"OK, so we know where they are going to push and where they are going to look to optimise, the rest of the continent is going to be the growth element, the South African assets are going to be made to work smarter for shareholders. Earnings estimates suggest that the company is going to roughly double their first half earnings (122.4 cents), whilst the dividend was actually hiked in this half to 46 cents, expectations for the full year are around 155 cents. That is a *nice* dividend underpin of close to 4.3 percent for the full year, pre tax of course. Just a little less than 4 percent after tax. A forward price to earnings multiple of around 15 times is hardly cheap, but not wildly expensive."

To market, to market to buy a fat pig. Record setting in the US last night, very good economic data meant that the bears were shooed into the woods for the day and the S&P 500 was able to extend the record setting rally. Locally we had a rubbish GDP read, Michael will deal with that later. The headlines around the world in Barron's, S. Africa's GDP Contraction Worst Since '09, the Financial Times, Platinum miners' strike takes toll on South Africa growth.

And so on locally too, the headlines all worried about the general state of the economy. The BusinessDay says that we (the South African economy) have been knocked to their knees. I have not seen a Government response, have you? SA Inc. stocks did take a little tap over here. Banks fell over one and a half percent, the gold stocks unfortunately was where most of the pain was, the whole idea that improving US fundamentals are bad for the outlook of the metal. The price I mean, I am pretty sure that the consumption story remains intact, richer people buying more gold jewellery, but you know our view on that, buy Richemont instead.

Nampak. Bidvest once tried to have a go for this business, remember? But said in October of 2008 that this was no good, the financial crisis had derailed Nampak's earnings. The offer however was one Bidvest share for each 7.5 Nampak shares. That was to try and buy one quarter of the company. The Bidvest bid then disappeared when information available to everyone (a trading update from Nampak) meant that financial conditions had deteriorated, and suddenly this did not look like a good idea. The full year 2008 results came in showing a 41 percent drop off in profits, this also coincided with the appointment of Andrew Marshall as CEO of the business, perhaps a turning point. Marshall had been at Oceana for a decade or so, but Nampak before that. John Bortolan left the CEO job at the end of March 2009, when the markets globally bottomed out. The Nampak share price was somewhere in the region of 13 ZAR a share then, about the same when Bidvest were trying hard. Ironically, this was good news for Bidvest, they have outperformed Nampak from a price point of view, but perhaps in the case of Nampak, Marshall would not have taken the job as CEO if Bidvest had bought it.

But that is like saying, what would have happened in that opening match in 2010 if Katlego Mphela had not hit the post, and the ball had snuck in? Or what would have happened if Allan Donald had not dropped his bat and had run straight away in that semi final at Edgbaston in 1999? It does not matter, the point is that it did not happen. It was very sad, but unlike sport, in the market you have choices with regards to which companies you want to own. The emotional attachment to a football team is too much to break, the national team, well you can never break that!

Anyhows, that was a while back, Marshall has already done his time at Nampak and is moving on, and the new CEO is none other than Andre de Ruyter, who took over at the beginning of April. If you were paying attention you would recognise that name. He (de Ruyter) looks like an older version of the boxer in Rocky 4, the Dolph Lundgren character named Drago. Of course he comes from Sasol where he was highly regarded, partly responsible for the turnaround of the Olefins and Surfactants businesses back to profitability. So that box is checked! Talking of checked boxes, the Chairman of this business is none other than Tito Mboweni. If you were wondering about what his role would or could have been in government, read the Mail and Guardian story: Mboweni clarifies MP list withdrawal on Facebook.

We digress a little. Nampak have released numbers this morning for the six months to end March. Revenue for their local business increased 9 percent, their UK business in Rand terms increased turnover 22 percent and their rest of Africa business revenue (also in Rand) up 24 percent. What is interesting is that whilst this may be a South African company from a revenue point of view (73 percent), the profits from this geography (56.5 percent) are lower relatively speaking. This is in part the margins in their UK business being lower, 6.3 percent trading margins in the UK versus 8.5 percent in South Africa. And the rest of the continent? Trading margins are a whopping 17.3 percent, more than double the local margins. The company has, lest you forget, businesses in 12 African countries, including our own of course. I have heard many people talk about South African companies and African businesses, we forget that South Africa is in Africa. The second half of the name gives it away.

The recent acquisition of the Nigerian manufacturer, Alucan announced on the 25th of February this year signals the intentions of the company, the growth is going to be on our own continent. It makes sense that a business with a proven track record and knowledge operating here looks for the higher margin business whilst the continent is still experiencing rapid urbanisation. Nampak is essentially both a urbanisation and demographics story. More goods that need to be moved around in containers that are not traditional. Game for instance sells most of their merchandise across the continent in non perishables. Also, those goods need to be packaged to move around more freely. I certainly think this holds true, the greater the GDP growth on our continent, the better businesses like Shoprite, Massmart, Tiger and Nampak will do. You need a place to store that peanut butter, that juice, that long life milk and those biscuits. Even a carton, that business in Kenya, Malawi, Nigeria and Zambia has margins of over twenty percent.

OK, so we know where they are going to push and where they are going to look to optimise, the rest of the continent is going to be the growth element, the South African assets are going to be made to work smarter for shareholders. Earnings estimates suggest that the company is going to roughly double their first half earnings (122.4 cents), whilst the dividend was actually hiked in this half to 46 cents, expectations for the full year are around 155 cents. That is a *nice* dividend underpin of close to 4.3 percent for the full year, pre tax of course. Just a little less than 4 percent after tax. A forward price to earnings multiple of around 15 times is hardly cheap, but not wildly expensive. It comes down to one thing, in our investment portfolios is there space for Nampak? Possibly not, because we own Tiger Brands and Bidvest, both quality businesses in their own right. If the stock was screamingly cheap (it said, "buy me" a la Alice in Wonderland) and somewhere in the region of 22-25 ZAR the decision would be easy. But at 35 ZAR, the relative attraction of Bidvest and Tiger Brands is much higher. Great business, good prospects, super management team, at the "boring end" of manufacturing (in terms of what you can and can't own)

Holy smokes. This is probably the most amazing video you will watch all day. And if you do watch something more amazing, please share with us. It is titled A First Drive and contains the prototype vehicle. The first thing people notice when they get in the little bug, that looks not too dissimilar to the Smart Car. And then the big one, no steering wheel, and no brakes. The brakes could be a bit of a problem, don't you think? Or not. The having more time with one another is important, but whether or not that time is well spent or not, that is important too. What is the point of everyone fiddling on their smart device when sitting with their backs to one another? These are still for urban and suburban spots, no speed here.

What I found really funny from this NY Times article on the vehicle: Google's Next Phase in Driverless Cars: No Brakes or Steering Wheel, was that the vehicle is required to have rear view mirrors (law in California). So nobody driving, but a set of rear view mirrors. Ha-ha!! Sometimes the law is silly, right? But at the core of invention is a great cost saving for consumers in the future. And that is why we like Google as a business so much, whilst they continue to make almost all of their money from advertising, there are many more irons in the fire. This is just one of them in which they might not necessarily be a wholesale manufacturer of motor vehicles, but they could then sell their technology onwards. I am also reminded that quality companies attract above average quality employees!

Byron beat the streets

Yesterday we received full year results from high flying retailer Mr Price. Wow, these guys deserve all the money they make. They have done fabulously well through good times and bad. Revenues increased 15.2% to R15.8bn. Headline earnings per share were up 22.4% to 715c while the dividend was increased by 21% to 482. The company has now achieved a 28 year compound annual growth in headline earnings per share of 23.4%. The share price has grown 27.1% on an annual basis since listing.

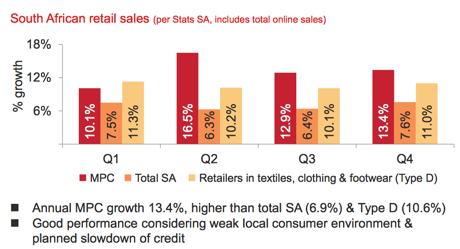

The share trades at R165, 23 times earnings at this price. Expensive yes, but do you blame the market for affording such a premium? In fact growing earnings at 22.4% puts the stock on a PEG ratio of 1. One of the main reasons for their growth this year was interestingly price increases of 9.7%. Due to the quality of their goods they are able to charge a premium and people are willing to pay it. I guess for me the below image is the kicker. Mr Price have managed to get the mix between price and quality perfectly and have therefore stolen market share. As you can see they have comfortably grown above the market.

Divisions.

The report summarises it all very well.

"The Apparel chains increased sales and other income by 17.0% to R11.4 billion and comparable sales by 11.9%. Operating profit grew by 21.7% to R2.1 billion and the operating margin increased from 18.3% to 19.1% of retail sales. Mr Price Apparel opened 24 new stores and recorded sales growth of 18.9% (comparable 13.0%) to R8.6 billion (56.4% of Group sales). Mr Price Sport recorded sales growth of 14.2% (comparable 6.5%) to R962.4 million and Miladys 7.0% (comparable 7.2%) to R1.4 billion. The Home chains increased sales and other income by 10.2% to R4.2 billion with comparable sales up by 7.3%. Operating profit rose by 20.2% to R590.6 million and the operating margin increased from 12.9% to 14.0% of retail sales. Mr Price Home increased sales by 10.5% (comparable 8.2%) to R2.9 billion and Sheet Street by 8.9% (comparable 5.4%) to R1.3 billion."

As you can see all the divisions are doing well. I find it amazing that the home division has managed to grow so nicely in a sector where the likes of JD Group, Ellerines and Lewis are really struggling. Even when you dig into the retails sales released by Stats SA you can see the sector is struggling.

Prospects are also exciting as the company plans to grow its online retail platform as well as expand stores both here and north of our borders. All in all a great set of numbers. We do however prefer Woolies in the sector, we feel the management are on a par but Woolies have further diversification with the food stuff. Their global reach is also a *nice* to have.

Michael's musings: South Africa GDP

"Real gross domestic product at market prices decreased by 0,6 per cent quarter-on-quarter, seasonally adjusted and annualised." A figure that is probably more relevant than a seasonally adjusted, annualised figure is the year on year comparison. The year on year change is 1.6%, which is hardly anything but at least it is positive.

Some of the biggest movers in the last quarter were, construction up 4.9% (a good strong number), mining down 2.5% (the strikes would have a big impact on this number), manufacturing up 2.4% and Wholesale and Retail up 2.2%. These numbers are all much lower than they need to be in order to create the jobs needed to uplift people out of the poverty trap.

Giving you a quick breakdown of our economy. The biggest sector by a significant margin is Finance, Real estate and Business services, with 22.29% of GDP. Next is General government services with 17.4% (our taxes hard at work) and then in third place we have wholesale, retail and motor trade; catering and accommodation with 16.4%. Mining comes in with 8.7% and manufacturing with 11.8%. From a jobs point of view, these are the two main sectors where large numbers of jobs are created, so not ideal numbers. The biggest sector being the finance and services sector employs fewer people, but the people they employ are skilled which doesn't help the large number of unskilled people in the country.

What does this mean for investing and share prices? The first thing to note is that the economy is not the stock market, companies share prices factor in what investors think will happen in the future not only focusing on what is happening today. The All Share then can be considered a leading indicator for what happens in the real economy. The impact on share prices happens when the actual economic performance is different from what was forecast.

Another thing to note is that all of the 10 largest companies (around two thirds of the index weight) on the JSE have significant operations all over the world, which dilutes the slow growth in the South African market. If South Africa has slow growth then these companies will allocate their capital in the countries that will have better long term growth; not good for SA but good for the shareholders.

As an investor, we need to be diversified across companies and across countries, thus lowering the risk of slow growth in one country. Once you have your diversified portfolio then back management to allocate capital where it will get the best returns.

Home again, home again, jiggety-jog. Markets have bounced off their lows. The Rand has certainly weakened in recent days, post the weekend and the cabinet announcement, but more important the weak growth has meant less excitement for local assets. And that juggling act that the Reserve Bank keep referring to. Perhaps we can say that the only respite for consumers is that interest rate hikes might stay away a little while longer.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment