To market, to market to buy a fat pig. Holy smokes. Records here there and everywhere. Well, not quite, but nearly. The local equities market zoned in on 42 thousand points, finishing a mere 29 points away from that mark for the first time. The main reasons were twofold, one, a movement higher in commodity prices which were spurred on by better economic data out of the US (and Europe), and two, worse than anticipated data out locally led to a slide in the Rand to the US Dollar to the worst level in four and some change years.

That is good for the equities that are listed abroad and priced in ZAR, but not so great for the local economy. Imported inflation is creeping in here locally. We will discuss all of that data today, we will look at Nampak, which disappointed the market and we will look at the commentary from the MTN AGM, Byron will look at those. There was also some really useful feedback on Famous Brands, we will publish that too. Some good stuff, some bad stuff, and some real, real ugly stuff emerging yesterday.

But first, let us deal with the good stuff. The WSJ has the headline: Home Sales Power Optimism. And this is true, the more optimistic that there is a value underpin in the price of your property, the greater the chance of you spending or even renovating on that asset. Or acquiring that furniture, or a new wardrobe. That sort of thing. So I guess then it wasn't surprising that at the same time that The S&P/Case-Shiller Home Price index rose by 10.87 percent over 12 months that the consumer confidence number would also bash expectations.

What is important to note, from the 20 city download is that prices are nowhere near the highs of 2006, check it out when you download the .pdf via the above link. I had fiddled with a wonderful image, and then was reminded that it was a copyright piece. But the point I wanted to make was that the highs of 2006 were around 210 on the index. Years to go before that particular high is reached again, that is my sense. The other release that got everyone excited as well was this one: Conference Board Consumer Confidence Index. Now what I find quite funny though, that the base for the index, 100, was back in 1985. What? Does that mean that confidence has trended lower since then? What happened back in 1985 that it is better in 2013?

In 1985 Reagan was sworn in for a second term, the song "we are the world" was recorded, the worlds first autofocus lens was released by Minolta (remember them?), Gorbachev became the leader of the USSR, South Africa ended their ban on interracial marriages (no really), we discovered that the ozone layer had a hole in it, president of South Africa at the time, P.W. Botha declared a state of emergency, Tertis was released and DNA was used in a criminal case for the first time. The world population was less than 5 billion back then. So, what was so great about 1985? I can't see it. Oh, and Justin Bieber would not be born for another 9 years, isn't that astonishing!

Well, this one from yesterday showed that US consumers confidence was at a five year high. Expectations for an improved labor market had risen too, those expecting the economy to improve were more, those expecting the economy to worsen were fewer. I am ordinarily wary of surveys, because one event can change everything, change the way that people react in the short term. But it meant record highs for the Dow Jones Industrial, and a strange metric that everyone seems to be keeping an eye on, the 20th consecutive Tuesday of gains for blue chips. That is weird. Why would you care which day stocks went up or down? Seemingly some people do care. They ("those" people you know) have also measured that the Dow Jones has not yet been down three days in a row, this year that is. So what? Do I care? Not really. What matters is what you own, not what the index does. Pfff...... Markets are indicated lower today after closing off the best levels for US stocks. Better luck next time.

Local GDP. What went wrong? Why was the miss much worse than consensus? Consensus, as far as I could understand was for quarter on quarter growth of somewhere in the region of 1.7 percent, yet the actual print was around 0.9 percent. Which isn't pedestrian. It is crawling. Well, the single biggest industry going backwards is the manufacturing sector. Too expensive. Fixed costs have risen at an alarming rate over the last four to five years and finally these are the consequences. The manufacturing industry, which used to be a massive contributor to the economy is only 12.6 percent now. I suppose that can be viewed two ways, first the contributors to overall GDP: "Finance, real estate and business services - 22,4 per cent", "General government services - 16,8 per cent" with "The wholesale, retail and motor trade and catering and accommodation industry - 16,0 per cent".

And then I guess a rewind to the past, when manufacturing was a far bigger contributor. But a fall of seven percent plus? Well, there were a few public holidays in the first quarter that normally fell into the second quarter, obviously losing some steam. Newsflash, I guess the weaker Rand does not help manufacturing minister Davies. Pfff... I guess the fact that the labour minister, Mildred Oliphant, who said yesterday that illegal strikes had cost the country 17,290,552 hours last year, that could be a factor of sorts. That is 720,439.66 days. Or 1973 years. That is quite a lot of time lost there! Most of that was in the mining and quarrying sector.

And what is the state response? Well, the Mines Minister tabled her budget speech yesterday, you can find it at the Department of Mineral Resources website. I was particularly struck with this one line, that seems to go around and around (a lot): "It is the truth that South Africa has the world's largest mineral endowment, with an estimated value of US $3.8 trillion dollars. These endowments, if properly exploited using the combination of appropriate policies and regulatory framework such as we have, we are more than capable of breaking the back of the triple evils of poverty, unemployment and inequality."

Meanwhile just this morning there is an announcement from Sibanye Gold, that they could cut 1100 jobs. So much for that. But if you read the speech further you will see that under the heading titled Shale gas, there is a little interesting paragraph: "We are engaging legal processes to finalise the establishment of a State Owned Mining Company." Do you know what that sounds like to me? It sounds like the state are saying, OK, there is this reserve under the Karoo that we are going to exploit, currently no private companies do this in South Africa, so let the state get rolling here. The worst possible idea if I think about it. Hopefully I am dead wrong. And the whole idea that a relationship with the Russians could lead to something great, I am not sure that the Russians have anything but their own agenda. Again, hopefully I am wrong with that!

GDP not good, Mines Minister incredibly upbeat against what is the backdrop of poor, poor news, seemingly. I hope she is right.

Results from Nampak yesterday that Mr. Market did not like at all. I am not too sure why there was such a large overreaction, but a miss of the markets estimates is often met with aggressive selling, IF of course the stock has been up sharply over the last twelve months. And all of those things happened yesterday. Nampak stock, before yesterday's open and the number release was at 37.30 ZAR per share. A year ago the stock was at 22.34 ZAR, so you can quite clearly see the absolutely fabulous return that shareholders have enjoyed. Yesterday the enjoyment was nowhere to be found. The stock fell hard, down 4.77 ZAR, or 12.79 percent to end at 32.53 ZAR. I guess you could still say that the 12 month return has been fabulous, but clearly more was expected on the earnings front.

And coupled with earnings not meeting expectations was perhaps the one announcement that shareholders did not want to hear at all, that the chief responsible for the turnaround, Andrew Marshall, was looking to end his short stint at Nampak. I suppose that he could say that it was job done, but still, shareholders would have wanted more of him, not less. The retirement date is set for March 2014, after which Marshall would have completed his five year contract with the company. The board appreciates the man for the work that he did: "The board wishes to thank Mr Marshall for his valuable contribution to the group. During his tenure the groups expansion into the rest of Africa was accelerated, under-performing businesses were closed or sold and profitability improved significantly." Spending more time with family and also time for new and fresh management, says Marshall. Well, good for him, and jolly well done!

The main anxiety was over margins, and I guess costs. Locally the business struggled with imports (cheaper) and lower demand, which we can see in some of the GDP numbers. Plus, big expansions in their glass and cans businesses saw them accepting lower prices for longer term contracts. I suppose that makes sense at some levels, lock in the customer for longer in order for less volatile sales numbers.

Essentially, as Marshall said in his interview on CNBC's closing bell with Samantha Loring: Nampak’s Interim Results with CEO, a short term knock for a 6 to 10 year lock in! That adjustment accounted for 150 basis points, whilst the weaker South African economy accounted for a 100 basis point reduction. So there you go, the margin decline essentially explained. Marshall says that by taking the knock now, and securing the longer term contracts with multi-nationals, investors should in essence be happy. Yes. I suspect that he is very right, these investments take a long time to bear fruit, these businesses are run for the longer term.

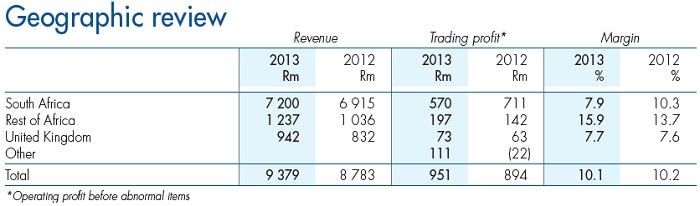

Check out the geographical split in the graphic below, taken from their report: Interim report and dividend declaration for the six months ended 31 March 2013. What is quite amazing is that the UK business, which essentially sells plastic bottles to the dairy industry in the UK, has similar margins to the local business. And that is where the disappointment came through, as Paul said, this sounds like the old Nampak, making excuses for the South African businesses. Check it out:

Nampak has traditionally always been a good measure of the South African economy. You could and can get a sense of what the local consumer is up to. It is interesting to note that in their cans business that people are eating more fish, but less fruit and vegetables. And the paint and aerosol cans business was a little lower in terms of volumes. Plastics, flat, lower drum sales, crate demand "moderate". We haven't run out of tissue paper, thanks to Nampak, remember the crazy story about Venezuela a few weeks back running out of the stuff.

The real growth however is going to come from the rest of our continent, where the margins are much higher, nearly double here locally, because there is of course a much higher barriers to entry in those places. The can factory in Angola is cooking, that was the example used. The African division grew profits 39 percent. That business, the rest of Africa portion, has quadrupled in five years. I am not suggesting that is going to continue. Not at all, but you can clearly see what is happening. But each country in Africa has a different set of businesses currently. Marshal said that the plan would be to replicate the model here in each territory. The major expansion territories will be Angola, Kenya and Nigeria for the time being, investing 175 million Dollars in the process. Those monies were actually raised in the US, and are 7 to 10 year dated, at what they call extremely competitive rates.

Best guess, trundle along here locally and grow rapidly through the rest of our continent in the coming years. It is not without execution risk however. And the stock hardly looks overwhelming cheap anymore, on a 15 multiple. Bidvest stepped away a long, long time ago, late 2008, before Andrew Marshall was there. However, with profit projections of 15 percent per annum, and a current yield of around 4 percent I would say that this is a steady eddy stock. One for those kind of portfolios that you can shelve the shareholding and wait.

Byron beats the streets

Yesterday we received a business update for the 4 months to 30 April 2013 from MTN. I am still constantly amazed by the subscriber growth of this business. Not because I think the numbers are not there but because off a constantly higher base the growth remains consistent. MTN are expecting to service 200 million people by the middle of the year. That is astounding.

The exact number for this period came in at 197.4 million, a 4% growth for the period. To put things into perspective, in the last report ended 31 March 2013, MTN had 195.4 million subscribers. That means they have added 2 million subscribers in a Month! By the end of 2004 the business had just short of 9 million subscribers. The power of compound growth, 4% does not seem like much but when you put things into perspective you look at it differently. And that was only ten years ago.

On the back of this subscriber growth revenues grew 5.6% year on year thanks to a good performance from MTN Nigeria. Of course the weaker rand has been beneficial for a business who report in Rands but get most of their income outside of the country. Rand reported revenues are up 15% year on year.

There have been a few issues in Nigeria with regards to the quality of their network. This is cleared up in the update.

"The main focus for the Nigerian operation is to improve network quality and capacity to enhance competitiveness and cater for higher usage. We have made good progress on our capital expenditure rollout programme and continue our constructive dialogue with the regulator, the Nigerian Communications Commission, regarding its recent determination that MTN Nigeria is a dominant operator in that country."

I guess with more control and power comes more responsibility. They also talk about South African operations which remain fairly muted as earnings marginally declined. If it weren't for good data and SMS growth this would be even worse. Fortunately this business has huge geographic diversification.

"The Group's operations in Iran, Ghana, Sudan and Uganda showed healthy growth in both revenue and subscriber for the period. Group data and SMS revenue continued to expand strongly in most markets, increasing its contribution to total group revenue to approximately 18%."

That last sentence is key. 18% is huge when you consider that data was barely mentioned a few years ago. And we expect this to only get bigger.

In a separate announcement the company announced that former CEO and the man who brought MTN to such great heights, Phuthuma Nhleko will be taking over as chairman from Cyril Ramaphosa. I take one positive and one negative from this turn of events. The positive is that over the years I am sure that Phuthuma has built quite a large share holding in MTN. This means that his interests are aligned with shareholders. The negative however is the temptation to take a more executive roll. It may be quite distracting for Sifiso Dabwengwa to have his former boss as chairman. Overall it is probably net neutral.

Crow's nest. Markets are much lower across the board here, searching for a reason is not hard. Markets were lower in the US when most of our time zone signed off, it was a matter of catch up in some senses. It seems like the currency is heading towards ten to the US Dollar, a level not seen since the financial crisis. And ironically the rest of the developing world is seemingly making progress. #Winning somewhere.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment