Jozi, Jozi. 26o 12' 16" S, 28o 2' 44" E. Lost in translation, or was it actually Spanglish? That is what it felt like, we were waiting for more information around the Spanish funds that were specifically going to be used. I honestly think that the Rajoy text to his finance minister was in poor taste, you know the one where he was purported to have said that "Spain was not Uganda", basically implying that the powers that be (the IMF and the rest of the Europeans) were not going to leave them hanging. Well, forgive me for thinking that your labour laws are a bit banana republic and the banking sector having given wild loans to property developers to build like there was no tomorrow, well that seems a bit banana republic too. The subtle racism (or blatant) drives me nuts. {Sigh} Spanish yields and Italian yields started to rise later in the day as the same talking heads asked the question, does this solve the real problems, or is this just to stop a leak. I suspect that the answer is somewhere in the middle there.

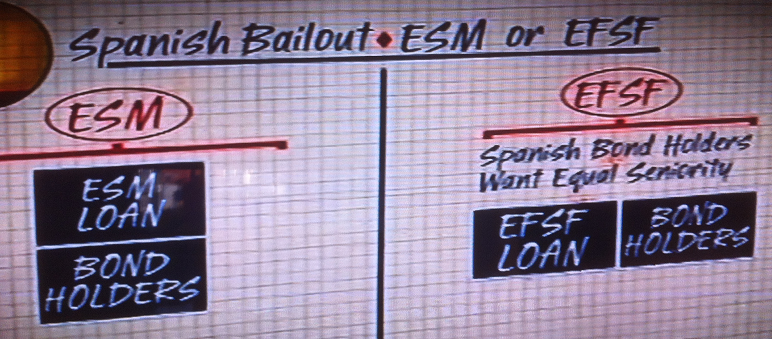

The fact that the Dutch and Finns want collateral does not necessarily mean that they will get it, if the loan from "Europe" is given through the ESM (the European Stability Mechanism) and NOT the EFSF. Man, just don't ask, but the ESM requires all members to contribute, and as such be on the hook. The main issue probably was that bond holders of Spanish debt were left worrying whether or not they would be subordinated. This question, not answered, left Spanish yields to rise beyond six and a half percent, and probably, along with rising Italian yields, saw the equity markets sell off. Again, using either the ESM and the EFSF is the question everyone wants answered. This Bloomberg TV graphic sums it up, I think, check it out:

So whilst the collective Mr. Market started to ask more questions and not fewer, and the answers of course were not immediately forthcoming, the collective does what it knows best, sell first and ask questions later. Correct. After opening comfortably above 34 thousand points on the Jozi all share, and being nearly a percent higher at the open, the market closed in the red, down 0.15 percent, or 49 points to the bad at 33616. Banks were particularly hard hit, down over a percent and three quarters. Poor Telkom was absolutely trashed again, the stock was down at 1911, down 5.86 percent on the day on about average volumes, so nothing too sinister as far as I could tell. Just the lack of clarity (what a twist) and lack of direction, perhaps most importantly, no dividend payment for the foreseeable future. Whilst the company attempts to roll out infrastructure aggressively, with enormous capex plans. Errr, you need a lot of money for that. Either government should sell the stake or they should take the business over and run it themselves and buy out the rest of the shareholders. This double message is plain strange.

We have always maintained that there is nothing like a good old fashioned crisis to make the European project work properly, after all, only the Europeans are aware of the war in their back yard and not across the shores. They are the ones that wear the scars. Fiscal integration is a must, at least we should have a public roadmap that each state votes on, a referendum. There is a wonderful article in Der Spiegel titled A Sneak Peek at Tomorrow's Europe which is well worth a read. The fact that the piece replaces the headlines that would suggest the opposite of what was being thrown out there, you know, the abyss and the edge of the cliff, etc, is actually refreshing. See that the task of coming up with a plan has fallen to Mario Draghi (ECB head), Jean-Claude Juncker (Euro-Group leader), Durao (Jose Manuel) Barroso (President of the European Commision) and Herman Van Rompuy (EC council president).

Van Rompuy is a politician, but was an economics lecturer pre his political career, his father was an economics professor! And he was the Belgian Prime Minister, so he has some pedigree. Barroso is a lawyer by trade, and was also Prime Minister of Portugal, and was someone always involved in politics, from an early age. Juncker is the current Luxembourg Prime Minister, and whilst he is a qualified lawyer, he never practiced. So, it is fair to say that he is a lifer politician. Draghi has a doctorate in economics, and has worked for various organisations both in the public and private sectors. So, I guess it is fair to say that we have two lawyers and two economists working on a plan to integrate Europe, fiscally and perhaps politically too. So, perhaps the United States of Europe would see colourful governors and senators, with the president being the collective representative, having a far more important role. The language thing worries one, at least in the US, English (and Spanish) is spoken by everyone. I guess seeing this headline, over some of the others leads me to believe that the grand plan is being fast tracked.

It had to happen at some stage. Byron wrote a piece last week that compared the platinum and oil prices and found that they are actually a dead ringer for one another when you place a graph over each other. And the oil price, although still historically high, is weaker if your measure is over the last 18 months. I am not going to deviate away from what I want to talk about, the platinum sector and costs. Yesterday there was a statement from Aquarius Platinum: "Aquarius Platinum Limited advises that the partners in the Marikana Pooling & Sharing Agreement ("P&SA2") have agreed in principle to place the P&SA2 operations on care and maintenance, due to the enduring low PGM basket price environment." This pooling and sharing agreement is with Amplats. In their last operational review, Amplats had this to say: "Cash operating cost per equivalent refined platinum ounce increased by 20% to R16,384. Similar to the situation at Kroondal Platinum Mine, the current mining contract has a high fixed-cost element resulting in increased unit costs when production decreases."

16,384 Rands per refined platinum ounce? Wow, that sounds "high". The current Rand platinum price is 12029 Rands per fine ounce. And, as Forrest Gump would say, and that's all I have to say about that. Check this out, a miningmx story that suggests this is not actually enough to make any meaningful impact to the platinum price: Aquarius cutback 'too small to notice'. I am a bit confused with the operational costs issue, presented in this story and presented on the Amplats website. All that I know is that this is not very good and we should be outraged. Instead, like Cees Bruggemans says in his latest piece, we just shrug our shoulders. Read it: Shrugged Fatalism.

New York, New York. 40o 43' 0" N, 74o 0' 0" W. A great big Spain fade on Wall Street last evening, the Dow Jones futures were indicating a one and a half percent to the good open when I walked in the office here yesterday morning, but the end results all those hours later when the markets had actually closed in New York was the exact opposite of that. Markets fell hard in the last half an hour after having trended downwards for most of the day. The NASDAQ dropped 1.7 percent, the Dow fell 1.14 percent whilst the broader market S&P dropped just over a percent and a half.

Byron's beats The big news of the day besides the usual Europe stuff was that Apple were announcing some new products. Always exciting, Byron covers it below.

- When Apple makes announcements everyone gets very excited about what new life changing products will be introduced to the world. Yesterday they had a Worldwide Developers conference which included introductions of both new hardware and software. They started it off with some interesting facts about the App store. There are now over 400 million iTunes App store accounts with access to over 650 000 apps. These have been downloaded over 30 billion times. In the last quarter over $5 billion was paid out to app developers. That is an industry that did not exist a few years ago.

So what's new from Apple's production line? A new MacBook Pro was introduced which has a higher resolution retina display similar to the iPad. It has a lower pixel density than any of the mobile gadgets but it is the highest resolution for any PC ever. With further adjustments it's even thinner than before.

That was the hardware side of the announcement followed by 2 software introductions. Firstly we had the new OS X Mountain Lion which is an operating system for the Mac. Interestingly Mac only has 66 million users which means penetration is low. This is a good thing for potential growth as Apple fans shift to the Mac, keeping all their devices under one umbrella after being sold by the iPhone and iPad. The numbers suggest that this is happening.

Then IOS 6 was announced which is the new operating system used on the iPhone and the iPad. There are 365 million devices which use this platform, roughly 220 million iPhones and 65 million iPads. With IOS 6, Siri has various upgrades and will be available to the iPad.

For me however the most exciting development was a feature called Flyover which are 3-D models of Cities and Landmarks much like Google maps. It sounds cliché but you would always expect Apple to make this type of thing cooler and better. Taking nothing away from Google maps, that is awesome! This will also be used as the navigating systems for Apple devices replacing Google. The rivalry continues.

We remain confident in Apple's ability to remain leaders in pretty much everything they are involved in, post Steve Jobs. There were rumours that an Apple TV was to be announced which obviously did not happen but I'm sure Apple are working on something amazing. The options are endless for this company that only trades on a forward PE of 13 for 2012 earnings estimates. We see this recent pull back as a fantastic buying opportunity for the stock.

Currencies and commodities corner. Dr. Copper is lower at 333 US cents per pound, the gold price is also off its best, down at 1587 Dollars per fine ounce, whilst the platinum price is also off the best levels, down at 1432 Dollars per fine ounce. The oil price is last at 82.19 Dollars per barrel. The Rand is weaker at 8.43 to the US Dollar, 13.07 to the Pound Sterling and 10.54 to the Euro. We are marginally higher here today. Crisis, what crisis?

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment