To market, to market to buy a fat pig. Some back to earth reality dished out by Mr. Market, there certainly was nobody asking for more when closing time came around. Unless you are a bruised bear that has been beating on a tired old drum for a while, there was a little respite for you on the day, if not too much over the last 12 months. No respite or quarter was given to MMI Holdings, the company slumping 9 and a bit percent and by my measurement falling out of the top 40 companies by market capitalisation. Early days here, perhaps we shouldn't jump the gun. Why did the company fall so much? Well, they warned, on the state of the consumer actually, in their nine month trading update: "Pressure on disposable income is increasing and the market remains highly competitive.". And their new business written, well, that was actually lower. I guess that indicates that either they are losing market share or margins are being put under pressure because the South African environment is becoming more competitive.

The company does point to that, as you see above. And if that was not enough, the fellows over at Santam, were also under pressure as a result of a high claims period, Limpopo floods, fire claims in their commercial businesses, hail damage to crops in the Eastern Cape, drought insurance claims in the Western and Central regions of the country, not good. However, as they point out in the AGM operational update, MiWay and Santam Re are still delivering good results. Santam said that "Gross written premium growth" were "satisfactory considering continued low industry growth." The company also announced that they had sold 500 million ZAR worth of equities and that they had taken out downside protection on a further 2 billion Rands to date.

Now, in the Santam annual report, the company said that they had "assets totaling almost R20 billion". So, that sounds like they are hedging at these levels, for roughly ten percent of assets. And plus, they have sold into a rising market. Are they too cautious? Not sure, time will tell. The stock (-2.1 percent) sank with the rest of the sector, but not much more than the rest of the market, which was down 1.76 percent.

So, in a sense, fewer problems seemingly than MMI, but that is not fair. Including the big drop yesterday by MMI, the stock is up 43 percent plus over 12 months. Santam is up only 11 percent in that time. Discovery is up a whopping 61 percent over the same 12 months, Sanlam is up 42 and a half percent. The ALSI is up 23.3 percent over the same time. To be fair, Santam do not operate in the life business, and as such have not seen the same returns as the others, hence the underperformance. Over ten years however, Santam has crushed the index. And still, South Africans are underinsured. So whilst I suspect there is caution currently, insurance is a good business when well managed.

As ever, we appreciate your feedback. In response to the Famous Brands piece from yesterday in which Byron did a fabulous write up, in case you missed it, here it is: Famous Brands results are great. Sorry, that lame heading was mine, not enough coffee! Well, here is a great piece sent to us from a friend of Vestact!

- "Interesting. After all costs and taxes Famous Brands seems to earn nett R150,000 per store; Wendy's $9,600; Burger King $18,000; Yum Brands (KFC, Pizza Hut & Taco Bell) $43,000; Tim Horton's $94,500; and McDonald's $158,000.

So McDonald's ultra efficient, Tim Horton's is probably the stock with the best growth potential on the TSX, YUM is big in China where it is not all plain sailing, and Burger King and Wendy's probably both have good recovery potential, both having emerged recently from major surgery and reconfigurations.

But profitability all over the place - quite an unusual scenario for an industry.

Subway with its 35,000+ outlets is still private (Fred de Luca and his medical doctor partner - so holding company Doctor's Associates) so no figures available. Let me guess $25,000 per outlet to give annual profits of $875m.; Wendy's $63m; Burger King $235m; Tim Horton's $403m; Yum $1,54bn and McDonald's $5.5bn.

And Famous Brands R332m from R11m just 11 years ago. Compound nett profit growth per annum of 36% compared to McDonald's 13% and Spur also 13%. Quite an achievement."

Byron answered the piece almost straight away, with a great set of observations about the market in general:

- "I have 2 interesting observations here.

The first one is first world, my friend went to Paris in December. He said that the entire front end of the McDonalds was mechanised. You basically placed your order and paid at what looked like a big ATM machine. I think this is a thing for the future, not good for employment however.

The second is third world. I heard the MD of Yum! Brands Africa on the radio the other day. He said that the KFC in Lagos had already hosted a few weddings! It is such an aspirational privilege to eat out and there is a huge lack of choice in many developing countries. What we consider a normal way of life is another man's aspiration."

Thanks everybody. Comments like these make it easier to understand the businesses that we are buying, what is fast food and convenience for one person is luxury for another, I think that we can be in agreement on that!

Byron beats the streets on Tiger Brands today. The company that was founded seemingly in 1896, well according to their website anyhow. Tiger Oats, the company that renamed to Tiger Brands in the year 2000. Fifteen years ago the share price low was 21.13 ZAR. Before you say, well, it is not even 300 now, remember that the company unbundled Astral in April 2001, Spar in August 2004 and Adcock Ingram in late August 2008. If you had continue to hold those, notwithstanding recent underperformance by Astral and Adcock, you would have done fabulously well. For the record, you got 1 Spar and 1 Adcock for every 1 Tiger you held, and 0.25 shares of Astral for every 1 Tiger Brands shares. The collective value of those companies is close to 500 bucks, 495.6 ZAR as of this morning.

And add in the dividend flow over the last 15 years from those four stocks, you get a far bigger number. I did the math. It was not as easy as I thought, but eventually I came out with a number of 118.5125 ZAR for all your collective shares. If you had gone to sleep in 1998 with 4 Tiger shares worth 20 odd Rands apiece, you could have returned today to see your value worth nearly 500 ZAR and be owning 4 Adcock shares, 4 Tiger shares, 4 Spar shares and 1 Astral share, plus nearly 119 Rands worth of dividends. That I guess would have earned some interest. What a great return! And now for the results, thanks Byron!

-

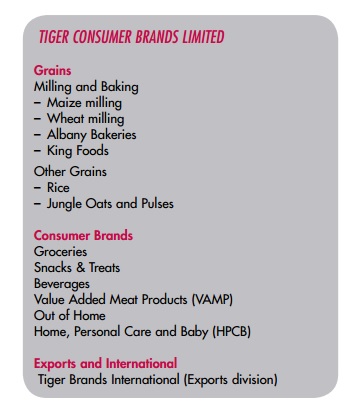

This morning we received results for the 6 months ended 31 March 2013 from Tiger Brands which looked slow as was expected. Before we delve into the numbers lets remind ourselves what these guys do and where they make their money.

As you can see from the image above which I hacked from their latest annual report, the company is split up into three divisions. Amongst the consumer brands includes Purity, Energade, Oros, All Gold, Black Cat, Koo, Crosse & Blackwell, Fatti's & Moni's, Doom, Peaceful Sleep, Kair, Ingram's, Beacon, Jungle and Maynards to name just a few. I am sure you have heard of a few of those.

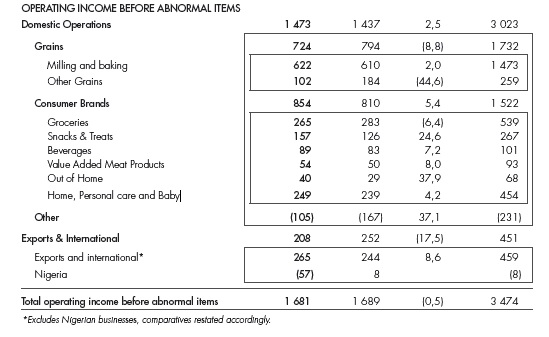

So where do they make the money? Below I cropped the segmental operating income from the latest numbers. As you can see, grains contribute nearly 40% of profits, consumer brands close to half and exports the rest. The exports business is basically their African growth story. Nigeria includes the recent acquisition of the Dangote Flour Mill, we will cover that later.

The Numbers. Headline earnings per share grew 4% to 818c, if you exclude the dilution from the Dangote acquisition earnings were up 14% to 897c. We have to include the dilution in our analysis however because we will happily include the growth in earnings when those start coming through. Group turnover increased 7% if you exclude the Dangote addition. The stock trades at R290 or 15.9 times consensus earnings of 1820c for the full year. I wouldn't be surprised if that comes down due to the dilution.

The grains division grew 6.7% but operating income decreased due to price differentials arising in the rice market. The company has embarked on many capital projects so far this year in order to grow this division.

Consumer brands turnover was flat due to raw material cost pressures which increased prices and decreased volumes. As you know the consumer is under pressure and these price increases are taking its toll. Again a lot of capital projects are being embarked on in this division in order to improve manufacturing efficiencies. The Mrs Balls acquisition was also completed in the period.

Exports grew 13% and operating income grew 9%. This is where the excitement is coming from. The Dangote acquisition in Nigeria is only expected to start contributing after two to three years. There is a lot of work to be done there but you can see why milling and processing grains in a poor country with 162 million people sounds attractive. As long term investors we are more than happy to wait for this to bear fruit.

Yes the numbers are not exciting but the South African economy is slow at the moment. I do not believe this will be forever. On top of that they have strong relations with businesses such as Shoprite and Massmart who are planning on massive expansions into Africa. They will bring Tiger products with them without Tiger having to worry about building shopping centres and other infrastructure. We are very happy to buy into the biggest food producer on this hungry continent of ours.

Home again, home again, jiggety-jog. Another savage Japanese sell off hasn't really rattled the market here, Europe seems just fine too. Perhaps the Buffett buying is boosting sentiment a little. The president gave a speech, not really that inspiring and is now off to Japan. Sayonara Zuma-san.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment