To market, to market to buy a fat pig. Record setting everywhere. That is what it was like across the globe. Well, that is not entirely true, not true of many places. For instance, and this may surprise you, the Shanghai Composite Exchange (SSE) is down 63 percent from the October 2007 highs. Yes, down 63 percent since then. Astonishing. Year-to-date (YTD) that Chinese market is down 3 percent and has not enjoyed the same gains as across the globe. The Nikkei 225 is down 11.4 percent YTD, currently 14,443 points this morning as we speak/write. The intraday high there? Well, I suppose you do know about the Japanese asset price bubble from the late 1980s, so you would not be startled with the print being 38,957.44 all the way back on the 29th of December 1989. Only 25 thousand more points to go guys, looking good. Even the FTSE is not at an all time high, that index peaked at 6950.6 points on the 30th of December 1999. We are pretty close in London to reaching that all time high, the FTSE 100 closed up over half a percent yesterday to 6851.75 points. 100 points to go, to put the Great back in front of Great Britain!

The French were at an all time high on the CAC40 on Thursday by the close, the Australians find themselves (no coincidence I guess) in the same predicament as the Chinese (34.5 percent of all Australian exports in Q2 2013 went to China alone) with regards to commodity prices and the link to infrastructural development, the all time high on the ASX 200 was October of 2007. The Aussie index is down 18.6 percent from their all time highs. So, the all time highs that we saw for the Dow Jones, the S&P 500 and even the Jozi all share index were not really shared by many places around the world, but at the same time some geographies and their respective indices are close enough. The S&P 500 is closing in on that 1900 level, currently 1896.65, whilst the Dow Jones Industrial Average ended the session at 16695, a little lower than the 16704.84 print earlier in the day. Down here in Jozi we closed at a record high, as well as touching a record high during the day. For the record the number printed was 49239. Fifty thousand will have a nice ring to it when it comes.

Not all is however hunky-dory (the origin of the phrase is not quite clear, some time around the American Civil War) in the world, the Ukrainian crisis, informal referendums and clashes still mean that the situation is dire. Ditto in Thailand, admittedly with a lot less bloodshed. The "West" as we know it wants to impose more sanctions on Russia. The fellows from Boko Haram want to swap prisoners for the school girls that are missing, which means that they are all able to be located and swapped, so that is very good news, a smidgen of good news I guess. Also on the front of good news is that the elections in India are almost done and dusted, the BJP (Bharatiya Janata Party) are expected to win the Indian elections, the market there likes that. In fact the market over on that side of the world is up 6 percent over the last four and a half sessions. Good. Now if only "my" (and Michael's) team over in the IPL would do a little better, that would be good. Hear us Virat Kohli and AB de Villiers? Yes, we are RCB fans.

There is always going to be bad news around, leading you to be hesitant to invest in the equities market, because "things" are too risky and therefore it is too hard to call a cycle or an entry point into the market. Remember riots in Greece in the middle of 2011? Remember the wrangling around the debt ceiling, the US debt downgrade and the Fiscal cliff? Remember the sequestration? Cyprus? Syria? And now the Ukraine? These are all events, there are many more that were significantly worse, the financial crisis of 2008/2009 was not exactly fun. Those were dark days for the equities market, but it turns out that the best thing to have done would have been nothing at all. And that is how we positioned ourselves in the crisis. By encouraging clients to "hold the line", so to speak. It probably felt like getting ready to pick up those long poles with the English army rushing at you. Of course presuming that you are Scottish and that William Wallace is shouting at you, to hold. Yech, bad analogy, sorry.

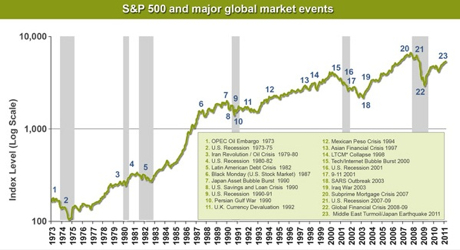

Anyhow, here is an old chart that I asked Paul to dredge up, you can put this alongside a keep calm and carry on sign. This is an extension of the events that could force you to never invest in the equities market, because "things" are going to be so bad. Well, forgive me for being rude here, but listening to that sort of scare mongering over and over and taking it as advice can be more costly than doing nothing. Check, this graph is from Fidelity and includes all the major market moving events over a forty year period. Which should more or less be a good time to invest in equity markets. All of the time is a good time.

Rather, the best thing to do is to have a plan, stick to it. Remind yourself that you own businesses and not an index or a share price. Businesses will always find a way, notwithstanding the powers that be that make it hard to operate, somehow thinking that stakeholders are more important than the people who own the business and take the risks, the shareholders. Do you remember how the taper from the US Federal Reserve was going to lead to a market contraction on a massive scale and the Fed were going to be forced to restart their bond buying program at double the pace? There were lots of people who talk openly with authority that this or that is going to happen, remember that almost always there is an agenda attached to that. If someone tells you that Naspers is wildly overvalued it may be that they never owned it, or sold it 600 Rand ago. Everyone has an agenda and puts theirs forward on powerful platforms (Twitter, the Internet and of course the Television), do not forget that.

Home again, home again, jiggety-jog. Markets are lower, the Rand is stronger, that is somewhat of a drag on the markets. But you know what, this is excellent news for the inflation outlook and that is why the banks and the retailers have been moving higher in recent days.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment