"Retail Africa will be a giant that will have/has annual revenues of 200 billion Rand, and EBITDA of 15 million Rand, roughly at the exchange rates today of 14.6 billion Dollars in sales and 1.1 billion Dollars in EBITDA. That is an epic beast, I was looking for global comparisons, as the company plan to operate in Sub Saharan Africa, I can't find anything outside of here, the local bourse."

To market to market to buy a fat pig What is Janet (and her team) Smellin'? Yellen rhymes with a lot, belling, dwelling, selling, telling, swelling, shelling and quelling are the obvious ones. Belling is to make a noise to a newly married couple by bashing on pots and pans. Byron is going to a couple of weddings in the next few days, perhaps he can sneak into the kitchen and come out pots and pans bashing. I don't think that will go down well.

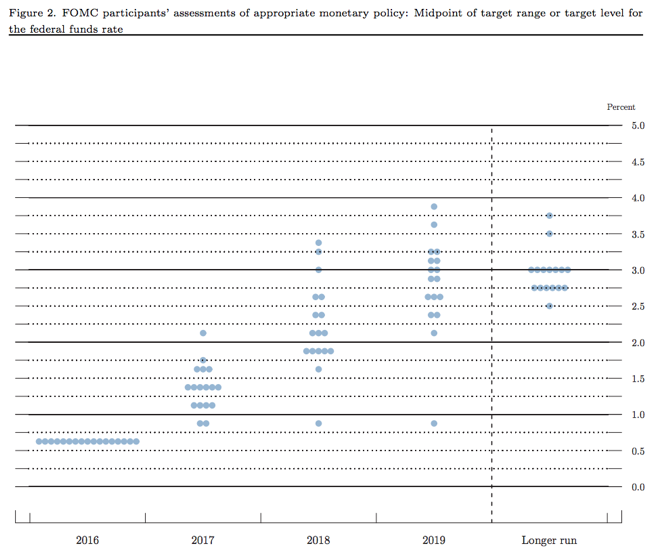

Telling. Janet Yellen and the Fed told us that the trajectory of rates may be quicker than the market anticipated, there may be three rate hikes next year. Stanley Fischer, the Fed deputy chair said at the beginning of the year that we could have four this year. We have had one, and that was yesterday. Quelling. Quelling that rate of rate hikes. How have the Fed "dots" moved? In the release yesterday the Fed give their projections of where they (as each voting member) see rates going, here it is:

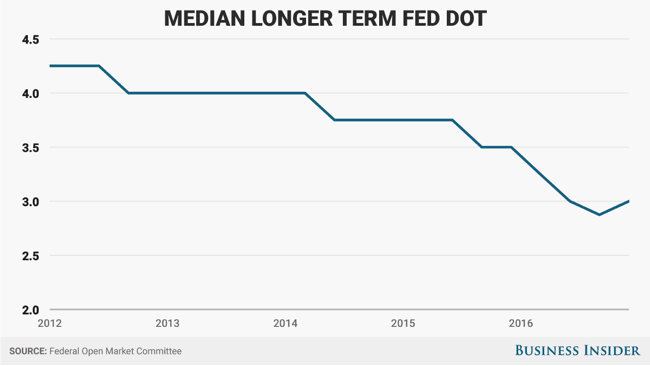

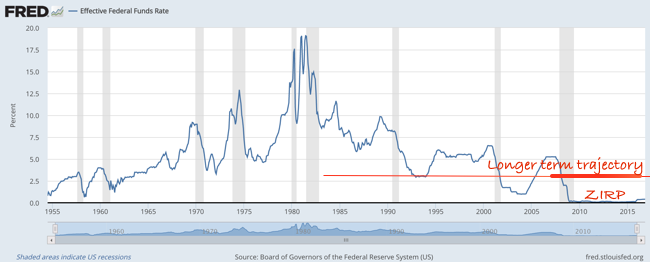

How does that compare to where the dots have been plotted before? What I can see is that the longer term trajectory of rates seems to settle now below three percent. Well, luckily for all of us, over at the BusinessInsider, someone has plotted where the Fed saw the long term rate trajectory a number of years ago, and where they see it now. Much of the last 6 odd years has been spent wondering when the Fed would raise rates. Since the "Great Financial Crisis" of 2007-2009 and rates heading to ZIRP (Zero Interest Rate Policy), the Fed have hiked rates twice, including yesterday.

I guess you could argue that the financial crisis ended when lending was "unfrozen", the great thaw that ensued, when Libor and the interbank rate spiked and came steadily back to earth again, and that happened in the middle of 2009. From the Fed itself, here is how rates have been, post World War Two, try and mentally draw a line around the three percent mark (I have done it there for you) and see where that is relative to ZIRP and history. And perhaps that is the reason why the itchiness of the rate watchers has come. They have expected the rates trajectory to be swelling.

What ensued was not exactly a shelling of stocks, rather some selling. No use dwelling on what might have been with a Dow 20,000, stocks came within an inch of that milestone 19966 was the print at the top, by the end of the session stocks had sold off and the Dow settled 0.6 percent off to 19792. I guess we will just have to wait around for another day, records such as stock prices and index levels are always "meant" to be broken. The broader market S&P 500 closed down 0.8 percent, led lower in most parts by energy and materials, a higher rates trajectory normally equals a stronger Dollar and by extension, lower commodity prices. Normally. The nerds of NASDAQ closed down half a percent by the time the session clocked out.

Back home, where local is lekker, stocks drifted lower through the afternoon and we closed near the lows of the day. The Jozi all share index ended the session around one-quarter of a percent off from where we started, there wasn't too much action except for a couple of company specific pieces of news, Rockcastle and NEPI announced the ratio at which they are going to form one business (there are plenty of shareholder overlaps, between the two), the combined entity will be the largest Central and Eastern European retail property owner by market cap, in excess of 80 billion Rand. Nice, why this affinity for property assets in Eastern Europe by South African businesses, or are there others?

And then there was an inflation read for October that slipped way outside of the zone that weighed a little on retail and banks, although as Michael pointed out, the Reserve Bank had indicated that they were going to expect a read of such "lofty" levels. 6.6 percent. Not good. However, as we said, not unexpected. Many in the "know" are expecting that rates may well be lower this time next year as the inflation trajectory from now flattens and gets lower. Food prices normalise and the drought eases, both obviously aligned with one another. Imported inflation, the Fed decisions may have a bearing on the currency, the local one that is.

And then the really huge news of the day (not that an 80 billion Rand combined entity isn't huge, it was kind of old news, NEPI and Rockcastle) is what we will jump into straight away below.

Company corner

Since Christo Wiese made the comments that he thought that Shoprite and Steinhoff was some sort of natural fit, the share price of Shoprite has outperformed the rest of their retail peers. Since Steinhoff released their results last Wednesday, the stock was up over 17 percent. That was all as at yesterday morning. And then basically around lunchtime, 12:30 to be exact, a release with some clarity as to what is likely to transpire (for Wiese at least) with the two companies hit the screens. Here it is - Steinhoff/Shoprite - Joint detailed cautionary announcement relating to the establishment of African retail champion.

So what do we have to work with here? Firstly, the Public Investment Corporation (PIC) and Christo Wiese are simplifying things here for themselves, getting one holding (of a business listed primarily in Frankfurt) which will be an African titan, excuse the pun. Wiese has built his empire through an entity called Titan Premier Investments, or just Titan. Retail Africa will be a giant that will have/has annual revenues of 200 billion Rand, and EBITDA of 15 million Rand, roughly at the exchange rates today of 14.6 billion Dollars in sales and 1.1 billion Dollars in EBITDA. That is an epic beast, I was looking for global comparisons, as the company plan to operate in Sub Saharan Africa, I can't find anything outside of here, the local bourse.

For instance, Shoprite has annual revenues of 130 billion Rand, you can see where the other 70 billion Rand is going to come from, you hardly need to be a genius to do that simple math. Pick n Pay, a pretty sizeable business in itself, has six month revenues of 37 billion Rand, roughly the size of the combined Steinhoff assets being sold to Shoprite. Spar has annual turnover of 90 billion Rand, their operations now extend to Europe too, Ireland and Switzerland. Massmart is around the same as Spar, a little less, they are more a "direct" competitor of Shoprite on the African continent. As such, the Retail Africa (as it will be known) giant will be over double the revenues of Massmart, perhaps their closest competitor. Remember that 52.4 percent of the shares of Massmart are held by Walmart, this hasn't exactly been the best of their offshore purchases.

I think that there were two specific reasons why both of the share prices of Steinhoff and Shoprite fell quite hard, and they differ for each stock. Firstly, I suspect that the shareholders of Shoprite were bidding the stock up in anticipation of an outright purchase and perhaps even a premium being built in. Hence, when the dilutionary effects are factored in and the company will have to manage assets that they haven't built over decades, I can understand the marginal frustration of the Shoprite shareholders. The stock sank 7.17 percent on the day to end at 178.97 Rand, a price last seen in July, when the last results were warmly welcomed.

At this point Christo Wiese owns 15.31 percent of Shoprite, the PIC own 12.26, just over 27.5 percent of the business. Add in the employees pool of 6.67 percent and you have one-third of all the shares in issue that are likely to be on the same page immediately.

So how is it going to work? first things first, Shoprite buys all of Pepkor Africa (PEP, Ackermans), JD Group (Russells, Bradlows, Hi-Fi Corp. and Incredible), Steinbuild and Tekkie Town. I have left out a few brands there. Price? Unknown for now?:

"Shoprite will issue new ordinary shares to Steinhoff in consideration, pursuant to which Steinhoff will receive a significant equity interest in Shoprite. The value for Steinhoff Africa Retail will be negotiated taking into account the best interests of both Steinhoff and Shoprite shareholders."

What is significant? Wait, like the Verimark (not in the league of any of these retailers) ads, there is more: "Steinhoff has entered into an in principle agreement with the PIC and Titan to acquire their interests in Shoprite as part of the Proposed Transaction in the form of a Steinhoff share-for-Shoprite share exchange, subject to an exchange ratio to be agreed ("the Exchange Ratio") which may ultimately result in Steinhoff acquiring control of Retail Africa."

So. Steinhoff will control Retail Africa and will shell out real Steinhoff shares to the PIC and Wiese for that, hence the dilutionary effect from their side. So that is one of the reasons why the Steinhoff share price sank. Whilst Christo Wiese then gets to stick all of his eggs in the Marcus Jooste stable at Steinhoff (note to self, horses don't lay eggs), other Steinhoff shareholders get diluted, and that sent the stock price of Steinhoff lower. Yet ...... the board says something else: "This Exchange Ratio will be negotiated taking into account the consideration price for Steinhoff Africa Retail on the basis that the Proposed Transaction will not be earnings dilutive to Steinhoff shareholders."

So whilst this may not be dilutionary now, the market is telling you something, selling the Steinhoff shares down 7.11 percent. You can presume that whilst the primary listing is in Frankfurt, it has only been a year. You would be right to presume that most of the shares are still held on the Jozi share register. And you would also be right to think that the reason that many hold the stock is for international and geographically diverse revenues. i.e. More Europe, the UK and now the US (as well as Australasia) and less African revenues. This is the opposite, at least in the short term.

A lack of dates and a lack of a price (swap ratio) is perhaps weighing on the market too. I think that for the PIC and for Christo Wiese this works well. Less Africa is what the Steinhoff shareholders wanted, which is recency bias and Shoprite is down as a result of perhaps going to be massaged into getting these assets. In the long run, this will work well is my sense. Plenty of logistical synergies between Shoprite and the Steinhoff African operations. Shoprite have great expertise in this area.

Linkfest, lap it up

Visual Capitalist had a very comprehensive breakdown of how they think the future of medicine will look like - Here's How Tech is Disrupting the Traditional Healthcare Market

Ladies please let us know if you would buy and wear this shoe - Luxury convertible shoe. After a Google search, it looks like you can buy one of the shoes starting at 260 Pounds.

Sometimes we forget how much the globe has advanced in the last few generations. Here is a cool website that will show you how much South Africa/any other country you choose, has improved since you were born - Your Life in Numbers

Home again, home again, jiggety-jog. The dollar strength (rand weakness) has not been able to cushion the markets after the interest rate hike. Steinhoff is starting to recover as that news gets absorbed.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment