To market, to market to buy a fat pig. Friday was not a great day for the local markets, the strengthening Rand was putting a lid on some of the industrial stocks that have of course dominated over the last couple of years. You would have heard many value investor types point to this specific bunch of stocks, Richemont, Naspers, SABMiller and British America Tobacco as being completely overvalued and therefore they (the value crowd) were not buyers. I like to look at it a little differently. For instance, we may not own SABMiller across our client portfolios, but I can understand the rationale for people paying up for the business. There are very few (if any) public companies, listed in a jurisdiction like the UK, which have emerging market consumer exposure on that scale as SABMiller has. It is single handedly one of the few investments of its type, emerging market consumers across the globe, with well established consumer businesses in developed markets.

So whilst volume growth has been pedestrian (I mean how much can you grow beer volumes?), earnings have been pretty strong as the management of this business have worked hard to reduce costs. Still, on a forward multiple of close to 23 times earnings, it seems closer to a fair price than a steal. Expect growth to be a more muted lower double digit, from an earnings point of view, which translates to a PEG ratio forward (price to earnings divided by growth) of somewhere around 1.7, which is not considered cheap at all.

So whilst one would not mind paying that sort of PEG ratio for a company that could grow by 20 percent per annum for two years, paying that for a business only growing by between 10-12 percent seems excessive. But then you are presuming that the rest of the market is dumb, and that is both arrogant and smug. And often the two go hand in hand. As they say in our broader industry, past performance does reflect future results.

But the point is that SABMiller finds themselves in a fairly unique situation in being a global (and more to the point, developing) consumer business investable in a developed market, there are few comparisons. Nestle is perhaps another good example, the market affords the Swiss food giant roughly the same valuation. 22 times earnings. Richemont trades at 19 times earnings. Of course using simple PEG and PE ratios do not tell all of the story, they never do. Return on equity, working capital, quick ratio, debt-to-equity, price to book or just plain old bottom line, they all give you an indication of the financial health of the business.

And trying to predict future sales and current managements ability to work the assets harder and/or smarter, that is a tough business in itself. Trying to predict what future sales are going to be based on the specific consumer companies is very hard. I can imagine that some very complex models can have one input change and everything can go wrong. I am not dismissing the excellent work, do not get me wrong, those are amongst some of the very smartest people in our industry, but sometimes keeping it simpler can be better. Industrials as a collective, and these aforementioned heavyweight stocks (add Aspen for a fiver) have only managed to add 1.5 percent this year, and have lagged the overall index which is up 6.1 percent year to date. 132 days into the year chaps, it has been hard work.

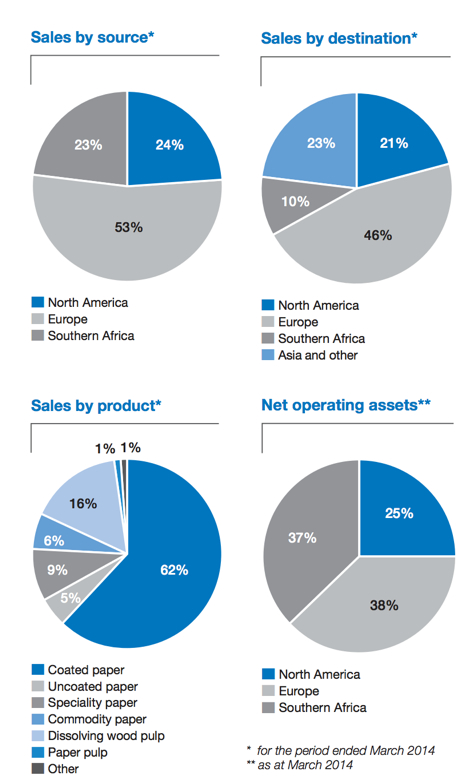

Results from Sappi this morning, this is for their second quarter of their financial year. Now forgive me here for a second, this is definitely not a favourite of ours, at all. This is their best quarter since Q4 2012. I think that the reason for not liking this business (there is no unlike on Facebook, only on YouTube) are very evident on this breakdown of their sales by geography and product.

Quite simply, this is a company that sells 67 percent of their products in Europe and North America and of the total products sold, 62 percent of it is in coated paper. Which in case you needed a reminder, from the presentation: coated fine papers used by printers, publishers and corporate end-users in the production of books, brochures, magazines, catalogues, direct mail and many other print applications. What? The most exciting part of the Sappi business is the dissolving wood pulp part of their business, or cellulose, which is 16 percent of their business by sales.

In case you were wondering what the cellulose was used for, in part the clothing industry. You know, when you look at the tag and it says that this garment was made with synthetic fibres, rather than wool or cotton, this is where it comes from. Or one of the places. And Sappi are the biggest in the world (16 percent), but as far as I can understand it from a Sappi Investor Presentation September 2013, this is a very fragmented market with almost 50 percent more production being added over the next four years. The same presentation points out that cotton has many more preservatives than trees. Cotton however can grow from the same plant next year, and the year after. Not many years, it is a bit hard to find out, but it looks like 6 odd years. If you chop down trees, it takes a while to grow back. Not that costly as you may think.

But if I wanted to be in the business of owning an extension of a clothing business and a demographics growth business, then it certainly would not be Sappi. Coupled with the unattractive outlook for what is their biggest business still (Tablets, reading devices and phones get more of our airtime nowadays), I would continue to avoid. The people that see deep value here (or did see deep value), they can keep it. The market seems to like it, Sappi is trading at a price last seen in the middle of 2011, 36.60 ZAR. The ten year high was back in the middle of 2007, when the stock was above 138 ZAR, over 100 Rand more. Sappi unfortunately has a creaking debt problem, with 2.248 billion Dollars (23 billion plus Rand), that is bigger than their market cap of 19.2 billion Rand, at last close. Eish, that is heavy.

Byron beats the streets:

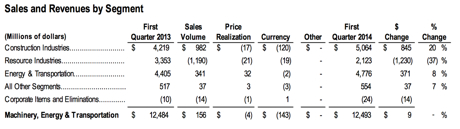

Continuing with our catch up of the US earnings season I am covering Caterpillars first quarter 2014 earnings release from a few weeks back. Sales came in at $13.24 bn which was flat on the comparable period. Per share earnings however came in at $1.44 compared to $1.31 from last year. Although sales are flat, within the company and amongst its divisions we have seen big changes. Take a look at the table below.

As you can see, Construction has leaped 20% while resource industries have fallen 37%. Energy and transport has been stable and was actually the biggest profit driver for the period with 43.5%. Construction contributed 36% while resources was only 7,8% for this quarter. In 2013 for Q1 Construction contributed 15.4% to profits while resources contributed 31%. It really is all over the place.

Expectations for the full year is for the company to make $6.51. The share trades at $105 or 16 times this years earnings. The company is expected to grow earnings by 8% to $7,03 in 2016 thanks mostly to cost cutting and less Research and Development spend. Most of the commentary is stating stronger construction demand as Europe and the US recover. The miners however are consolidating and holding back on their capital expenditure. This is of course not good for Caterpillar.

It is certainly useful to read their outlook for the overall economy. These guys operate on the ground floor and will know better than most what it is like out there. Here is what they had to say about 2014 which certainly seems cautiously positive.

"Overall, our expectation for world economic growth in 2014 has changed little from the outlook we provided with our 2013 year-end financial release in January of 2014. We anticipate global economic growth in 2014 of about 3 percent, up from about 2 percent in 2013. Economic indicators that signalled improvement in global economic conditions during the last half of 2013 continued to indicate improvement during the first quarter of 2014. Interest rates are at record lows in many countries, and low inflation coupled with elevated unemployment should cause most central banks to keep interest rates low throughout 2014.

Despite recent softness in some commodity prices, improvement in the world economy should increase demand for mined commodities and energy, keeping commodity prices at levels that are profitable for production. As a result, we expect mine production will continue to increase in 2014. While most commodity prices should be high enough to make investments attractive, we expect mining companies will remain cautious with equipment investments, and we expect continued decreases in mining capital expenditures for equipment in 2014."

My biggest concern with this business is the cyclicality of it all. Have a look at those profit swings within their divisions which I mentioned earlier. Fortunately their diversification stabilised the overall results but it doesn’t always happen that way. The lag in decision making by big business when times are either good or bad is extremely reliant on confidence. This may not be investment grade for most. You certainly need a strong stomach. We approach this one with caution.

Home again, home again, jiggety-jog. Markets are higher, US futures are higher, even the Dow Jones Industrial average touched a record high on Thursday and on Friday it registered a closing high. Cool beans, we continue to stay long here.

Sasha Naryshkine, Byron Lotter and Michael TreherneEmail usFollow Sasha, Byron and Michael on Twitter 011 022 5440

No comments:

Post a Comment