To market, to market to buy a fat pig. With markets closed in New York and London, we were left to our own devices. Resources stocks rocked, mostly led by the diversified majors, Anglo American and BHP Billiton. But, industrials and financials also had a decent showing, the Rand continued to slide, that is not good for everyone. However, for the exporters and the Rand hedges, it is all good. For imported inflation, well it is not. And I guess that was and is the conundrum that is facing the SARB and the MPC, having to juggle imported inflationary concerns. And the other issue is that mineral exports are lower as a result of lower prices for one, and demand being lower too. Although, as we pointed out yesterday, green shoots seem to be emerging in Europe. So Europe is not finished. And you are starting to see more and more stories like this: Optimism returns as Greece sees light at the end of tunnel. What? So you mean no more Greek exit.

What about all those trolls that were 100 percent certain that this was going to happen? The Eurozone was going to fall apart in weeks/months and in same case hours. What about the spreads and the Credit default swap rates that anxious folks continually bombarded us with hourly. Default this and that, finished this and that, over and over again. And some platforms which attract an enormous following and have nothing positive EVER to say. EVER! Zero Hedge is always in the business of fear mongering. I saw a post quoting Dave Rosenberg in June 2009 saying that the Era Of Green Shoots Over. The unrelenting publishing of bearish (and very real) news over and over again can suck one into believing that there is an imminent collapse at any time. Calling markets lower. And seemingly the folks there are bullet proof. I guess we are no different, we are just the flip side of that agenda.

OK, that is interesting. The story that was doing the rounds yesterday, that the central bank locally is happy that unsecured lending is slowing in South Africa, is pleasing at some levels. Bloomberg ran a short piece yesterday: South Africa Banks Slow Unsecured Loan Growth After Intervention. The trajectory has slowed from 30 percent per annum to 25 percent per annum. But a cut away at the same time from a Reuters story at Engineering News to one of the Deputy Reserve Bank governors, Lesetja Kganyago suggesting that unsecured lending in South Africa is too small to pose a risk to the banking sector.

He (Kganyago) quantified that, as you can read in the story, SA not at risk from unsecured credit - Kganyago, by saying that unsecured loans totalled 453 billion Rands by March 2013, out of a total bank assets of 3.6 trillion ZAR in South Africa. Or, 12.5 percent of all bank assets are unsecured loans. Now, if ABIL have a book of close to 51 billion Rands, and Capitec have a book of nearly 28 billion Rands, that means the rest of the banking institutions amongst them have outstanding loan books collectively of 374 billion Rands. Unsecured sports lovers. Now of course, in the case of ABIL and Capitec, this is almost entirely their whole business. But for the big banks to muscle their way in to what is a lucrative business, they have all the channels, they know all their clients well.

You might recall in the Standard Bank results in March, that they had the following to say: "The impairment charge in personal unsecured lending (excluding card) increased to R2,3 billion (2011: R1,3 billion). This was a result of the increased incidence of default in the R3,7 billion domestic personal term loans book (loans to lower-income customers known as the inclusive banking book) and strong growth in the middle market segment in South Africa and workplace banking in the rest of Africa."

FNB suggested that their unsecured credit book grew by 27 percent, back when they released their results in March. It seems more "in control" over at FNB, or at least that is what I could read at the time. ABSA, well, they were under pressure, but it seemed that nobody was on the blower as much as in the other places. This is very lucrative money for banks, the business of making money by lending it to people, that is great business, provided you are able to manage "things" through the cycles.

Paul wrote a simple email to a concerned client last evening:

"African Bank has had a bad year, and an even worse last few weeks.

Their real problem is that the big four banks are also issuing lots of unsecured credit, which is making the space more competitive. Also, the furniture sector is looking bleak, which hampers the Ellerines results.

Did you see Byron's excellent review of the credit markets, a few days ago in the daily report? Here it is:

Chances are that they will bounce back when public sector wage increases are negotiated or social grants are increased, or the economy picks up a bit.

We are keeping a close eye on it. Our normal inclination is to ride out the short-term ups and downs, but we will let you know if we change our minds!"

So what is the conclusion? Well, whilst the regulator and the central bank is clearly worried with the way that the unsecured market has boomed in South Africa, it is perhaps too far from what could be a bubble. And from time to time, these businesses go through tough times. But hold the line.

Byron beats the streets

Yesterday I went to the Famous Brands results presentation for the full year ending 28 February 2013. It's hard not to be impressed with a business that has managed to grow earnings on an average annual basis of 21% over the last five years. Of course the share price has followed suit, now trading at R94, up 482% from the R16 it was trading at 5 years ago.

Let's see how they went over the last financial year. Revenues grew 17% to R2.5bn which resulted in headline earnings per share growth of 22%. This equated to 339c, of that 250c will be paid out to shareholders as a dividend. As mentioned above, the stock trades at R94 which puts it on a historic PE of 28 and a dividend yield of 2.7%. Now there is no doubt this is a good business, but is it a good investment at these levels? Let's delve deeper.

For the year they opened up 140 new stores and revamped 136. According to CEO Kevin Hedderwick this was slower than normal because of a slowdown from their petrol depot clients. They look to open well north of 200 this year. These stores took the overall network to 2163 restaurants, 1881 in South Africa, 172 in the rest of Africa and 110 in the UK (these are all Wimpy's).

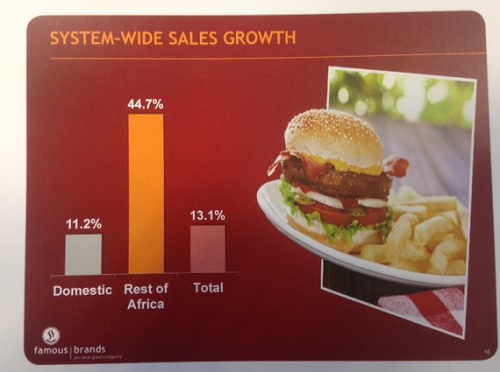

The sales growth is interesting, as you can see from the table below the rest of Africa is flying and now compromises around 7% of overall sales. A lot of this growth is attributable to new stores but even same store sales were up 28.3% in the respective areas. Local same store sales were up 7.7%.

That looks at the front end side of the business but what is so exciting about this model is that these stores are all locked in clients to their logistics and manufacturing business. This business has taken huge advantage of the economies of scope strategy. Basically they are trying to buy or replace any outsourced service which they can do themselves. Why pay an external supplier when you can buy the Coega Dairy factory and supply cheese to all your franchises yourself?

Another good example of a benefit of economies of scope happened within the Steers franchise. People were complaining that the burgers were too expensive. So instead of margin compression for the Steers franchisees, they supplied the meat at a cheaper price which allowed Steers to become more competitive. Yes margins in the meat manufacturing division came down but the growth in sales as a result more than made up for it.

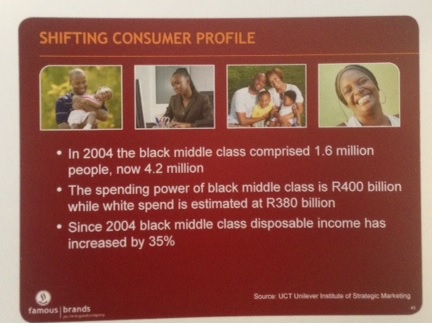

What does the future look like? Here are some interesting stats from the presentation which explains a lot for all retail in South Africa. As you can see from the image below, things have been getting better for a lot of people and I expect this to continue.

That is just locally, the prospects for the rest of Africa are huge. Kevin Hedderwick mentioned that he is in regular contact with Whitey Basson and they plan on following Shoprite into the shopping centres being built in places such as Lagos. The base in these places is so low and the choice of restaurants is extremely limited.

Having been to the presentation and seen what they are up to behind the scenes I think the potential for this company is still in its infancy. It is competitive out there but these guys have the infrastructure and experience to dominate. They have low debt and are extremely cash generative, I am happy to buy at these levels.

Crow's nest. Markets are going up today, across the globe. Anxious about Japan? Maybe, but as someone on the Twitter thingie pointed out, Japanese stocks as an investment over 23 years have been shocking. Exactly. And talking about shocking, our local GDP read was more than a little awful and a shock to the system.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment