"And the Brazilian currency was in free fall, right? Wrong. Again, a weaker Dollar boosted the local unit. External factors from the gatekeepers of capital determine the flows."

To market to market to buy a fat pig Step aside, Fed and co, it was time for the SARB to have their say. Whilst the president was taking questions in parliament, whether he answered them well enough for the question askers is in itself questionable, SARB governor Lesetja Kganyago was letting us all know that rates were to go up 25 basis points. Of course you can read the full transcript, delivered mid afternoon: Statement of the Monetary Policy Committee. Inflation higher for now, the longer term outlook has improved on that score, the local economy looks weak. Still.

So why then had the Rand rallied through the day, why then were equity markets hitting their highest level year to date? The world is connected, equity prices don't represent the economy and vice versa. For those of us who are not au fait (with French either) with Latin, it is the other way around. The stock market ain't the economy and the economy ain't the stock market. And certainly this is no more relevant than it is in South Africa, a large portion of Rand revenues of listed businesses are derived in foreign currencies, definitely not our own.

The Rand however was on a tear as the US Dollar sank, the Dollar index weakened, in response to a dovish Federal Reserve statement the session prior. I made a snide comment during the afternoon suggesting that the Rand was strengthening as the president was answering the questions put to him, helping with the confidence of the market. What, it didn't "tank" when the official opposition walked out! And it didn't tank when the next biggest party didn't even bother to show up!

Over in Brazil they have bigger fish frying, the president tried to "employ" the former president, to prevent him from being prosecuted. You cannot make this up: Ex-President Lula da Silva's Appointment Throws Brazil in Crisis. If people were angry last weekend, they certainly are going to be angrier this weekend. Meanwhile Brazil's finest, Neymar, and his team, Barcelona FC, have extended their unbeaten streak to 38 matches. True story.

And the Brazilian currency was in free fall, right? Wrong. Again, a weaker Dollar boosted the local unit. External factors from the gatekeepers of capital determine the flows. Anyways, back to the local market quick sticks, the governor raised rates by 25 basis points, it was however not unanimous. Which may well mean that we are ready to stand pat at the next meeting and take a wait and see approach. Which in light of recent events sounds about right! With demand in the local economy weak, inflation has to be kept in check. Inflation is a curse for all, in particular for lower income groups.

Stocks closed off their best levels in Jozi, Jozi, up 0.96 percent by the end of the session. A smidgen over 53 thousand points, we are still around five percent away from the all time highs. All stocks benefitted from the global rally, apart from the big dual listed stocks, AB InBev, Richemont, SABMiller, CapCo, British American Tobacco, and the like all sold off around two percent or worse. At the other end of the spectrum were the commodity stocks and the financials, in particular the banks. Amongst the majors, Anglo was up nearly 7 percent, Sibanye rallied an almost astonishing 11 percent, and then it was FirstRand, Barclays Africa, and RMB Holdings that made up the balance of the top five performing stocks. The performance of the JSE over the last 12 months? Up. Not even a percent however.

Over the seas and far away, in New York, New York (I listened to old blue eyes on the way home yesterday!) it was another #winning session for the US markets, the Dow Jones year-to-date has now ticked over into the green. Just in time for the end of the first quarter. In years to come we might well look at the scoreboard and suggest it was much ado about nothing. Staying on the Shakespeare theme, there was something that caught my eye yesterday on the BusinessInsider: 21 everyday phrases that come straight from Shakespeare's plays. The Green eyed monster? I can't say I ever use that one! The one I enjoyed the most was Swagger. Yeah, that is right, Shakespeare is so hip and stuff. Learn these, impress your friends, for the 400 year anniversary of the death of Shakespeare is upon us, indeed it is nigh. On the 23rd day of the year twenty-sixteen, the greatest Englishman ever (Beefy Botham is pretty good, as is Freddy Flintoff) would have been dead for 400 years!

We digress. The blue chip index, the Dow Jones Industrial Average, named after Dow Jones and Company founders, Charles Dow and Edward Jones, had tacked on 0.9 percent. It is now up all of 0.32 percent for the year. The broader market S&P 500 closed up two-thirds of a percent, it is still down a smidgen for the year, one good day of gains will see it too erasing those deep losses in mid February where it was nearly 10 percent lower than before. Well done to everyone who sold back then. Remember, the world was ending again, this may well be a crisis equal to the financial crisis. Remember? The market is an unforgiving place and it certainly owes you no favours. The nerds of NASDAQ added one quarter of a percent, year to date still down four and two-thirds of a percent. Eish.

Company corner

TenCent reported numbers yesterday, after the market had closed in Hong Kong. So we got the benefit of what people thought of them, translating that through to the Naspers share price. Remember that Naspers owns over one-third of the Chinese internet/entertainment business. They bought it for peanuts. If Koos Bekker does nothing else from here (which I am sure at 63 he won't, he still has lots to give), then the team that worked on that transaction hopefully had their boots stuffed full of Naspers stock options. Naspers stock here locally added 2.62 percent to close at exactly 2100 Rand a share. The all time high reached last November was 2270 Rand, we are still a way off that. This morning, TenCent stock in Hong Kong is up around three and a one-third of a percent, around 8 odd percent away from their all time highs. That was reached last April.

Here is a look at the TenCent results, from their release: TenCent announces 2015 fourth quarter and annual results. Revenues increased 30 percent. Yip, China must be finished that the revenue base of this company has grown to 15.8 billion Dollars. Operating margins were the same as last year, 39 percent, operating profits increased 33 percent year-on-year to 6.256 billion Dollars.

Non GAAP diluted earnings per share clocked 3.437 Renminbi. Which translated to Hong Kong Dollars equals 4.12 Hong Kong Dollars. Which means that the stock, currently at 157.4 Dollars trades on a multiple of 38.2 times. Put differently, with earnings growth of 16 percent, that means that the PEG ratio for this stock is still above 2 times. That is Price to earnings divided by growth in earnings. Expensive, still growing sharply however, and perhaps Mr. Market in Hong Kong has got it right.

Methinks that us Joburgers down here have it completely wrong. And whomever is buying Naspers currently. Whilst there is no such thing in life as a free lunch (somebody ALWAYS has to pay), the sum of parts calculation always reveals that the other huge businesses that Naspers owns and is developing are valued at basically nothing. I guess the market is saying that there is execution risk, the cash cow satellite TV business is going to face competition in the same way that Amazon and Netflix (and co) present dangers to traditional cable guys. Surely not nothing though?

Multiply Naspers' stake in TenCent (33.85 percent) by the current market cap of TenCent (1.47 trillion Hong Kong Dollars) and then convert it back to Rands, you get to roughly 980 billion Rand. Naspers closed last evening with a market cap of 920 billion Rand. granted the business separately must be valued at face value, they have other serious loss making ecommerce businesses that they are developing, those are not without their risks, equally Naspers are incuring debt in building those businesses. It just always looks like a fabulous opportunity, we continue to accumulate Naspers, and of course watch Tencent really closely!

Linkfest, lap it up

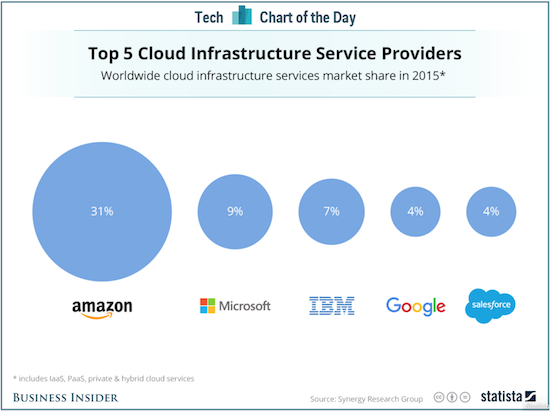

As you know Amazon has very high revenues but not very high profits. The main place they make profits is through the Cloud services business and here is why - Google may be winning some big cloud customers, but it has a long way to go to unseat Amazon

From a revenue and profits perspective Robots are not forecast to make much of either for the next decade, as a result Google is disinvesting from one of their Robotic companies - Google Puts Boston Dynamics Up for Sale in Robotics Retreat. From an outsiders perspective, I hope that whoever buys Boston Dynamics has a large balance sheet to continue spending large amounts of money on the research.

A big break though in paleontology as a Pregnant T. rex unearthed. Part of the reason that it is a big break through is due to researchers not really being able to identify the gender of dinosaurs until now.

Home again, home again, jiggety-jog. Asian markets are mixed, FTSE futures are up slightly and the Rand is holding steady around the R/$ 15.20 level. Our boys kickoff their World T20 tournament today, Sasha turns 40 on Saturday, F1 kicks off in Aus this Sunday and Monday is a holiday. Enjoy!

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment