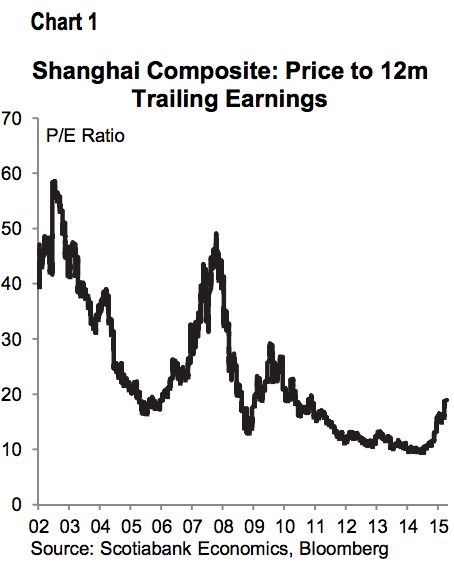

"Was the spike in Chinese prices warranted? I think some jump was, given that Chinese stocks have been considered cheap for a very long time and this is for a country that is considered the growth engine of the world. Have a look at the P/E ratio going back to 2002, it shows that a price increase in Chinese stocks was warranted."

To market to market to buy a fat pig. The headlines in major business media is still on Greece and China with a bit of Janet Yellen and Donald Trump thrown in for flavour. In our fast paced society I am now ready for the next 'big thing' and the markets seem to agree. Markets opened deep in the red yesterday and slowly moved higher as people shifted their focus away from the problems in Greece. I think this video is the best summary of how things in Greece have reached this stage - One Minute Greek Debt Crisis. It is implied that austerity has been part of the problem, I don't agree. Bringing spending inline with what you can afford is always going to hurt and defiantly has resulted in less spending but the alternative is to keep spending more than you can afford. At which point you have either grown fast enough so that the debt is not a problem or the more likely outcome, you implement austerity when your debt burden is even higher.

These are some very interesting Tweets from Simon Nixon, the Chief European Commentator for the WSJ, where is is comparing Greece from before Syriza (who came into power in January) to now.

There is an emergency European meeting today on Greece, so we will have a better idea of the path going forward when we wake up tomorrow. For now things are still in limbo and the Greek banks are still closed.

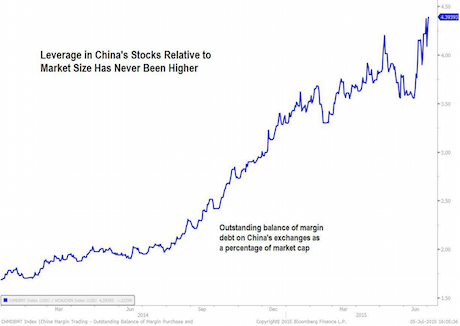

This Bloomberg graph caught my attention, China's Stock Plunge Leaves Market More Leveraged Than Ever.

That is where the current problem lies, too much debt too quickly going into a finite quantity of stocks, leads to prices going skyward. It is great to say that margin debt has climbed really quickly and now sits at 4.4% of the market cap of Chinese exchanges but what is it in comparison to the US? The margin debt on the NYSE is sitting at just below $500 billion (Margin debt) on a market cap of around $ 20.37 trillion (Market Capitalization) which works out to margin debt of 2.45%, so substantially lower than that of the Chinese market.

Was the spike in Chinese prices warranted? I think some jump was, given that Chinese stocks have been considered cheap for a very long time and this is for a country that is considered the growth engine of the world. Have a look at the P/E ratio going back to 2002, it shows that a price increase in Chinese stocks was warranted.

Like anything where human emotion is involved the market over corrected, this time to the expensive side. Now add in a dose of fear, people's life savings, people gambling, people taking stock tips from hair dressers (How Chinese Stocks Fell to Earth: 'My Hairdresser Said It Was a Bull Market') and a whole bunch of government intervention; the result is the very volatile market.

I think that there will be a number of people who have burn their fingers who are going to cut losses and never put another cent in the market again. It will probably help cut the margin numbers but the down side is some people will never invest in equity again which is a big part of building long term wealth.

Company Corner

It has taken longer than expected for the Bhp Billiton Plc - Demerger Of South32 Completion Of The Sale Facility to happen. On Friday you will receive the cash for your share of the South 32 spin off. The value per share will be R 19.38 which is about the average price since the shares listed 2 months ago and is much higher than the current R16.50 that the shares are trading at.

Linkfest, lap it up

There hasn't been a major leap in transportation since arguably the 747 which was launched in the 1960's. The Hyperloop if it gets into mass transport will probably be the next leap - The Hyperloop is much closer than people realize.

Black Friday is a huge day for retailers. Amazon are having what they call 'Prime Day' next week Wednesday for their 20th Birthday, were all Prime members will get more specials than those offered on Black Friday! - Amazon thinks it can beat Black Friday with 'Prime Day'. This will be a drive to get more people as Prime members, who stats have shown spend multiples more on Amazon than those who are not Prime members. The numbers from their sale will be very interesting to see.

Scooters are a cheap way to get around, I would only ride one if it was the main form of transport in a given city. On South African roads, bikes and scooters are rare and cars aren't very aware of them - These IIT graduates have built an electric scooter that charges faster than your phone.

Home again, home again, jiggety-jog. Markets are slightly down today, ours is down 0.5%. Gold shares have bucked the trend today up 1.5%. The R/$ has weakened trading between the R/$ 12.45 and R/$ 12.50 levels. We will probably have more pointed market movements tomorrow after there is more clarity of which direction the Greek talks are going to head.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment