To market, to market to buy a fat pig. Record setting all around here last Friday, ahead of Africa Day. You know, yesterday, the sunset was phenomenal here on the highveld, it always is in winter. We had the presidential inauguration over the weekend and the naming of the new cabinet, the Deputy Finance minister was elevated to the full post, Nhlanhla Nene is well known and not a surprise choice. He has both public and private sector experience and apart from falling off a chair once (you cannot unfortunately live that down) and is the right person for the job. So yesterday was officially his first day on the job, Minister Gordhan moves to Cooperative Governance and Traditional Affairs. I think that these are good moves, the chattering classes always have their specific thoughts, and that is good, but it won't change anything, right? Keep calm (not clammy) and carry on.

Back to the Souq, or Bazaar, floating, standing, public or night. We failed to crack the 50 thousand point close here, even though an intraday high had been set earlier in the session. Perhaps it would have been better to leave us hanging for another day. But over the seas and far away it was a record close for the major indices there, the S&P 500 having a record week and closing over the 1900 point mark. So whilst the index had been higher in intraday trade earlier in the month, this was the first time that we saw that close above that mark. No mark is ever key IMO, it just has a nice ring to it. It is tough to believe that we are a week away from June, and a mere four weeks away from the Winter solstice. Downhill to the coldness from here I am afraid sports lovers.

OK, what is happening in and around the world that is of importance to equity markets? Petro Poroshenko, the so called Willy Wonka of Ukraine is leading in the exit polls in the Ukrainian elections. What is the reference to the chocolate man? Well, Poroshenko made himself rich in the confectionary industry, he controls a business called Roshen. They do not export here, so that might be why you have never heard of them. He has been active in government and said immediately that he would engage with the Russian president, Vladimir Putin. Being rich means he does not want to pilfer the national coffers. At least you would hope so. I hope that this difficult chapter is put behind us, I am sure that everyone wants peace and stability.

Meanwhile the FT reports that Eurosceptics storm Brussels. And also, in what may seem to be a turnout for the books, BP signs shale deal with Rosneft. So here you have what is considered a British company (the B in BP is British, the P is Petroleum) signing a deal with the Russian Government owned Rosneft. There are other shareholders, but the Russian government owns three quarters of this business. BP are actually the other shareholder, so in actual fact this is just an extension of business as usual. BP owns just short of 20 percent. On the Rosneft board is a former STASI member, but I guess that might be normal in that part of the world. All you need to know is that this deal, according to the FT article, made Putin smile. And of course earlier in the week the Russians signed a 30 year gas deal with the Chinese.

Today there are major markets closed for holidays, both the US and the UK, Memorial Day in the US and Spring Bank holiday in the UK. It looks like there are only 8 holidays a year in the UK, the Americans look like they have 11 Federal holidays. Although the market is closed for only 9 of these days, the list is available on the NYSE website if you are interested -> Holidays. Today is sadly one of those. Perhaps I should not care so much, seeing as it does not really matter, other than from a liquidity point of view, whether the market is open or not.

Two sugar producing businesses reported numbers this morning, both Tongaat Hulett and Illovo, two companies synonymous with the industry here in South Africa. Although the argument can be made that Tongaat has indicated that there is a lot more money to be made in the short term in unlocking value with regards to their property assets. For Tongaat, land conversion activities as it is known, generated operating profits of 1.080 billion Rand. From only 259 developable hectares. Still in the bank is a whopping 8200 developable hectares. But operating profits from the sugar operations fell to 908 million Rand, from 1.4 billion Rand in the prior financial year. The sugar price has been weak. I guess the weaker developing market currencies have in some part had something to do with that. Brazilian production has been weak lately.

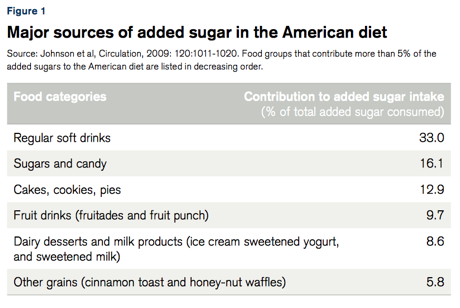

Sugar prices are set to be more agreeable for the companies producing sugar, but hopefully not as volatile as it once was. I remember a month or two when sugar prices went to three decade highs in early 2010 and then repeated a year later in 2011, the price is now half or so of what it was in 2011, at the beginning. The price is double what it was ten years ago. Very volatile and it must be tough to build a business around a very volatile commodity price. There are other major concerns that the sugar price will be under pressure, in fact there was an article in Barron's around ten days ago titled: Sugar Stocks May Rot Your Portfolio, Too. The subscription only article cites a Credit Suisse report from last September -> Sugar Consumption at a crossroads. I guess this table is pretty significant.

In large part this led to us selling Coke and buying Starbucks. Although you put sugar in coffee, you do not have to, I take my espresso with a little bit of froth, just to take the bitter edge off a touch. But, no sugar whatsoever. There is huge pushback from general society and with government funded health programs being able to implement future consumption taxes, the risks are certainly worth noting. The whole idea is that if I pay for your health, I can regulate what you consume, fair is fair. Ironically the same report refers to caffeine withdrawal symptoms. It really does! So perhaps in the long term the switch to caffeine is not necessarily the right one, but for the time being it seems that moderate consumption (with almost everything really) is not a bad thing.

The conclusion of the Credit Suisse report, in which they use cigarette excise duties (higher) versus consumption (lower as a result of taxes), is that the threat of stepped up regulatory response is real. For instance, did you know that a Red Bull (according to a public health study by the California Center for Public Health) has 8 teaspoons of sugar per serving. Fanta Orange is the highest at 12 teaspoons. Artificial sweeteners? Well, that is bigger than before, I am not to sure what the longer term repercussions are of artificial sweetener usage.

Anyhow, the companies deserve merit on their invest-ability right now. Whether or not you, or I, would buy them today, at these current levels. Both Tongaat and Illovo. I think that both these companies, from an internal consumption point of view in their key operating geographies, Mozambique, South Africa and Zimbabwe in the case of Tongaat and Zambia, South Africa, Malawi, Swaziland, Tanzania and Mozambique in the case of Illovo. Tongaat by a stroke of luck kept their land assets in KZN, Illovo, not so much. Illovo also have three meaty shareholders who make up nearly three quarters of their entire shares in issue, Associated British Foods (51.40 percent), Allan Gray (17.5 percent) and the PIC (6.6 percent). Allan Gray also own 14.71 percent of Tongaat. They obviously like these investments. The GEPF (Government Employees pension fund) owns 14.47 percent of Illovo.

So, the crunchy part. Do you own these businesses as a proxy for the emerging South African area, consumers putting their best foot forward? In the agricultural space we do prefer Omnia. Weather patterns, volatile sugar prices and pending regulations (we think) would perhaps see these companies evolve in time towards something different. Too volatile and too cyclical, agricultural businesses that is. Peter Staude is well regarded, perhaps he would be snapped up somewhere else. He owns (as per the 2013 annual report), 236 thousand odd shares and makes around 12.5 million Rand, all in. And he gets to live in Durban, which this year has the best Super 15 Rugby team. Although those fans will tell you that they are consistently the best team, the folks from Pretoria and Cape Town will tell you otherwise. The folks from Joburg. Sigh. Perpetually disappointed.

Home again, home again, jiggety-jog. Stocks are marginally off. It is quiet out here, because of the holidays. Oh well, we had all of ours, time for theirs!

Sasha Naryshkine, Byron Lotter and Michael Treherne

Email us

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment