company is currently in negotiations to acquire Argos, remember this post from a couple of weeks back: Steinhoff bids for Argos. As recently as yesterday, the news came that the company is now looking to bid against a sizeable European company, Fnac, in order to acquire a business called Darty. In France. Steinhoff Makes $924 Million Proposal to Win Darty From Fnac. I remember that there were only two shops where you could buy anything in Maputo (during the war), one was at Fnac, it was fun to shop there. You needed hard currency to buy there, a store card, and you couldn't be Mozambican, the ultimate smack in the face. There is a weird connection here to French political royalty, the heiress (Jessica Sebaoun-Darty) to the Darty empire is married to the son of Nicolas Sarkozy, the former president of France.

We continue to think that the company will do these deals, Markus Jooste is VERY ambitious and recognises that the time to buy these assets is now. Buy when Europe is seemingly weak and sweat the details really hard. He is great, it is one of the reasons we own the business, a strong and ambitious management team. We continue to recommend the stock as a buy.

Linkfest, lap it up

Environmental concerns are only going to grow going forward. An area that we don't really focus on here in South Africa is the impact of the waste that we generate - A German city just became the first in the world to ban single-use coffee pods. This may have an impact on Nespresso sales for Nestle but these companies are working hard to make more environmentally pods and for most, environmental concerns probably won't get in the way of their regular caffeine fix.

Bill Gates recently wrote about energy in the Bill and Malinda Gates Foundation's annual letter - It Is Surprisingly Hard to Store Energy. One of the keys to renewable energy is battery technology, one area that Tesla is working hard to improve.

"If you wanted to store enough electricity to run everything in your house for a week, you would need a huge battery-and it would triple your electric bill."

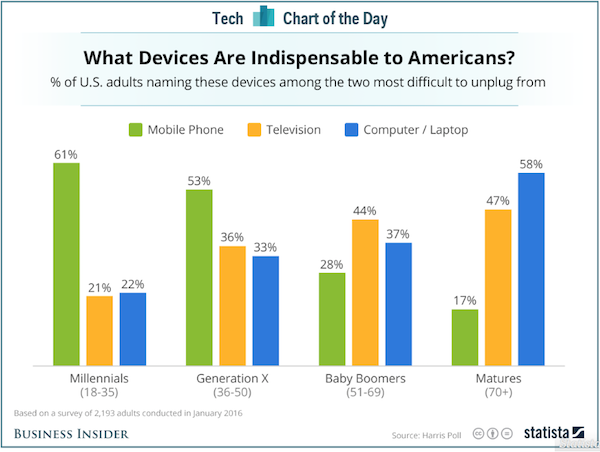

I was surprised that to see that the one thing baby boomers can not live without is the television set , maybe growing up when television was just finding its feet has something to do with it - Young Americans can't live without their mobile phones.

Home again, home again, jiggety-jog. MTN had results this morning, it is a huge bunch of moving numbers and the stock is up nearly 6 percent at the get go. A huge provision, a definite cut in the dividend looming this year. We will cover it tomorrow. For now, we have started better.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment