Jozi, Jozi. 26o 12' 16" S, 28o 2' 44" E. Not the best day ever, the same old anxieties come back time and again. It feels like trying to start exercising again, and being hurt by a niggling injury that just won't go away. And that niggling injury is Europe and their sovereign debt issues. We feel your pain, but at the end of the day these are rich people problems, just this morning I saw that 91 day Kenyan T-bills are yielding 10.537 percent, according to an interview done on CNBC Africa. The comparable rate in the US is 0.1 percent. Portuguese ten year debt currently yields 10.65 percent. So, whatever you think in terms of whether one economy is finished or not, that is what people are prepared to pay.

So, I often suggest that the problems of Europe are rich people problems, because to borrow the Spanish Prime Ministers text message, Portugal is not Kenya. Portugal has an economy roughly the size of the Nigerians, and seven times the size of the Kenyan economy. Kenya, according to Wiki, has a population of 42.7 million versus Portugal of 10.5 million. Don't take this the wrong way, but if you had to ask 10.5 million Portuguese and an equal number of Kenyans where they would like to live and adopt the relative lifestyles, what do you think the answer would be? And Portugal have Nani and Ronaldo, Pepe and Meireles. Kenya has McDonald Mariga. Have I missed anyone? I still maintain that the "problems" in Europe are rich people problems. And they have the resources to deal with them, if not now, then sooner than we think.

The Jozi all share index closed down 211 points to 33826, a loss of 0.62 percent on the day, there were a few spots of green across the board, Sasol, the platinum shares and general retailers all closed a little higher, in the negative column there was the broader sector resources down three quarters of a percent, banks off nearly a percent. Not too much from a companies or earnings point of view yesterday, Sentula released results which saw their price higher on the day, but that said, the stock is trading near the five year lows, and over that same time frame are down a whopping 91 percent. Yech. Numbers of shares in issue at Sentula are up four and a half fold over 9 years. Not good. Although it is a different business of course now, than it was then, but having said that, turnover is down 16 percent from 2009. Perhaps they have turned the corner. But there is still a small matter of a civil judgement(s) against the former CEO and CFO, that hangs over the business like a bad smell. The NPA and the FSB sniffed around and raised numerous red flags (danger, communism I guess, or perhaps the athletics usage applies) that have been dealt with. Phew, too much baggage.

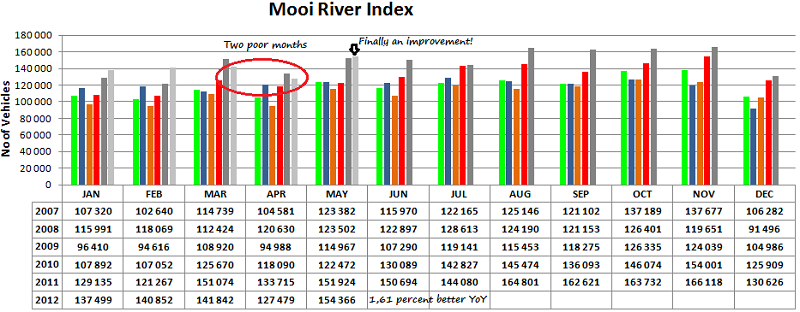

It is back! The Mooi River Index went missing for a while, Byron actually knows the fellow who compiles them, I think he was just very busy moving up to Joburg from Mooi River. But the reading is back, thanks to the settling of the compiler of this very important piece of our puzzle. What is it? Well, the Mooi River Index was thought up by a logistics chap by the name of Adam Kethro. He thought that heavy trucks, those with five axles or more, travelling on the national highway between Jozi and Durbs would be a good measure of state of the economy. The more traffic means that the wheels of the economy are moving faster than anticipated.

Strangely however, we are not too sure if this is as a result of the Transnet numbers falling. I have heard from several sources that Transnet is struggling, on the railways side, and in fact I was told yesterday that the last month's coal volumes through to Richards Bay was NOT GOOD, not because the demand was not there, but because of derailments and poor performance from the supplier of rail services. Which is a business that is 100 percent owned by government, so effectively, you and I, the people of the country that we live in, own this asset.

But that is another piece of the puzzle, something that I do not have access to unfortunately. If I did, I would put it all together and get a sense of whether this explosion in road traffic is as a direct result of a worsening in rail services. Here goes the Mooi River Index, for the last six years, since the beginning of 2007.

As you can see, the year on year improvement is slight, 1.6 percent better. I decided to take a leaf out of the cement stats book and introduce two sets of extra data to this, the moving annual total (MAT) and compare that to the prior twelve months and then of course the year to date statistics, and see how that is going. First, moving annual total, which will compare the second half of the last 24 months, to the first half. So, for the last 12 months the volumes of five axle trucks through Mooi River toll plaza has totalled 1,784,710. Or roughly 4889 trucks a day, 203 an hour! The 12 months prior to that, June 2010 to May 2011, registered 1,502,634 heavy trucks, or roughly 4116 a day, 171 an hour. That increase is a pretty remarkable 18 percent. Moving annual total. Now, onto the year to date numbers! 702,038 heavy vehicles went through the Mooi River toll plaza from Jan 1 to May 31 2012. The number for the year 2011, fitting the exact same dates were 687,115 heavy vehicles.

So, that is an increase of just over two percent so far this year. And I guess it tells you something, that whilst we have recovered to pre crisis levels, the going lately has been fairly stodgy. Europe, slower growth rates in China, fairly ropey local looking economy, it all adds up I guess. There is cause for being optimistic, this is the BEST May ever, for the data that goes back to 2004, and in fact over 80 percent better than in 2004. That tells you that there is a lot more trucks on the road now, than there was then.

Byron's beats today must be a yearning for his youth, when he built structures with Lego. Sigh, we were all engineers back then!

- I often talk about a YouTube clip I saw which shows a 15 storey hotel being built in six days. This of course takes place in China and is a great tribute to their work ethic and efficiency.

This WSJ article has indicated that the company which made this viral video has made more clips and is now using it as a fantastic marketing tool. Good on them.

The next clip they made is one where a 30 storey hotel is built in 15 days. Here it is. I strongly urge you to watch it. It is absolutely fascinating, starting from the foundations to the installation to the interior. I am far from an engineer so this kind of thing is almost mind blowing for me. When I walk through any CBD around the world and look up at the buildings I am astounded and dumbstruck by these structures. Yes Joburg that includes you. How we as humans manage to put up such an amazing structure with such precision is phenomenal. To do it in 30 days is even more impressive.

The next step for this company is plans to build the tallest building in the world in 9 months. The building will be a whopping 838m high, 10m higher than the current tallest building, the Burk Khalifa in Dubai and nearly double the height of The Empire State Building. That is whole lot of iron ore, copper, cement, labour and many many more inputs.

Where am I going with this? We are getting more efficient which means we consume things faster and therefore more of it. That's how humans work. Look at the iPhone. Because it works better and quicker than all the others the average iPhone consumes 3 times more data than any other smartphone. That is why innovation is so important for economic growth. And the more we innovate the more room is made to innovate, if you get my just. Because I can use my iPad and the internet to get so much information across to you so quickly I have more time to do other productive things. So basically the more efficient we get, the more efficient we get. And the more efficient we get the more we consume. McDonalds, Starbucks, Wal-Mart, Visa, Amazon and many other great companies are good examples of this.

So you see why I love stories like this and why I get frustrated that we sit and watch negativity on our TV's all day. I guess bad news is what sells and for some reason by sounding bearish you seem very clever. It is in our nature to be cautious but if you ask any successful person, breaking out of your comfort zone is key.

New York, New York. 40o 43' 0" N, 74o 0' 0" W. Stocks benefitted late from the rumour mill running at full tilt again, this time on the whiff that central banks are ready to act in full force against any uncertainty. And that announcement could come Monday, or so it is thought, that was what the rumour mill was doing. Session end the Dow Jones closed a whole percent and a quarter higher.

Currencies and commodities corner. Dr. Copper last traded at 339 US cents per pound, slightly higher on the day, but noticeably higher than yesterday. The gold price is about flat on the day, last at 1623 Dollars per fine ounce. The platinum price is creeping up, the last traded price is 1489 Dollars per fine ounce. 84.69 Dollars per barrel is where the oil price last traded, that is for WTI as per the last NYMEX quote. The Rand is slightly firmer today, 8.36 to the US Dollar, 13.01 to the Pound Sterling and 10.61 to the Euro. We wait for the Greek elections on Sunday, I do think that the distraction of the Euro 2012 is much better for my health. Because, whilst I do not really have any allegiance, the French are who I am backing there!

Parting shot. I am not too sure why people are fascinated with the worst case scenario, and why people who are bearish always get more attention. I guess it is the same morbid fascination of how someone met their demise. Probably. I am just saying how I see it. Those who bring bad news are revered, because they somehow know something that we don't. I remember seeing a tweet from a journalist friend in which he said coming back from a Nouriel Roubini talk that he was going to put his money under his mattress. Make no mistake, I have heard this from many people who have heard Roubini talk, they all say that he is very smart and very compelling, and as such sucks you in. And in fairness, thus far he has been right about the European debt issues. But is it completely awful? Spanish yields might have topped 7 percent yesterday, but it was much worse in the 90's, in the pre Euro common currency era, so I guess there is a whole lot of room for great concern. And clearly the banks creaking and requiring more money (and the unsold properties which top 1 million) in order to shore up reserves, are a huge issue. Are these problems insurmountable? Can Spanish and Italian debt issues be solved?

Well, you can take a quick scan through this, you will be left being completely deflated: The End of the World as We Know It. And the comments on the side are full of praise for such an insightful piece, what insight, these predictions.

Last evenings rally in the US was founded on a rumour that globally central banks are setting up a coordinated manoeuvre post the Greek elections. So, what to expect on Monday? Well, I found via the eFX, the scenarios from Bofa Merrill Lynch:

- "Base case (high probability): election result allows Greece to form a pro-EU government; limited European policy response

Bull case (low probability): election result means Greece does not form a pro-EU government; substantial ECB & European policy response

Bear case (low to medium probability): election result means Greece does not form a pro-EU government; limited ECB/ European policy response"

Thanks for that, I am of the opinion that if Greece "goes", which I still think has the lowest odds, then there might be some relief of sorts. Equally if the base case applies and Greece stays in the Euro zone, then there could equally be a rally. Worst case scenario would be if there were another stalemate. Do not count that out. Do I care about the inventors of democracy struggling to form a government, because the political landscape is so fragmented? Perhaps not. In the ultra short term, I do, in the long term, I don't.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment