"In ordinary trade, i.e. in the spot market that is open from 08:30 to 16:00 in New York, the Google stock price (ticker GOOGL) rose three percent to crest 600. After hours the market saw something they liked a lot, I suppose we could call it the Ruth Porat effect. The stock is up 12 percent plus post the market, 675 Dollars. That means, should these gains hold, Google would have finally performed inline with the rest of the NASDAQ and finally we can say that the company (and the stock) is 'doing well'."

To market to market to buy a fat pig. The Greece afterglow, the Janet Yellen I am going slowly, in a year and a half time we will have something new to talk about. Mind you, from what I have read, market participants are always anxious about where the Fed are going next. To be clear, that falls in the category of things that we have absolutely no control over and as such should spend more time obsessing over company earnings and company potential. And reading annual reports. Rather than obsessions over stuff you have no control over. Try to see current trends and predict where consumers are going to spend, where companies are likely to develop life changing technologies and services that will be readily adopted.

Rather than worrying what it is that Janet Yellen and the Federal Open Market Committee (The FOMC meet and discuss interest rates) are thinking and interpreting which word belongs where in a committee statement. Spend less time caring about what other people care about interest rates. That should be your investing mantra. If you were worried about something currently making headlines that could scupper market rallies, you would never part with a cent, thus confining yourself to a lifetime of average returns. And cash returns after tax are lower than inflation. I am not suggesting throw caution to the wind, I am advocating buying (and by definition owning) quality companies. That matters.

After all was said and done and interpreted in a second day of testimony on the hill by Janet Yellen. Low level questions that could be easily answered if the person asking the question did not have a political agenda. And surely they could email her the questions, she could answer them long before a deadline. I am of the opinion that her time is better spent elsewhere and not answering to self important people looking to score political points. By the end of the session stocks were up, the S&P 500 now only 10 points (one good day) away from the all time highs. So much for all those worries a few weeks back.

Company corner

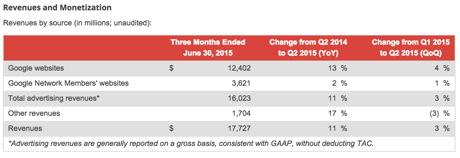

Google has been a serious laggard, in terms of their price performance relative to the market. As I speak to many people about companies it is human nature for us to look at share price performance and translate that to internal company dynamics and quite quickly come to the conclusion that Google "is not doing that well", we are ALL guilty of that. Don't beat yourself up, we all do it. Revenue growth of 11 percent year over year (when measured against Q2 last year), serious currency headwinds in there, constant currency revenue growth was 18 percent. 17.7 billion Dollars in revenues for the quarter is pretty impressive, currency impact was a whopping 1.6 billion Dollars, with the benefit of modest hedging that was reduced to 1.1 billion Dollars. GAAP diluted EPS clocked 4.88 on GAAP net income of 3.351 billion Dollars. 9 out of every 10 Dollars are still from advertising, check out the revenue breakdown:

What the market liked the most however about these results were cost controls. In March this year we wrote about Google's new CFO, who was heading back to her San Francisco roots after an extended Wall Street stint (quarter of a century plus) at Morgan Stanley. She has immediately been credited with this success, Wall Street's estimate concerns on costs getting a little hot have been addressed.

Not that it is the job for Ruth Porat (Google CFO) to pander to the earnings needs of Wall Street analysts, rather her job is to keep spending at the correct levels. Again this represents a certain maturity of Google, whilst there is still a company encouragement of free thinking to maintain the entrepreneurial spirit, it become harder when you reach the size of 70 billion Dollars of annual revenues, with your 57,100 employees at quarter end. Notwithstanding the large workforce, Google still ranks as the best place to work in the USA, Canada and Japan, courtesy of the publication Fortune. And they continue to hire, the number of Googlers increased by 18 percent over the last year.

The company continues to "win" in mobile and in particular with YouTube. The purchase of the video website an age ago is just starting to take off, according to Porat on the conference call: "Growth in watch time on YouTube has accelerated and is now up over 60% year-over-year, the fastest growth rate we've seen in two years. Mobile watch time has more than doubled from a year ago." Who would have thought that people like to watch moving pictures on their smartphones?

As with many technology companies, there is possibly too much cash on hand, 70 billion cash and cash equivalents (58 percent outside of the USA), this amount is approximately 19 percent of the closing market capitalisation. This will be deployed properly to sustain their core search business (they spent 2.5 billion Dollars in the quarter, mostly on data centre construction and for production equipment), as well as their newer and possibly bigger revenue generators of the future, Nest, Fiber and Google Life Sciences.

Nest is a set of smart home products, thermostats, smoke and carbon monoxide alarms, as well as camera monitoring. Hardware. Google Fiber, I want it, 1000 Mbps, Google TV and all that, hardware again. Google Life Sciences, that is a little more secretive. Competing with big pharma, using technology, there are many competing firms in this space. The reason why we own Google is that they are one of the very few companies that are constantly trying to find extra businesses that will benefit humankind, you have to admire that.

In ordinary trade, i.e. in the spot market that is open from 08:30 to 16:00 in New York, the Google stock price (ticker GOOGL) rose three percent to crest 600. After hours the market saw something they liked a lot, I suppose we could call it the Ruth Porat effect. The stock is up 12 percent plus post the market, 675 Dollars. That means, should these gains hold, Google would have finally performed inline with the rest of the NASDAQ and finally we can say that the company (and the stock) is "doing well". Patience and owning great companies, with rosy futures, are rewarded in time. Should the stock open around these levels, it will be a comfortable all time high. More significantly, Google has been a ten bagger since listing. We continue to hold and buy this transformative company.

Thanks for your input, we always appreciate it. I stand to be corrected, all the way from the second largest country on the planet, Canada (you knew that, yet you are still surprised) comes our old friend who tells me that I have it wrong on Carl Icahn. I said that Icahn was nuts yesterday. Perhaps I meant to say his manner comes across as nuts as he is one of those rare people who speak their mind, no matter what the situation. Most people are uncomfortable with that abrasive style, perhaps I am one of those. Seeing as Larry Fink was sitting right next to him whilst he was articulating that he thought they would hit a "black rock" after falling off a cliff (Fink runs investment firm Blackrock), I can't see anyone else able to do the same. Perhaps with age and experience comes two things, one, the ability to not care what others think what you say and two, to actually have the confidence to say it.

Herewith our good friend from Canada telling me Icahn is a top chap:

"if I may disagree, I think Carl Icahn is anything but nuts. And he reportedly has accumulated a net worth of $25bn through Stock market activities only. His point to Larry Fink about the potential illiquidity of the high yield bond market when everybody wants to exit at the same time is very valid. Exactly what happened in 2008. When everybody wants to sell his bond ETF (or any ETF) at the same time and ishares cannot sell the underlying instruments, what then? Will the Fed buy up those unwanted bonds. Probably not. Result - turmoil as in 2008. Carl Icahn is actually in my opinion a deep thinker and very astute and observant."

As this is an opinion piece, I encourage everyone to disagree with me if they think I am wrong, collective thinking makes us all the wiser. Valid observations, perhaps as I said earlier, Icahn is abrasive, I should not have used the word nuts. Sorry. In my box on this score. BTW I have read the Icahn autobiography an age ago, his street fighter approach may be a long way away from the finesse of fellow activist Bill Ackman, their end goals are the same, to make money for their investors. And themselves.

Linkfest, lap it up

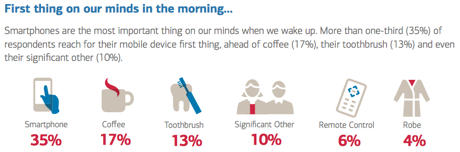

Looking forward to heightened conversation with members of your family or friends? Sorry. According to a Bank of America we are using our phones more and more. In short, we are addicted to our smartphones says this report: Trends in Consumer Mobility. This image made me LOL. Not really out loud, in my head, that is the way we LOL. Get, it, that is the way we roll? Nope? Take the next two days off then.

Moore's law basically says that computing power will double every 2 years. When you think about how powerful that compound growth is, it blows my mind! Imagine if stock prices doubled every second year, going back to the 1960s - Moore's Law stutters as Intel's tick-tock skips a beatThe link also has a video of Mr Moore himself talking about how he didn't think his observation would become a 'law' and how he didn't imagine it would still be relevant today.

What does technology mean for jobs, education and society in general? This short paper from The Hamilton Project has a look at what they think the future will hold - The Future of Work in the Age of the Machine - A Hamilton Project Framing Paper.

One fear that many people have is that technology lessons the number of people needed in certain industries, which will then lead to rising unemployment. History has shown that, that has not been the case as technology has been introduced. "For example, between 1900 and 2000, the proportion of the U.S. workforce in agriculture fell from 41 percent to 2 percent, yet agricultural output rose dramatically and there was no long-term increase in the unemployment rate, even as a greater proportion of the population participated in the labor force".

Another example used is that of Henry Ford's production line. It lowered the number of workers needed to produce a car but it made cars cheaper, so more people could afford cars, more cars meant that there was a demand for car service centres, creating jobs. It also meant that more people could travel longer distances at cheaper rates, creating a boost for tourism. Also cheaper transport means that people then have more money in their budget to spend on other things, creating more jobs in retail.

Going forward computers will continue to replace more routine and non-intuitive jobs. High skilled workers and those who are creating new things or ideas will receive high wages. The story for unskilled people is bleak though, as more technology is introduced more unskilled people will be displaced resulting in the value of unskilled labour to drop. The point that is made in the article is that the education system has not kept pace with the skills needed in the working world, which is part of the reason for growing inequality in society. Spending 12 years in school is already a large opportunity cost and for poorer families the cost of further studies is then very high. So 12 years of schooling to get skills that are not relevant to the working world, means that only those who can study further (pay the opportunity cost and the fees) get to the skilled level where they can get the high paying jobs.

Home again, home again, jiggety-jog. Stocks are up marginally. News on the wires is that the German Finance minister, Wolfgang Schauble wanted Greece out of the Euro area. He was that tired of it all, suggesting that an exit from the region would allow debt forgiveness, which at the moment is not possible under the Euro rules. i.e. One country borrowing form their brothers and sisters inside of the currency union cannot get debt relief. From the IMF and others, that is possible, which is why the private bondholders took deep haircuts last time around. The rules say not from others, that leads to deeper distrust, right?

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment