"A natural response to a rapidly changing world, and many people do not like change. The Italian referendum is marginally different, the polls for once got it right, way back in September the No crowd took over from the Yes. And it has stayed that way. Old people wanted constitutional reforms, young people (who have felt left behind since the financial crisis) not so much."

To market to market to buy a fat pig Anti establishment is on the rise. I think that people being angry with politicians and their promises and therefore swinging in the direction of more colourful (dark is a colour?) characters is natural. A natural response to a rapidly changing world, and many people do not like change. The Italian referendum is marginally different, the polls for once got it right, way back in September the No crowd took over from the Yes. And it has stayed that way. Old people wanted constitutional reforms, young people (who have felt left behind since the financial crisis) not so much. Normally the younger you are, the more receptive you are to change. One thing is clear, if I was a politician, I would be worried. Out of touch, out of reach, the people have a single shot each at mixing things up. Bloomberg View has a sweet article - Don't Confuse Italy With Brexit or Trump.

Over in Austria, a giant leap to the right didn't happen, that was somewhat of a relief for liberals, right? I guess for the European system to work effectively, there needs to be general consensus across Europe. At the moment .... not so much. That did not seem to bother global markets, initially Italian stocks were indicated around 4 percent lower, when markets opened, stocks reversed their negative trend and turned strongly green. Strongly better. Generally strong. Locally, in the city founded on gold, stocks in Jozi, Jozi turned green around the same time that European markets opened. Which is ten am local time, these days. The first hour is filled with a sad void.

Leading the charge were financials, and then some specific stock news. Kumba soared 6 percent, Shoprite was up nearly 4. In the minus column was AngloGold Ashanti, down 4 percent as the gold price slipped away. Intu and Hammerson down over 2 percent, on a strengthening Rand, to the Pound specifically. Steinhoff has results tomorrow, the stock touched a 12 month low yesterday. I think that this is a fabulous opportunity to acquire a quality global outfit. We will watch the results. At the opposite end, Barloworld and Invicta continue their march day after day to new 12 month highs.

Did you know that the gold price in US Dollars is down 32 percent in 5 years, up 86 percent in 10 years. It always matters where you draw that line in the sand. Over a year, the gold price in Dollars is up 8.35 percent. The Rand equivalent, the NewGold ETF is up 231 percent in 10 years, up 12.23 percent over five years and up 3.5 percent over the last 12 months. With inflation not really a problem and in a rising rates environment, what do you think that the outlook for the yellow metal is? It certainly has been a "good" investment in Rand terms, versus the S&P 500, how has gold done? The S&P 500 is up 58 percent in ten years, 77 percent over five and 5.4 percent over the last 12 months. Stocks in Dollars win. The All Share index is up 108 percent in ten years in Rands, 52 percent over five years and down marginally over the last 12 months. You always need to remember where you drew your line in the sand and started measuring.

Stocks across the oceans and far away, in New York, New York were once again higher, the Dow Jones Industrial Average setting another all time closing (and intraday) high. Blue chips closed one-quarter of a percent better on the day, the broader market S&P 500, led by a broad based rally, closed 0.58 percent to the good by session end. The nerds of NASDAQ rallied a percent and a bit. Banks and financials were winning again, Alphabet, Amazon, Microsoft and Bank of America. We will deal with Amazon in a bit, see below in the company corner segment. It seems that not matter what is going on, including the politics of Europe and the oil price rallying again, the Street is still digesting the Trump trade, that is what is being thrown forward. I wondered about that oil price, how sustainable it was at the higher levels. Guggenheim upgraded Visa, the stock caught a bid and rallied over 2 percent. Nike was upgraded by HSBC, the stock also rallied hard, up over three percent.

Company corner

When you think about Amazon, you think about a company that is completely online, you think about a company that has no store presence and is at the cutting edge of retail with their massive fulfilment centres. That is how I think of Amazon. Well, wait. That is about to all change. Except, not in the way that you may have thought. There may still involve very few people in these stores. The technology being touted is something called "Just Walk Out". Here is an introductory video that Byron sent to the WhatsApp group, introducing Amazon Go, with the pay off line of "No lines. No Checkout. (No, Seriously) - The world's most advanced shopping technology. You see that the clip, a day old, has had 1.5 million views already and counting at a rapid rate.

Amazon Go, as per the landing page, is a concept that is being tested amongst their employees, expected to open in early 2017 in Seattle, the place in the state where major innovation takes place. As a result of lower tax rates. A convenient and easy space, 1800 square feet, which is around 167 square metres. So you cannot fit too much into the space, at least into the front end space. It looks a lot like packaged food, convenience, will be the order of the day at shops like this. And we really like that theme, packaged and prepared food, which is why we have investments in Bidcorp.

Whilst the suggestion is that Amazon will roll out around 2000 of these stores, I suspect that if it does not work, they will immediately cut the program. Looks like a great concept, not so? And that, in the links, dovetails nicely into what jobs are likely to be eliminated here. Provided that the company can find some cheaper system to replenish the shelves and to make the sandwiches. What about stock control and theft? Surely there has to be security? I am pretty sure that they have thought this all through though. See the WSJ article - Amazon Working on Several Grocery-Store Formats, Could Open More Than 2,000 Locations.

Linkfest, lap it up

Remember mail room employees and typists? Weavers and blacksmiths were once thriving professions too. Until we worked out that we could do the stuff better in larger factories, and a whole lot cheaper. The article link below highlights that instead of getting worried about robots "taking your job", look for another vocation that probably will pay you more and you'll enjoy it. It says: "A study of census data in England and Wales since 1871 found technology created far more jobs than it destroyed during that 140-year period." Quite right - Robots, jobs and the human fear of change.

You must have seen it by now, the Nike HyperAdapt. Nike have been working on this project for 10 years to get to the finished product. At 720 Dollars, the WSJ reviewer (Nike HyperAdapt: Self-Lacing Shoes Are Here) said "I'll tie my own laces, thanks." By 2020 this article suggests that there are likely to be 600 million connected wearable devices, all in pursuit of making us healthier - The Rise of Wearable Health and Fitness.

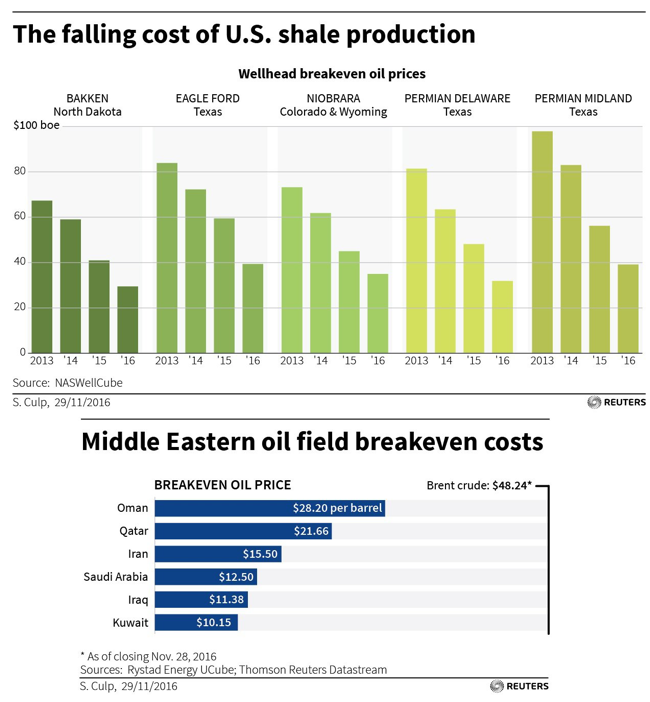

I came across a graphic that speaks for itself here I think, this is from AEI, our old pal Prof Mark Perry, via the Reuters article titled Leaner and meaner: U.S. shale greater threat to OPEC after oil price war. The falling cost of US shale production verse the cost of the oil producers in the Middle East. What is amazing is that some of the shale producers in four years have managed through technological innovations, to achieve half the cost of production. In the words of Sarah Palin, Drill Baby, Drill.

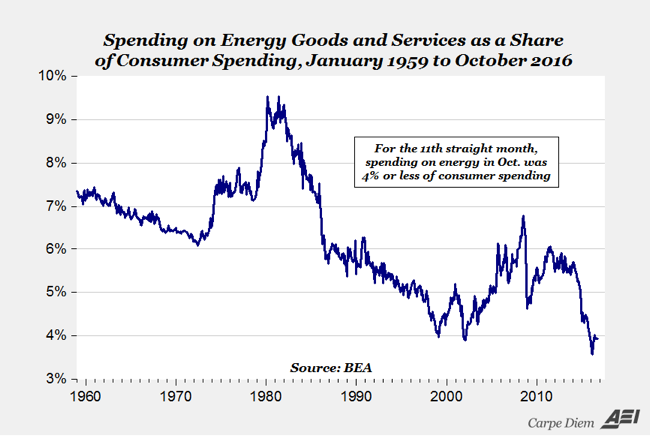

And then another graph, also on energy from the same source. As the cost of production of energy goes lower and humans build in a whole lot more efficiencies, via his Sunday evening links. "In October, consumer spending on “energy goods and services” represented only 3.94% of total consumer expenditures, and marked the 11th straight month starting in December of last year that the share of consumer spending on energy was 4% or less." This is a wonderful example of humans doing more with less.

Home again, home again, jiggety-jog. Stocks have opened better here in Jozi, a follow through from a positive Wall Street. Although ..... that is never a sure thing nowadays. Stocks across Asia are all higher, apart from Shanghai, the one year return of that market is down just over nine percent. Since the October highs of 2007, the Shanghai exchange is down 46 percent. Yip, things are always worse somewhere else.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment