"Think of the cloud as an offsite storage space. Provided that your internet connection is up to scratch and that you do not need to have to worry about capping your data usage, this is the future of storage and using services, not as much pressure is put on your hardware."

To market to market to buy a fat pig We were not saved by the bell on Friday. It would have been better if those kind fellows from Standard & Poor's ratings agency had delivered their verdict on Friday morning, rather than Friday evening. That way a whole lot of selling pressure would have been averted, the sell South African stocks button was pressed with great force. A lot of it may well have been local too, judging by the movement in the currency, or should I say lack thereof. So, in short, a lot of heavy selling pressures on Friday were attributable directly to local insurance taking and not wanting to be caught off-guard by a ratings decision.

Stocks as a collective sold off over a percent and one-third, financials and industrials both off around one and one half of a percent. There was little or no place really to hide, if you scanned across the indices from top to bottom, it was basically a couple of stock specific stories dragging their respective indices higher, and the gold stocks that motored ahead by nearly four percent on the day. What was pretty intriguing was that there was Invicta and CMH at 12 month highs. What is unusual about that, you say? Equally, in recent days, Barloworld has also been hitting 12 month highs. So? Well, if you look a little closer at what these respective companies do (i.e. what is their line of business), then you may be a little confused.

First, CMH, which is short for Combined Motor Holdings. The recent published numbers by the seller of new cars suggested that sales were down nearly ten percent for the prior month, when compared to this time last year. CMH by their very name, you can tell that they sell motor vehicles. They also have fleet services, and own First Car Rental. And of course they work with the banks to provide finance to buyers of motor vehicles. So in an economy such as ours, with the backdrop as it is, why is the stock trading at a 52 week high? The stock is up 101 percent over the last five years. Such is the cyclical nature of their business however, that the stock is basically flat over 10 years.

Invicta sells capital equipment (earthmoving machinery and agricultural machinery, as well as the associated spares), supplies SA inc. engineering businesses with almost everything they need (tools and equipment) as well as having a smaller building supply segment (Tiletoria is well known). Again, mining, farming and general industrial South Africa are not exactly the sectors that you would expect to be doing well right now. Invicta is a stock that has had an excellent 10 years and a terrible three years (up 204 percent relative to down 39 percent), there are also loads of moving parts in there like a rights issue and a special dividend, so it makes it a little harder to decipher. I guess for the purpose of this comparison, all we need to know is that the stock is trading at a 12 month high.

And then Barloworld. That stock is up over 50 percent in the last year. Over ten years it is only up 23 percent, the company is a well know entity in the South African business landscape, heavy equipment sales to construction and mining (they have the Caterpillar licence), they move goods around with their logistics business, as well as own many automotive dealerships. Again, not exactly a company who you would expect their share price to be doing particularly well.

So what is happening here? Agriculture, mining, construction, automobile buying and general industrial South Africa (as well as moving stuff around) is not exactly firing on all cylinders. You would argue that perhaps there is a bang and splutter here and there. Markets are forward looking. Markets are in the business of peering into the future and wanting to predict what is likely to happen in 12-18 months with earnings. In other words, Mr. Market sees the road looking a little better for SA inc., even if the talk on the street does not share that sentiment.

Over the seas and far away, across vast oceans, time zones and hemispheres, stocks in New York, New York closed mixed. Mixed to little changed. It was jobs Friday, that time of the month where all the economists ramble about the labour situation. The US Bureau of Labor Statistics releases on the first Friday of the month something called the Employment Situation. The headline number is what everyone focuses on, and the unemployment number. The fact that these numbers are very volatile is often escaped on our captured short term nature. We are captured by the octoboxes and the perceived importance. As we always say around these parts, what matters most is the ability to be able to detect a trend with these numbers. Session end the Dow Jones Industrial Average had lost just over one-tenth of a percent, the S&P 500 added less than a point, whilst the nerds of NASDAQ nearly squeaked out a one-tenth of a percent gain.

Company corner

Amazon have just finished what is called the AWS Re:INVENT conference. I don't blame you for not knowing what that is, we will try our best to explain. It is 32 thousand folks crammed into a giant auditorium (this time in Vegas) with the web service business chief (Andy Jassy) opening with examples of how the services are used, and then away we go. Get togethers for all the people there, plus another 50 odd thousand watching online, in part enabled through the backbone of Amazon Web Services (which is what AWS stands for). Don't feel confused, this is all rather new for all of us, this business after all is only ten years old, and is half the age of the parent company, Amazon.

Amazon Web Services, as we have tried to explain in the past with our various reports - Amazon 2Q blows estimates away, is a big and growing business. Think of the cloud as an offsite storage space. Provided that your internet connection is up to scratch and that you do not need to have to worry about capping your data usage, this is the future of storage and using services, not as much pressure is put on your hardware.

The group describes the services as follows: "AWS offers over 70 fully featured services for compute, storage, databases, analytics, mobile, Internet of Things (IoT) and enterprise applications from 38 Availability Zones (AZs) across 14 geographic regions in the U.S., Australia, Brazil, China, Germany, Ireland, Japan, Korea, Singapore, and India. AWS services are trusted by more than a million active customers around the world – including the fastest growing startups, largest enterprises, and leading government agencies – to power their infrastructure, make them more agile, and lower costs."

This is the future of storage. As data becomes cheaper and faster, it makes more and more sense to store all of your data off device and off site. With mirrored and accessible AZs (Availability Zones) more and more available, it will be quicker to access. We continue to think that this is going to become an increasingly bigger part of Amazon's business, and continue to accumulate a business that trades at a discount to their sum of the parts.

Linkfest, lap it up

Where does technology and medicine collide/combine? Is it lead by tech or advancements in medicine? Often there are individuals involved, people who are involved in making decisions to change lives. This is therefore not surprising to see - IBM unveils Watson for drug R&D, teams with Pfizer on oncology and Sean Parker's I/O group teams up with CRI for cancer neo-antigens R&D deal. Using advanced technology (and mega resources) to cure specific cancers is a huge leap forward for humanity.

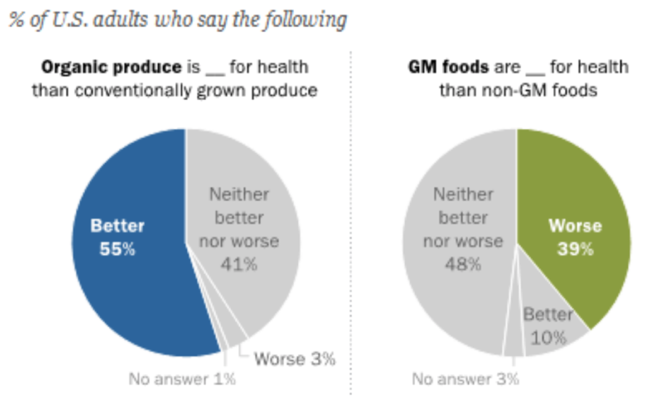

I know that we think about food, we think about it a lot. We are hard coded to be on the lookout for the next bunch of calories that will see us through another day. As humanity gets richer, we think more deeply about where the food comes from, where the food was grown, and importantly, how. The Pew Research Centre conducted a survey and I guess that you would not be too surprised with the outcomes, it is still pretty mixed - The New Food Fights: U.S. Public Divides Over Food Science

Staying with food, did you see that the founder of the Big Mac passed away - Jim Delligatti, Big Mac Inventor at McDonald's Chain, Dies at 98. Jim gave us more than just a tasty sandwich, his idea made sure that the "Big Mac" index could be a useful measure of which place is more expensive relative to another. Herewith the most recent - The Big Mac index. We (South Africa), are very cheap on that index.

This was a great read about Shoprite and Whitey. By keeping their costs down they were able to grow and benefit the consumer along the way - The grocery chain that became Africa's biggest retailer by betting on its middle class. Sasha gets a mention here too.

I think that sometimes we are blind to the risks that we take. When investing we start counting our chickens before they hatch and then pay lip service to the possibility that our portfolios could drop 30 - 40% at some period. Small caps are a great example of increased risk for increased returns - The Agony of Investing in Small Cap Stocks. There are many small caps that go bust but there are those few that turn into "Amazons" or "Tencents".

Home again, home again, jiggety-jog. Whoa, Renzi has resigned whilst Italians have rejected the constitutional reforms that the Italian prime minister wanted to implement. Markets are selling off a little here globally, as a result of this "anti establishment" vote. I suspect that for the folks down here, avoiding the ratings downgrade will be a relief and buy the retailers and banks (and financials), for the other half it will be risk off and sell the global stocks. We will see how it all transpires, I suspect a mixed day, depending on how and where you are placed. Italian stocks are called off around 4 percent, I would not be surprised if there are some high profile banking wobbles here, in Italy to be precise.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment