"Quick numbers now, JNJ recorded revenues of 17.8 billion Dollars for the quarter, or 195 million Dollars of sales a day across the globe. To put that into perspective, the biggest company by revenue globally, Walmart, recorded daily sales of nearly 1.33 billion Dollars daily. Pretty mind boggling, right? That is equal to a whole year worth of economic output of the Seychelles"

To market to market to buy a fat pig. Today we wait for Greek politicians to agree to the err... ummm.... the "agreekment" as it has been labeled. Tsipras makes it quite clear that he wants to stay in the Euro, which we knew all along, as per that cartoon yesterday he was always outgunned and really was bringing a swiss army knife to a sword fight. Put another way, you can't eat your dinner and then debate if you should pay for your it, as one economist on Twitter put it. He suggested that you ordered the food and then ate it, after which you convene a family meeting in order to discuss whether or not to pay for the same said meal.

The benefits have been had, blame whomever you want, the current terms of existing debt are about as good as you are going to get. Greece may well be in a tight spot for a while to come, perhaps a more business, less bureaucratic approach could solve this quicker. More small and compliant businesses, all pulling their weight in the same direction. I am pretty sure that all the hard working Greeks that I met (not in public service) would definitely agree with that outcome. We shall see what happens.

I for one am very glad that we are into earnings season now, that is ultimately what sets market levels. In any event market levels can be whatever they need to be, all the collective share prices set the level, for us any way we are trying to own a very small part of the market. There are ALWAYS going to be businesses that you wish you owned, why were you not smart enough to own that stock, they have been on a tear. In the end it is about the sustainability of earnings, the fact that none of us can with any reliability predict the future, it is how we pay attention whilst we own the company that counts for the future returns of that business for you the shareholder. Make sense? It should. You own companies and not share prices. Share prices should reflect the collective market view of what the future earnings are likely to be, and what you are willing to pay for that today. Fast growing businesses are often most difficult to value.

Quick market closing level check, the JSE all share (Jozi, Jozi) closed down 0.7 percent to 100 odd points above 52 thousand. Dragging the ship were the financials, gold mining stocks had a decent day though. To put it into perspective, the train wreck that is the prices of the gold companies should be measured over the longer term. Year to date as a collective gold stocks are down 14 percent. Your ten year return on the gold index is minus 36 percent. And the future hardly looks brighter at this point with higher costs and lower metal prices, as a result of the benign inflation outlook. Or any other financial disaster. If gold was really acting as the worry-wort positive indicator, it has barely budged recently in the face of the Greek drama. The strong Rand (weak Dollar) was dragging the majority of stocks that count, the heavyweights, lower.

Over the seas and far away on Wall Street (New York, New York) a tepid retail report did little to impact on stocks enjoying a really good session, (WSJ -> Retailers Ring Up Consumer Caution) the broader market was up nearly half a percent. The Dow Jones crested 18 thousand points again, the S&P 500 was through 2100 again too. The nerds of NASDAQ are around 60 points, a little more than a percent away from the all time highs.

The Chinese market is getting smoked today, down over four percent notwithstanding a GDP read of 7 percent for the last quarter, see the FT: GDP growth hits 7% target as easing measures fuel investment rebound. I am still so very surprised at how people brush off the number as normal, it is everything but that. The Iranian nuclear deal (a couple more hurdles in the US) had a negative impact on oil prices. That took a while! See the WSJ -> Iran Deal Raises Prospect of Fresh Oil Glut Earnings season, I said that right? My favourite season.

Company corner

Woolworths have released a 52 week trading statement this morning, group sales up a whopping 54.9 percent, if you exclude the David Jones contribution, group sales were up 12 percent. I suspect that it may take a while to normalise and get used to the greater contribution from Down Under, the business is going to have a 50/50 split between here and Australasia. Food sales grew 13.5 percent here locally, comparable store sales grew 6.6 percent. Local clothing sales were not exactly strong, 4 percent across comparable stores, 9.6 percent in total. Aussie and New Zealand was strong, Country Road sales in those two currencies grew 11.5 percent, an aggressive store space rollout inside of David Jones had a positive impact. The only negative I can see is that the impairment rate increased from 4.8 percent to 5.4 percent. A progressive dividend policy and a quality premium attached to the securities of this business should see this trading update as a neutral, perhaps a touch light. We do however think that this is the best of the retailers that we have access to here in the South African market, well run, brilliance in terms of quality and mix.

I heard some fellow call in the wireless yesterday afternoon, bemoaning the fact that Starbucks was coming to South Africa, he was worried what this would do to the fledgling coffee culture that was growing in Johannesburg. Did he think that Starbucks started with 1000 stores? I must say that my choice of words in the car were not PG13 even, sorry. The first Starbucks started 44 years ago, with a single store in Seattle, their experience no matter where in the world is supposed to be the same. Starbucks is awesome. If the coffee being offered by the boutique houses is of a better quality and the experience is fine for men wearing lumberjack shirts, skinny jeans and sporting beards, then fear not, the same patrons will continue to frequent that joint. When Starbucks IPO'ed in 1992, 21 years after being found, there were only 165 stores. Last year that number crossed 20 thousand.

All I am saying is that if you have a quality product like the hipster suggests, then he need not worry about big business with their generic offering upsetting his "experience". He need not worry if his experience is the only authentic one, if anything he should plan to roll out more experiences and spread the love. Everyone has choices. Well done to Taste Holdings, Carlo Gonzaga and his team for scoring the Starbucks licence here and across the continent. As per the release: The license agreement sees Taste owning the exclusive rights to develop Starbucks retail outlets in South Africa. As Taste is the licensee, it will own and operate the stores directly. As simple as that. Well done, really. The first store? That is coming in the first half of next year, you are going to have to be patient on that score.

JNJ released numbers for the second quarter yesterday, before the market opened. This is one of the oldest and most recognisable business in the healthcare space across the planet, if not the owner of that title. A bandaid is synonymous with the word plaster. It is a really big business, consisting of three specialist divisions, one being their medical devices (Synthes and DePuy), the other being the well known consumer division (if you have had a baby, you know this one well) and then lastly the pharma business.

As standalone business these three could compete against the best across the globe in size and scale, as it stands now the collective market valuation for JNJ is a whopping 277 billion Dollars. The business trades at a discount to some of their peers, at 17 times historical earnings, it is less than Pfizer (24 times) and Roche (25 times), it does trade at a slight premium to Merck however, which trades at 15 times historical earnings. Only Novartis is a bigger business in the US, in the same space, the ADR is worth 283 billion Dollars. Yowsers, that is huge! Novartis for the record trades on a 24 multiple in their home market, the Swiss market.

Quick numbers now, JNJ recorded revenues of 17.8 billion Dollars for the quarter, or 195 million Dollars of sales a day across the globe. To put that into perspective, the biggest company by revenue globally, Walmart, recorded daily sales of nearly 1.33 billion Dollars daily. Pretty mind boggling, right? That is equal to a whole year worth of economic output of the Seychelles, in fairness there are only 92 thousand permanent residents in the beautiful tropical island. As a result of currency swings, this revenue number was 8.8 percent lower than the corresponding quarter in 2014, operational growth was a muted 0.5 percent. Earnings were 4.5 billion Dollars for the quarter (or nearly 50 million Dollars a day), 1.61 Dollars of earnings per diluted share.

Guidance for the full year was in the range of 6.10 to 6.20 Dollars per share, meaning that at the closing price of 99.76, the stock trades on forward guidance of 16.2 times. The yield is almost spot on 3 percent, pre dividend tax of course. The government always need their 15 percent share in dividends tax for doing such a wonderful job and thereby further encouraging companies to be more profitable. Or do they not take enough along the way? Separate argument altogether.

Whilst they have encountered competition in their old therapies, they certainly are making headway in their cancer therapies, which would of course be the next big hurdle for humanity. The question remains, will JNJ remain a compelling investment? The short answer is that whilst share price performance has been lacklustre at best, they continue to increase their dividend and there is always a chance of M&A, as well as a break up of the group into separate divisions, something that should unlock value. We continue to maintain our hold on the securities of this fine business, accumulating on weakness.

Linkfest, lap it up

On the scale of 1 to 10 of dumbness, this must class as an eleven or twelve. Reading is believing: Twitter confirms purported Bloomberg story is false. It may look like a duck and quack like a duck, be sure to make sure that the url is the real deal, OK?

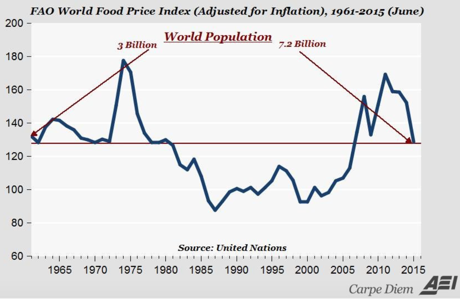

Via American Enterprise Institute and our old pal prof Mark J. Perry comes an interesting observation, at the bottom of his Monday night links. Food prices adjusted for today are the same as in 1960, yet there are 4 billion more of us (no extra land I last checked). Source is the UN, here -> FAO Food Price Index. Here is the graph:

Move aside Silicon Valley and California, Hello Amsterdam and the Netherlands: A Look At The World's High-Tech Startup Capital. You know what a Unicorn is right, a startup worth more than 1 billion Dollars, there are more and more of those.

This is interesting, The Billion Dollar Food Delivery Wars. It even features Nando's in there. The sharing economy, it makes sense to get fresher rather than fast food into the equation.

Home again, home again, jiggety-jog. The gift that keeps on giving is the Tour de France. Every year when the most watched live sporting event pops up (second most watched on the telly, with 2.6 billion watchers) we get to see the awesomeness of France. Europe is not finished, and never will be. Greece will vote today, I am pretty sure that will be the main focus today.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment