"There are many reasons to own this company, they will remain at the cutting edge of technological innovation in the healthcare industry, their products are highly regarded by professionals. That is always the most important thing for me, you can have the most amazing product, if there is no demand, you go nowhere. Stryker will see more and more demand in the years to come, as the middle class population globally continues to grow and age too, they will enter new geographies"

To market to market to buy a fat pig. Another accelerated sell off in the afternoon, resource stocks bearing the brunt of a stronger Dollar and the demand side looking ropey. The supply side is coming on stream with multiple mega projects all at the same time. We are stuck with a commodities cycle that is resembling the previous ones, lack of supply, higher demand, long time frames with projects, loads of investments, demand cools, mega projects come on line as that happens. Although I guess that each and every cycle is very different from one another, China has certainly changed the economic fabric of the planet that we live on.

The Chinese economy is 25 times bigger now than it was in 1990. The Japanese economy is only around two-thirds bigger, the US economy is nearly three times the size it was in 1990. As China has more people than those two countries put together, the ability to continue to shift the economy around from a central planning point of view, still exists. Whether or not you or I might think it is right is meaningless, it is someone else's reality. There are more economic freedoms now in China than there ever were in the past, even if the communist party is still in charge and the perceptions are that corruption is rife. Obviously the current dispensation realises that the success of managing the people from ivory towers depends on slowly giving people more freedoms, even if that means setting your political ideology up for extinction at some stage.

All I am saying is that the great Chinese miracle set the stage for greater resource demand than we had ever seen before, and whilst it is not likely to end any time soon, the pace is slowing. China is slowing their commodity consumption to be roughly the size of their economy relative to the globe, there is going to be pain felt in the prices. I saw a puzzling tweet on the weekend from Zwelinzima Vavi: "Union haters who blame unions for a fall of commodity prices consider these facts: 50% of SA workers earn below R3033. 60% living in poverty". I am pretty sure that he knows that commodity prices are set by supply and demand, least cost producers survive and the economics of keeping unprofitable shafts open takes hold. Nearly half of all costs of mining is labour, it is not 5 percent. These companies are not profitable and more importantly, if they are unlikely to be a good investment, they will not attract capital.

Mind you, who am I to say that? Allan Gray have been accumulating shares in Harmony Gold, they now own more shares than African Rainbow Minerals, 15.38 percent to be exact. The company traded at the lowest level I think I have ever seen it Friday, below 12 Rand a share, the entire market cap is 5.2 billion Rand. AdvTech is a bigger business! That makes sense, as an economy matures should services and retail not form bigger parts of the economy.

If you think that ONLY local businesses have their heads on the block, you are wrong, the FT (subscription only) has this article that stands out this morning: Shares in Australia's Atlas Iron sink 70%. Cost of production is at 50 Dollars a ton. Where the current price is. The company tried to raise money at a discount to the market, 5 Aussie cents (nearly 60 percent discount to the last traded price months ago, the stock has been suspended) and the demand was not there. There has been a strike on investment, due to lower prices and higher costs. The upshot of it all? It may mean that a 15 million tonnes targeting by Atlas may be reduced to zero by next year, absolute zero in a business sense is worse than zero Kelvin (you chemistry freaks know what I am talking about), it means shut down.

And those who have crunched the supply demand fundamentals reckon that there is between 100 and 200 million tonnes of capacity that needs to come offline. All the smaller producers lose, the main ones can drive down their costs further and be break even below 20 Dollars a tonne, sadly not everyone is there. Producers like Fortescue (4th largest after the top three; Vale, Rio and BHP) are probably OK, other marginal producers like Atlas are on the edge. Sad and true all at the same time, this is the nature of the beast I am afraid. If you think about it, advancements in recycling are bound to drive investment in that sector, thus reducing the need for more raw materials. India remains the elephant in the room, will their infrastructural development programs reach those in size and scale of the Chinese? Perhaps.

For the time being I keep recalling that line over and over, "a bet on commodities is a bet against humanity" and what it means for the major producers. i.e. With all the advancements that we make in the fields of alternative and Green energy, sun, wind, rain, tides, geothermal heat and err .... Tesla?, does that mean we continue to move further away from the older technologies? It does come down to the money, when alternatives become viable as the price drops, those get used and by extension become cheaper and cheaper. We are about to find out this week, all the oil majors are likely to announce massive investment cuts which will be good for the oil price in the short term, no doubt. And a more expensive oil price is better for alternatives in the end.

At the end of the local session the Jozi all share had fallen by 1.69 percent. Phew. Commodity stocks were down a whopping 3.49 percent. Platinum miners were down 4 percent, the gold stocks down over five. Mr. Market was unimpressed. Equally over the seas in the US, stocks were down around one percent by the time all was said and done. A pretty average day all around, Visa, Stryker, Starbucks and Amazon bucking the trend, all with decent results.

I sit amazed in my world each and every day, the engineering feats that humans have achieved, yet many take it for granted, over and over again. I was talking to a wonderful man, a pilot in his sixties and I said that flying amazes me and yet many travellers are completely uninspired by all of it. He said to me that it is still amazes him, and he must have done it thousands and thousands of times, that is pretty pleasing I guess. You can plug the coordinates into one of those massive planes and the error is three metres, somewhere on the other side of the world. If that does not amaze you, then I guess nothing will. As we discussed and I had this same conversation with a another pilot, people are not amazed and expect a hotel in the sky, there is a reason that the airbus is called a bus, the travel is more like a bus, and not a restaurant or hotel in the sky. That was called a Zeplin and was very unsafe.

Low cost airlines have only been around since 1990. That was the first time that bums on seats exceeded the 1 billion passenger market per annum for the very first time. Beijing airport overtook London as the busiest airport in 2010 (this all dovetails nicely with the piece above), over 3 billion people flew in 2013. Predictions suggest that we are going to close in on 4 billion passengers travelling by 2018, over 6 billion by 2030 will fly each and every year. Obviously there is a multitude of people who fly regularly. And to think that in 1950, around 50 million people per annum flew. The fear of flying is obviously a control thing, it is safer than all other modes of transport, including on foot where your chances of getting injured whilst walking and texting are higher than when you fly. Yet we all do it.

Company corner

Stryker reported second quarter numbers on Thursday evening, raising their guidance for the year on an improved outlook. To borrow a line from Jim Cramer, there is always someone making money in some market. You can try, yet you will never suppress human ingenuity. We have seen technological advances in the fields of medicine, and that continues to be the case with improved hardware and software across all fields. They augment each other well, the science of medicine is more receptive to these changes. As per their website, Stryker "offers a diverse array of innovative products and services in Orthopaedics, Medical and Surgical, and Neurotechnology and Spine, which help improve patient and hospital outcomes."

The products includes bone cutters, surgical equipment, hospital beds, reconstructive products, like hips, knees, ankles, as well as the spine and craniomaxillofacial. Huh? Face reconstruction, people have accidents and need to be fixed. This is the technology age, where humans are being given a new lease on life with their new machine made products. And the richer that people get, the longer they live as a result of improved diets, improved science around exercising and improved medicine, the more commonplace these procedures will become. Even hip replacements are more prevalent now than ever before.

Germany and Switzerland sit above the OECD average of 154 per 100,000 people, with 296 and 287 respectively, in places like Chile and Mexico, that number drops to well below 20 per 100 thousand. Diets, average age, longevity, these are all reasons that people are receiving more and more procedures to improve their lives. If you think about it, when you part way with your money here to invest in a business like Stryker, you are allocating capital to a business that wants to advance humanity, to fix and repair ordinary people. So much so that this company has increased sales tenfold over a period of 20 years, through the worst financial crisis of our time.

This is still very much US based business, and that is why it is exciting. 70 percent of their sales comes from their "home", nowadays many businesses want to be multinationals, you cannot confine yourself to x number of customers only. Breaking down some of their other revenue numbers, orthopaedics represents 42 percent of group sales. MedSurg (cute name for Medical and Surgical) represents 39 percent of total sales, these two businesses are their two pillars for now.

Numbers going forward, the range in EPS is expected to be 5.06 to 5.12 Dollars, which means forward with the stock at 100.97 Dollars trades just less than 20 times. Currently the yield is less than 1.4 percent. They still plan to buy back around 2 billion Dollars worth of shares in the next two to three years as they see fit. This is a company that will continue to consolidate the industry, on the conference call the CEO (President and Chairman) of the company, Kevin Lobo said that mergers and acquisitions is their first priority and use of cash. Share buybacks seem pretty aggressive, dividends seem a little lower on the chain of importance. Recently the company bought a Turkish hospital bed manufacturer, located in Kayseri. Turkey's fastest growing city, it is no coincidence that this is an economic free zone.

There are many reasons to own this company, they will remain at the cutting edge of technological innovation in the healthcare industry, their products are highly regarded by professionals. That is always the most important thing for me, you can have the most amazing product, if there is no demand, you go nowhere. Stryker will see more and more demand in the years to come, as the middle class population globally continues to grow and age too, they will enter new geographies. The future is bright for them and their products, as it is with the whole industry, we continue to recommend this company as a buy.

Linkfest, lap it up

You do not eat that much chocolate, or do you? According to Statista, The World's Biggest Chocolate Consumers are the Swiss, 9kgs per person per year. A normal Toblerone bar is 35 grams (plastic packaging), normal size 200g, the tin foil and cardboard packaging. 45 of those a year! Yowsers. Just BTW (by the way), Toblerone is owned by Mondelez, the confectionary company spun off from Kraft, it has a market cap of 68.3 billion Dollars.

Seeing is believing, the NYT (New York Times) reports that Americans Are Finally Eating Less, children are eating 9 percent less. And as per the article: "the amount of full-calorie soda drunk by the average American has dropped 25 percent since the late 1990s". Continue to avoid Coca-Cola as an investment?

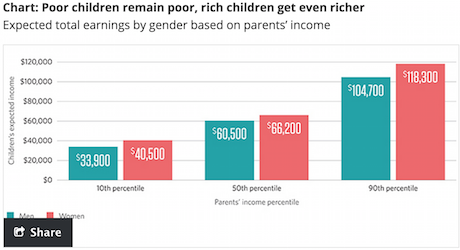

These numbers show that where you are born and grow up has a big bearing on where you end up - This chart shows that your parents' income determines your future. How much of the gap do you think is due to life lessons taught by the parents (Rich dad, Poor dad). How much does the education and connections that you have play a role? Do more affluent families have more confidence in themselves so they step out and take the risks that pay the rewards? Very few people can just coast based on their parents legacy. For most people to stay in the income bracket that they are accustomed to, it still requires hard work and smart life decisions.

This vaccine will make a huge difference for the most venerable in our society. Consider that half a million people die from Malaria a year - A malaria vaccine nearly 30 years in the making just got a green light from EU regulators.

Always take research results with a pinch of salt because there are many ways to interoperate the same data and you can skew outcomes based on what data you choose to focus on. This is still interesting though - Too much TV could raise the risk of Alzheimer's, study suggests. The article also shows that physical activity increases cognitive function, which many studies have shown and I can say is true for me. So spend less time watching TV, go to the gym and then buy some Nike shares.

Many people can't afford a Ferrari but now you can own the shares - Ferrari IPO Seen Giving Boost to Demand for Supercar Brand

Home again, home again, jiggety-jog. Our market is up today being driven by the commodity stocks soaring today. Probably a mix between a bounce after being hammered recently and a weak Rand which helps the selling price of commodities. My screen says that the Rand reached R/$ 12.64, not the direction the MPC was hoping for after their interest rate rise. Another and bigger rate rise is probably on the cards for the next MPC meeting! The dollar has been really strong recently after the jobless claims number last week, which was the best in around 40 years. So more a Dollar story than a Rand story.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment