"There are problems, and then there are problems. Bill Ackman is getting caned, murdered in fact, in a market sense. People are starting to point out that he blew up before, why can't it happen now. He must be taking calls left right and centre. Here is a BusinessInsider story on the bad time that he and his investors are having: Bill Ackman is having the worst year in his fund's history."

To market to market to buy a fat pig Yesterday was a waiting in formation kind of day, waiting for Janet and her friends. And by that, I mean the FOMC statement that was due for release during the course of the evening local time. I am not too sure why these events capture the market as much as they do, it is however very important what rates are for each and every consumer. I guess there are countries that don't have to worry about interest rates, as they have no central banks.

On further inspection, an earlier list from 2000 is much smaller, and as far as my web snooping can tell, only North Korea (other than small Pacific Islands) has no central bank. Those desperate citizens pretty much have nothing. For me, that is the worst example that we have of the George Orwell's 1984. There are a multitude of other dictatorships globally and autocratic territories, none as bad as North Korea. The anti-human spirit country. Talking of which -> North Korea sentences US student to 15 years' hard labour.

We can be grateful that we have a vibrant democracy. It wasn't always the case, lest we forget. I spoke to a (how should we put this) more mature lovely client yesterday, she recalls the newspaper bans of the 70's and 80's in which she had no knowledge of major events in South African history. She just said that the state made sure all the literature that was fed to all, kept readers in the dark. So I am guessing that if you are over a certain age in this country, your lived history would be skewed and wrong. In the internet era you can try and muzzle the press, there are too many channels for people to communicate. Be grateful for vibrant media, working tirelessly to tell you as much as possible.

Communication is at our core. And until recently, the Federal Reserve did not communicate their statements and explain in a press conference. This is all pretty new to central banks, perhaps in response to the recent financial crisis, central banks needed to show they were on top of things. And as such, answer pressing questions in the best possible way. What does not appeal to me is the idea that central banks often are seen like a doctors visit, if the doc says you are OK, you go away and start feeling better. The Fed is not a doctor, we are not patients, I dislike that analogy. If you are looking for the announcement, then look no further than here: March 16, 2016.

The FT interprets the statement and the Q&A session as follows: Fed scales back forecasts for rate rises amid global risks. The Wall Street Journal says: Fed Dials Back Pace of Rate Hikes. Smaller steps. Longer time. We have always read it that way. No rush, data watching, like all of us. Caution. Dovish stance. Expect only two rate hikes this year. From four earlier. June? Perhaps then, the data obviously has to improve.

The market reaction was understandable, stocks rallied in the aftermath of the announcement, wiping out earlier mid session wallowing. After all was said and done the broader market, the S&P 500 added over half a percent, the Dow tacked on over four-tenths of a percent and the nerds of NASDAQ were the real stars of the show, up three-quarters of a percent. Not all stocks were winners, bank stock prices were factoring in more gradual gains. Higher interest rates = more interest related income for banks. If the Fed rise is more gradual, then so will this earnings boost. Financials closed the day flat, UBS, Bank of America and Wells Fargo all closed lower.

There are problems, and then there are problems. Bill Ackman is getting caned, murdered in fact, in a market sense. People are starting to point out that he blew up before, why can't it happen now. He must be taking calls left right and centre. Here is a BusinessInsider story on the bad time that he and his investors are having: Bill Ackman is having the worst year in his fund's history. All this is related to Valeant of course, the stock traded down over 50 percent two sessions back, on 40 percent of all the shares in issue, last evening another 54 million shares traded (the stock was flat), around 15.8 percent of all the shares in issue. So around 56 percent of all the shares in issue have traded in just two sessions. The situation is very fluid for Ackman, I am guessing that he is fielding awkward calls!

Locally in the city founded on gold, in the capital of continental capital (I am getting all Mark Haines here) we rallied into the close, stocks as a collective added 0.83 percent. Resources stocks were the winners, there you go again, there is your volatility! New 12 month highs for Harmony and Steinhoff, both stocks have been on a tear. Glencore was at the top of the leaderboards, "doing well" recently. Certainly since management followed their rights at 125 pence a share, they are nearly 20 pence in the money at the moment. Although I am pretty sure that they are holders through thick and thin. That is the model, and that is why they get paid a bomb, from time to time they are asked to suck it all up.

Linkfest, lap it up

This is a point that we try convey regularly and is a distinction that gets muddled frequently by the media. Understanding that investing and trading/speculating are different and involves very different time frames will help you better understand markets and know what news to ignore - Warren Buffett has a simple test for separating investors from speculators

The stock market is the one asset class where you can invest in other people's ideas and ride the coat tails of some of the best and brightest people - The Stock Market's Secret Weapon

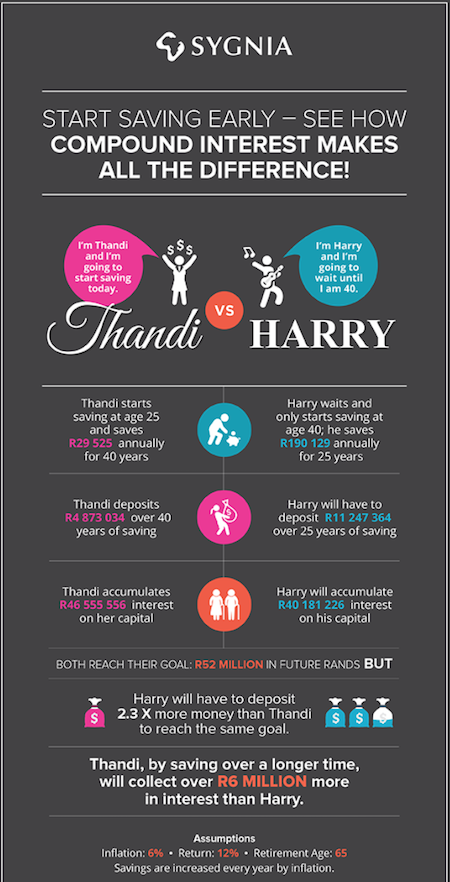

Here is an infographic showing why starting to save early is important. Smaller and consistent investments is all that is required for financial freedom over the long run.

I like this a lot. It represents that companies are listening to their shareholders. The problem may be that the shareholders are looking to maximise the gains in their stock holdings at the expense of the company longer term. Which ever camp you fall into, according to the BusinessInsider: Activist investors went after companies at a record pace in 2015 - and won.

Is this just a gimmick, or will it take away another needless task, saving a mere 20 odd seconds a day. Either way it looks like progress: Nike just unveiled the first real power-lacing sneaker, the HyperAdapt 1.0. One less thing to do, teach little people to tie up laces. Your parenting skills are being replaced by robots.

Home again, home again, jiggety-jog. Capital markets are looking strong with AB Inbev raising a record EUR 13.25 billion yesterday, the largest amount by a corporation in Euros. Looking to the rest of the day, we have the SARB's interest rate decision this afternoon, Initial Jobless claims out of the US and then a CPI number from the EU. Never a dull moment of financial markets, always a new number to digest.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment