"What is equally astonishing is the "legacy" that Schultz has created, and must hand over to Johnson. 300 thousand employees who wear the green apron, and as Bright pointed out via a Motley Fool Tweet: "Since Howard Schultz brought @Starbucks public in 1992, the stock is up over 170 times in value. That's north of 23% yearly returns. Wow" The space between is for effect. "

To market to market to buy a fat pig Same old. This time the headline read that we were lower ahead of the S&P credit rating, that is due today. In the same way that consumers in Dischem didn't know or care about the company listing (I canvassed a few), I suspect that people will view the credit rating agencies and their view on the ability of South Africa to service their debt effectively with a shoulder shrug. The truth is, it does not matter how much influence we have over the ratings agencies, whether you are finance minister or just an ordinary fellow on the street, their minds are made up. Besides, as I said to a nervous client yesterday, recently Bloomberg suggested that there was only a 20 percent chance of South Africa hanging onto their "investment grade" status by this time next year. Don't bash your head against the wall on the things that you can't change, rather focus on the things that you can change.

By the time we closed up shop, rolled up the pavements (6pm in some places around our beautiful land) and the dust had settled, stocks as a collective, the Jozi all share, was just over half a percent lower on the day. The Rand was marginally weaker, all major indices were wallowing in the red. There was company related news, Anglo said that they were selling their stake in Exxaro via an accelerated bookbuild. They would place 9.7 percent of the EXX market cap, the entire Anglo stake. Exxaro took badly to the news, the stock fell nearly ten percent on the day. Anglo intend using the proceeds to reduce net debt. What is interesting is that whilst some may view this as a "big deal", it is around one percent of the market capitalisation of Anglo America. In short, not core. And with the Exxaro price up around 85 percent over the last year, the timing is pretty good.

Also in the commodities space was Glencore suggesting that the dividend was coming back next year, and that the sum would be around 1 billion Dollars, paid in the first and second half in equal tranches. Also, the company said that their divestment process is complete (6.3 billion Dollars, way ahead of what was originally targeted) and they are on track to reduce net debt to 16.5 to 17.5 billion Dollars. Big, eye popping numbers. Relative to their market cap of around 51.3 billion Dollars .... not so much. Still, a sizeable number. Remember when management followed their rights in full and sank in a ton of money just over a year ago?

The company (Glencore) raised 2.5 billion Dollars, a 10 percent dilution and at 125 pence it looked like "not enough" for a while. The share price is now 283 pence. Together, management (which includes Ivan Glasenberg from these parts) cobbled together 360 million Pounds in order to keep their stakes relative, that was around 22 percent of the business. The pound .... sigh, it certainly has fallen from grace. Either way, they have made real money (on paper) over the last 12 months. Not too fast .... since listing in May of 2011, the stock is down 47 percent. As is always the case in these investment time horizons, it depends where you draw the line in the sand.

For instance, if your portfolio has fallen by ten percent from the highs, have you lost money? In this case, has Ivan Glasenberg made, or lost money? I suspect that he views it as neither. He has not just started on what he currently wants to achieve, both for himself as a shareholder and for other shareholders, nor is he finished with what must be a masterplan. So when he looks at all of his beans (of which there are many) on paper, does he stress that he is down 47 percent since listing the business in May of 2011, or is he thrilled that he is up 198 percent since he followed his rights in October last year? Which one do you think? I think again, neither.

I suspect that he views it in the way that most sensible investors view it, the share price is not something that you have control over. The business that you own, the direction that management (in this case himself and his colleagues) gives it, that he does have control over. And the fact that he chose to not be diluted and found access to tens of millions of Pounds tells you want he thinks, or thought at that time. It is often easy to forget that we own businesses and not share prices. Those share prices reflect what the collective thinks on a minute by minute basis, and what the company ought to be worth at any one given time ..... If you intend and plan to own a business, then own it, fret less about the fortunes of the share piece, thinking you have "made" or "lost" money on paper. In the end, the cashflows will reward you with dividends, with superior returns.

Some of you were very interested in the local stocks that made up the 10 billion Dollar club, from the message yesterday. Firstly, there are 15 stocks in total that have market capitalisations above 10 billion Dollars, that is here in Jozi. Only 6 of them, of the 15, have primary listings here. They are, in order of market cap, Naspers (891 billion Rand - 63.3 billion Dollars), FirstRand (286 billion Rand - 20.3 billion Dollars), Sasol (245 billion Rand - 17.4 billion Dollars), Standard Bank (242 billion Rand - 17.24 billion Dollars), Vodacom (212 billion Rand - 15 billion Dollars) and lastly MTN (208 billion Rand - 14.8 billion Dollars).

That is of course at the current market cap and exchange rate of 14.07 Rand to a US Dollar. Collectively these businesses have a market capitalisation of 148.3 billion Dollars, the 6 above. That is a little bigger than Cisco, and a little smaller than IBM (all six of them put together). Naspers is by no means small fry, it is roughly the same size as AstraZeneca, or the Vodafone Group or chemicals giant Du Pont. So how big is FirstRand, in comparison? It is (in market cap, size and scale) slightly smaller than International Paper, slightly bigger than Hershey. Sasol, Standard Bank are around the same size, they are equal in size and scale to businesses like Campbell Soup and Hormel Foods.

Vodacom, MTN? They happen to be very similar in size and scale to Telecom Italia and Viacom. So there you have it. These are our top six by size and scale and the only locally (primary) listed businesses that attract a market valuations in excess of 10 billion Dollars. The other nine for interests sakes, who obviously have an association with South Africa, history with South Africa, some were made for decades and decades in South Africa, have their primary listing elsewhere.

They are, in order, AB InBev (2.4 trillion Rand - 171 billion Dollars), British America Tobacco (1.54 trillion Rand - 109 billion Dollars), Glencore (722 billion Rand - 51.3 billion Dollars), BHP Billiton (excludes the limited listing, other wise it would be bigger) has a Rand market cap of 495 billion and a Dollar market cap of 35.2 billion. Next on the list is Richemont (471 billion Rand - 33.5 billion Dollars), Anglo American (295 billion Rand - 20.9 billion Dollars), Steinhoff with a recent Frankfurt listing (278 billion Rand - 19.8 billion Dollars). And lastly, rounding out the top 15 stocks with market capitalisation in excess of 10 billion Dollars is South32, at 11 billion Dollars, which is 156 billion Rand.

Lastly, if you add the whole lot up, all of the combined market caps of the 15 top businesses here in South Africa, it equals 612 billion Dollars. 8.6 trillion Rand. Apple was there a few weeks ago, the stock closed last evening at a market cap of 578 billion Dollars. Nearly as big as the lot put together and nearly 4 times bigger than the combined 6 ZA local listed stocks. Put differently, Apple is over 9 times bigger than Naspers. Which may come as a surprise to you, one way or another. There you go, perspective is always a great thing. There are, for interests sake, around 50 businesses with a market cap in excess of 100 billion Dollars, including ADRs, if you use the trusty Google Finance Stock Screener.

Across the oceans and far away from our superb summer conditions (a wee bit hot this week, not so?), stocks in New York, New York resumed the old Trump trade again. Financials and energy, industrials at the fringes all rallied and the Dow Jones Industrial average made stocks great again. For all the ructions and scandals surrounding Wells Fargo, the stock basically now shows a flat return year to date. Minus of course the 2,8 percent dividend yield at these levels. Since the bottom (again, depending on where you draw your line in the sand) the stock is up 24 percent. October 4th to present. Pretty amazing if you think about it, how can one of the biggest banks in the world move that far in 60 days? It happens in equity markets that certain sectors and certain specific stocks get re-rated to that sort of extent.

Session end, and with all the major indices off their mid morning and opening highs, the nerds of NASDAQ had slipped by over one and one-third of a percent, the broader market S&P 500 lost just over one third of a percent, whilst the Dow Jones Industrial Average closed at another record high, up 0.36 percent to 19191.93. Darn three at the end! All the stocks in the losing column, amongst the majors, included Alibaba, Facebook, Microsoft and Alphabet. The winners were Berkshire, JP Morgan, the aforementioned Wells Fargo, as well as GE. Yip, Industrials and Finance trumps tech, making America great again is no mean feat. Alibaba was supposedly (according to sources and people familiar with the situation) in talks with Snap (the parent company of Snapchat) in order to acquire the platform, the story was later not so .... No Snap for BABA tonight.

Company corner

There was the inevitable announcement that came, still Mr. Market did not take that kindly, the stock is down over three percent in the aftermarket. Starbucks Announces New Leadership Structure to Drive Next Wave of Global Growth. Howard Schultz is handing over the baton to Kevin Johnson, who is currently the Chief Operating Officer of Starbucks.

Schultz will move his role to executive chairman. His main aim now will be to "focus on retail innovation and accelerating growth of Starbucks ultra-premium retail formats." What does that mean? Well, more stores like the roastery, where coffee becomes a destination and the improvement of consumer experiences. Check out a picture of the roastery from the Starbucks website, the first of which was debuted two years ago in Seattle.

You have to remind yourself at some level that the experience of coffee, coffee drinking and coffee culture are both centuries old as well as very new. The plan to roll these out is calculated and clearly takes a lot of homework, as well as huge expense. Schultz is not going places other than the company, fulfilling a role that he enjoys more, and as such, shareholders are bound to get the very best out of him.

Onto the successor, Kevin Johnson, who will assume the role in April next year. He has a huge technology background, having spent 16 years at Microsoft and 5 years at Juniper (smaller competitor to Cisco), both hardware and software. What is equally astonishing is the "legacy" that Schultz has created, and must hand over to Johnson. 300 thousand employees who wear the green apron, and as Bright pointed out via a Motley Fool Tweet: "Since Howard Schultz brought @Starbucks public in 1992, the stock is up over 170 times in value. That's north of 23% yearly returns. Wow" The space between is for effect.

Great brand, great company, huge global presence (25 thousand stores) and in good hands. Our view is unchanged since we covered the results in early November - FY numbers, store rollout continues, in which we concluded "We continue to accumulate one of the best brands and consumer stocks globally."

Linkfest, lap it up

As a consumer this is bad news. Airbnb is placing limits on the number of days that you can rent out your place without having a license - Airbnb Toughens Up Home Sharing Limits in London, Amsterdam.

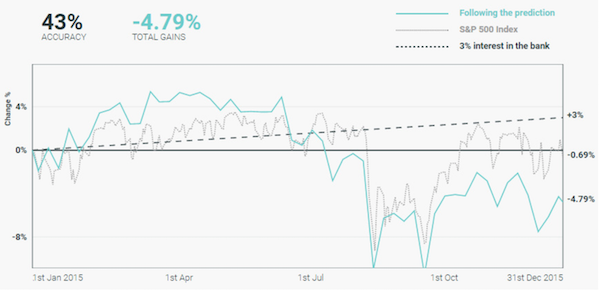

This graph highlights why following other peoples recommendations is a bad idea. Stock analysts normally know a company better than any other but because their time frames are based on a quarterly basis, buy/ hold/ sell recommendations are more influenced by emotion than fundamentals, hence the poor accuracy - Most Banks Are Getting Their Stock Picks Badly Wrong.

Here is one great use for AI, scheduling meetings with and for people with very busy calendars. The process can be very time consuming but doesn't need a high degree of technical knowledge, the perfect situation for AI to thrive - This AI personal assistant took 3 years and millions to build - it completely fooled me. The one person interviewed said that he can spend up to 3 hours a week going back and forth trying to arrange a meeting time!

Home again, home again, jiggety-jog. Not much by way of company results, Steinhoff are expected to report next week, in the middle. Just as all school leavers (both grade and for good) and their parents head out on their December vacations. We are always around, via the normal channels and will continue to be available for our clients and their needs. Of course the big, big numbers from a global point of view is the non-farm payrolls. October, screaming people and so forth, the first of many for Mr. President elect to have to "explain" through his staffers, as is always the case.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment