Jozi, Jozi. 26o 12' 16" S, 28o 2' 44" E. Everyone is quickly becoming an expert on Spanish banks and bond yields from Spain and Italy and their respective levels. Yesterday the US ten year treasury fell to a historic low level of 1.5326 percent. Like my headline suggested yesterday, conservation of capital is at the top of the list for the loose term "investor". People get paid a lot of money to all park for a while in Bunds, Bonds, Gilts and JGB's. All the while in Europe we are moving towards the idea of Euro Bonds, my favourite European CNBC journalist, Sylvia Wadhwa suggested that there could be a start at the short end of the curve. Very short term debt, just to help out the liquidity of the struggling banks. An FDIC type deposit guarantee could also go a long way from us seeing the headlines that Greek depositors continue to transfer funds out of their banks into other Euro banks. I guess that might stop if the looming elections in Greece go in the favour of the conservatives and less in the favour of the far lefties. I saw polls suggest two things, one, the 80 odd percent of the people in Greece want to stay in the EU, but the same percentage, more or less want to see the austerity measures stopped. In other words like most human beings around the world, want to be paid more, be better looking, live in a bigger house and drive a bigger car. Gotcha!

Mr. Market here added 174 points, or 0.53 percent to close at 33143, around 150 points off the highs of the day. The gold miners rocketed away, the collective were up 4.2 percent after all was said and done. Phew, that is amazing. Platinum stocks lagged the rest of the market, Implats was downgraded by two separate brokerage houses. This morning Aquarius is falling hard, it is down to an all time low. The once darling sector of the JSE is having a rather tough time sadly. This is a great pity, because we have so much potential to exploit these assets. I suspect in time the demand will continue to rise for the metal, and we will see better days. For the moment the miners must feel like they are on a slippery slope coated in baby oil with their hands tied behind their backs, and feet tied together. You can scream all you want, but nobody is hearing anything. Someone once asked me what it would take for a shakeup, and sadly it would be worst case scenario, a major mine (not miner) shut. It must be incredibly tough out there in the platinum and gold mining sector in South Africa. And as the assets age and the fixed costs continue to climb, I can't see it getting much better in the short term.

Telkom. Shaking my head in disbelief again (SMHIDA). Touching tomorrow or perhaps never touching anything, the announcement this morning basically suggests that the biggest shareholder, the Government of South Africa is not happy with the Koreans taking a twenty percent stake in the only fixed line operator in South Africa. Pfff... One of the conditions would be that the South African government as a shareholder would ultimately decide on this. Remember at the beginning of the month, with the last announcement, you saw that basically government and the government employees pension fund control the business with a little over fifty percent of the business: Telkom and KT Corp. Is this for real this time?

The news today comes as no shock then: "Shareholders are advised that on 31 May 2012 Telkom was informed by the Honourable Minister of Communications that the proposed transaction between the Companies had been presented to cabinet on 30 May 2012 and that cabinet had taken the decision not to support the transaction as proposed. The board of directors of Telkom will be engaging with the Honourable Minister of Communications to discuss cabinet's decision and the implications thereof. A further announcement will be made in due course." As my old varsity friend used to say and Paul said this morning which made me chuckle: "Legends of the..... fall asleep". Well, whatever you want to think of the business, shareholders have voted with their feet over the years.

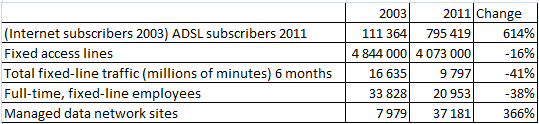

But then I thought to myself, let me whip out the first set of results after they listed nearly ten years ago and the last set of numbers and compare with those numbers from 2003. Perhaps not real revenue and profits numbers, but rather subscriber numbers and number of lines, because back then Telkom held a significant stake in Vodacom, that of course is no longer the case. Remember also that one of South Africa's corporate legends (IMO) Sizwe Nxasana ran Telkom back, perhaps having a much easier job than Nombulelo Moholi, otherwise known as Pinky. I hear she is tough, but she perhaps needs to be tougher. So, here goes, I stuck it into a spreadsheet and have a graphic here below for you, this compares September 2003 half year results to September 2011 half year results:

So, what does this tell us? First, that there are a whole lot more internet subscribers, but the margins in that part of the business are probably not what they were a few years ago, internet packages have been getting cheaper and not more expensive. The fall in number of fixed lines is lost to those folks with mobile lines, who are happier to use their mobile services over their fixed line options. Because everyone is mobile nowadays. The headcount reduction could actually be misleading, Paul suggested that perhaps there are actually non permanent staff in there.

But, there probably were quite a few people who have left over the years, old timers whose time for lying on the beach had come. One can see this in employee expenses, which for the six months of 2003 clocked 3.707 billion Rand. In 2011, the same expense was 4.542 billion Rand. On a per staff basis, Telkom's costs have doubled from the six months to end September 2003 to the six months to end September 2011. Quite simply it is employee costs divided by staffers. Perhaps if you run through many a company you will find the same thing, I have no problem with people earning more if they are able to deliver more. And sadly, I suspect that from a customer point of view, not much has changed over that time. Sub standard service really, that is always what I have had. Is it then any surprise that the company has seen turnover flat for five years. Completely flat. Yech. The market cap is now 12.7 billion Rand, versus 19.2 billion Rand last year at the end of March. The governments roughly 40 percent has lost 2.6 billion Rands in value in just over a year.

So, why say no? Perhaps the price is too cheap. But as you can see, has got cheaper. I have always been completely against owning the company because of the corporate culture, that I have experienced as a customer. If you do not treat your customer as king, they will and have found alternatives. And if the government continues to block a part sale for whatever reason, then I wish the remaining shareholders of Telkom the best of luck. One problem however, is that I guess we are all owners of government and as such Telkom. Telkom, which were whacked yesterday as a result of being chopped out of the MSCI emerging market index, the region specific one. So, this time zone, which includes Poland and Turkey. Today the stock is experiencing similar heat, down nearly five percent, another 621 million wiped off the market cap, more or less. And governments stake is not diluted (happily), but is worth 250 million Rand less. I am sure that the Honourable Minister of Communications should be made aware of this shareholder destruction. And do not get me started about the massive write offs of failed African business forays.

New York, New York. 40o 43' 0" N, 74o 0' 0" W. OK, today is about nothing else other than non-farm payrolls. The ADP number from yesterday was positive, but missed expectations by quite some margin really. Not a big margin, but one nevertheless. The weekly jobless claims number was worse than anticipated, as was a second look at US GDP. Or was it? I quite enjoyed this Bob McTeer piece: Real Final Sales Tick Up a Notch. He comes to this conclusion about the GDP read: "This morning's revision of the second quarter pulled the headline GDP number down to plus 1.9 percent from the earlier estimate of 2.2 percent, but real final sales were actually revised up a notch to plus 1.7 percent. So, while the headline number will get the press and will be treated as a downgrade, one could argue that it was actually a tad stronger than the earlier estimate" But concedes straight thereafter that strength is relative and we continue to see this weakening trend. The Fed, their foot off the gas, slowing naturally, that sort of thing, easing off.

I am not completely excited about the non-farm payrolls number because of their variability and unpredictability and remember that they are always prone to all sorts of revisions too. We actually spoke about that last month, remember:

- You know how I feel about the "jobs number", and it was great that I stumbled across this article titled Wise Up to the Proper Flaws of Monthly NFP Data, by Barry Ritholtz. For him, and his publication, the "stuff" that is useful is hours worked, temp help and wages paid.

My irritation that it is the one and only focus aside, it is what it is, the most important number across the globe, the one that everyone trades around. So, what are expectations then? The unemployment rate is set to stay steady at 8.1 percent, the average work week is set to be unchanged too at 34.5 weeks (I don't know anyone who works that little), whilst private payrolls number is supposed to be in the region of 160 thousand. So, tune in to possibly the biggest market data point on the planet at around 14:30 Jozi time this afternoon to catch it.

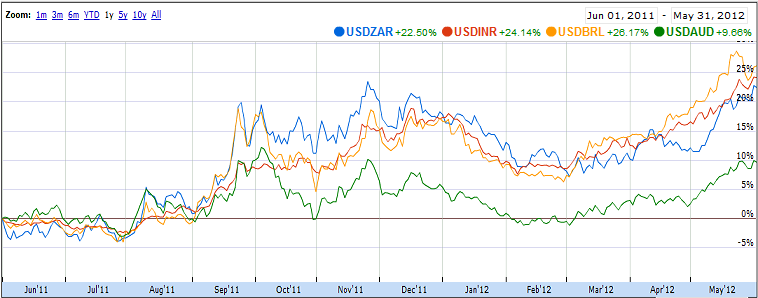

Currencies and commodities corner. Dr. Copper is lower at 336 US cents per pound, the platinum price is last at 1390 Dollars per fine ounce. The gold price is also lower at 1553 Dollars per fine ounce. The oil price is trading at levels last seen in October last year, 85.03 Dollars per barrel on WTI Nymex. Good for inflation reads, that is for sure. The Rand has taken a fair knock, like all emerging market currencies. And I have illustrated this with a little hacking of a Google Finance currencies graph, this shows Dollar strength when compared to the Indian Rupee, Brazilian Real and South African Rand, all weakening relative to the USD, all around a quarter weaker over the last 12 months, this has very little to do with the local currency. And then for good measure, I have thrown in the Aussie Dollar, a commodity exporter. Nice graph, tells us that risk off the table means all emerging market currencies and equities have been sold off.

If you want the more up to date link, follow here: US Dollar ($) / South African Rand (ZAR). For the record, the Rand is at 8.64 to the US Dollar, 13.22 to the Pound Sterling and 10.70 to the Euro. We are slightly lower here at the start. Waiting like everyone else.

Parting shot. Chinese manufacturing activity slowed once again, the government number suggest slight expansion, the HSBC number contraction. The government number missed expectations, and now everyone is getting all down on themselves and asking if China can maintain eight percent plus growth for the current quarter. The suggestions are starting to point to yes. But who am I to know, what I do know is that whilst we are all feeling beat up about life, companies are hanging onto more and more cash. Which needs deployment sooner rather than later. In the meantime, the ECB is telling European leaders to act with shock and awe. I am still looking for this, sooner rather than later.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment