To market, to market to buy a fat pig. Markets in Jozi opened higher and pretty much stayed there all day, all the way through to the close. Resources boosted stocks, better US employment data still trumped a weaker sub set of Chinese data, and a marginally improving (but still weak) European set of data. Just this morning the Aussies have decided to cut rates, the expectations from the economist community were split on the matter, most siding with a no change for now. So it does come as a little surprise, but we have seen some weaker Aussie data over the last little while. Not too dissimilar to disappointing data from everywhere, really. Markets, well, they cared less for the disappointing data from China and Europe (and indeed locally) and cared more about the jobs data from the US. Local markets rallied 0.6 percent to 39 829. US markets were mixed, the Dow was a fraction lower, whilst the S&P 500 rallied again, and the NASDAQ was buoyed by a strong performance from Apple, that stock up nearly two and a half percent. Barclays raised their price target. Wow, that is amazing against the backdrop of a whole host of price targets being lowered recently.

Another strange (I thought) piece of news was the French Finance Minister declaring that austerity is (sort of) over. That is it, he said. Bill McBride has an interesting piece: The End of Austerity in Europe? The poor Reinhardt and Rogoff theories and calculations are getting rubbished just because a few economics students had some question marks about their spreadsheets. I suspect that Germany will just "give a little more" rather than a full austerity out the window. AND, in a sign that the bottom is close, this WSJ was welcomed: Spanish Jobless Claims Dwindle. Markets were closed in both Tokyo and London yesterday, those have to be in catch up mode today.

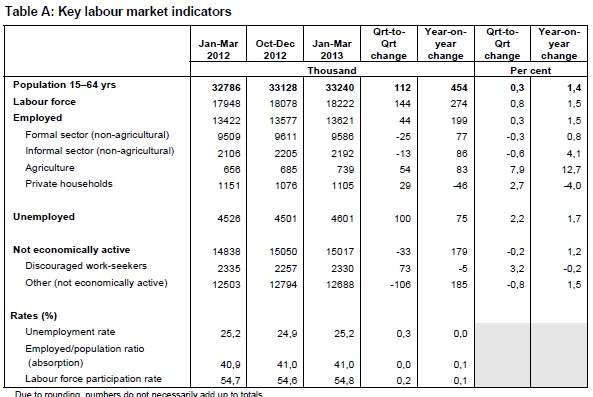

Talking of the trend of disappointing data, the local employment data was really grubby. The StatsSA release at 11:30 in the morning, the Quarterly Labour Force Survey, was met with a great collective sigh. We are all in agreement that something needs to be done to restructure our economy, the liberal types will say that labour laws and regulations must be greatly relaxed, whilst those in a position of power as well as their allies have been pushing for a more radical government involvement in the economy. Very little will be given on either side seemingly. Here is a simple table that tells a pretty sorry story:

We have a population of around 50 million, right? Around 17 million of those folks are younger than 15 or older than 64, most younger than 15. I would say, that judging from the population pyramids that I have seen, 3 odd million are older than 64. So, we have over the next decade and a half, around 14 million people entering the workforce. And because we are a young population, most people will all be jostling for jobs at the same time. 70 percent of unemployed people are "the youth".

There are 100 thousand more unemployed people than there were in the prior quarter, perhaps the school leavers impact, but the truth is that jobs have been shed in the formal sector. There are 144 thousand more people in the labour force, from the December quarter, that is enough to almost fill both the FNB Stadium (err... National Stadium, Soccer City) and Ellis Park. Those are the number of new people that entered the workforce during a three month period. Did you know that Ellis Park staged 6 cricket test matches and did you know that the first Wanderers cricket club was at Park Station. Wanderers Street is still around there, running next to Park Station.

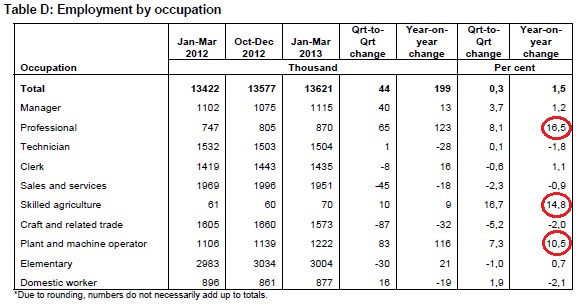

There is some insight into where the jobs are actually being created, check out this table:

What is absolutely astonishing is that the jobs that ARE being added are skilled jobs and the people that are operating machines. So, I can tell you from this table what business have been doing, they have been mechanising for one, and then hiring people with more than above average skills. I would even go so far as to suggest that the "one percent" in a South African sense continues to benefit from a dearth of skills here locally. The short answer is to make sure that the education system does all the hard yards. The education system can change everything. There needs to be political will however. The thing is, the right and left of centre are pretty far apart around here!

CNBC carried an exclusive with Warren Buffett and Bill Gates yesterday, anchored by Becky Quick on all sorts of topics. Gates is a board member of Berkshire remember, and to have both of them in one place being interviewed at the same time was pretty cool. What is amazing is that even Buffett does not say anything particularly insightful, if he says something that others say, it carries greater weight. When asked by Becky about the markets going higher on a daily basis, whether that makes him anxious, this was his simple answer. He remembered it crossing 100, 1000 but it will be higher in his lifetime and also in Becky's. So I guess the key, as ever, is patience. And owning the right businesses. But when he (Buffett) says it, people nod their heads. I call it the Buffett comfy blanket effect.

Shorts. Digest these tasty morsels.

I think that this single event is huge. I am not one to watch foreign relations closely, but this specific one caught my eye: Chinese President makes four-point proposal for settlement of Palestinian question. The fact that the Chinese are negotiating in what must be the most difficult beat diplomatically indicates that Xi Jinping thinks that they are "ready". They might be a member of the Security Council, they might be the go to people on North Korean tensions, but this is very different. This is a political hotbed. And it reflects that the Chinese are heading towards being the global power brokers. With economic influence comes great political influence. This link comes via a fantastic daily email, which you should sign up for (yes, more reading): The Sinocism China Newsletter.

This also really captured my attention, the post is short, but a picture tells a thousand words. I found this fellow, via another fellow, but this is an economics PhD student at UC Berkley who has a post titled Corporate Profits as a Share of GDP. He mean US corporate profits, but he lives there, so that is OK. Here is the chart, it needs no explanation:

And if you needed an explanation why markets were higher, this is as good as any. The jobs picture might look iffy, but the corporate profitability picture most certainly does not.

Crow's nest. I have seen an encouraging sign that European financials (the majors) are starting to beat expectations that have been lowered over the last little while. We are a little lower here today. But have been higher. Hey, Buffett reckons that stocks are good and bonds are bad, in general. So when is that great rotation going to happen then? How long will it last, or will that be determined by interest rate levels? Mario Draghi is lining up another potential rate cut (one last week), perhaps the deposit rate could even go to zip, zero, that is what some are suggesting. And, more importantly, in an attempt to spur lending by big banks, the ECB could be ready to stand for a negative deposit rate. We wait and watch.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment