Jozi, Jozi. 26o 12' 16" S, 28o 2' 44" E. We managed to eke out a small gain on the day, the Jozi all share added just shy of 30 points to close up shop at 33851, an improvement of just 0.09 percent. But, as I have gotten to know over the years, that is a better outcome than giving those points back. Banks were absolutely smothered, those losses largely laid at ABSA's doorstep, the stock closed the day down 8.3 percent, and the stock traded over four times its average daily volumes, there must have been some stressed out folks there yesterday who were in short term positions. I think I heard Bruce Whitfield say on his show that this was the worst price action for the stock in decades. Yip, volatility in the big caps is not something that we are used to, whereas the Americans are usually ruthless when it comes to these things. The Americans are not scared to sell big cap stocks off aggressively, but the same applies on the other side of the equation, happy to buy too if the news beats expectations.

Resources for once held it all together for us here, up half a percent on the day, the Euro noise around their pow wow still knocks around, still with mixed messages. In the US I read that some are calling an end to house prices falling, after a recent Case-Shiller release, this is good news, because in the age old(e) British saying, a (wo)mans house is his(her) castle. I think that single asset for most people is most important. Perhaps it is because I have moved often, but home is a place to live with your family. Just me. If you want to read more about this subject, housing in the US, this is an awesome middle of the road view: Real House Prices and Price-to-Rent Ratio.

I am not going to let ABSA off so lightly, I had a great interaction with a client and friend, in which the conclusion was that Barclays extraction of cash has been a little reckless to say the least. I know that Barclays have been demanding their pound of flesh. That always sounds icky, pound of flesh. This friend of mine suggested that one of the top analysts that he had chatted to said that Barclays are squarely to blame for this, as ABSA have been carrying the lowest provisions of their peer group, particularly so for the last three years. So I guess you normally get what should come to you for poor business decisions, and in this case the Barclays stake is worth over eight percent less than at the beginning of trade when we opened up yesterday.

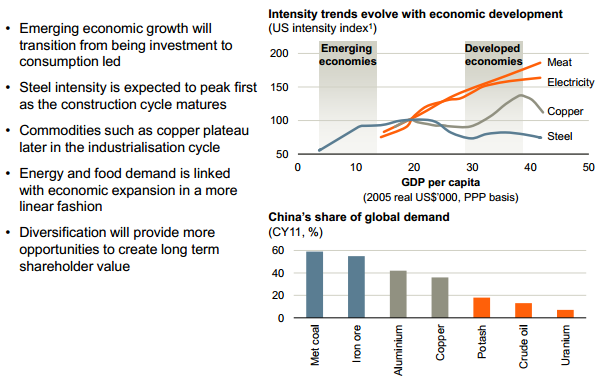

BHP Billiton has released a presentation about their base metals business this morning, it always makes for interesting "looking" and reading -> Building momentum in Base Metals. There are always a couple of slides that catch your attention, this one in particular is a goodie, what it shows is resource usage in countries as their GDP per capita rises and they head towards developed country status. The slide is titled: Demand evolves with economic development

The point that the base metals division is trying to make is that they are more likely to be in the sweet spot later, with oil, uranium and in particular potash going to be more important as China evolves towards developed status. The example often used is close neighbour South Korea, who transitioned from developing to developed status over the last 60 years. I was interested in their copper assets part of their presentation, but it is nothing new. What I was particularly interested towards the end of the presentation was the Chile slide about costs and labour. Sounds very familiar, check out the key points on labour:

-

"Availability of qualified labour for both operations and projects is a key challenge

Productivity is lower in Chile compared to other mining jurisdictions"

When BHP Billiton say other jurisdictions here, they are referring to their other base metals projects. But then they say something about costs, which makes you sit up and take notice:

-

"Increased mining and reconstruction activity has tightened the supply of key raw materials

Our competitive position on the cost curve is important in this environment"

So what that means is that if commodity prices stay here, then at least they have the best quality assets. But that is always what Marius Kloppers says in his Nataniel type voice, about the BHP Billiton assets being Tier one. I do a decent impersonation of Marius and perhaps Nataniel as well. Comfortable? Yes, we are using the lower prices to continue to add.

Righto, Naspers have reported their full year numbers for the full year to end March 2012 this morning. This business is essentially four parts, first the pay TV part, which is DSTv across the continent with the larger home base here. Then there is the internet segment which is the fastest growing and most misunderstood part, which consists of stakes in TenCent, Mail.ru and various e-commerce businesses that are the biggest revenue generators (for that segment). The print media might be a smaller contributor than the two mentioned above and is essentially the old part of their business. The split inside of this segment consist of Media24, Abril (their Brazilian print media business) and MIH Print, which I suspect includes Jonathan Ball Publishers and Paarl Media.

And then there is a smaller part of their business, the smallest, "technology", which is a business known as irdeto, which is headquartered in Amsterdam and Beijing and as per the Naspers website "is a global software security and media technology company trusted by the world's leading content owners and distributors and device manufacturers to enable new forms of broadcast, broadband and mobile entertainment."

Most of the highlights I am going to base on the presentation, which you can download here to have a look at the same material -> Naspers Financial results presentation. Revenue for the group for the full year increased by 19 percent to 39.5 billion Rand, driven by a 15 percent increase in the pay TV segment and a 59 percent jump in the internet businesses. Print media managed to grow overall revenues by 12 percent. Core HEPS (their key metric) increased 15 percent to 18.50 ZAR per share. The dividend jumped a healthy 24 percent, but is still only at 335 cents after this jump. Whilst this business is in ramp up mode, expect the dividend flow to be modest relative to the share price. EBITDA was down a disappointing 3 percent to 7 billion Rand, the biggest drop being in the SSA segment inside of pay TV, that was down 12 percent, currency related is my best guess, will get to that later. But the main reason given for the overall number being lower in the presentation was "impact of expensing growth initiatives". Consolidated development costs clocked 2.8 billion Rand in the 2012 financial year and that is comfortably ahead of the 1.5 billion Rand for the 2011 year.

Here is a rather "nice" graphic to visualise the opening two paragraphs, this is the segment that explains the e-commerce side of their business. Here goes, all the brands and names that you might or might not know:

And then there is the explanation of why EBIDTA was lower than the prior period, they expensed much higher development projects, associated with their e-commerce businesses, which you can see are plentiful. The last two half year periods, H1 2012 and H2 2012 were the highest development spend as percentage of spend in the last five years. Koos Bekker never sits still, but we like that about him.

The valuation part is always the trickiest part when trying to determine what Naspers should, and should not trade at. For instance, what would you pay for a pay TV business that is growing profits and revenues in the middle to low teens? 10 to 13 times earnings would be a fair value to apply to these assets, the pay TV segment generated 6.331 billion Rands worth of trading profits, so roughly you could say that this business is worth 70 billion Rands, and that is a conservative valuation. I never complain about my DSTv service, they are nothing short of brilliant. Their print business has margins below ten percent, but still managed to improve trading profits significantly, a 25 percent improvement on last year to 1.09 billion Rand. So what would you pay for that business? 7 to 10 billion Rands does not sound out of order at all. Those are two parts of the business that we know pretty well, so it is fair to say that we are currently at 80 billion Rands so far.

And then the part that always seems to deliver market participants and analysts alike with a Shane Warne flipper to Daryll Cullinan (two superb cricketers, one a genius, you pick) is how to value the internet assets. I suspect it is as easy as letting the respective markets determine the value and then take the value to Naspers. Both TenCent and Mail.ru have quoted prices and as such, this should be easy. First things, probably the biggest part, and the future (for now), TenCent. The stock is listed in Hong Kong, and trades under the pretty cool ticker 0700. In Hong Kong the tickers are all numbers, confusing I know. 0700 closed at 226 Hong Kong Dollars per share, valuing the whole company at 415.8 billion Hong Kong Dollars, according to Google Finance. One Hong Kong Dollar equals 1.086 Rand. So, on that currency conversion, TenCent has a market cap of 451.56 billion Rand. And Naspers own 34.26 percent of the business, according to the TenCent annual report from 2011. The exact number of shares is 630,240,380. And that then makes it easy to work out, with the exchange rate and TenCent price available, the stake is worth 154,683,677,906 Rands. Or just 154.7 billion Rands.

On our rolling additions so far we come to 234.7 billion Rand. Let us add in Mail.ru to this list. Naspers own 29 percent of this asset (through MIH), according to the mail.ru annual report for 2011. There was a swap of an asset remember for a bigger stake in this parent company. Although much smaller than TenCent, the company still has a market capitalisation of 4.911 billion pounds as per the London Stock Exchange -> MAIL.RU GROUP LIMITED. So, in Rands, at an exchange rate of 13.15 to the GBP, that is 64.58 billion. And 29 percent of that is 18.73 billion Rands. So, add them all up to that running total and you get roughly 253.5 billion Rands. The current market cap of Naspers is around 190 billion Rands.

But the question that many people ask, does TenCent deserve to be on a 33 times earnings multiple? And that is perhaps why the Naspers discount is applied, but basically these other businesses, including the exciting e-commerce business are the cream. But the business is not without its risks, they made some serious purchases last year for blue sky (260 million Dollars in total), but if you are going to back a team, they are great. And remember that sadly they lost a core member of the team over the weekend with the passing of Antonie Roux, that was a bit of a shock for everyone.

The outlook segment basically tells me that Naspers are going to carry on doing what they do. And just be Naspers, buying nerds businesses and flattering them with the price. And to keep rolling out the DSTv business across the continent and closer to home, that business is simply amazing. It is difficult to value, but we continue to believe that the market does not appreciate the company. I am not going to use the line that it should trade higher, the level today represents the balance of buyers and sellers. And the stock price is two percent plus higher on a day that the whole market is slightly lower. We continue to accumulate the stock at current levels.

Byron's beats is too kind to me, I don't like it, I love it!

- Following up on my piece yesterday, here is a perfect example of what I was talking about. Coca-Cola, one of our recommended stocks in New York announced a $5billion investment in India by 2020. Sasha, who is probably the most avid cricket fan I have ever met, made a good point. Pepsi sponsors all the big cricket events so you get the feeling that Pepsi is bigger than Coke in India. But let's be honest, everyone loves Coke. This is why the company wants to try and probably will "hook" the 1.2bn people who live in that country.

This WSJ article points out that Indians consume only 12 eight-ounce bottles of Coke per year whilst in Brazil they consume 240 on average. The average globally is 90 bottles so India is clearly coming off a very low base. The article which quotes Muhtar Kent, Coca-Cola's CEO also says that the company have only put $2bn into the country over the last 20 years. The lack of exposure to India stems from a choppy history where Coke actually had to leave the India all together in the 70's.

This is also a good vote of confidence for India who have faced a lot of scrutiny from the private world for certain policy decisions. At the same time PepsiCo have also been investing in the country. We often forget that India has 17% of the world's population and even though they are still growing between 5%-7% the potential there is phenomenal.

At this stage Indian GDP sits at $1.7 trillion which ranks alongside Canada, Spain, Russia and Australia. This puts them at 11th in the current world ranking tables. However on a per capita basis (PPP) they rank shockingly 129th with $3694 per person per year. That is well below us at $11000 and even countries like Namibia, Angola and Mongolia have higher GDP's per capita.

What I am trying to say here is that India is coming off an extremely low base, similar to Africa. That is why, when they reported 5.3% growth in the first 3 months of this year, the market was not impressed. But once the juggernaut starts rolling again like the Chinese did, we have massive growth to look forward to. The country fascinates me and I plan to visit it soon. Maybe I'll do a bit of a market research while I'm there and will certainly report back.

Currencies and commodities corner. Dr. Copper is trading lower (the price is at least) at 333 US cents per pound, the gold price is also lower at 1568 Dollars per fine ounce. The platinum price is lower at 1406 Dollars per fine ounce. The oil price is last at 79.07 Dollars per barrel. The Rand is strangely firmer to the US Dollar, 8.38 currently, 13.10 to the Pound Sterling and 10.51 to the Euro at last check. Mr. Market is in risk off mode. There are various developments in Europe that need to be watched, including the various bond auctions. But for the moment Angela Merkel has said no to Euro bonds as long as she lives, perhaps she means politically. Crouch, pause, touch and engage and all that, OK?

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment