"As you can see, even without the big distraction of the bid, operationally the company is under pressure. OTC (over the counter) sales were down 19% thanks to competition and a weak consumer. It is now 30% of overall sales. With those kind of brands that is unacceptable when you look at the rest of the retail sector, especially in a defensive sector like this. Prescriptions increased by 13.8% and is now 40% of sales. Hospital which represents 20% of sales grew at only 3.5%. The rest of sales comes from assets in Zimbabwe, India and Ghana."

To market, to market to buy a fat pig. Not us this time, but the holidays in the US and the UK obviously had a marked effect on volumes and price movements. We did however manage a close above 50 thousand points, I guess that is worth a song and a dance. The idiom however suggests however association with an untruth and usage in this context would then be incorrect, the closing level was 50021.72 points, of that I have absolutely no doubt whatsoever. I made a decision to not get irritated and incensed with politicians and their agendas, even if it completely is against everything I believe. There is no point in getting angry about X or Y appointments to cabinet, because you know, there is absolutely nothing that any of us can actually do to change it. Everyone has an opinion on who is the best person for the job, but the country has decided and we should respect the wishes of all. Companies will succeed in spite of governments, they always have.

Venezuela might well be the fifth largest oil producer on the planet, but since the nationalisation of the oil industry, production has been consistently lower. Oil production currently is at 1991 levels, about one million barrels, or 29 percent lower than at the height, when business did it. The worst part for Venezuela is that they could be stuck with all these fossil fuels if someone likes Elon Musk gets his way. I guess that you still need to generate electricity in order to manufacture batteries and solar panels, those need to come from renewables too. Byron nailed it the other day. If you are going to be an enemy of capital, if you are going to embrace socialism, then you must accept that you will have to queue for hours for toilet paper and other essentials. I wish, for the sake of the people that live there, I was making this up: Queues, shortages hit Venezuela's homeless and hungry. Wonky economic ideas normally have a much more marked impact on the most vulnerable in society. A free market is quite simple to understand, but works better in a society that is more equal.

An announcement yesterday afternoon from Nashua Mobile, a subsidiary of Reunert in which they were disposing of their Cell C customer base in the mobile business to Autopage Cellular, a subsidiary of Altech. This follows an earlier announcement in which both the MTN and Vodacom books were sold onwards by Reunert to both MTN and Vodacom respectively. Those books collectively were worth 2.26 billion plus VAT, the entire consideration here is 91.5 million Rand plus VAT. No more than 95.75 million Rand. So agin, whilst Cell C might be fighting for the rights of the consumer and never stopping until their customers had the lowest call rates in South Africa, in reality all the cream had disappeared when Cell C had come into the country and acquired their licence in November of 2001. At that stage MTN had 3.54 million South African subscribers (M-Cell results 6 months ended 30 Sep 01) and Vodacom had around 5.1 million subscribers by the end of March 2001 (Telkom SA Limited Analyst day). That Vodacom presentation looks like it is from around 2003. There and thereabouts.

So what does this tell you, if anything at all? Does it tell you that the first twenty odd percent of the South African mobile market was the best part by a long way? And because companies like Nashua Mobile and Autopage could use their platforms to sell contracts quickly. 3310's and 6310's rolled out like hotcakes. Cell C obviously struggled to capture market share and I would love to know all the ARPU's at this moment in time, after the mobile wars. Telkom Mobile, with blended ARPU's at the last reporting period of a little less than 60 ZAR for their 1.6 million subscribers, rolled out 8ta in October of 2010. The current Telkom CEO, Sipho Maseko said that in its current form, this business is not viable. Being the cheapest is not necessarily good for your customers, ironically. Back then the company said, the CEO in fact, Jeffrey Hedberg was quoted as saying: "We are able to mobilise the reliability of fixed-line and the agility of mobile to provide products that South African people really want."

So what happened? Late to the market? Chasing price and not quality? For first time, smartphone sales take lead in SA is a TechCentral article from a few days ago. What do people use smartphones for? To make calls? No. People use these devices to send messages, emails and check specific apps. Less so to make calls. Pfff... Data, coverage, that is where it is all at.

OK, is this acting in the best interest of shareholders, the AstraZeneca board get to keep their jobs have thwarted the Pfizer advances. Yesterday afternoon them fellows from Pfizer decided to walk away from a 117 odd billion Dollar offer for the British pharma company. Wow. That would have been huge. That is roughly the market capitalisation of Volkswagen, that is how big it is. Glaxo is 133 billion Dollars, that is how much Pfizer offered. The fellows from AstraZeneca have their work cut out for them now, trying to convince shareholders that this was the right thing to do. According to this FT article -> Pfizer admits defeat in AstraZeneca bid, AstraZeneca's revenue are expected to fall as blockbusters come off patent. But the management of the business are expecting revenue to grow 75 percent over the next ten years as they bring on newer therapies. By 2020 the British Pharma company is predicting that they would be introducing 10 new medicines.

According to this Reuters article -> How AstraZeneca escaped Pfizer's clutches this time, both companies could reengage with one another. Pfizer can come back and make another offer before the year is out and AstraZeneca could be told by the owners of the business, the shareholders, that they must reengage. Blackrock own 8 percent of AstraZeneca and are the biggest shareholder. How conflicted are boards when making decisions on behalf of shareholders? I guess it is only natural to be conflicted, your job is at risk if you accept the offer.

These businesses are incredible machines, 1 in five employees at AstraZeneca work in R&D and a similar amount in manufacturing and production. The rest? Sales and marketing. Of their 50 odd thousand workforce, nearly 60 percent work on selling the companies therapies. And of those, Crestor, where the patent for Rosuvastatin expires in 2016. Now AstraZeneca did not develop Crestor, that belongs to Japanese company Shionogi. But because of the reach of AstraZeneca, their annual sales of the cholesterol drug Crestor is nearly double that of Shionogi's total sales. Royalties. You must have heard of Claritin, that belongs to Shionogi too, but is marketed together with Schering-Plough.

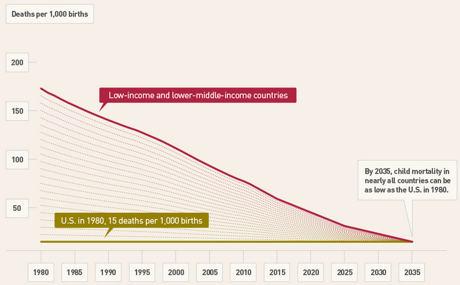

This is big business in the business of saving lives and extending lives. According to the WHO, in a fairly old report on Average life expectancy at birth in 1955 was just 48 years; in 1995 it was 65 years; in 2025 it will reach 73 years. Over 110 years ago, at the turn of the last century, the average life expectancy was a mere 31 years. Believe it or not that had not changed much for thousands of years. The critical age was 21 years old, if you made it that far, you did well and could live a long a fruitful life. The Gates Foundation (let us celebrate humans and capital combined) in their 2014 Gates annual letter had a fascinating graph titled Converging on a massive breakthrough for humanity. I have taken a small part, just for those of you that won’t click on the link:

The Gates foundation predicts that by 2035 that infant mortality globally will be the same as the US was in the year 1980. But this begs the question, if in developing countries the infant mortality rate is much lower, education and healthcare are worlds apart, is this the era (currently) in which we are going to see the greatest population growth? The paragraph below that astonishing graph puts it into perspective:

Let's put this achievement in historical perspective. A baby born in 1960 had an 18 percent chance of dying before her fifth birthday. For a child born today, the odds are less than 5 percent. In 2035, they will be 1.6 percent. I can't think of any other 75-year improvement in human welfare that would even come close.

I think that Gates is right. This is truly amazing. Perhaps there will be day shuttles to the moon by then, but surely changing the odds to that low number will mean that childbirth will be a "normal" event where a human is welcomed into the world. And of course nothing more to attribute the advances in healthcare than these beast like Pfizer and AstraZeneca. You may have your own opinions, strong or otherwise, on the price of the therapies, the availability to many, the exclusive use, the patent length, the chemical makeup and ethical usage, but the stark truth is that many more lives have been "saved" in the modern era by science advancing. I for one am grateful that shareholders part with tens of billions of Dollars from companies they own (with profit motives) in order to push boundaries and look for the next blockbuster. The broader healthcare industry is on the cusp of something revolutionary. Whilst healthcare remains a very emotive issue, it is also one with great opportunities for investors.

From a consumption point of view there comes a conundrum, if The Gates Foundation is right (and the evidence supports that they are right) then we are going to get lower population growth rates.

When children are well-nourished, fully vaccinated, and treated for common illnesses like diarrhea, malaria, and pneumonia, the future gets a lot more predictable. Parents start making decisions based on the reasonable expectation that their children will live.

But for the time being, with the base being so low for global consumption (relatively speaking), the huge disparities amongst developed and developing countries mean that there are many opportunities for investors. More than ever before. The conclusion of the letter is that whilst there is a lot of work to do, the future is improving for many desperate people. You can ironically allocate your capital in the direction of businesses that have a profit motive that change the direction of society for the better. Makes you think, right?

Byron beats the streets

Today we received six month results for the period ending 31 March 2014 from Adcock Ingram. As you may know we have indirect exposure to this company via Bidvest. There was an extremely public tug of war between CFR a Chilean listed pharma company and Bidvest who already had a small 4% stake. Bidvest pushed for and convinced shareholders to accumulate a stake of 34.59% which is just below the 35% level where an offer to minorities is required. Along with the PIC's 25% they managed to block the CFR bid and subsequently install Brian Joffe as Chairman and former Bidvest exec, Kevin Wakeford as CEO.

From my Calculations the stake cost Bidvest R3.7bn at R70 a share. The stock trades at R57.60 today. As you will see from the results below there is a lot of hard work ahead. Bidvest have a market cap of R100bn so the transaction was not as significant as you may think but they have managed to get the control they were seeking and if they manage to turn the business around, which they are known for, we may see this one becoming more influential for the group.

According to the Adcock website.

"Adcock Ingram is a leading South African manufacturer, marketer and distributor of a wide range of healthcare products. The Group enjoys a sizeable share of the private pharmaceutical market with a strong presence in over the counter (OTC) brands. The Group is South Africa's largest supplier of hospital and critical care products and its footprint extends to other territories in sub-Saharan Africa and India. The Group's extensive product portfolio includes branded and generic prescription medicines, OTC/fast moving consumer goods (FMCG) brands, intravenous solutions, blood collection products and renal dialysis systems."

Brands of their OTC division include Panado, Corenza C, Bioplus, vita-thion and Citro-Soda. All very well know, very powerful brands.

Here are the financials. Sales increased by 3.4% to R2.4bn thanks to the inclusion of recent acquisitions in Zimbabwe and India. Gross profit for the period declined 13.9% to R846 million. After all costs however which included some big capital investments, heavy inflation and a R94 million advisory bill for the CFR bid, the company made a headline loss of R39 million. If it weren't for the advisory fees the company would have made a profit of 29 cents per share compared to earnings of R1.88 last year. Not Good.

As you can see, even without the big distraction of the bid, operationally the company is under pressure. OTC (over the counter) sales were down 19% thanks to competition and a weak consumer. It is now 30% of overall sales. With those kind of brands that is unacceptable when you look at the rest of the retail sector, especially in a defensive sector like this. Prescriptions increased by 13.8% and is now 40% of sales. Hospital which represents 20% of sales grew at only 3.5%. The rest of sales comes from assets in Zimbabwe, India and Ghana.

All in all the company operates in a great sector with some very strong brands. Operationally it needs to be turnaround and we back the Bidvest team to do just that. I would not buy directly into the company however. The turnaround will take a while and the share looks expensive. We are more than happy to hold Bidvest and continue to be heavily weighted in Aspen.

Home again, home again, jiggety-jog. Stocks are lower here. Our GDP for the first quarter was a washout, showing contraction of 0.6 percent quarter on quarter. Sis. As per the StatsSA release: Economic activity in the mining and quarrying industry reflected negative growth of 24,7 per cent, due to lower production in the mining of gold, the mining of other metal ores (including platinum) and 'other' mining and quarrying (including diamonds). Perhaps we can have a look at it tomorrow.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment