"As is the case with many mid cap listed businesses, there are very few shareholders that Curro will have to talk to. There is a total of 83 shareholders that hold 75.4 percent of the shares, we have identified three shareholders who control 45 percent of the business, together with the founder, just over 50 percent. Remembering that Curro need not get it all, they are offering smaller shareholders cash."

To market to market to buy a fat pig. Wow. I thought that the BHP Billiton production report was decent enough, sadly the commodity rout continued across our market, as a collective the stocks sold off nearly four percent. Perhaps the "all emerging markets with commodities exposure" sell button was hit. And from there we were down, and heavily, the Jozi all share index fell 999 points. That is a loss of 1.75 percent on the day. What to do? Nothing.

Locally there was an inflation read that suggested that perhaps a rate hike today is the wrong thing to do, in particular as food inflation is moderating, what do I know however? I am just a stocks guy, the powers that be must set interest rates and normal people must deal with the repercussions of higher borrowing costs relative to their income. There always will be an obsession with interest rates and that is for both savers and indebted folks at exactly the same time, a move one way or the other. There are relatively few mortgages in South Africa, relative to the population, there is however a lot of short term debt that is being serviced at high interest rates.

On the other side of the world, stocks clawed their way off the worst levels, whilst Apple lagged the market badly (down 4 and one quarter percent by the close), Boeing, which is a big Dow component had a sterling day, up over a percent relative to blue chips down one-third of a percent. We continue to see earnings top expectations, there has been a view that expectations have been set too low. I for one do not think that equity markets are too hot, we could be accused of being too optimistic all of the time. Wall Street and financials services businesses have been shrinking their respective workforces for more than half a decade since the financial crisis and it looks like that is going to continue.

Pick yourself as an analyst/strategist in an environment where your pals are being handed pink slips, the bonus pools are shrinking and regulation is making it harder to get ahead, your reality is different from those people in Silicon Valley who are changing the technological landscape forever with newer inventions, better products, pushing technological boundaries. Someone who tells you that things are terrible may find it very hard to separate their lived reality relative to the rest of the country, or pockets of brilliance and change.

In this regard I am lucky. I have a job that I really like and each and every day is completely different from the one prior and tomorrow will be different from today. I have never seen the market close completely flat, the days differ from one another. It does not however mean that you do not try and do the same things over and over again, and make sure that you have the same high standards for yourself. One of the main reasons that we churn this note out day in and day out is so that we ourselves can stay relevant and up to date. We need to be sure that we act as shock absorbers, making sure that we understand and get across the point that you own companies and not share prices. Yet ironically, share prices need to go up in order for the businesses to attract more capital from their shareholders and have more favourable borrowing costs. There is of course a big correlation between the two. Stay calm, invest in quality and always stay the course.

Company corner

It's getting hot in there, so take off all the prose. In this case it was the other way around, the chaps from Curro stuck out a stinging SENS in response to the Advtech board rejecting their offer. This is unusual that any PSG controlled company goes hostile, it seems now that Curro will speak to the shareholders of the company. After all, they are the owners of the company and had expressed a desire for a deal of some sort to happen, bearing in mind that it is at a significant premium. We had seen earlier in the day a letter to parents of a school that is owned by Advtech, suggesting that any bid would be disruptive for the teachers and pupils. Not a single mention of the shareholders, the people that actually parted with their funds in order to build these institutions.

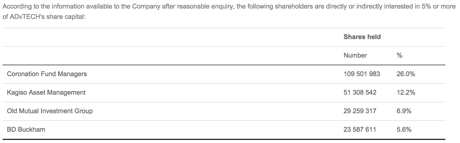

First things first, who are the shareholders of Advtech? As per their website, under the segment Major shareholders, they are:

Coronation, Kagiso, Old Mutual (who have done deals with Curro before, that is not unusual for Old Mutual though) and BD Buckham. Who is BD Buckham? He used to be a non exec, Brian Buckham, who last transacted in shares in November 2006. He sold a few, correction, he sold nearly 900 thousand shares. He is actually the founder of the business, from way back in 1978. At 76 years old, I wonder if he is up for the fight, or maybe he can cash in at this level. His stake at the closing price is worth 287.7 million Rand. Motty Sacks used to be a non exec there too.

As is the case with many mid cap listed businesses, there are very few shareholders that Curro will have to talk to. There is a total of 83 shareholders that hold 75.4 percent of the shares, we have identified three shareholders who control 45 percent of the business, together with the founder, just over 50 percent. Remembering that Curro need not get it all, they are offering smaller shareholders cash.

Before we move away from shareholders, there is one board member, temporary CEO, Frank Thompson who has much to gain here. I think that is worth noting. As at his retirement date last year, in October, he owned 12.367 million shares. At 12.2 Rand, where the price closed last evening, he is worth 150 million Rand on paper. Not bad for a 30 year plus career in corporate South Africa. He ran Advtech from the beginning of August 2002 to October 24 last year. Leslie Massdorp (who had 2 million options at 8.19 Rand, as per the annual report) came to replace Thompson and left immediately on the 23rd of March. I am guessing that if anyone knows the business well and better than anybody else, it must be Frank. As part of the board and person who owns 2.9 percent of the business, he has said no thanks to Curro. I certainly think that is worth noting.

Yes, so here goes, as per the SENS announcement from Curro, they had written letters of support for a deal price of 13 Rand from "major Advtech shareholders". This was at a 42 percent premium to the 30 day "volume weighted average price of Advtech at 28 April 2015, the date prior to the submission of Curro's initial expression of interest to Advtech."

Curro had made a proposed offer at 13 Rand: "The proposed offer by Curro is based on a share swap with Curro valued at R33.65 per share, resulting in a swap ratio of approximately 2.59 Advtech shares for every 1 Curro share. The proposed offer also includes a 50% cash underpin for Advtech shareholders who do not wish to accept Curro shares (a minority shareholder is likely to be able to receive 100% cash, as many of the major shareholders have indicated preference for Curro shares). The aforesaid offer was only subject to a limited due diligence on specific matters;"

Possibly the best point that Curro made in their SENS announcement is a point that Byron made on PowerFM last evening (what you mean you never heard him?) and it is simple. When Advtech announced that they had bought Maravest, they were happy that issuing shares of their own at 8.02 Rand a share and that was a fair price. The Advtech board believed this to be a fair reflection of the value of the business, and said as much. So why would 13 Rand a share not reflect (it is after all a 63 percent premium to that) a really magnificent price, more than fair? That is why I think Curro are more than peeved, you can't suggest it does not reflect the real value of the business, when you said something much lower was fair. Even if the market might have thought that Advtech overpaid for their recent transactions, perhaps Curro are talking to those shareholders, they would have made some quick bucks out of all of this, not so?

I suspect that this is not over by a long stretch, it is pleasing to see private education making so much headway in South Africa, filling a vital gap in the economy where parents see the benefits of a wonderful education for their children. Far better than they had or their parents could afford, education is something that everyone should be passionate about. It is of course a very emotive issue globally.

Linkfest, lap it up

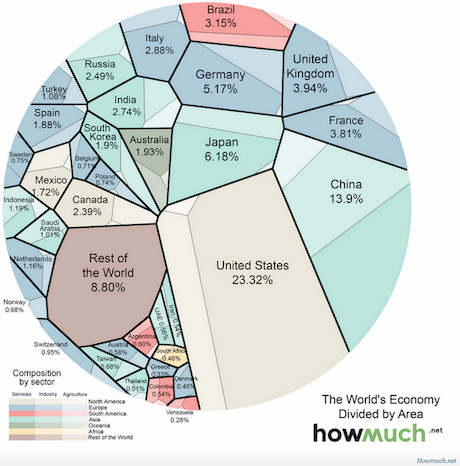

This puts the global GDP into perspective, I am glad to see that South Africa made it onto the map - This one map explains the entire worldwide economy

The wonders of modern medicine - Attention celiac sufferers! Scientists are working on a pill that will let you eat bread and pasta. Would you take a pill so that you can eat gluten or would you still rather avoid it?

Will a market with lower trading costs and longer trading hours be a good thing or a bad thing? The academic answer would be yes from a practical point of view, probably not - The Cost of Free

Home again, home again, jiggety-jog. There was a Rolling Stones article on the worst first names for good bands, Pearl Jam their first name was the Mookie Blaylock. Huh? Radiohead called themselves "On a Friday" first. That could work. Queen's first name was "Smile". Freddie Mercury and the Smiles? Nah. Def Leppard was Atomic Mass. Maroon 5 was Kara's Flowers. No, no, no, Adam. The Beach Boys were The Pendletons. What is that? Green Day was Sweet Children. They are not that sweet now, are they? Pink Floyd were called Screaming Abdabs. Try and say that quickly. Red Hot Chilli Peppers were, wait for it "Tony Flow and the Miraculously Majestic Masters of Mayhem". They actually shortened their name. What is in a name however? It turns out a lot if you are trying to get a gig I guess.

Stocks have bounced a little here this morning, look out for the interest rate decision later. I think that there is too much focus on that (from an equities view), really. It is what it is, as we mentioned however it does impact on more peoples lives than just the equities market, hence all the air time that it tends to get. A hike? Would it be right or wrong, it is irrelevant what I think, it is one of those many things that are beyond our control.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment