Jozi, Jozi. 26o 12' 16" S, 28o 2' 44" E. Adele, my daughters really like her music, I really do too. Although I often say that amongst the people that you don't want to be is Adele's ex-boyfriend. He sounds like he hurt her so badly, that it inspired an entire album and everyone loves her! Which means he is on the opposite end of that loving, and getting a whole lot of hating. Where is this going? Well, one of her songs has the words "rumour has it". And this piece was taken directly from the last evening show of Jim Cramer's which pointed to a multitude of rumours doing the round, pushing markets globally higher. We will deal with that later.

We closed near our highs here in Jozi, with most of the major sectors comfortably in the green, on exception was Sasol, which enjoys all almost all of the dominance in a sector called Oil & Gas producers. The oil price actually went in the opposite direction of stocks, which is the old theory, not the new one. Session end the Jozi all share index closed 0.71 percent better to 33855, a gain of 238 points. Telkom caught a giant bid, and added 3.19 percent on the day. I was chatting to a journalist yesterday and it suddenly occurred to me that this little table might actually hold a few twists:

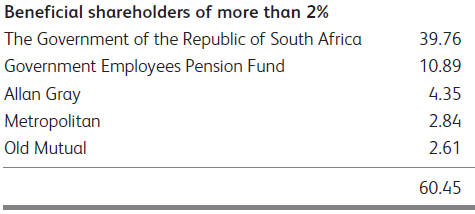

Now, this is old. This is over a year old, but I suspect that not too much has changed here. Remember that all pension funds have obligations to their beneficiaries, the pension holders. If you were managing a pension fund and you owned any company's stock that indicated that they were not paying a dividend for three years at least, what would you do? Sell it, because it would not matter if the business was sound and in expansion mode (Telkom are one of those things, IMO), but if you are uncertain of the future, then get out. BUT, this then leaves the government short, IF (big if) the government pension fund sells out. Because then there is no 50 percent plus, provided that this shareholder register is still correct.

At the same time however, government is less than a 14 percent shareholder (13.91 percent) of Vodacom, that stake is worth 20.3 billion Rand. Government owns nearly 207 million Vodacom shares, with a handsome payment date coming up on the 25th of June, 450 cents a share, that is roughly 931.384 million ZAR, and this is only for the second half. The first half dividend from Vodacom was 260 ZA cents, which meant government benefitted to the tune of 538 million ZAR. So, whilst the dividend payments from Telkom are zilch, nothing, zip, niks, luto, you can definitely see that the Vodacom holding rakes in nearly one and a half billion ZAR in dividends. Does government pay dividend tax? Perhaps the economic impact of selling state owned enterprises and remaining big shareholders thereafter is an easier and more compelling way of making money out of these assets. But of course I would say that, that suits me to say that. What would you do? You could raise an enormous amount of money this way, not so? What is Eskom worth? What is Transnet worth?

South Africa, according to this table from Wiki -> List of countries by electricity consumption, we are the 16th biggest consumers of electricity. In the measurement of consuming MW per hour. The biggest users of electricity on a per capita basis unsurprisingly is Iceland, then Norway, Canada, Finland and then Sweden. We fall much further down the ranking tables on a per capita basis, rubbing shoulders with Portugal, Hungary and Croatia. But we are half of that of New Zealand and Bahrain, where it is cold in the one, heaters, and hotter in the other, lots of aircon required. But, do you think we have problems?

From Wiki I found this: "In terms of fuel, coal-fired plants account for 55% of India's installed electricity capacity, compared to South Africa's 92%; China's 77%; and Australia's 76%." Wow. 92 percent here locally. But for India it is terrible, there are 300 million people who have no electricity in that country, which make up a large portion of the 1.4 billion people globally who have no access to switches and plugs. Most of those people are rural folks, nearly 90 percent, living by sunrise and sunset. I think all I am trying to say that whilst our power problems seem insurmountable, there are bigger problems elsewhere in the world. But still, make sure you switch off your non essential items during the peak periods.

Privatising the government owned entities would make it a whole lot easier for the economy to work in the long run, but would it make it good for jobs? I have no answer anymore as to what will create jobs, we have free markets types feeling like they are head butting stone walls trying to make a breakthrough, whilst the fellows on the left feel like business is still killing it and exploiting workers and workers need a bigger say in the way that businesses are managed. I am all for empowering employees, the more that own equity stakes in businesses the better, but these stakes are worth something and need to be paid for. Time to look forward. But again, that is very easy for me to say.

Byron's beats is a continuation of my thought processes above, for better or for worse. Great minds and fools, you know how it goes.

- I'm getting really worried about the South African mining industry. Three announcements this week have suggested that the sector is getting worse, firstly, and Sasha mentioned this in his note yesterday, we had an announcement from Aquarius which suggests that the Marikana Pooling & Sharing Agreement is to be placed on hold because the current platinum price is not high enough to meet the costs to mine it.

The second announcement involved Gold One and dismissals due to illegal strikes. The last one was news of a possible rise in mining taxes which could reach 55%. Here is an extract from a MONEYWEB article, titled SA mining tax rate could rise to 55%: "The ANC is due to discuss policy changes at a conference later this month. While an ANC-commissioned study found after a more than two-year debate that seizing mines would be an unmitigated economic disaster, it recommended imposing a 50 percent tax on the profits of mining companies earning returns in excess of 15 percent, levies on the sale of prospecting rights and more taxes on companies based in offshore tax havens."

In the 1970's mining contributed 21% to our GDP, today it is around 6%. That is not necessarily because it has fallen. Our economy has shifted to services. It is however still responsible for 60% of our exports and very important for our deficit. It is responsible for nearly 1 million jobs, 30% of capital inflows into the economy and between 10%-20% of corporate taxes.

In other words it is absolutely vital for the success of our fragile economy and right now current policies are killing it. Labour laws are too strict and unions are bringing our mining sector to its knees. We cannot afford to lose jobs, especially from illegal strikes. And you can bet your bottom dollar that miners are going to do everything in their power to mechanise as much as possible.

Then we have electricity. This is out of our control and if tariffs do not increase Eskom will not be able to supply electricity. There are options however and the government should be a lot more open minded about opening up the grid to the private sector. I do not understand why the government feels they need to do everything themselves. Outsource it, teamwork is a lot more efficient than going it alone.

If these taxes are implemented it could be the final nail. This is similar to what is being implemented in Australia yet there, the mines have been thriving. Remember that article I wrote about Kumba at the beginning of the year, titled Kumba Iron ore trading update, looks good? It looked at how a successful mine was benefitting the community and its employees. This way is also a lot more sustainable. I beg the policy makers to please give the miners a break. A tax like this could break them and cost a lot of jobs and money for all of us.

New York, New York. 40o 43' 0" N, 74o 0' 0" W. Markets absolutely rocketed from about midday onwards, with folks wondering whether or not something big is going to happen, the rumour mill. And this was in the face of rising bond yields in both Spain and Italy, with the Austrian finance minister suggesting that the Italians might need funding at some stage, extraordinary funding from the outside. And let us face it, Italy is not ...... errr ...... Italy is not Cyprus, that is also looking for money. Europe needs to find a path towards growth as well as cut to the bone on public spending, the socialist route is the one that they have chosen, but you have to be able to comply. Like the Scandinavians, not like the Southern Europeans. I thought that this piece was supposed to be about the New York markets? But that is just it, the worries that the Americans are having is all about Europe. Even though many professional Americans cannot tell you what the capital of Slovakia is. And yes, Slovakia is a full blown Eurozone member. Which differs from the European Union. Yes, try and ask most smart people you know what the answer is to that, what is the capital of Slovakia? Slovakia's economy is similar in size to that of New Zealand, and on a per capita basis equal to Portugal.

I loved this from Jim Cramer last evening: "It's like the whole world is one big stock with a bad balance sheet that trades with its headquarters in Madrid or Rome." I understand what he is saying, and in fact out of character I went to a results presentation yesterday, and the European question was asked: "What is it like on the ground" or something to that effect. And the answer was, well, people are waiting before they make any decisions, and you have seen that echoed time and again. Waiting for something or other in the form of a solution to the European debt crisis. And strangely, that is why Jim Cramer is telling all the people on his show to buy American companies with American exposure, 100 percent. Wow, that seems like a U turn from a few years ago, where countries wanted diversification at all costs. I suspect Jim is just going for comfort out of the same fear that is gripping everyone else.

So what will change this? What will make the cautious turn to buyers? What levels of comfort do you think people need to have? Greek staying and proceeding down a path of austerity and looking for a new growth path? Eurobonds? Guaranteeing bank deposits? I suspect we might have to jumble our way through this until the grand plan is released from those folks yesterday. In the interim the impact is being felt by multinationals, there was a weaker than anticipated McDonald's sales number on Friday last week, both European and mainland China sales were slower and lower than anticipated, and expect currency issues from those regions too, and I see that McDonald's had a broker downgrade as a result of a stronger Dollar versus the Euro, but also using central banker speak, McDonald's are going to face "headwinds". Happy to hold, happy to add at these levels.

Currencies and commodities corner. Dr. Copper last traded at 336 US cents per pound. The gold price is higher, last at 1612 Dollars per fine ounce, the platinum price is 1451 Dollars per fine ounce, marginally better on the day. The oil price is last at 83.36 Dollars per barrel, up on the day. The Rand is last at 8.38 to the US dollar, 13.05 to the Pound Sterling and 10.56 to the Euro. We are about flat here on the session.

Parting shot. Of course that is going to happen, Greek people withdrawing money from their banking accounts heavily ahead of the weekend elections. Because humans are engineered that way, we are a cautious bunch by nature. Greek cash withdrawals could be capped, I laughed when I saw the Telegraph suggest this could impact on British tourists. WHAT? Poor (not so poor) British tourists will have to watch out when they spend their cash. Err... what about credit cards and debit cards, surely those work? My recent experience in Italy is that almost everyone except the hotels preferred cash. Hmmm.... via the Business Insider to Bloomberg, this story tells it like it is: Greek Bank Deposit Outflows Said To Rise Before Elections. And that would just make matters worse and not better. Unless the Europeans guaranteed all Euro deposits, because then regardless of where you are, a Euro deposited in a Euro bank is a Euro. Most exciting of all is that Joe Weisenthal is heading to Athens, follow him on Twitter here -> @TheStalwart. Should be fun, he is there until elections time!

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment