To market, to market to buy a fat pig. Wow. The Fed statements and testimony in where Bernanke and his fellow FOMC members have indicated that the "punch bowl" is going to be taken away soon. Or at least that is how the market sees it. Now that term "punch bowl" was coined (as far as my reading tells me) by the longest serving Fed chairman, William McChesney Martin. Now before you shout, it was Alan Greenspan, Martin beats him by a whisker. Martin was in the position so long that he served under five US presidents, Truman, Eisenhower, JFK, Johnson and Nixon. Martin was the guy who when asked what the job of the Fed is answered simply: "to take away the punch bowl just as the party gets going...." It is an art, like leaving a function just before the youngsters tie their ties around their heads and the table dancing begins. Recognising when that is going to happen is when the Fed must withdraw the punch bowl. You don't have to tell everyone to go home, but you can prevent the inevitable chaos by withdrawing the jungle juice.

So that I guess was the biggest anxiety yesterday, concerns that the central bank stimulus is coming to an end. We were pleased here. We really were. Because the way that we see it here in this office is simple, if some of the finest minds believe that the US economy can stand on its two feet alone, that is as good a sign as anyone needs, right? But not everyone sees it that way. The Japanese market reaction was brutal, stocks there after the most incredible run over six months experienced a Genghis Khan raid of sorts. Heading for the hills, and leaving behind them an index that was down 7 percent and some more on the day. Just this morning here, the index has been 3.6 percent higher at the open and then three percent lower, before rebounding around another two percent from the lows. Volatile. Very volatile. Ha-ha, and the Japanese Finance minister, Taro Aso, said that it was natural for markets to go up and down. Insightful. But not really, thanks for that Mr. Aso.

An unbelievable story, of Taro Aso, he is related through marriage to the royal family, to prime ministers past and has seemingly overcome many hiccups. According to Wiki, whilst studying at Stanford his parents cut off funding, because he was becoming too American (I thought that was the job of the Disney channel), so he returned home on a boat. He then managed to get into the London School of Economics and finished there. He worked for a diamond miner in Sierra Leone before the civil war pushed him out. Fear not, the next adventure sent Aso to Brazil, where he learnt to speak Portuguese fluently. And if that is/was not enough adventure, he went to the Olympics in 1976, not as a spectator, but rather as a member of the Japanese shooting team. Not that it should matter too much, but he is a Roman Catholic, a tiny minority (1 percent) of the overall population. And there you thought Japanese folks were conservative. Anyhows, let us leave that for another day.

The upshot of the global where-am-I-going-to-get-my-punch-from-next realisation, was met with the usual reaction. Sell. Everything. And do it fast. We were no exception here, experiencing a 1000 points sell off in the local market. So, from record highs to a serious spot of turbulence. Across the board selling, resources particularly hard hit, as we mentioned yesterday, the weaker than anticipated Chinese PMI numbers did very little to encourage resource stocks buyers. Coupled with that came a whole host of broker downgrades for stocks in the resource space. And for what it is worth, Citigroup research suggests the end of the resources boom. Maybe. The same institution also said a few days ago that their base case for Greece leaving the Eurozone no longer has a date. Yes. We got some of our money from that. So thanks so much the guys at PIMCO, thanks so much Nouriel and all you other fear mongers, but it seems like the Euro zone is intact and working just fine. OK, let me retract the second part of that last sentence, but the truth is, all the predictions for a "disintegration within weeks" and "a total collapse imminent", well, that never transpired.

I am always amazed that we need some folks to tell us that "things" are better in order to proceed from a specific point. If Mario Draghi hadn't told us yesterday that the crisis in Europe, well, lawmakers and policy folks were on top of it. But the most important thing about the speech that Mario Draghi delivered yesterday in London, was to explain to both Europeans and English people that they are more tied than they think. Check it out: Building stability and sustained prosperity in Europe. "Around 40% of the deposits placed with euro area banks from outside the euro area come from the UK. At the same time, an equally large share, i.e. 40%, of all loans granted by euro area banks to non-euro area residents goes to UK borrowers."

Nice, so if banks stopped doing business there with each other it might take another 30 to 40 years before ties are severed. It is never going to happen. As Draghi said in his closing remarks: "Since then, even more political capital has been mobilised. The answer to the crisis has not been less Europe but more Europe." Non Europeans were telling Europe to solve their problems by being less connected, the answer was to get more integrated. Oh, and then I saw this port: The Eurozone's economy could surprise to the upside. Fancy that, green shoots in Europe. And just from last week: New Passenger Car Registrations. That is some of the best news that I have seen for a while, at least for the platinum price. Negotiations, wages? Who knows where to from here.

SABMiller served up their results yesterday, this for the full year to end 31 March 2013. And you thought that pouring a beer was easy, well it turns out that there is some sort of art to it, at least according to this from (the competitor) Stella Artois: The Stella Artois 9 Step Pouring Ritual. Huh? I suppose you could have a whole lot of froth, and that would be bad. Drink it out of the bottle, already in a glass I say.

So, what were the results like? I guess good, and ahead of market consensus as far as I could tell, it was difficult on a day where the market was getting toasted to tell. SABMiller are masters are cost containment, fixed costs per hectolitre in many of their territories were much lower than CPI. Locally, much below that, and even in soft drinks. Yes, SABMiller is one of the biggest bottlers of soft drinks globally. They stick to their knitting, when buying a local producer, they grow that brand. In fact they only have four beers that they refer to as their global brands, Pilsner Urquell, Grolsch, Miller and Peroni. You know those ones well, locally here in South Africa you know Castle, Castle light, Castle Milk Stout, Hansa Pilsner, as well as Redd's and Brutal Fruit. You are however less likely to know the local brands from the other places that they operate, Bluetongue (Australia), Laurentina (Mozambique, OK, you know that one), Timisoreana (Romania) and Balboa (Panama), perhaps that one leaves you feeling like you went five rounds with Rocky. Keep the local brands, and grow those aggressively. 200 plus beer brands might seem like too many, but it has worked really well.

SABMiller group revenue increased by 9.9 percent to 34.487 billion Dollars, EBITA increased by 14 percent to 6.421 billion Dollars with margins increasing too, all pleasing numbers. Adjusted EBITDA margins rose to 24.1 percent. Gearing has been reduced sharply to 57.2 percent from 68.6 percent last year, holy smokes, that is pretty impressive. Total volumes, those are fairly important, they clocked 300 million hector litres for the first time, 306 to be exact. Of which 242 million was Lager, 57 million was soft drinks and the balance, 7 million hectolitres was categorized as "other alcoholic beverages".

All that translated to earnings per share numbers of 238.7 US cents, 151.1 pence and 2031.3 ZAR cents. The dividend declared for the second half of the year was 77 US cents, bringing the full year payout to 101 cents. Which at current exchange rates is around 67 pence a share (FY) and 964 ZAR cents (FY). For the purposes of simple valuations we will look at the UK market, which attracts the most volumes. The stock trades more or less at 3416 pence. The stock trades on a 22.6 multiple with a dividend yield of 1.9 percent. Sound attractive at these levels? I hear you say no. But here is the deal. There are very few, if any companies that operate on all the continents, are listed in one of the few financial centres in our time zone, but more importantly are at a ground level in terms of Latin America and Africa. And also in China and India.

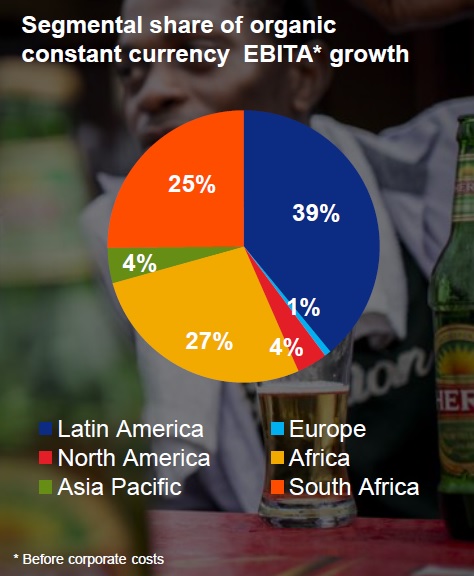

So, whilst the stock looks expensive to many, it operates in the growth territories that everyone wants to be in. And this little pie chart, you can see that clearly. This is EBIDTA growth contribution. You can see who is responsible for growing earnings, South Africa, the rest of the continent and Latin America.

And that is why I think that folks pay a premium, for the specific growth territories. The actual contributions to EBITA are Latin America 32 percent, South Africa (beverages) 17 percent, Rest of Africa at 12 percent, North America and Europe at 12 percent each too and 13 percent from Asia Pacific. So, essentially nearly three quarters of profits come from emerging markets. Premium beer, premium stock. I shall leave you with one single reason why I think the premium exists. Their Chinese equity accounted share of volumes is 53.750 million hectolitres, and was 6 percent higher than last year. Their second biggest market is here, inside of our borders, 27.28 million hectolitres. The Chinese market is almost double the local market, in terms of volumes, but astonishingly a whole lot less profitable. The market is probably waiting for that to change.

What are the risks? Increased regulatory pressures have to come, these are soft targets for government revenues that are under pressure. And social programs that continue to expand, even our local minister does not want advertising from these types of businesses. Healthcare over beer, I can see where the minister is going with this. Also, volumes are not growing at the pace that justifies the multiple and again, there is only so much cost cutting you can do. Having said all that, the company has positioned themselves to capture the next growth continent, our own.

Byron beats the streets

On Wednesday we received a very informative and encouraging sales update from Massmart. Not because the numbers were good but because it gave some clarity of how operations are going within the business. Let's look at the commentary, then the numbers.

The first part of the update explains to investors that the distraction of the Wal-Mart deal, along with Competition Commission enquiries, interrogations and community commitments, are now a thing of the past. It is now time to 100% focus on implementing their strategy. That's encouraging because although the Wal-Mart deal has been great for the business, the complications surrounding it have surely been distracting for management.

The next part tells us about a bit about what is being implemented.

"We have conducted a thorough review of the business. This has resulted in management changes and redoubled focus on underperforming parts of the business on strategic and operating disciplines, including considering closing or selling underperforming stores."

The next part talks about the massive restructuring of their supply chain which has been completed. I have spoken about this before, the business is investing heavily and gearing themselves up to supply a continent with goods. This may be sacrificing current profits but the future looks bright. And along with the supply chain investments comes new stores.

"We remain focused on store growth in South Africa and sub-Saharan Africa. New store openings have included opening a Makro in Alberton, Builders Warehouse in George, Saverite in Xai Xai, Mozambique, one Cambridge and two Game stores, and the commissioning of our Massbuild national DC in Midrand, Johannesburg. Over the remainder of the financial year to December, we will open 27 stores, including a Makro in Amanzimtoti, Durban, and a Builders Warehouse store in each of Botswana and Mozambique.

The increase in trading space compared to a year ago is 9%.

We have completed the acquisition of seven Makro properties that were previously lease-held and secured a loan from Walmart to fund this purchase."

This makes me excited for what's to come.

Before we look at the numbers here is a reminder of their divisional breakdown (I'm putting this in because I needed a refresher myself).

The numbers looked in line. Total and comparable sales growths in each division 17.0%, 7.4% (2.8% inflation) in Masswarehouse; 5.6%, 4.5% (5.0% inflation) in Masscash; 10.0%, 4.5% (0.7% inflation) in Massdiscounters; and 7.6%, 7.5% (2.9% inflation) in Massbuild.

The big Masswarehouse growth is on the back of new Makro stores.

I am encouraged by this update as it reinstates what we have been saying about this company all along. Be patient because behind the seens the hard yards are being covered.

Crow's nest. We are flat here to start with, some German confidence numbers were better than anticipated. Later we have US durable goods numbers. Methinks depending on how those turn out, that could change the makeup of the day here.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment