Jozi, Jozi. 26o 12' 16" S, 28o 2' 44" E. Wow. Another day, another record close for the Jozi all share index. Financials led the charge, collectively up nearly four fifths of a percent, the overall market closed marginally in the green, up 74 points or 0.21 percent better on the day to 34788 points. There was news in the form of the Greeks actually forming a government, but that was expected, the fellow that you need to know now is Prime Minister Antonis Samaras. Who actually warned more than a year and a half ago that the austerity measures were going to have a dire impact on the Greek economy. Samaras is 61 years old, he is an economist by trade, but has been in politics for over three decades, so it is fair to say that he is a politician. If nothing, at least we have learnt about the Greek political landscape and know that there are crazies in all politics with harebrained ideas about the way the world should work. More worrying I suppose is the fact that there are people out there that seem to think that they are right. I am talking about the far left, who seem to want everything, isn't that how you got here in the first place? Probably.

There was something interesting yesterday in the form of South African inflation numbers, which fell back into the comfort zone (5.7 percent was the headline CPI annual inflation rate for urban areas) and in fact beat economists predictions. Here is the full release: Consumer Price Index - May 2012. Excellent, fresh numbers, I know that they are from 21 days ago, but StatsSA used to take slightly longer to release these numbers, back slaps are in order. Well done and stuff to Statistician-General Pali Lehohla and team! The food and non alcoholic beverages index decreased 0.2 percent month on month. Did you get that sense in your basket? Cheaper food is a good thing, in particular fruit and meat got cheaper, but not sweets and desserts nor cold beverages. Well, you should not be buying that sort of stuff. But don't let me stop you from enjoying yourself, eat those awesome Woolies deserts!

Year on year though, you are paying 6.6 percent more for your food. That is mostly being driven by fish, which has clocked an astonishing 11.2 percent increase. Turns out there are not plenty of fish in the sea. I am happy to report that for vegetables you are only paying 2.2 percent more. Food is a pretty big component in the CPI basket, 15.68 percent in total. Alcohol beverages and tobacco sadly makes up 5.58 percent of the basket, LESS than clothing and footwear, which make up 4.11 percent of the overall basket. Housing and utilities make up the largest part of the basket at 22.56 percent, it will come to you as no surprise that the electricity (and other fuels) component has risen 17.1 percent since this time last year. And since 2008, when the base was 100, has risen to 196.8. In other words, in the last four years your electricity bill has about doubled. The single biggest item in the sub sector, Housing and Utilities is Owners' equivalent rent, which makes up 12.21 percent of the overall index. Since the beginning of 2008 (base of 100) this has risen to 117.8. Which I guess is not bad at all.

The other big component of the CPI basket is transport, which has as much as 18.8 percent weighting overall, with the biggest part (of that sub set) being purchase of motor vehicles, 11.25 percent of the OVERALL Index. That has decreased month on month, but for the last four years, again the base of 100 being applied, the index is at 102.6. Which basically means that the price that you are paying now is the same as you paid four years ago, but that obviously consists of a different motor vehicle mix in 2012 when compared to 2008. Probably because of cheaper motor vehicles in the market. Good news for the consumer I guess.

The other big component in the overall basket is "Miscellaneous goods and services" which is a pretty wide measure of "stuff" makes up 13.56 percent of the overall basket. Insurance is in there, and makes up 7.71 percent of the bigger basket, which means of course you are covering that house and motor vehicle, as well as life insurance of course. "Education" sadly makes up a small portion of the overall basket, a mere 2.19 percent, less than "restaurants and hotels" at 2.78 percent.

It is pretty simple I guess, Home, motor vehicle and then food. It is good to see the rate back inside of that 3-6 percent range, although as far as I can see from what I have been hearing and reading, the Reserve Bank is unlikely to budge rates from here. I guess caution remains the watchword. Yeah, let's watch it!

Oh dear. Not again Joe, oh no Joe, not again. There was a song that went something like that, I think it was a comedian who sang it, I could not find it online with my internet skills. Slippage. But this unfortunately is of absolutely no laughing matter, this morning Aquarius Platinum have announced that they are placing their Everest mine on care and maintenance. It is happening people, Aquarius are not going to be in the position of running mines that are unprofitable. The official announcement does not make for pretty reading:

"The ramp-up at Everest has encountered challenges resulting from poor ground conditions and on-going disruptive industrial relations over an extended period and these issues, coupled with the present low PGM price environment, have rendered the mine uneconomic."

It makes me feel a little nauseous really. The company goes on to say that they think that the market will be in surplus by around half a million ounces this year, and point fingers squarely at the issues in Europe. And the official announcement also says that rising costs and lower labour productivity have not helped matters at all. So, how big is Everest. Bigger than you think, this represents 21 percent of the total groups PGM production. 100,252 PGM ounces produced in their 2011 financial year. Check out from their website: Everest. I think if that we were outraged about a painting we should be more outraged here. 1681 folks without a job now, waiting for things to improve. And all we do is talk.

New York, New York. 40o 43' 0" N, 74o 0' 0" W. Markets were pretty wild yesterday, even though the point where we ended was basically flat, that does not really tell the days story. Waiting for the Fed, and when they came, a selloff, and a repeat of that again. I suppose that the hot short term money knows that the nearly five percent rally in a month has been nothing short of very good. I just checked it out, if you sold in May and went away, you looked clever, but you probably missed this rally back and now are only three percent better on the S&P 500. So now what? Paul said yesterday something that I liked, when you hear people say things like, the market looks overbought, oversold, waiting for Europe to sort their stuff out, waiting for a confirmation of higher global growth rates, that is nonsense. The market is the aggregation of buyers and sellers in different sectors and companies, and the level today is what it is. And those levels are not likely to be at the same levels tomorrow, or next week. So, don't try and fight it, or think that the collective are right, or wrong, the levels are what they are. End of story.

I caught the second half of the press conference last evening, with Fed chairman answering the questions shot at him from the press. Man, the guy is an incredible articulator, and although there is lots of Fedspeak in the answers, a lot of it makes complete sense. For the record, here is the statement firstly from the FOMC meeting: Press Release - Release Date: June 20, 2012. There is nothing too new in there, growth is not quick enough, there are risks, they will act, unemployment not falling fast enough, rates are most likely to stay at these levels all the way through to late 2014. So expect rates to be here for a while still. I often think that not enough credit is given to the FOMC for their work in negotiating the mine field, most folks have an Oliver Twist porridge yearning and always want more. There is not too much more that the Fed could do, they indicated that they were continuing to employ operation Twist to the tune of 267 billion Dollars.

What is operation Twist? Well from the statement: "...the Committee intends to purchase Treasury securities with remaining maturities of 6 years to 30 years at the current pace and to sell or redeem an equal amount of Treasury securities with remaining maturities of approximately 3 years or less." So, in simple English, the Fed will sell the shorter term debt, and buy the longer term debt and look to flatten the curve. And by doing that, they are trying to making longer term borrowing more attractive. And at the same time the short term yields less attractive to folks parking their funds somewhere, forcing those same folks to invest more to get a higher return.

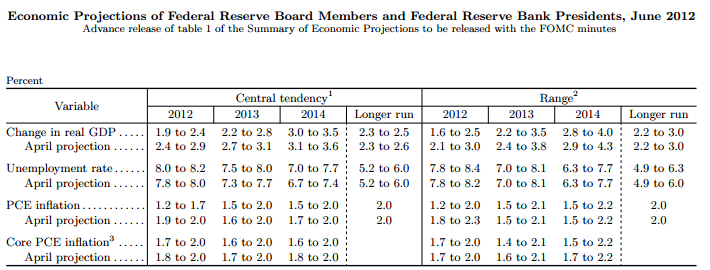

Of course Euro land still looks like a problem for everyone, and this has forced the Fed to downgrade their growth forecasts. Check out the table hacked from the release Economic Projections of Federal Reserve Board Members and Federal Reserve Bank Presidents, June 2012.

As you can see, the projections from the last meeting have been lowered which suggests that the Fed did not see this current bout of weakness. Which brings me to the last point I wish to make on the smartest economic policy makers in the world, if their view of the future is as clouded as ours, then what is to say that they cannot be surprised to the upside too? I suspect of course they can, and invariably the future always turns out better than you think. I unfollowed a fellow on twitter yesterday because he compared 1931 conditions in Europe to the current. Hogwash. Did they have the incredible efficiencies of mobile phones, the internet, global air travel via jet engines, cable and satellite TV, the BRIC's as contributors to the global economy (still small really, but growing fast), microwave ovens, fuel efficient and safe vehicles, broad home ownership, as there is now? No. And are monetary policy makers better advised with all the information that they have available, in order to make better decisions? Yes!! So, what would you say now? Asleep at the wheel, or being the best folks to steer? No, not asleep, and yes, yes, yes, the best people to steer!!! Sit down all you armchair Fed members.

Currencies and commodities corner. Dr. Copper is last at 335 US cents per pound, the gold price is also lower at 1597 Dollars per fine ounce. The oil price is also lower, in fact the lowest level since January 2011, in the time before the Arab Spring, 80.49 Dollars a barrel for NYMEX WTI, 91.65 for Brent Crude oil. The Platinum price is last at 1456 Dollars per fine ounce. The Rand is weaker in the face of some selling pressure here today, last at 8.21 to the US Dollar, 12.96 to the Pound Sterling and 10.45 to the Euro. We are slightly weaker here at the start.

Parting shot. A Chinese Flash HSBC PMI number has come in below 50 again, indicating that Chinese manufacturing continues to contract, but I guess with the European issues that continue to dominate the headlines this is likely to dampen demand. Check it out here: Manufacturers report modest deterioration in operating conditions during May. Not good, and this has been the trend. But, there is no sign of it falling hard, hard landing or whatever you want to call it, but again this morning we are seeing folks talk about landings and a weaker global economy. True. But markets are predictors of the future, not the present.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment