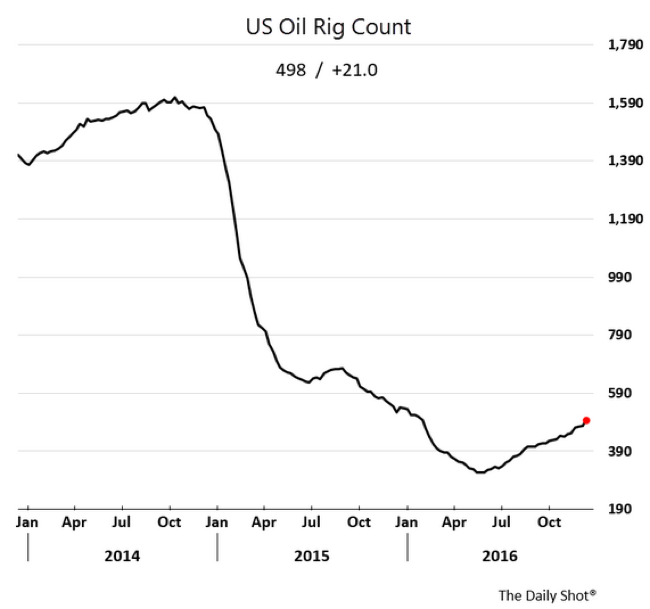

"The problem for those folks is that the frackers of North America are standing by to pump like crazy, since the lows of May 2016, the rig count (those pumping) has risen over 50 percent."

To market to market to buy a fat pig The oil price is barreling along, getting a lift from non-Opec members getting ready to cut production in order to shore up prices. The problem for those folks is that the frackers of North America are standing by to pump like crazy, since the lows of May 2016, the rig count (those pumping) has risen over 50 percent. The higher the price goes, the more favourable for private enterprise. So whist recent events may be back slapping in the halls of national oil ministries, corporate America, Harold Hamm and his mates have been high-fiving just as much. The oil price is now double from the lows of the year. Wow. See - Oil prices soar on global producer deal to cut crude output. That is today.

That Daily Shot (which now belongs in the WSJ) has this take on it - America Defeats Saudi Arabia. The oil rig count may have spiked a lot, it is still a long way off the all time highs, as you can see from this graph below, courtesy of the Daily Shot -

Stocks in New York, New York, closed higher Friday to set another record again. The Dow Jones Industrial Average added nearly three-quarters of a percent to close at 19756 points. 20 thousand on the Dow is looking like a distinct reality. So not too much has changed other than confidence and many business types feeling excited that the Republicans control the lot. And that means a lot, that means that if people feel things are going to be better, then people are going to invest more, spend more, hire more. It may seem strange to you and I that with the recovery in the labour market, the general business people don't feel it, and as such, the new dispensation may feel better from their perspective. And confidence, as we know, is a very powerful thing.

The broader market S&P 500 closed at 2259, up 0.59 percent, whilst the nerds of NASDAQ added half a percent to 5444. Basic materials were lower whilst non cyclical consumer goods (food and toiletries and stuff like that) were the big winners on the day. Healthcare finally caught a bid too, some good and some bad since the US elections. Hospitals, and services around the sector have not had the best time, a repeal of part of "Obamacare" may impact heavily. Hospital group HCA is down 8 percent since the US elections. Fewer people with healthcare insurance equals fewer people visiting US hospitals. The company looks cheap at face value, it trades on an 11 multiple historic and less than that forward. Just as you may think a sector falls in a sweet part of the economy (hospitals do not really have cycles, one way or another), does not mean that the market gives it the same multiple. HCA is huge, on a revenue basis is bigger than Merck. Therein may actually be an opportunity, a very big long term one.

Where local was happening, stocks ramped up nearly three-quarters of a percent on Friday. The All share index closed out at 50900 points (a fraction shy of that), with industrials and financials leading the charge, resources were lower by just over a percent, stinking up the joint. Resources as a collective (and these are the top ten by market cap) are up 41 percent over the last 12 months. Over five years, unfortunately it is still a bum investment, down 37 percent. The law of make up percentage numbers. In other words, what will it take in percentage terms to make that up. If a stock goes down 50 percent, you need it to double (100 percent gain) to get back to break even.

The main news on the day was that resource company Sibanye (no longer a gold business) were buying the only real US based PGM business for 2.2 billion Dollars, a company called Stillwater. Not everyone sees the synergies. Neal Froneman, the CEO is quoted as saying the following: "The Transaction represents a transformational opportunity for Sibanye to acquire high-quality, low-cost, PGM assets at a favourable point in the cycle." I guess by favourable he means lower price. Still, reactive market types sent the stock much lower, possibly as a result of a dilution in the pipeline, i.e. a rights issue. Whilst the gearing will also rise, for many this represents some sort of opportunity. Over a single year, the stock, Sibanye is down 1 percent. Since August the 2nd, the highs of the year, the stock is down a whopping 66 percent. Since being unbundled from GoldFields the stock is up 48 percent. As ever, and is always the case, it depends where you draw your line in the sand.

A lot of people don't get it. Being on the Richest list does not necessarily mean that you are liquid, and by extension, very rich. I am pretty sure that if Stephen Saad announced that he was leaving Aspen, his net worth would plunge. If he sold it, or placed them, he would have to sell them at a discount, heck, he may no longer be a Dollar billionaire. I am pretty sure that with his energy and the way that he speaks about the growth of the business, equally he is young by modern day corporate standards, he may not want to retire any time soon.

Equally, whilst Saad is liquid, some folks would never find buyers for stakes of businesses that they are invested in, you know who I am speaking about. Famous Brands announced that the salary measures were also messed up. They stuck out a SENS this morning - Announcement relating to significant error contained in Business Times' rich list "The Big Earners" table. An incorrect decimal place in there. It said that Group strategic advisor and ex CEO, who drove the business from a family business (essentially) to a now powerful branded company, earned 45.991 million Rand last year. When in fact, he earned 4.591 million Rand. A whole lot less than an England cricket contract, which is 700 thousand Pounds a year, excluding match fees (12 thousand Pounds a test, 5 thousand Pounds a 50 over match and 2500 Pounds per T20). Is Hedderwick worth it? Hell yes, every single cent.

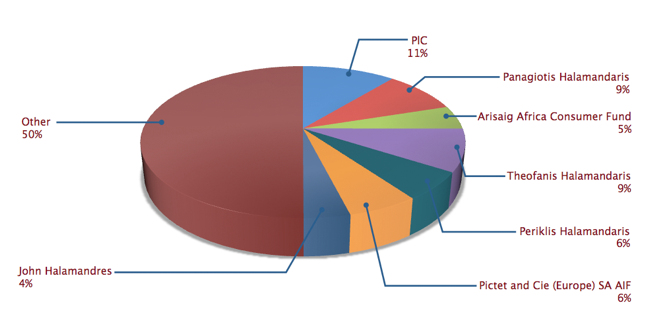

If you had searched in the last annual report, you would have found all the details that you need, for what really matters in wealth creation, and that is ownership. Hedderwick has been a board member for over 15 years. These shareholders below, most of whom have stayed constant have much of the guidance of Hedderwick to thank for their wealth:

In the middle of this year there were sales of around 120 to 180 million Rand for some of the bigger shareholders. At the same time, Hedderwick himself has all and sundry around him (including himself), to thank for making his personal wealth a larger pot now than at any other time. Even if he owned (I tried to scratch here and there) 2 percent of the shares in issue (I think that may be the number, I am very open to correction, it is harder to find than you may think), it is worth over 300 million Rand. The dividends, which have been suspended for now, would be worth a lot more than he earns in a year. So ..... forget what someone is worth on paper, if the cash flows from the business give you huge dividend payouts, then it is worth more. And you know who (not Lord Voldemort), is worth a lot on paper, can neither transact or get dividend payouts. Understood?

Linkfest, lap it up

I have never used Snapchat but as their list of features grows I am continually thinking about joining - Snapchat will show more exclusive TV shows with the help of Turner

A big chunk of charity's funds are spent on salaries. A friend of mine who audits charities says a good charity "only" spends 70% of the funds given to them on salaries (can anyone else confirm or deny this based on their experience?). Reducing the complexity of getting money to people under the poverty line will mean that less people need to be employed and more money will get to the people who need it - Definitive data on what poor people buy when they're just given cash. Interesting that when just giving cash it results in lower alcohol and tobacco consumption for the average person.

Diet sugary drinks have had falling sales over the last number of years. It looks like if people want to be a bit healthier they rather go for something like water instead of a diet version of Coke/ Pepsi which doesn't taste as good as the original - Diet soda has fallen out of vogue in the US

Home again, home again, jiggety-jog. Stocks are mixed here, mostly higher as Chinese and Hong Kong stocks took an almighty whack (China stocks fall by most in months amid crackdown on insurers), US Futures are higher, thanks for the higher oil prices people. Inflation no doubt will be stoked again, which may mean higher rates, which is not necessarily bad for financials and banks. Which also equals a better future for alternatives, higher energy costs focus the mind.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment