"All the shares here on the JSE will then be owned by a Dutch Holding company, not too dissimilar to the setup that Reinet has, their listing is in Luxembourg. You will then have one share in the Dutch holding company for each one here, think along those lines, at least in percentages. None of this is new news, it is an evolution of the company, the brilliance of that management team and execution."

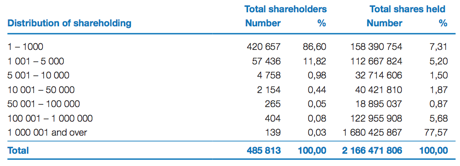

To market to market to buy a fat pig. Another good day for the local equities markets, the all share ended around one-third of a percent better, no thanks to the financials who as a collective fell around half a percent. Sanlam shares sank around three and one-third of a percent if you are looking for a stock price to blame, Sanlam is a business that has a market cap of 144 billion Rand. That is sizeable and is bigger than Nedbank and Remgro. It is double the size of Anglo American Platinum and four times the size of Kumba Iron Ore, yet they seem to just get on with their business. The stock has only been available on the JSE since 1998 when it demutualised and since then has been a steady and decent payer. It probably is one of the most widely held stocks on the JSE, if you check their annual report then you see that there are 477 thousand shareholders who have 12.5 percent of the shares in issue, most of them have less than 1000 shares.

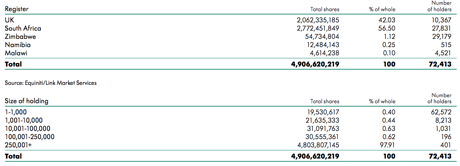

The other company that demutualised at about the same time, Old Mutual, they would also have a large amount of shareholders, not so? Their share register is a little more complicated than Sanlam, as they are listed in London too, as well as Zimbabwe. Here you go, 62 thousand odd shareholders (possibly all Zimbabwe and South Africa) own 1000 shares or less in Old Mutual.

So there you go, the most widely held shares in South Africa, as far as I can tell are both the Sanlam and Old Mutual shareholders. Most important question, do all of these people know that they are shareholders? Most people would be aware, yet they could have moved, and not know. What then happens to the share that remain in place at Computershare or Link, the transfer secretaries. There must be laws in place that clean up "stale" shareholders. Normally, and this happened with Naspers (unfortunately), the company makes an odd lot offer, in this case they may buy back all your shares if you have less than a certain number, say, 500 shares or so.

The company needs to have the ammo, I am all for retail investors paying attention and getting invested, these two cases are possibly different, people were "given" the stock as they were policy holders of investments or life insurance products. I got some shares, I sold them to pay for parts of my wedding, they were most useful back then. I knew I had them however. How many hundreds, if not thousands of people know that they do not have the shares? I suspect many, and that in itself confirms many things, if you pay for shares with your own money, you know you have them, right? If anything is just given to you, the value is almost always less in your books, tell me if I am wrong.

Over the seas and far away, stocks pared their losses, the broader market S&P 500 closed out flat on the session, after being down half a percent at the open. US GDP for the second quarter, the first read was a little light. People have shifted their expectations of an interest rate hike to later in the year, it could be the first quarter of next year. Byron is hoping for that in the predictions markets, he is long that question like a crazy person. Outliers. If you are looking to get interested in prediction markets, you should, visit Inkling. Try it, it will make you a better forecaster.

Company corner

What is up with Steinhoff, what was that yesterday? The company announced a convertible bond offering. When you buy debt from a business and convert it to equity, that is what a convertible bond is. It does two things, one, it dilutes you the shareholder, it also gives you as the shareholder less obligations to the bond holders. In effect, the party holding the convertible bond will be paid a regular coupon payments (interest), in this case with Steinhoff it is 1.25 percent.

Which you may well say is an awesome outcome for the company, managing to raise 1.116 billion Euros (at an exchange rate of 13.90 Rand to the Euro) for 6 years. Steinhoff has the option to redeem the outstanding bonds (pay them out the principal and accrued interest) by September 1 2019 if the parity value of the Bonds translated into Euro at the prevailing exchange rate exceeds EUR 130,000 for a specified period. Understood all of that?

As they point out, the initial conversion price represents a 35 percent premium to the volume weighted average price (WVAP) of the ordinary price on the JSE, in other words 103.46 (and some change) Rands a share. That part is easily understandable, the price at which it becomes attractive for the convertible bond holders to convert debt to equity is around 140 Rand a Steinhoff share, that is my best guess. The bonds will convert (if chosen) to around 150 million Steinhoff shares, which as the announcement points out is 4.1 percent of the issued share capital.

Also, whilst Steinhoff were at it, below the announcement of the issuance (convertible debt is to be issued in Austria), they explain what the funds will be used for. Further share repurchases to manage and counter dilution, as well as for general corporate purposes. I am still trying to wrap my head around that.

Most exciting however is the potential listing of Steinhoff on the "Prime Standard of the Frankfurt Stock Exchange" accompanied by an inward listing on the JSE. This will take place in the fourth quarter of this year. And this part is also interesting: "It is anticipated that a Dutch incorporated holding company will acquire all of the issued shares in Steinhoff in exchange for shares in the Dutch holding company, by way of a scheme of arrangement pursuant to the South African Companies Act, 2008."

OK? So all the shares here on the JSE will then be owned by a Dutch Holding company, not too dissimilar to the setup that Reinet has, their listing is in Luxembourg. You will then have one share in the Dutch holding company for each one here, think along those lines, at least in percentages. None of this is new news, it is an evolution of the company, the brilliance of that management team and execution. Having done some hard charging, Steinhoff have ended up with principally a European business. As such the inward listing on the JSE and principal listing on the Frankfurt Stock Exchange is justified.

And before all of that happens, Steinhoff are expected to report numbers in September, there should be a decrease in earnings as a result of all the massive deal related activities that have seen the number of shares in issue increase substantially. There are now 3.667 billion shares in issue, there was half that in 2013. Such has been the pace of deal making, acquiring JD Group (second time lucky) and Pepkor. Pursuing a strategy that has certainly worked well for them, the number of shares in issue in June 2005 was less than one-third of what it is now. That is not for the purists, this company is certainly run by some hard charging and very hungry individuals, Markus Jooste (53), Danie van der Merwe (56), Frikkie Nel (55) and Piet Ferreira (59) are up for it. After all, 50 is the new 30, right?

If you do not own any of these shares, you should. They are likely to report earnings per share marginally lower than last year, the Frankfurt listing could see a potential re-rating of the stock, and the dividend policy from here might change a little as the business "matures" in the coming three to five years. September, we wait for that sports lovers.

Linkfest, lap it up

Here is the only thing you have to watch today, it is a clip shared by Mark Zuckerberg about the completed construction of our first full scale aircraft. The aircrafts are expected to stay in the air for a time of 3 months at a time and use lasers to transmit internet connectivity to each other and then beam the content down to users, using radio waves!

Glad to see these guys are back on the air. I think this is a great way for Amazon to get more attention to their Prime offering - Amazon Prime sign Top Gear's Jeremy Clarkson, Richard Hammond and James May for exclusive new show

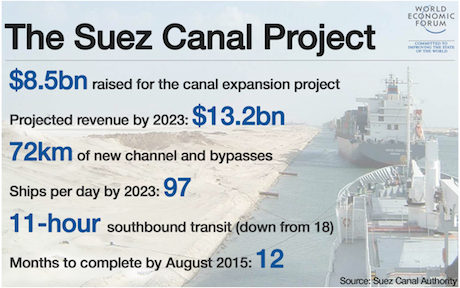

Increased efficiency benefits everyone and with ships getting bigger and an ever increasing tonnage of goods shipped globally, making the canal bigger is a great project - 6 facts about the second Suez Canal

Home again, home again, jiggety-jog. Markets are lower here, I noticed that the gold stocks were down, the Harmony ADR was below 1 Dollar, around 95 US cents, which means sadly that it is a penny stock. I am pretty sure however that Steinhoff was once a smaller company than Harmony. So I decided to have a look. In June of 2005, at the end of Harmony's financial year, there were 393.3 million shares in issue, the share price was 58.25 Rand. That is around 22.9 billion Rand market cap back then.

At the same time, Steinhoff had 1.13 billion shares in issue, the share price was 15.40 Rand at the end of the period. 17.4 billion market cap, relative to the 22.9 billion of Harmony. Today? Last evening, Harmony closed up shop with a market cap of 5.3 billion Rand, Steinhoff were 281 billion Rand. They are both South African companies, their respective industries have just done a whole lot differently. Yet the nature of people is to see the "bad" and not the good that is Steinhoff and their successes. Ah well, that is their loss.

Markets are almost flat here mid morning. The Dollar continues to make progress against all currencies, emerging market currencies as a collective are at a 14 odd year low to the Greenback.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment