To market, to market to buy a fat pig. Those platinum stocks got hammered yesterday, the union turf wars at Lonmin impacting on the majors. And the aftermath of the Amplats restructuring plans which have seemed to please only the PR people, they are the ones getting paid to write the releases. Collectively the platinum stocks sank 4.85 percent to a seven odd year low. Sis. Amplats went below 300 ZAR, Implats sank below 100 ZAR a share. Equally the gold stocks this morning find themselves in a pickle.

The gold stocks as a collective are at a four odd year low, but apart from the 2008 swoon (when the world was ending), the index was last at these levels 8 odd years ago. In fact, my eldest daughter turns 8 this Friday, if I had bought her gold stocks on that day, we would be basically break even. Sis. Too many struggles with higher costs on the labour and power front, lower grades, falling production, it has looked a little sad out there. No, terrible. And on an inflation adjusted basis, I am pretty sure even worse. Prices in the last CPI data was rebased to 100 in December 2012. And I can't really find too much on the StatsSA website to get an inflation adjusted return. But I suspect it has been absolutely woeful.

I have access to ten and a half year history. Over that time the all share index has increased by nearly 330 percent, the gold index is down over 50 percent. The platinum index is up only 30 odd percent. These companies constitute a very important past and future for this country. But yet, GoldFields was trumpeting the importance of the fact last Friday that they only employed around 9000 folks. Just a few days ago we were talking about AngloGold Ashanti's (they should really change that name) mechanisation projects. No really. They were excited about the idea of mechanising their operations. And this must be worrying for labour, and NUM, as if the union does not have enough on their plate. But I guess there is a point where business says enough is enough. You will recall in the last labour report that mechanisation was already happening, because machine operators were being hired, skilled people were being hired, unskilled labour was NOT. Sad. True.

What did happen however is that David Tepper spoke, and when he does speak, people listen. He is one of those very few market commentators who have the ability to move the market. My favourite quote I emailed to my colleagues, it went like this: "guys that are short, better have a shovel to get themselves out of the grave." Phew, he is talking his book, the line that everyone is using is, "I'm definitely bullish", and that captured the broader market. Stocks rallied again, and new all time highs were reached, again! As Paul however said this morning, and I hadn't thought of it this way, if your investment thesis is to wait for someone else to come on TV and then say everything is OK, then perhaps you should try doing something else. There is so much noise to sift and filter through.

Byron beats the streets

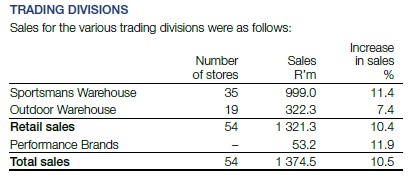

This morning we received full year results from one of our recommended retailers, Holdsport. For the year ending 28 February, the company managed to grow sales by 10.5% to R1.375bn which resulted in operating profits of R243 million. This was up 7.4% from last year and equated to headline earnings of 416c a share. Let's have a look at their sales mix.

As you can see from the table above, Sportsmans Warehouse compromises 73% of sales, Outdoor Warehouse 23% and Performance Brands 4%. In case you needed reminding, this from the website. "Performance Brands own and distribute brands that produce technical gear, designed to work when you need it most. Our brands include First Ascent, Capestorm and Nathan. Each brand is independently managed through the design, production and marketing stages, and then distributed through our Performance Brands platform."

Fundamentals. For the first half they only made 143c. That means that the second half was very good, nearly 100% more than the first with 273c. That is because it includes the festive period and as Sasha mentioned, summer, where people tend to get more active. The stock trades at R44 and a historic PE of 10.5. Sounds cheap. With a dividend before tax of 200c that is a very healthy yield of 4.5%.

The commentary was interesting. The weaker rand hampered margins somewhat. Product inflation was only 2.9%, this was probably kept in line by strong competition from the likes of Mr Price Sport. They also increased investment in working capital by 24.3% and this explains why sales growth outperformed earnings growth. Nothing wrong with that. The business is increasing its Sportmans trading space by expanding its Fourways store, relocating in Polokwane and adding new stores in Rustenburg and Bloemfontein. An Outdoor Warehouse was also added in Rustenburg while a JV was entered into with Redefine to develop a distribution centre in Cape Town.

They also mention that the base was high in 2011 because of a rugby world cup. This has a big impact on merchandise sales. There is nothing significant this year but next year we have a soccer world cup (hopefully Bafana qualify) and a rugby world cup the following year (hopefully the Bokke win) which should bode well for the future.

Prospects. You know my take on the growing awareness of an active lifestyle. And as our middle class grows these people will enter that realm where first world problems such as watching your calorie intake versus calories burnt, become important. This business is still small which means the room for growth is huge. Opening up Sportsmans stores in Rustenburg and the likes will help the business grow fast as they expand their footprint.

Because it is small opening up 1 or 2 stores can have a big impact on sales. We feel the demand for these kinds of stores is still huge around the country, especially in the smaller towns that are growing fast. Of course being small has its risks and the competition is rife. We continue to like and add to this stock.

Shorts. Digest these tasty morsels.

Byron loves to read the Buffett Berkshire annual letters. Really. Better than most text books he tells us, I have been reading them for a while, but not the much further back ones that Byron is talking about. That is why I wasn't too surprised to read blogs like these: 5 Lessons from Warren Buffett's Letters. The one about the oil prospector going to heaven and then to hell is rather amusing.

I was interested to see this BusinessInsider article, because there has been lots of evidence to suggest that shorter and sharper bursts are more productive than a long slog: One Chart That Will Absolutely Convince You To Get More Sleep. It turns out that being tired is not different to having the same sort of performance as someone who has had a few toots, a few too many actually. I remember my physics teacher who encouraged us to yawn in class, because it meant more oxygen to the brain. Perhaps the secret to a successful business is a whole lot more yawning. Or more sleep actually.

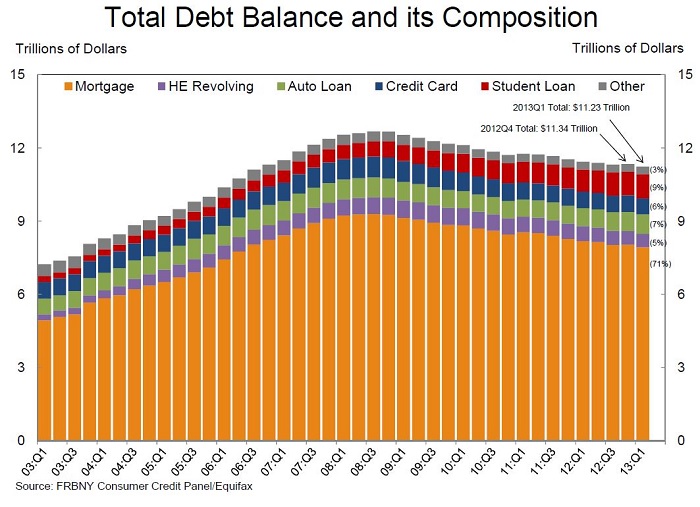

Via Bill McBride, on his Calculated Risk: NY Fed: Consumer Debt declines in Q1, Deleveraging Continues. This is amazing. A 1.45 trillion Dollar decrease in household indebtedness from Q3 2008. Wow. And that is what happens when people feel under pressure, they change their spending patterns. What also helps explain the student debt exploding is the simple fact that fewer jobs being available means those currently studying will extend their stay at university. Or go back. Or do more post graduate stuff, making sure that whilst times are poor, the prospect of getting employment after skilling up, get better. So, pile on the debt now, pay it off later. Hopefully.

Unsurprisingly mortgages are still the bulk of total consumer debt, 71 percent of the whole pot. Perhaps also the much lower household debt environment would have normally led to loads more refinancing, but the banks reigned in their lending practices too. Home ownership in the US is quite high, two thirds or so. In places like Slovenia and Spain, home ownership is exceptionally high. Germany is strangely, very, very low at around 40 percent. Why?

Wow. The WSJ headline says it all: Greece Gets Rating Recognition. And that part about rates having gone from 30 percent to 9 percent, over 12 months, that is in-between the ratings downgrade and the ratings upgrade. Bizarre. But that is probably another reason why one should do their own homework, rather than rely on the ratings agencies, who seem to put two slips and a gully in place after the ball has been nicked twenty times.

This is probably the worst egg on the face of the deficit hawks, and in particular the Ryan/Romney campaign, but too late to rubbish their detailed work. I am pretty sure that a lot of people are in favour of keeping a lid on entitlements. But, for better or worse: Federal deficit shrinks at surprising rate. On the other side of the US, the Washington Post had a similar story with nice graphs: CBO says deficit problem is solved for the next 10 years. See that. When an economic recovery takes place, tax receipts increase. I wonder what the highly volatile Rick Santelli thinks about all of this, perhaps Steve Liesman should have a quiet word, that would make for interesting television.

Crow's nest. Markets are trading close to the all time highs here locally, notwithstanding multi year lows from the precious metal producers. Industrials continue to drive this market up. European GDP reads were pretty poor, all missing expectations. Austerity sucks, and continues to suck some more. Perhaps the French were right.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment