Our overall market fell yesterday, stocks slid from their record highs, down just over four-tenths of a percent with financials and in particular banks leading us lower. African Bank released another awful trading update and I have seen folks suggest that there may have to be another round of raising money from their shareholders, who have certainly changed in their makeup. Heavily made up by some institutional types who have been loading up as either the shorts or smaller shareholders bail on what looks like the perfect storm. The irony is that interest rates have been relatively unchanged through this time, the shocks would have been worse in an environment where the consumer would be seriously compromised. Local PMI bucked the global trend and sank to the lowest levels since July of 2011, the Kagiso PMI coming in at 47.4 points. To read the whole report, download it -> Kagiso PURCHASING MANAGERS' INDEXTM (PMITM).

We continue to hear that the consumer is under pressure (I should have put that in inverted commas), but both casual dining companies Famous Brands and Taste Holdings released trading updates that seemed really good. Famous Brands said that they expect "to report headline earnings per share (HEPS) and earnings per share (EPS) (calculated on an IFRS basis) of between 402 cents per share and 410 cents per share. This is an improvement on the prior year comparable HEPS and EPS of between 19% and 21%. The group also expects to report diluted HEPS and diluted EPS of between 401 cents per share and 409 cents per share, an improvement of between 20% and 22%." The share price added over a percent to close at 108 Rand a share. Results are in two weeks time, EPS are expected to then be somewhere in the region of 482 cents, at 108 ZAR the stock trades on a 22.3 multiple, but growing at that rate means that the PEG ratio is around 1.1 times. You would prefer that to be under or closer to one, but still, the company continues to grow in this fast growing part of the economy.

Taste Holdings had a similar range: "A review of the financial results for the year ended 28 February 2014 by management has indicated that the earnings per share and the headline earnings per share are expected to be between 17% and 23% higher, compared to the earnings per share of 12.8 cents and the headline earnings per share of 13.3 cents for the year ended 28 February 2013." The stock trades at 380 cents, down 10 cents yesterday. With EPS expected at 15.4 cents in the middle for the range, Taste trades on a historical 24.7 multiple and a PEG of 1.23 times. Those are often used to see if these companies are just expensive, but what matters most are their prospects from here if you are considering buying them (Famous Brands too). Let us be clear, we think that the sector, casual dining is a fabulous investment in emerging markets. It is part of the broader aspirational consumerism theme that we like.

Taste of course have recently announced that they have have signed an exclusive 30 year Master Franchise agreement with Domino's Pizza. The existing Scooters and St. Elmo's stores will be converted. As at 31 May 2013 (a year ago), there were 132 Scooters and 26 St. Elmo's stores, I presume that there are more now. But that already gives the brand here locally a major presence. I have no doubt that Taste are going to grow aggressively off admittedly a much lower base than Famous Brands.

Both these businesses have energetic management teams who are invested in their respective businesses, and as such have as much to gain as you. Darren Hele is a new appointment as CEO (Kevin Hedderwick is now Group CEO) and is a young fellow, by running listed business standards. He is 41 years old according to Bloomberg. Carlo Gonzaga, the Taste CEO is only 39 according to Bloomberg and has been at the business since the beginning in 2000. He is energetic and entrepreneurial in nature, everything you want when investing in a smaller business, relative of course. Both these businesses have experienced rapid growth over the last decade and will continue to do better as the middle income segment across the continent grows, outpacing global middle income growth. Soft luxury, very good.

OK, sorry, we have been backed up here with too many off days and too many results to cover properly at the same time. We had Q1 2014 numbers from JNJ on the 24th of April, which in trading terms is so far back that you cannot remember. Q1 sales when measured against the comparable quarter were 3.5 percent better at 18.1 billion Dollars, net earnings at 4.7 billion Dollars and EPS clocked 1.64 Dollars. The dividend had a few days prior been hiked by 6.1 percent to 70 cents a quarter. That is 2.80 Dollars a year, which means that at 100 odd Dollars the yield is easy enough to work out, not so? Earnings guidance for the rest of the year is in the range of 5.80 to 5.90, which means in the middle of the range the stock trades on a forward multiple of 17.1 times, with a yield of 2.8 percent. The earnings growth for the year is expected to be somewhere in the region of 11.8 percent. Relative to their peers, the company is afforded about the same rating.

The difference between JNJ and their "peers" as it were is that they are probably not an out and out pharma company, neither are they a consumer business. Nor are they a devices and diagnostics business. They are all of those things. In fact, in the last annual report the sales breakdown is 39 percent pharma, 40 percent devices and diagnostics and the balance, 21 percent is their consumer division. The acquisition of the business Synthes, an orthopaedics business has boosted the sales of the devices division specifically.

As Byron says, sometimes you need to have a pharma background to get to know these businesses intimately and understand specifically their pharma products, as well as an orthopaedics background to get a fair understanding of their devices and diagnostics business. The consumer businesses are a little easier, everyone can understand baby products (no more tears!), their skin and hair care products (Clean & Clear, Neutrogena to Piz Buin) as well as Listerine through to Band Aids, more commonly known as plasters around here. Throw in Acuvue and Visine, the shorter sighted folks would definitely know those ones! Easy enough to understand, right?

Without getting to know the blockbuster drugs (personally or reading reams of information) and in order to appreciate why 25 percent of sales are from new product releases inside of the last five years, you need to look at the Research and Development annual spend. Last year it was 8.147 billion Dollars on an annual revenue number of 71.312 billion Dollars. The year prior to that, in 2012, the company spent 7.665 billion Dollars on R&D on a revenue number of 67.224 billion. On both occasions R&D spend is approximately 11.4 percent of annual revenue. This will continue, and has to continue in order for the business to produce the NEXT blockbuster ahead of what is a very tough and competitive space.

But the margins are good, both in their core business and their newer businesses and having diversified more (Synthes), shareholders can expect more stable returns. Is this an exciting business however? Apart from a potential value unlock, with one or two parts of the business being floated (with the Merck announcement of them selling their consumer business to Bayer, it becomes increasingly likely that JNJ will consider doing the same) separately it remains a core part of a theme which we really like, healthcare. We continue to accumulate a great quality business.

Byron beats the streets: GE results

A couple of weeks back we had results from GE which I've only had time to cover now. Fortunately we are long term investors so short term swings to things like results releases are not important to us. The actual numbers however are so lets take at look at GE's first quarter of 2014.

Operating earnings came in at $3.3bn which was down 18% from Q1 2013. This is because there were a few once off sales last year as well as some effects from the bad weather in the the first period of the year. Revenues came in at $34bn which was down 2%. This equated to EPS of $0.33 which beat expectations by 1 cent. Expectations for the full year are for $1.70 and $1.80 for 2015. The stock trades at $26.58 or 15.6 times 2014 earnings. Growing earnings at 6% I'd say that is a fair price. Earnings growth is expected to accelerate to 8.3% in 2016.

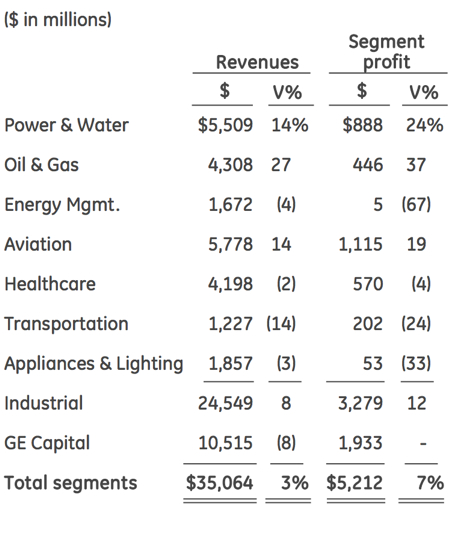

As you can imagine the business is complicated, this table says a thousand words and breaks down the divisional Revenues and profits.

Aviation had a really good quarter and is a very profitable business. Earnings are quite choppy though because it is driven by big once off orders. Capital is the most profitable division but also carries the most risk. Talks are that this is going to separately list but ideally would be sold to another Bank. It would probably attract a price tag of $100bn with those sort of profits so that will narrow down potential buyers to the fingers on my one hand.

So why invest in GE? All the sectors they operate in have bright futures. Power and Water is crucial as both become scarce in a growing global economy. Oil, Gas and energy management fall in the same category. Aviation will grow as more people enter the middle class and are able to travel. This is happening as we speak. Air France has ordered $1.7bn worth of GE engines for the the 37 Boeing 787 Dreamliners they have bought.

Transportation falls in the same category as developing nations require these services as they develop. In fact Transnet get a direct mention in the results report for the 233 Advanced Evolution Series locomotives they have ordered worth $0.7bn. A direct example of a developing nation using GE to help grow their infrastructure. Healthcare as you know is a great theme to be invested in with still so much room for improvement.

If you are still not convinced explore the GE YouTube account and see what they are up to. Here is an example from their Healthcare division to prevent queues in hospitals, a YouTube clip titled Eureka Place - Imagining A Hospital With No Waiting Rooms - GE. They are exploring better alternatives and products in all the essential services and finished goods they sell. We continue to buy the story and it remains a core holding in our portfolio.

Michael's musings: Cash and recalls

One of our favourite sectors is the healthcare industry. As global wealth rises so should the amount spent on healthcare, the one thing that can make us live longer and more comfortable. Added to this trend are the ageing baby boomers, who are getting to the age where they require more healthcare.

J&J is one of our favourite stocks in this sector as is Stryker. Stryker are a relatively small company with a market cap of $29.5 billion compared to J&Js $283 billion, they (Stryker) operate in over 100 countries, South Africa included. Their three main divisions are Reconstruction, Medical Surgery and lastly Neurotech & Spine (one of their products is a spinal implant, I didn't know that we could do this yet!).

On to the results, their EPS were down 77% to 18c per share, due to earnings dropping to $70 million from $304 million in the previous comparable period. The reason for the huge drop in earnings is due to the recall of some of their products. The one product being recalled is their replacement hips which started to corrode, not ideal having a corroding hip inside of you! As you can imagine it is very costly having a recall on hips because the cost of the recall includes having a surgery to change hips. Another of their products is a waste management system, from what I understand it is like the suction devise used by dentists except this one is larger and used during surgeries. Both these recalls started in 2012, so they are not unexpected, they are costly though in terms of impact on earnings and reputation damage.

Removing the cost of the call backs, adjusted earnings come in at $1.06 down from $1.09. The lower earnings are due to non-operational expenses and increased shares through options granted. Even though earnings went sideways revenue was up 5.3% to $2.31 billion.

So onto the reasons why we like the stock. The company has a new CEO who has shuffled the management team a bit, which I hope eradicates another product recall. In the health industry when you lose the confidence of your customer it is very hard to get it back, people don't want to take chances with their health. Stryker have been on an acquisition spree to add to their product range and offering. According to one market analyst healthcare providers are starting to reduce the number of supply vendors to get better prices on their bulk purchases, so for Stryker being able to offer a number of products is advantageous.

Stryker have also increased their R&D spend by 16%, which according to my calculations puts the total spend at over half a billion dollars. Being relevant and innovating is key to future growth.

The company generates a large amount of cash, with the current figure sitting at $4 billion (13.5% of current market cap) and they are expected to generate an additional $1.4 billion over the 2014 financial year. All the cash allows them to fund their R&D, further acquisitions and from an earnings perspective further share buy backs. There are still $700 million dollars' worth of share buy backs pending.

Stryker are a global company in an industry that will see significant growth in the coming years. So it is where you want to be, the only worry for me is that there might be another run in with the regulators resulting in more recalls. This is a small risk and not enough to rule out the stock, they are in the correct sector and generate strong cash, so are a strong contender to be one of your health care stocks.

Home again, home again, jiggety-jog. Markets are mixed, almost flat in fact. A bit of news here and there, European services PMI data at nearly a three year high. Sorry? Where are those people who said that the Euro are/region was going to the dogs? I miss those people.

Sasha Naryshkine, Byron Lotter and Michael TreherneEmail usFollow Sasha, Byron and Michael on Twitter 011 022 5440

No comments:

Post a Comment